Terex Corporation (NYSE:TEX) today announced third quarter 2017

income from continuing operations of $56.6 million, or $0.63 per

share, on net sales of $1.1 billion. In the third quarter of 2016,

the reported income from continuing operations was $33.3 million,

or $0.31 per share, on net sales of $1.1 billion. Income from

continuing operations, as adjusted, for the third quarter of 2017

was $45.0 million, or $0.50 per share. This compares to income from

continuing operations, as adjusted, of $19.0 million or $0.17 per

share in the third quarter of 2016. The Glossary at the end of this

press release contains further details regarding these non-GAAP

measures.

“Our third quarter financial results demonstrate the

accelerating momentum across Terex,” said John L. Garrison, Terex

President and CEO. “All three segments increased sales, improved

operating margin and grew backlog. Aerial Work Platforms (AWP) grew

in North America and Europe, and expanded its operating margin.

Cranes continued to be profitable in the third quarter, realizing

benefits from its restructuring program. Materials Processing (MP)

continued its excellent performance, growing sales and operating

margin for the fourth consecutive quarter.”

“Having completed the first element of our strategy - focusing

the portfolio on our three core segments, our strategy deployment

efforts are concentrated on simplifying the Company and

implementing our Execute to Win business system,” added Mr.

Garrison. “Footprint consolidation progress in the quarter included

completing the sale of manufacturing locations in Jinan, China and

Bierbach, Germany. A fundamental component of Execute to Win is

improving our commercial capabilities. In addition to enhancing our

performance management tools and increasing process discipline in

sales pipeline and account management we made key additions to our

commercial leadership team.”

“We continue to follow our disciplined capital allocation

strategy. We monetized our remaining holdings of Konecranes shares

for proceeds of $221 million, bringing the total consideration

received by Terex for the disposition of MHPS to approximately $1.6

billion. This demonstrates the significant value to Terex

shareholders that was created by the sale of our MHPS segment. In

addition, we repurchased 6.4 million Terex shares for $254 million

in the third quarter, bringing the total to 22.3 million shares

repurchased for $770 million for the first nine months of the

year.”

Mr. Garrison concluded, “Considering our year to date results,

our current view of market dynamics, operational expectations for

the fourth quarter, and our capital market actions, we are

increasing our full year adjusted EPS guidance to $1.20 to

$1.30.”

Non-GAAP Measures and Other Items

Results of operations reflect continuing operations. All per

share amounts are on a fully diluted basis. A comprehensive review

of the quarterly financial performance is contained in the

presentation that will accompany the Company’s earnings conference

call.

In this press release, Terex refers to various GAAP (U.S.

generally accepted accounting principles) and non-GAAP financial

measures. These non-GAAP measures may not be comparable to

similarly titled measures being disclosed by other companies. Terex

believes that this non-GAAP information is useful to understanding

its operating results and the ongoing performance of its underlying

businesses. Terex now calculates its quarterly adjusted effective

tax rate by multiplying the adjusted forecast full year effective

tax rate by the adjusted pre-tax income. Terex believes this more

closely aligns with how its investors analyze quarterly results.

2016 results have been adjusted using the same approach.

The Company provides guidance on a non-GAAP basis as the Company

cannot predict with a reasonable degree of certainty some elements

that are included in reported GAAP results, such as the impact from

periodic adjustments to fair value in our ownership interest in

Konecranes, the impact of the release of tax valuation allowances

and future restructuring charges.

The Glossary at the end of this press release contains further

details about this subject.

Conference call

The Company has scheduled a one hour conference call to review

the financial results on Wednesday, November 1, 2017 at 8:30

a.m. ET. John L. Garrison, President and CEO, will host the call. A

simultaneous webcast of this call will be available on the

Company’s website, www.terex.com. To listen to the call, select

“Investor Relations” from the home page and click on the webcast

microphone link. Participants are encouraged to access the call 10

minutes prior to the starting time. The call will also be archived

on the Company’s website under “Audio Archives” in the “Investor

Relations” section of the website.

Forward-Looking Statements

This press release contains forward-looking information

regarding future events or the Company’s future financial

performance based on the current expectations of Terex Corporation.

In addition, when included in this press release, the words “may,”

“expects,” “intends,” “anticipates,” “plans,” “projects,”

“estimates” and the negatives thereof and analogous or similar

expressions are intended to identify forward-looking statements.

