Fourth Quarter 2017 Revenues of $595.1

million, up 15.8% Versus Prior Year Period; up 12.6% on Constant

Currency Basis

Fourth Quarter 2017 GAAP Diluted EPS of

($0.92), down 171.3% Versus Prior Year Period

Fourth Quarter 2017 Adjusted Diluted EPS of

$2.44, up 14.6% Versus Prior Year Period

Full Year 2017 Revenues of $2,146.3 million,

up 14.9% Versus Prior Year; up 14.1% on Constant Currency

Basis

Full Year 2017 GAAP Diluted EPS of $3.33,

down 33.1% Versus Prior Year

Full Year 2017 Adjusted Diluted EPS of

$8.40, up 14.4% Versus Prior Year

2018 Guidance Range for GAAP Revenue Growth

of 14% to 15%

2018 Guidance Range for Constant Currency

Revenue Growth of 12% to 13%

2018 Guidance Range for GAAP Diluted EPS of

$7.10 to $7.20

2018 Guidance Range for Adjusted Diluted EPS

of $9.55 to $9.75

Teleflex Incorporated (NYSE: TFX) (the “Company”) today

announced financial results for the fourth quarter and full year

ended December 31, 2017.

Fourth quarter 2017 net revenues were $595.1 million, an

increase of 15.8% compared to the prior year period. Excluding the

impact of foreign currency exchange rate fluctuations, fourth

quarter 2017 net revenues increased 12.6% over the year ago

period.

Fourth quarter 2017 GAAP diluted earnings per share from

continuing operations decreased 171.3% to ($0.92), as compared to

$1.29 in the prior year period. The decrease in GAAP diluted

earnings per share from continuing operations is due to $107.9

million of tax expense reflecting the impact of the Tax Cuts and

Jobs Act ("TCJA"), which was enacted on December 22, 2017. Fourth

quarter 2017 adjusted diluted earnings per share from continuing

operations increased 14.6% to $2.44, compared to $2.13 in the prior

year period.

Full year 2017 net revenues were $2,146.3 million, an increase

of 14.9% compared to the prior year period. Excluding the impact of

foreign currency exchange rate fluctuations, full year 2017 net

revenues increased 14.1% over the year ago period.

Full year 2017 GAAP diluted earnings per share from continuing

operations decreased 33.1% to $3.33, as compared to $4.98 in the

prior year period. The decrease in GAAP diluted earnings per share

from continuing operations is due to $107.9 million of tax expense

reflecting the impact of the TCJA, which was enacted on December

22, 2017. Full year 2017 adjusted diluted earnings per share from

continuing operations increased 14.4% to $8.40, compared to $7.34

in the prior year period.

Liam Kelly, President and Chief Executive Officer, said,

“Despite modestly softer than expected sales in the fourth quarter,

due in part to Vascular Solutions distributor go-directs within

EMEA, we reported solid gross and operating margin performance in

the period and delivered full year adjusted earnings per share

results at the high-end of our guidance range. Following our

acquisition of NeoTract, the business continues to perform at a

high level, with UroLift experiencing deeper penetration of the BPH

market. UroLift delivered $39 million in revenues for the fourth

quarter, which represented growth of 121% year-over-year, and we

remain excited about the long-term contributions the business will

make to our revenue growth and margin profile.”

Added Mr. Kelly, “As we look into 2018, our new product

launches, our acquisitions of Vascular Solutions and NeoTract, and

gross and operating margin expansion programs give us confidence we

can deliver double digit constant currency revenue growth and

significant adjusted earnings per share expansion.”

FOURTH QUARTER AND FULL YEAR NET REVENUE BY SEGMENT

Following the Company's acquisition of Vascular Solutions, the

Company commenced an integration program under which it is

combining the Vascular Solutions business with some of its legacy

businesses. Specifically, the Company is combining the Vascular

Solutions North American business with the Company's interventional

access business, which formerly was part of the Vascular North

America operating segment, and the Company's cardiac business,

which formerly was a separate operating segment included in the

"all other" category for purposes of segment reporting. These

businesses are now in the Company's Interventional North America

operating segment. Additionally, the Company is combining the

Vascular Solutions businesses in Europe, Asia and Latin America

with the Company's legacy businesses in the respective locations,

and these Vascular Solutions businesses are now part of the EMEA

(Europe, Middle East and Africa), Asia and Latin America operating

segments, respectively. The changes in the Company’s operating

segments, which became effective in the fourth quarter 2017, also

reflect the manner in which the Company’s new chief operating

decision maker assesses business performance and allocation of

resources.

As a result of the operating segment changes described above,

the Company has the following seven reportable segments: Vascular

North America, Interventional North America, Anesthesia North

America, Surgical North America, Europe, Middle East and Africa

("EMEA"), Asia and Original Equipment and Development Services

("OEM"). In connection with the presentation of segment

information, we will continue to present certain operating

segments, which now include Interventional Urology North America

and Respiratory North America as well as Latin America, in the “all

other” category because they are not material. All prior

comparative periods presented in this release have been restated to

reflect these changes.

The following tables provide information regarding net revenues

in each of the Company's reportable operating segments and all of

its other operating segments for the three and twelve months ended

December 31, 2017 and December 31, 2016 on both a GAAP and constant

currency basis. The discussion below the table of the principal

factors behind changes in net revenues for the three months ended

December 31, 2017 as compared to the prior year period applies to

both GAAP revenue and constant currency revenue, although GAAP

revenue also was affected by foreign currency exchange rate

fluctuations, as indicated in the "Foreign Currency" column of the

table.

Three Months Ended % Increase/

(Decrease) December 31, 2017 December 31,

2016

ConstantCurrency

ForeignCurrency

TotalChange

(Dollars in millions) Vascular North America $ 80.7 $ 80.3

0.3 % 0.2 % 0.5 % Interventional North America 61.7 22.2

177.2 % 0.4 % 177.6 % Anesthesia North America 49.9 54.9 (9.4 ) %

0.2 % (9.2 ) % Surgical North America 43.7 48.3 (9.8 ) % 0.4 % (9.4

) % EMEA 143.6 135.7 (2.0 ) % 7.8 % 5.8 % Asia 78.8 73.0 4.5 % 3.5

% 8.0 % OEM 46.0 45.3 (0.1 ) % 1.4 % 1.3 % All Other 90.7

54.2 67.0 % 0.6 % 67.6 %

Total $ 595.1 $ 513.9 12.6 % 3.2 % 15.8

%

Twelve Months Ended %

Increase/ (Decrease) December 31, 2017

December 31, 2016

ConstantCurrency

ForeignCurrency

TotalChange

(Dollars in millions) Vascular North America $ 313.6 $ 295.2

6.1 % 0.1 % 6.2 % Interventional North America 220.6 82.4

167.5 % 0.1 % 167.6 % Anesthesia North America 198.0 198.8 (0.5 ) %

0.1 % (0.4 ) % Surgical North America 175.2 172.2 1.6 % 0.1 % 1.7 %

EMEA 552.7 510.9 6.3 % 1.9 % 8.2 % Asia 269.2 249.4 7.0 % 0.9 % 7.9

% OEM 183.0 161.0 13.2 % 0.5 % 13.7 % All Other 234.0

198.1 18.0 % 0.1 % 18.1 % Total

$ 2,146.3 $ 1,868.0 14.1 % 0.8 % 14.9

%

Vascular North America fourth quarter 2017 net revenues were

$80.7 million, an increase of 0.5% compared to the prior year

period. Excluding the impact of foreign currency exchange rate

fluctuations, fourth quarter 2017 net revenues increased 0.3%

compared to the prior year period. The increase in constant

currency revenue is primarily attributable to higher sales volumes

of existing products, despite the unfavorable impact of five fewer

shipping days in the fourth quarter of 2017, and an increase in new

product sales and price increases.

Interventional North America fourth quarter 2017 net revenues

were $61.7 million, an increase of 177.6% compared to the prior

year period. Excluding the impact of foreign currency exchange rate

fluctuations, fourth quarter 2017 net revenues increased 177.2%

compared to the prior year period. The increase in constant

currency revenue is primarily attributable to net revenues

generated by sales of Vascular Solutions' products. We acquired

Vascular Solutions in February 2017.

Anesthesia North America fourth quarter 2017 net revenues were

$49.9 million, a decrease of 9.2% compared to the prior year

period. Excluding the impact of foreign currency exchange rate

fluctuations, fourth quarter 2017 net revenues decreased 9.4%

compared to the prior year period. The decrease in constant

currency revenue is primarily attributable to a decline in sales

volumes of existing products, due in part to five fewer shipping

days in the fourth quarter of 2017, partially offset by an increase

in net revenues generated by an acquired business and an increase

in new product sales.

Surgical North America fourth quarter 2017 net revenues were

$43.7 million, a decrease of 9.4% compared to the prior year

period. Excluding the impact of foreign currency exchange rate

fluctuations, fourth quarter 2017 net revenues decreased 9.8%

compared to the prior year period. The decrease in constant

currency revenue is primarily attributable to a decline in sales

volumes of existing products, due in part to five fewer shipping

days in the fourth quarter of 2017, partially offset by an increase

in new product sales and price increases.

EMEA fourth quarter 2017 net revenues were $143.6 million, an

increase of 5.8% compared to the prior year period. Excluding the

impact of foreign currency exchange rate fluctuations, fourth

quarter 2017 net revenues decreased 2.0% compared to the prior year

period. The decrease in constant currency revenue is primarily

attributable to a decline in sales volumes of existing products,

due in part to five fewer shipping days in the fourth quarter of

2017, partially offset by net revenues generated by acquired

businesses and an increase in new product sales.

Asia fourth quarter 2017 net revenues were $78.8 million, an

increase of 8.0% compared to the prior year period. Excluding the

impact of foreign currency exchange rate fluctuations, fourth

quarter 2017 net revenues increased 4.5%. The increase in constant

currency revenue is primarily attributable to net revenues

generated by acquired businesses and price increases.