However, the absence of these words does not mean that the

statement is not forward-looking. The Company has based these

forward-looking statements on current expectations and projections

about future events. These statements are not guarantees of future

performance.

Because forward-looking statements involve risks and

uncertainties, actual results could differ materially. Such risks

and uncertainties, many of which are beyond the control of Terex,

include among others: Our business is cyclical and weak general

economic conditions affect the sales of our products and financial

results; the need to comply with restrictive covenants contained in

our debt agreements; our ability to generate sufficient cash flow

to service our debt obligations and operate our business; our

ability to access the capital markets to raise funds and provide

liquidity; our business is sensitive to government spending; our

business is highly competitive and is affected by our cost

structure, pricing, product initiatives and other actions taken by

competitors; our retention of key management personnel; the

financial condition of suppliers and customers, and their continued

access to capital; our providing financing and credit support for

some of our customers; we may experience losses in excess of

recorded reserves; the carrying value of goodwill could become

impaired; our ability to obtain parts and components from suppliers

on a timely basis at competitive prices; our business is global and

subject to changes in exchange rates between currencies, commodity

price changes, regional economic conditions and trade restrictions;

our operations are subject to a number of potential risks that

arise from operating a multinational business, including compliance

with changing regulatory environments, the Foreign Corrupt

Practices Act and other similar laws and political instability; a

material disruption to one of our significant facilities; possible

work stoppages and other labor matters; compliance with changing

laws and regulations, particularly environmental and tax laws and

regulations; litigation, product liability claims, intellectual

property claims, class action lawsuits and other liabilities; our

ability to comply with an injunction and related obligations

imposed by the United States Securities and Exchange Commission

(“SEC”); disruption or breach in our information technology

systems; and other factors, risks and uncertainties that are more

specifically set forth in our public filings with the SEC.

Actual events or the actual future results of Terex may differ

materially from any forward-looking statement due to these and

other risks, uncertainties and significant factors. The

forward-looking statements speak only as of the date of this

release. Terex expressly disclaims any obligation or undertaking to

release publicly any updates or revisions to any forward-looking

statement included in this release to reflect any changes in

expectations with regard thereto or any changes in events,

conditions, or circumstances on which any such statement is

based.

About Terex

Terex Corporation is a global manufacturer of lifting and

material processing products and services that deliver lifecycle

solutions to maximize customer return on investment. The company

reports in three business segments: Aerial Work Platforms, Cranes,

and Materials Processing. Terex delivers lifecycle solutions to a

broad range of industries, including the construction,

infrastructure, manufacturing, shipping, transportation, refining,

energy, utility, quarrying and mining industries. Terex offers

financial products and services to assist in the acquisition of

Terex equipment through Terex Financial Services. Terex uses its

website (www.terex.com) and its Facebook page

(www.facebook.com/TerexCorporation) to make information available

to its investors and the market.

TEREX CORPORATION AND

SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENT OF

OPERATIONS

(unaudited)

(in millions, except per share data)

Three Months EndedSeptember 30,

Nine Months EndedSeptember 30, 2017 2016 2017

2016 Net sales $ 1,111.2 $ 1,056.4 $ 3,299.8 $ 3,468.4 Cost

of goods sold (892.2 ) (872.5 ) (2,687.8 )

(2,860.7 ) Gross profit 219.0 183.9 612.0 607.7 Selling,

general and administrative expenses (154.8 ) (144.3 )

(478.2 ) (483.4 ) Income (loss) from operations 64.2

39.6 133.8 124.3 Other income (expense) Interest income 1.9 1.0 5.2

3.3 Interest expense (15.5 ) (25.4 ) (52.0 ) (75.6 ) Loss on early

extinguishment of debt (0.7 ) — (52.6 ) (0.4 ) Other income

(expense) – net 6.8 (1.3 ) 52.2

(13.3 ) Income (loss) from continuing operations before

income taxes 56.7 13.9 86.6 38.3 (Provision for) benefit from

income taxes (0.1 ) 19.3 5.1

82.5 Income (loss) from continuing operations 56.6

33.2 91.7 120.8 Income (loss) from discontinued operations – net of

tax — 64.1 — (33.4 ) Gain (loss) on disposition of discontinued

operations- net of tax 2.6 —

63.7 3.5 Net income (loss) 59.2 97.3 155.4

90.9 Net (income) loss from Continuing Operations attributable to

non-controlling interest — 0.1 — 0.1 Net (income) loss from

Discontinuing Operations attributable to non-controlling interest

— (0.6 ) — 0.1 Net

income (loss) attributable to Terex Corporation $ 59.2 $

96.8 $ 155.4 $ 91.1 Amounts attributable to

Terex Corporation common stockholders: Income (loss) from

continuing operations $ 56.6 $ 33.3 $ 91.7 $ 120.9 Income (loss)