OEM fourth quarter 2017 net revenues were $46.0 million, an

increase of 1.3% compared to the prior year period. Excluding the

impact of foreign currency exchange rate fluctuations, fourth

quarter 2017 net revenues decreased 0.1% compared to the prior year

period. The decrease in constant currency revenue is primarily

attributable to a decline in sales volumes of existing products,

due in part to five fewer shipping days in the fourth quarter of

2017, partially offset by an increase in new product sales.

All Other fourth quarter 2017 net revenues were $90.7 million,

an increase of 67.6% compared to the prior year period. Excluding

the impact of foreign currency exchange rate fluctuations, fourth

quarter 2017 net revenues increased 67.0% compared to the prior

year period. The increase in constant currency revenue is primarily

attributable to net revenues generated by NeoTract.

OTHER FINANCIAL HIGHLIGHTS AND KEY PERFORMANCE

METRICS

Depreciation expense, amortization of intangible assets and

deferred financing charges for 2017 totaled $160.3 million compared

to $128.3 million for the prior year period.

Cash and cash equivalents at December 31, 2017 were $333.6

million compared to $543.8 million at December 31, 2016.

Net accounts receivable at December 31, 2017 were $345.9 million

compared to $272.0 million at December 31, 2016.

Net inventories at December 31, 2017 were $395.7 million

compared to $316.2 million at December 31, 2016.

2018 OUTLOOK

On a GAAP basis, revenues in 2018 are expected to increase 14%

to 15% over the prior year, reflecting the anticipated 2.0%

favorable impact of foreign currency exchange rate fluctuations. On

a constant currency basis, the Company estimates that revenues for

full year 2018 will increase 12% to 13%.

The Company expects full year 2018 GAAP diluted earnings per

share from continuing operations to be between $7.10 and $7.20. The

Company expects adjusted diluted earnings per share from continuing

operations to be between $9.55 and $9.75 for full year 2018,

representing an increase of 13.7% to 16.1% over 2017, reflecting

our expectation of an approximately 3% positive impact from foreign

currency exchange rate fluctuations.

Forecasted 2018 Constant Currency Revenue Growth

Reconciliation

Low High

2018 GAAP revenue growth 14 % 15 % Estimated

impact of foreign currency exchange rate fluctuations

(2 ) % (2 ) % 2018

constant currency revenue growth 12 %

13 %

Forecasted 2018 Adjusted Earnings Per Share Reconciliation

Low

High

Diluted earnings per share attributable to common

shareholders $7.10 $7.20 Restructuring, restructuring

related and impairment items, net of tax $0.17 $0.20

Acquisition, integration and divestiture related items, net of tax

$0.27 $0.30 Other items, net of tax $0.01 $0.02

Intangible amortization expense, net of tax $2.00

$2.03

Adjusted diluted earnings per share $9.55

$9.75

CONFERENCE CALL WEBCAST AND ADDITIONAL INFORMATION

As previously announced, Teleflex will comment on its financial

results on a conference call to be held today at 8:00 a.m. (ET).

The call will be available live and archived on the company’s

website at www.teleflex.com and

the accompanying presentation will be posted prior to the call. An

audio replay will be available until February 27, 2018 at 11:59pm

(ET), by calling 855-859-2056 (U.S./Canada) or 404-537-3406

(International), Passcode: 6373419.

ADDITIONAL NOTES

References in this release to the impact of foreign currency

exchange rate fluctuations on adjusted diluted earnings per share

include both the impact of translating foreign currencies into U.S.

dollars and the impact of foreign currency exchange rate

fluctuations on foreign currency denominated transactions.

In the discussion of segment results, "new products" refers to

products we have sold commercially within the past 36 months and

"existing products" refers to products we have sold commercially

for more than 36 months.

Certain financial information is presented on a rounded basis,

which may cause minor differences.

Segment results and commentary exclude the impact of

discontinued operations.

NOTES ON NON-GAAP FINANCIAL MEASURES

We report our financial results in accordance with accounting

principles generally accepted in the United States, commonly

referred to as “GAAP.” In this press release, we provide

supplemental information, consisting of the following non-GAAP

financial measures: adjusted diluted earnings per share and

constant currency revenue growth. These non-GAAP measures are

described in more detail below. Management uses these financial

measures to assess Teleflex’s financial performance, make operating

decisions, allocate financial resources, provide guidance on

possible future results, and assist in its evaluation of

period-to-period and peer comparisons. The non-GAAP measures may be

useful to investors because they provide insight into management’s

assessment of our business, and provide supplemental information

pertinent to a comparison of period-to-period results of our

ongoing operations. The non-GAAP financial measures are presented

in addition to results presented in accordance with GAAP and should

not be relied upon as a substitute for GAAP financial measures.

Moreover, our non-GAAP financial measures may not be comparable to

similarly titled measures used by other companies.

Tables reconciling historical adjusted diluted earnings per

share to historical GAAP diluted earnings per share are set forth

below. Tables reconciling changes in historical constant currency

net revenues to historical GAAP net revenues are set forth above

under “Fourth Quarter and Full Year Net Revenue by Segment”. Tables

reconciling forecasted 2018 constant currency revenue growth and

forecasted 2018 adjusted earnings per share to their respective

most directly comparable forecasted GAAP measures, forecasted 2018

revenue growth and forecasted 2018 diluted earnings per share

available to common stockholders, are set forth above under “2018

Outlook.”

Adjusted diluted earnings per share: This non-GAAP

measure is based upon diluted earnings per share available to

common stockholders, the most directly comparable GAAP measure,

adjusted to exclude, depending on the period presented, the impact

(net of tax) of (i) restructuring, restructuring related and

impairment items; (ii) acquisition, integration and divestiture

related items; (iii) other items identified in note (C) to the

reconciliation tables set forth below; (iv) amortization of debt

discount on convertible notes; (v) intangible amortization expense;

(vi) loss on extinguishment of debt and (vii) tax adjustments.

Management does not believe that any of the excluded items are

indicative of our underlying core performance or business

trends.

In addition, the calculation of the weighted average number of

diluted shares within adjusted earnings per share gives effect to

the anti-dilutive impact of shares due to the Company under its

previously outstanding convertible note hedge agreements. The

convertible note hedge agreements reduced the potential economic

dilution that otherwise would have occurred upon conversion of the

Company’s senior subordinated convertible notes (under GAAP, the

anti-dilutive impact of the convertible note hedge agreements was

not reflected in the weighted average number of diluted shares). We

believe that an adjustment to show the anti-dilutive effect of the

convertible note hedge agreements provides supplemental information

that can be useful to investors in assessing the computation of

diluted earnings per share.

Constant currency revenue growth: This non-GAAP measure

is based upon net revenues, adjusted to eliminate the impact of

translating the results of international subsidiaries at different

currency exchange rates from period to period. The impact of

changes in foreign currency may vary significantly from period to

period, and generally are outside of the control of our management.

We believe that this measure facilitates a comparison of our

operating performance exclusive of fluctuations that do not reflect

our underlying performance or business trends.

RECONCILIATION OF CONSOLIDATED STATEMENT OF INCOME

ITEMS

Dollars in millions, except per share amounts

Quarter Ended -

December 31, 2017

Cost ofgoods sold

Selling,

generalandadministrativeexpenses

Research

anddevelopmentexpenses

Restructuringandimpairmentcharges

(Gain) loss onsale

ofbusiness andassets

Interestexpense, net

Income taxes

Net income (loss)attributable

tocommonshareholders

fromcontinuingoperations

Diluted earningsper share

availableto commonshareholders

Shares usedin

calculationof GAAP andadjustedearnings

pershare

GAAP Basis $264.4 $213.3 $25.5 $1.1 — $23.5 $110.2 ($42.8 )

($0.92 ) 46,636 Adjustments

Restructuring,restructuringrelated

andimpairmentitems (A)

3.9 0.3 0.3 1.1 — — 1.8 3.7 $0.08 —

Acquisition,integration

anddivestiturerelated items(B)

0.4 16.2 0.2 — — — (2.8 ) 19.5 $0.42 — Other items (C) 1.3

1.9 — — — — 0.6 2.7 $0.06 —

Amortization ofdebt discounton

convertiblenotes (D)

— — — — — — — — — —

Intangibleamortizationexpense (E)

— 34.7 0.1 — — — 10.0 24.8 $0.53 —

Loss onextinguishmentof debt (F)

— — — — — — — — — —

Taxadjustments (G)

— — — — — — (106.0 ) 106.0 $2.27 —

Shares due toTeleflex undernote hedge

(H)

— — — — — — — — — — Adjusted basis $258.8 $160.2 $24.9 — —

$23.5 $13.9 $113.7 $2.44 46,636

Quarter Ended - December 31,

2016

Cost ofgoods sold

Selling,

generalandadministrativeexpenses

Research

anddevelopmentexpenses

Restructuringandimpairmentcharges

(Gain) loss onsale

ofbusiness andassets

Interestexpense, net

Income taxes

Net income (loss)attributable

tocommonshareholdersfrom

continuingoperations

Diluted earningsper

shareavailable tocommonshareholders

Shares used incalculation

ofGAAP andadjustedearnings

pershare

GAAP Basis $240.9 $144.2 $15.7 $46.4 ($0.2 ) $16.2 ($10.1 )

$60.9 $1.29 47,112 Adjustments

Restructuring,restructuringrelated

andimpairmentitems (A)

3.7 0.5 0.0 46.4 — — 18.0 32.5 $0.69 —

Acquisition,integration

anddivestiturerelated items(B)

— (5.1 ) — — (0.2 ) 3.4 1.9 (3.7 ) ($0.08 ) — Other items

(C) — 0.2 — — — — 0.1 0.1 $0.00 —

Amortization ofdebt discount

onconvertiblenotes (D)

— — — — — 1.1 0.4 0.7 $0.02 —

Intangibleamortizationexpense (E)

— 15.9 0.1 — — — 4.0 12.0 $0.26 —

Loss onextinguishmentof debt (F)