from discontinued operations – net of tax — 63.5 — (33.3 ) Gain

(loss) on disposition of discontinued operations – net of tax

2.6 — 63.7 3.5

Net income (loss) attributable to Terex Corporation $ 59.2

$ 96.8 $ 155.4 $ 91.1 Basic Earnings

(Loss) per Share Attributable to Terex CorporationCommon

Stockholders: Income (loss) from continuing operations $ 0.64 $

0.31 $ 0.96 $ 1.12 Income (loss) from discontinued operations – net

of tax — 0.59 — (0.31 ) Gain (loss) on disposition of discontinued

operations – net of tax 0.03 —

0.66 0.03 Net income (loss) attributable to

Terex Corporation $ 0.67 $ 0.90 $ 1.62 $ 0.84

Diluted Earnings (Loss) per Share Attributable to Terex

CorporationCommon Stockholders: Income (loss) from continuing

operations $ 0.63 $ 0.31 $ 0.93 $ 1.10 Income (loss) from

discontinued operations – net of tax — 0.58 — (0.30 ) Gain (loss)

on disposition of discontinued operations – net of tax 0.03

— 0.65 0.03 Net

income (loss) attributable to Terex Corporation $ 0.66 $

0.89 $ 1.58 $ 0.83 Weighted average number of

shares outstanding in per share calculation Basic 88.0

107.6 96.2 108.5

Diluted 90.0 108.6 98.1

109.3

TEREX CORPORATION AND

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEET

(unaudited)

(in millions, except par value)

September 30,2017

December 31,2016

Assets Current assets Cash and cash equivalents $ 592.7 $ 428.5

Other current assets 1,858.7 1,539.1 Current assets held for sale

5.7 732.9 Total current assets 2,457.1 2,700.5

Non-current assets Property, plant and equipment – net 300.8 304.6

Other non-current assets 844.8 830.4 Non-current assets held for

sale — 1,171.3 Total non-current assets

1,145.6 2,306.3 Total assets $ 3,602.7 $ 5,006.8

Liabilities and Stockholders’ Equity Current liabilities Notes

payable and current portion of long-term debt $ 4.9 $ 13.8 Other

current liabilities 1,006.5 939.4 Current liabilities held for sale

2.2 453.8 Total current liabilities 1,013.6

1,407.0 Non-current liabilities Long-term debt, less current

portion 980.0 1,562.0 Other non-current liabilities 228.0 204.5

Non-current liabilities held for sale 0.8 312.1 Total

non-current liabilities 1,208.8 2,078.6 Total

liabilities 2,222.4 3,485.6 Total

stockholders’ equity 1,380.3 1,521.2 Total

liabilities and stockholders’ equity $ 3,602.7 $ 5,006.8

TEREX CORPORATION AND

SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENT OF

CASH FLOWS

(unaudited)

(in millions)

Nine Months EndedSeptember 30,

2017 2016 Operating Activities Net income (loss) $ 155.4 $ 90.9

Depreciation and amortization 48.7 77.4 Changes in operating assets

and liabilities and non-cash charges (260.3) (68.0)

Net cash provided by (used in) operating activities (56.2) 100.3

Investing Activities Capital expenditures (27.2) (64.2) Other

investing activities, net 1,577.0 61.5 Net cash

provided by (used in) investing activities 1,549.8 (2.7) Financing

Activities Net cash provided by (used in) financing activities

(1,434.1) (226.8) Effect of exchange rate changes on

cash and cash equivalents 34.3 6.4 Net increase

(decrease) in cash and cash equivalents 93.8 (122.8) Cash and cash

equivalents at beginning of period 501.9 466.5 Cash

and cash equivalents at end of period $ 595.7 $ 343.7

TEREX CORPORATION AND

SUBSIDIARIES

SEGMENT RESULTS DISCLOSURE

(unaudited)

(in millions)