— — — — — — 0.0 0.0 $0.00 —

Tax adjustments(G)

— — — — — — 4.9 (4.9 ) ($0.10 ) —

Shares due toTeleflex undernote hedge

(H)

— — — — — — — — $0.06 (1,343 ) Adjusted basis $237.2 $132.7

$15.6 — — $11.7 $19.3 $97.5 $2.13 45,769

(A) Restructuring, restructuring related and impairment items -

Restructuring programs involve discrete initiatives designed to,

among other things, consolidate or relocate manufacturing,

administrative and other facilities, improve operating efficiencies

and integrate acquired businesses. Our restructuring charges

consist of termination benefits, contract termination costs,

facility closure costs and other exit costs associated with a

specific restructuring program. Restructuring related charges are

directly related to our restructuring programs and consist of

facility consolidation costs, including accelerated depreciation

expense related to facility closures, costs to transfer

manufacturing operations between locations, and retention bonuses

offered to certain employees as an incentive for them to remain

with our company after completion of the restructuring program. For

the three months ended December 31, 2017 and December 31, 2016,

pre-tax restructuring related charges were $4.4 million and $4.2

million, respectively. There were no impairment items during the

three months ended December 31, 2017. In the three months ended

December 31, 2016, impairment items included (i) a pre-tax,

non-cash $41.0 million impairment charge and a $14.9 million

reduction in related deferred tax liabilities in connection with

discontinuation of an in-process research and development project;

(ii) $2.4 million in pre-tax, non-cash impairment charges related

to two properties, one of which was classified as an asset held for

sale; and (iii) a $0.7 million reduction in related deferred tax

liabilities.

(B) Acquisition, integration and divestiture related items -

Acquisition and integration expenses are incremental charges, other

than restructuring or restructuring related expenses, that are

directly related to specific business or asset acquisition

transactions. These charges may include, among other things,

professional, consulting and other fees; systems integration costs;

legal entity restructuring expense; inventory step-up amortization

(amortization, through cost of goods sold, of the increase in fair

value of inventory resulting from a fair value calculation as of

the acquisition date); fair value adjustments to contingent

consideration; and bridge loan facility and backstop financing fees

in connection with facilities that ultimately were not utilized.

For the three months ended December 31, 2017, the majority of these

charges were related to our acquisitions of Vascular Solutions and

NeoTract. For the three months ended December 31, 2016, amounts

attributable to these activities reflect reversals related to

contingent consideration liabilities, including $8.3 million

related to the discontinuation of an in-process research and

development project, somewhat offset by acquisition costs.

Divestiture related activities involve specific business or asset

sales. Depending primarily on the terms of the divestiture

transaction, the carrying value of the divested business or assets

on our financial statements and other costs we incur as a direct

result of the divestiture transaction, we may recognize a gain or

loss in connection with the divestiture related activities.

(C) Other items - These are discrete items that occur

sporadically and can affect period-to-period comparisons. For the

three months ended December 31, 2017, these items included both

gains and losses associated with litigation settlements, the

reversal of previously recognized income due to distributor

acquisitions related to Vascular Solutions, the reversal of

previously recognized income due to our distributor conversion in

China, and relabeling costs. For the three months ended December

31, 2016, these items included relabeling costs.

(D) Amortization of debt discount on convertible notes - When we

sold $400 million principal amount of our 3.875% convertible notes

(the “convertible notes”) in 2010, we allocated the proceeds

between the liability and equity components of the debt, in

accordance with GAAP. As a result, the $83.7 million

difference between the proceeds of the sale of the convertible

notes and the liability component of the debt constituted a debt

discount that was to be amortized to interest expense over the

approximately seven-year term of the convertible notes, which

significantly increased the amount we recorded as interest expense

attributable to the convertible notes. The amount of the

amortization of the debt discount was reduced as a result of our

repurchases of convertible notes in 2016 and 2017 and redemptions

of the convertible notes by holders of the notes, although we

continued to amortize the remaining portion of the debt discount to

interest expense until August 2017, when all remaining convertible

notes were either converted or matured.

(E) Intangible amortization expense - Certain intangible assets,

including customer relationships, intellectual property,

distribution rights, trade names and non-competition agreements,

initially are recorded at historical cost and then amortized over

their respective estimated useful lives. The amount of such

amortization can vary from period to period as a result of, among

other things, business or asset acquisitions or dispositions.

(F) Loss on extinguishment of debt - In connection with debt

refinancings, debt repayments, repurchases of convertible notes and

redemptions of convertible notes, outstanding indebtedness is

extinguished. These events, which have occurred from time to time

on an irregular basis, have resulted in losses reflecting, among

other things, unamortized debt issuance costs, as well as debt

prepayment fees and premiums (including conversion premiums

resulting from conversion of convertible securities).

(G) Tax adjustments - These adjustments represent the impact of

the expiration of applicable statutes of limitations for prior year

returns, the resolution of audits, the filing of amended returns

with respect to prior tax years and/or tax law changes affecting

our deferred tax liability. In addition, for the three months ended

December 31, 2017, these items include tax expense associated with

the TCJA, which was enacted on December 22, 2017.

(H) Adjusted diluted shares are calculated by giving effect to

the anti-dilutive impact of the Company’s convertible note hedge

agreements, which reduced the potential economic dilution that

otherwise would have occurred upon conversion of the Company's

convertible notes. Under GAAP, the anti-dilutive impact of the

convertible note hedge agreements is not reflected in the weighted

average number of diluted shares.

RECONCILIATION OF CONSOLIDATED STATEMENT OF INCOME

ITEMS

Dollars in millions, except per share amounts

Year Ended - December 31, 2017

Cost ofgoods sold

Selling,

generalandadministrativeexpenses

Research

anddevelopmentexpenses

Restructuringandimpairmentcharges

(Gain) loss onsale

ofbusiness andassets

Interestexpense,net

Loss onextinguishmentof

debt, net

Income taxes

Net

income(loss)attributable

tocommonshareholdersfromcontinuingoperations

Dilutedearnings

pershareavailable

tocommonshareholders

Shares

usedincalculationof GAAPand

adjustedearnings pershare

GAAP Basis $974.5 $700.0 $84.8 $14.8 — $81.8 $5.6 $129.6

$155.3 $3.33 46,664 Adjustments

Restructuring,restructuringrelated

andimpairmentitems (A)

12.7 0.8 1.0 14.8 — — — 9.1 20.3 $0.44 —

Acquisition,integration

anddivestiturerelated items(B)

10.8 27.8 0.2 — — 2.1 — 4.1 36.8 $0.79 — Other items (C) 1.3

(1.9 ) — — — — — (1.1 ) 0.6 $0.01 —

Amortization ofdebt discounton

convertiblenotes (D)

— — — — — 0.9 — 0.3 0.6 $0.01 —

Intangibleamortizationexpense (E)

— 98.3 0.4 — — — — 27.7 71.1 $1.52 —

Loss onextinguishmentof debt (F)

— — — — — — 5.6 2.0 3.5 $0.08 —

TaxAdjustments(G)

— — — — — — — (101.4 ) 101.4 $2.17 —

Shares due toTeleflex undernote hedge

(H)

— — — — — — — — — $0.05 (280 ) Adjusted basis $949.6 $574.9

$83.1 — — $78.8 — $70.3 $389.5 $8.40 46,384

Year Ended - December 31,

2016

Cost ofgoods sold

Selling,

generalandadministrativeexpenses

Research

anddevelopmentexpenses

Restructuringandimpairmentcharges

(Gain) loss onsale

ofbusiness andassets

Interestexpense,net

Loss onextinguishmentof

debt, net

Income taxes

Net

income(loss)attributable

tocommonshareholdersfromcontinuingoperations

Dilutedearnings

pershareavailable

tocommonshareholders

Shares

usedincalculationof

GAAPandadjustedearningsper

share

GAAP Basis $871.8 $563.3 $58.6 $59.2 ($4.4 ) $54.5 $19.3

$8.1 $237.2 $4.98 47,646 Adjustments

Restructuringrestructuringrelated

andimpairmentitems (A)

14.6 0.7 0.0 59.2 — — — 25.5 49.1 $1.03 —

Acquisition,integration

anddivestiturerelated items(B)

— (3.0 ) — — (4.4 ) 3.4 — 1.2 (5.2 ) ($0.11 ) — Other items

(C) — 0.5 0.0 — — — — 0.2 0.4 $0.01 —

Amortization ofdebt discount

onconvertiblenotes (D)

— — — — — 7.2 — 2.6 4.5 $0.10 —

Intangibleamortizationexpense (E)

— 63.1 0.4 — — — — 16.1 47.4 $0.99 —

Loss onextinguishmentof debt (F)

— — — — — — 19.3 7.0 12.2 $0.26 —

Tax adjustments(G)

— — — — — — — 10.7 (10.7 ) ($0.23 ) —

Shares due toTeleflex undernote hedge

(H)

— — — — — — — — — $0.31 (2,025 ) Adjusted basis $857.3

$502.0 $58.1 — — $43.9 — $71.5 $334.8 $7.34 45,621

(A) Restructuring, restructuring related and impairment items -

Restructuring programs involve discrete initiatives designed to,

among other things, consolidate or relocate manufacturing,

administrative and other facilities, improve operating efficiencies

and integrate acquired businesses. Our restructuring charges

consist of termination benefits, contract termination costs,

facility closure costs and other exit costs associated with a

specific restructuring program. Restructuring related charges are

directly related to our restructuring programs and consist of

facility consolidation costs, including accelerated depreciation

expense related to facility closures, costs to transfer

manufacturing operations between locations, and retention bonuses

offered to certain employees as an incentive for them to remain

with our company after completion of the restructuring program. For

the twelve months ended December 31, 2017 and December 31, 2016,

pre-tax restructuring related charges were $14.6 million and $15.3

million. There were no impairment items during the twelve months

ended December 31, 2017. In the twelve months ended December 31,

2016, impairment items included (i) a pre-tax, non-cash $41.0

million impairment charge and a $14.9 million reduction in related

deferred tax liabilities in connection with discontinuation of an

in-process research and development project; (ii) $2.4 million in

pre-tax, non-cash impairment charges related to two properties, one

of which was classified as an asset held for sale and (iii) a $0.7

million reduction in related deferred tax liabilities.