Q3 Year to Date 2017 2016 2017

2016 % of % of

% of % of

NetSales

NetSales

NetSales

NetSales

Consolidated

Net sales $ 1,111.2 $ 1,056.4 $ 3,299.8 $ 3,468.4 Income (loss)

from operations $ 64.2 5.8% $ 39.6 3.7% $ 133.8 4.1% $ 124.3 3.6%

AWP Net sales $ 556.7 $ 484.4 $ 1,622.1 $ 1,598.8

Income from operations $ 57.5 10.3% $ 48.6 10.0% $ 140.0 8.6% $

159.2 10.0%

Cranes Net sales $ 301.9 $ 282.8 $ 869.6

$ 947.5 Loss from operations $ (1.3) (0.4)% $ (12.1) (4.3)% $ (19.6

) (2.3)% $ (41.5 ) (4.4)%

MP Net sales $ 259.9 $

228.2 $ 789.5 $ 708.2 Income from operations $ 28.4 10.9% $ 19.5

8.5% $ 89.3 11.3% $ 63.9 9.0%

Corp and Other /

Eliminations Net sales $ (7.3) $ 61.0 $ 18.6 $ 213.9 Loss from

operations $ (20.4) 279.5% $ (16.4) (26.9)% $ (75.9 ) (408.1)% $

(57.3 ) (26.8)%

GLOSSARY

In an effort to provide investors with additional information

regarding the Company’s results, Terex refers to various GAAP (U.S.

generally accepted accounting principles) and non-GAAP financial

measures which management believes provides useful information to

investors. These non-GAAP measures may not be comparable to

similarly titled measures being disclosed by other companies. In

addition, the Company believes that non-GAAP financial measures

should be considered in addition to, and not in lieu of, GAAP

financial measures. Terex believes that this non-GAAP information

is useful to understanding its operating results and the ongoing

performance of its underlying businesses. Management of Terex uses

both GAAP and non-GAAP financial measures to establish internal

budgets and targets and to evaluate the Company’s financial

performance against such budgets and targets.

The amounts described below are unaudited, are reported in

millions of U.S. dollars (except share data and percentages), and

are as of or for the period ended September 30, 2017, unless

otherwise indicated.

2017 Outlook: The Company’s 2017 outlook for earnings per

share and 2017 full year adjusted forecasted tax rate are non-GAAP

financial measures because they exclude items such as restructuring

and other related charges, impact from periodic adjustments to fair

value in ownership interest in Konecranes, deal related costs, the

impact of the release of tax valuation allowances, and gains and

losses on divestitures. The Company is not able to reconcile these

forward-looking non-GAAP financial measures to their most directly

comparable forward-looking GAAP financial measures without

unreasonable efforts because the Company is unable to predict with

a reasonable degree of certainty the exact timing and impact of

such items. The unavailable information could have a significant

impact on the Company’s full-year 2017 GAAP financial results.

After-tax gains or losses and per share amounts are

calculated using pre-tax amounts, applying a tax rate based on

jurisdictional rates to arrive at an after-tax amount. This number

is divided by diluted weighted average shares outstanding to

provide the impact on earnings per share. The Company highlights

the impact of these items because when discussing earnings per

share, the Company adjusts for items it believes are not reflective

of ongoing operating activities in the periods. Restructuring and

related charges are a recurring item as Terex’s restructuring

programs usually require more than one year to fully implement and

the Company is continually seeking to take actions that could

enhance its efficiency. Although recurring, these charges are

subject to significant fluctuations from period to period due to

varying levels of restructuring activity and the inherent

imprecision in the estimates used to recognize the costs and taxes

associated with severance and termination benefits in the countries

in which the restructuring actions occur.

Q3 2017

Income (loss) fromContinuing

Operationsbefore Taxes

(Provision for)benefit fromIncome Taxes

(1)

Income (loss)from ContinuingOperations

Earnings (loss)per share (2)

As Reported (GAAP) $ 56.7 (0.1 ) 56.6 $ 0.63 Restructuring &

Related (0.8 ) (0.3 ) (1.1 ) (0.01 ) Deal Related (3.2 ) (2.1 )

(5.3 ) (0.06 ) Transformation 9.1 (1.9 ) 7.2 0.08 Extinguishment of

Debt 0.7 (0.2 ) 0.5 0.01 Tax & Interim Period (3)

— (12.9 ) (12.9 )