(B) Acquisition, integration and divestiture related items -

Acquisition and integration expenses are incremental charges, other

than restructuring or restructuring related expenses, that are

directly related to specific business or asset acquisition

transactions. These charges may include, among other things,

professional, consulting and other fees; systems integration costs;

legal entity restructuring expense; inventory step-up amortization

(amortization, through cost of goods sold, of the increase in fair

value of inventory resulting from a fair value calculation as of

the acquisition date); fair value adjustments to contingent

consideration; and bridge loan facility and backstop financing fees

in connection with facilities that ultimately were not utilized.

For the twelve months ended December 31, 2017, the majority of

these charges were related to our acquisitions of Vascular

Solutions and NeoTract. For the twelve months ended December 31,

2016, amounts attributable to these activities reflect reversals

related to contingent consideration liabilities, including $8.3

million related to the discontinuation of an in-process research

and development project, and the gain on a sale of assets, somewhat

offset by acquisition costs. Divestiture related activities involve

specific business or asset sales. Depending primarily on the terms

of the divestiture transaction, the carrying value of the divested

business or assets on our financial statements and other costs we

incur as a direct result of the divestiture transaction, we may

recognize a gain or loss in connection with the divestiture related

activities.

(C) Other items - These are discrete items that occur

sporadically and can affect period-to-period comparisons. For the

twelve months ended December 31, 2017, these items included both

gains and losses associated with litigation settlements, the

reversal of previously recognized income due to distributor

acquisitions related to Vascular Solutions, the reversal of

previously recognized income due to our distributor conversion in

China, and relabeling costs. For the twelve months ended December

31, 2016, these items included relabeling costs and costs

associated with a facility that was exited.

(D) Amortization of debt discount on convertible notes - When we

sold $400 million principal amount of our 3.875% convertible notes

(the “convertible notes”) in 2010, we allocated the proceeds

between the liability and equity components of the debt, in

accordance with GAAP. As a result, the $83.7 million

difference between the proceeds of the sale of the convertible

notes and the liability component of the debt constituted a debt

discount that was to be amortized to interest expense over the

approximately seven-year term of the convertible notes, which

significantly increased the amount we recorded as interest expense

attributable to the convertible notes. The amount of the

amortization of the debt discount was reduced as a result of our

repurchases of convertible notes in 2016 and 2017 and redemptions

of the convertible notes by holders of the notes, although we

continued to amortize the remaining portion of the debt discount to

interest expense until August 2017, when all remaining convertible

notes were either converted or matured.

(E) Intangible amortization expense - Certain intangible assets,

including customer relationships, intellectual property,

distribution rights, trade names and non-competition agreements,

initially are recorded at historical cost and then amortized over

their respective estimated useful lives. The amount of such

amortization can vary from period to period as a result of, among

other things, business or asset acquisitions or dispositions.

(F) Loss on extinguishment of debt - In connection with debt

refinancings, debt repayments, repurchases of convertible notes and

redemptions of convertible notes, outstanding indebtedness is

extinguished. These events, which have occurred from time to time

on an irregular basis, have resulted in losses reflecting, among

other things, unamortized debt issuance costs, as well as debt

prepayment fees and premiums (including conversion premiums

resulting from conversion of convertible securities).

(G) Tax adjustments - These adjustments represent the impact of

the expiration of applicable statutes of limitations for prior year

returns, the resolution of audits, the filing of amended returns

with respect to prior tax years and/or tax law changes affecting

our deferred tax liability. In addition, for the twelve months

ended December 31, 2017, these items include tax expense associated

with the TCJA, which was enacted on December 22, 2017.

(H) Adjusted diluted shares are calculated by giving effect to

the anti-dilutive impact of the Company’s convertible note hedge

agreements, which reduced the potential economic dilution that

otherwise would have occurred upon conversion of the Company's

convertible notes. Under GAAP, the anti-dilutive impact of the

convertible note hedge agreements is not reflected in the weighted

average number of diluted shares.

ABOUT TELEFLEX INCORPORATED

Teleflex is a global provider of medical technologies designed

to improve the health and quality of people’s lives. We apply

purpose driven innovation - a relentless pursuit of identifying

unmet clinical needs - to benefit patients and healthcare

providers. Our portfolio is diverse, with solutions in the fields

of vascular and interventional access, surgical, anesthesia,

cardiac care, urology, emergency medicine and respiratory care.

Teleflex employees worldwide are united in the understanding that

what we do every day makes a difference. For more information,

please visit teleflex.com.

Teleflex is the home of Arrow®, Deknatel®, Hudson RCI®, LMA®,

Pilling®, Rusch® and Weck® - trusted brands united by a common

sense of purpose.