(0.15 ) As Adjusted (Non-GAAP) $ 62.5 (17.5 ) 45.0 $ 0.50

(1) Tax effect on adjustments is calculated using the

applicable jurisdictional blended tax rate (2) Based on diluted

average shares outstanding of 90.0 million (3) Includes adjustments

without related pre-tax amounts and the tax amount necessary to

align quarterly tax expense (benefit) with the forecasted full year

as adjusted effective tax rate

YTD 2017

Income (loss) fromContinuing

Operationsbefore Taxes

(Provision for)benefit fromIncome Taxes

(1)

Income (loss)from ContinuingOperations

Earnings (loss)per share (2)

As Reported (GAAP) $ 86.6 5.1 91.7 $ 0.93 Restructuring &

Related (4.4 ) (0.8 ) (5.2 ) (0.05 ) Deal Related (28.1 ) (11.1 )

(39.2 ) (0.40 ) Transformation 35.4 (7.6 ) 27.8 0.28 Extinguishment

of Debt 53.1 (19.0 ) 34.1 0.35 Asset Impairment (1.6 ) 0.6 (1.0 )

(0.01 ) Tax & Interim Period (3) —

(8.1 ) (8.1 ) (0.08 ) As

Adjusted (Non-GAAP) $ 141.0 (40.9 ) 100.1 $ 1.02

(1) Tax effect on adjustments is calculated using the

applicable jurisdictional blended tax rate (2) Based on diluted

average shares outstanding of 98.1 million (3) Includes adjustments

without related pre-tax amounts and the tax amount necessary to

align quarterly tax expense (benefit) with the forecasted full year

as adjusted effective tax rate

Q3 2016

Income (loss) fromContinuing

Operationsbefore Taxes

(Provision for)benefit fromIncome Taxes

(1)

Income (loss)from ContinuingOperations

(2)

Earnings (loss)per share (3)

As Reported (GAAP) $ 13.9 19.3 33.3 $ 0.31 Deal Related 6.2 (0.9 )

5.3 0.05 Restructuring & Related 5.8 (1.9 ) 3.9 0.03 Tax &

Interim Period (4) —

(23.5 ) (23.5 ) (0.22 ) As Adjusted

(Non-GAAP)

$

25.9 (7.0 ) 19.0 $ 0.17

(1) Tax effect on adjustments is calculated using the

applicable jurisdictional blended tax rate (2) Excludes $0.1

million net loss attributable to non-controlling interest (3) Based

on diluted weighted average shares outstanding of 108.6 million (4)

Includes adjustments without related pre-tax amounts and the tax

amount necessary to align quarterly tax expense (benefit) with the

forecasted full year as adjusted effective tax rate

YTD

2016

Income (loss) fromContinuing

Operationsbefore Taxes

(Provision for)benefit fromIncome Taxes

(1)

Income (loss)from ContinuingOperations

(2)

Earnings (loss)per share (3) As Reported (GAAP) $

38.3 82.5 120.9 $ 1.10 Deal Related 29.5 (6.4 ) 23.1 0.21

Restructuring & Related 48.0 (14.2 ) 33.8 0.31 Tax &

Interim Period (4) —

(93.2 ) (93.2 ) (0.85 ) As Adjusted

(Non-GAAP) $ 115.8 (31.3 ) 84.6 $ 0.77

(1) Tax effect on adjustments is calculated using the

applicable jurisdictional blended tax rate (2) Excludes $0.1

million net loss attributable to non-controlling interest (3) Based

on diluted weighted average shares outstanding of 109.3 million (4)

Includes adjustments without related pre-tax amounts and the tax

amount necessary to align quarterly tax expense (benefit) with the

forecasted full year as adjusted effective tax rate

Terex Corporation200 Nyala Farm Road, Westport,

Connecticut 06880Telephone: (203) 222-7170, Fax: (203) 222-7976,

http://www.terex.com

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171031006060/en/

Terex CorporationBrian Henry, 203-222-5954Senior Vice President,

Business Development and Investor

Relationsbrian.henry@terex.com

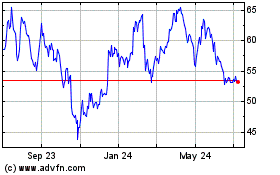

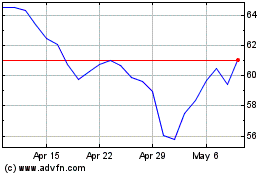

Terex (NYSE:TEX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Terex (NYSE:TEX)

Historical Stock Chart

From Apr 2023 to Apr 2024