CAUTION CONCERNING FORWARD-LOOKING INFORMATION

This press release contains forward-looking statements,

including, but not limited to, the long-term contributions the

NeoTract business is expected to make to the Company's revenue

growth and margin profile, forecasted 2018 GAAP and constant

currency revenue growth and GAAP and adjusted diluted earnings per

share. Actual results could differ materially from those in the

forward-looking statements due to, among other things, changes in

business relationships with and purchases by or from major

customers or suppliers; delays or cancellations in shipments;

demand for and market acceptance of new and existing products; our

inability to integrate acquired businesses into our operations,

realize planned synergies and operate such businesses profitably in

accordance with our expectations; the inability of acquired

businesses to generate revenues in accordance with our

expectations; our inability to effectively execute our

restructuring programs; our inability to realize anticipated

savings from restructuring plans and programs; the impact of

healthcare reform legislation and proposals to amend the

legislation; changes in Medicare, Medicaid and third party coverage

and reimbursements; competitive market conditions and resulting

effects on revenues and pricing; increases in raw material costs

that cannot be recovered in product pricing; global economic

factors, including currency exchange rates, interest rates,

sovereign debt issues and the impact of the United Kingdom's vote

to leave the European Union; difficulties in entering new markets;

general economic conditions; and other factors described or

incorporated in our filings with the Securities and Exchange

Commission, including our most recently filed Annual Report on Form

10-K.

TELEFLEX INCORPORATED

CONSOLIDATED STATEMENTS OF INCOME Three Months

Ended December 31, Twelve Months Ended December 31,

2017 2016 2017 2016

(Dollars and shares in thousands, except per share) Net revenues $

595,106 $ 513,933 $ 2,146,303 $ 1,868,027 Cost of goods sold

264,375 240,881 974,501 871,827 Gross

profit 330,731 273,052 1,171,802 996,200 Selling, general and

administrative expenses 213,289 144,180 699,963 563,308 Research

and development expenses 25,471 15,687 84,770 58,579 Restructuring

and impairment charges 1,067 46,351 14,790 59,227 Gain on sale of

assets — (194 ) — (4,367 ) Income from continuing

operations before interest, loss on extinguishment of debt and

taxes 90,904 67,028 372,279 319,453 Interest expense 23,662 16,362

82,546 54,941 Interest income (155 ) (150 ) (771 ) (474 ) Loss on

extinguishment of debt — — 5,593 19,261

Income from continuing operations before taxes 67,397 50,816

284,911 245,725 Taxes on income from continuing operations 110,244

(10,060 ) 129,648 8,074 Income from continuing

operations (42,847 ) 60,876 155,263 237,651

Operating loss from discontinued operations 63 (806 ) (4,534 ) (922

) Tax benefit on loss from discontinued operations (126 ) (993 )

(1,801 ) (1,112 ) (Loss) income on discontinued operations 189

187 (2,733 ) 190 Net income (42,658 ) 61,063

152,530 237,841 Less: Income from continuing operations

attributable to noncontrolling interest — — — 464 Net income

attributable to common shareholders $ (42,658 ) $ 61,063 $

152,530 $ 237,377 Earnings per share available to

common shareholders: Basic: Income from continuing operations $

(0.95 ) $ 1.38 $ 3.45 $ 5.47 (Loss) income on discontinued

operations — 0.01 (0.06 ) 0.01 Net income $

(0.95 ) $ 1.39 $ 3.39 $ 5.48 Diluted: Income

from continuing operations $ (0.92 ) $ 1.29 $ 3.33 $ 4.98 (Loss)

income on discontinued operations 0.01 0.01 (0.06 ) —

Net income $ (0.91 ) $ 1.30 $ 3.27 $ 4.98

Dividends per share $ 0.34 $ 0.34 $ 1.36 $ 1.36 Weighted

average common shares outstanding: Basic 45,093 44,058 45,004

43,325 Diluted 46,636 47,112 46,664 47,646 Amounts attributable to

common shareholders: Income from continuing operations, net of tax

$ (42,847 ) $ 60,876 $ 155,263 $ 237,187 (Loss) income from

discontinued operations, net of tax 189 187 (2,733 )

190 Net income $ (42,658 ) $ 61,063 $ 152,530

$ 237,377

TELEFLEX INCORPORATED

CONSOLIDATED BALANCE SHEETS December 31,

2017 2016

(Dollars and shares in

thousands,except per share)

ASSETS Current assets Cash and cash equivalents $ 333,558 $

543,789 Accounts receivable, net 345,875 271,993 Inventories, net

395,744 316,171 Prepaid expenses and other current assets 47,882

40,382 Prepaid taxes 5,748 8,179 Assets held for sale —

2,879 Total current assets 1,128,807 1,183,393 Property,

plant and equipment, net 382,999 302,899 Goodwill 2,235,592

1,276,720 Intangibles assets, net 2,383,748 1,091,663 Deferred tax

assets 3,810 1,712 Other assets 46,536 34,826 Total

assets $ 6,181,492 $ 3,891,213

LIABILITIES AND

EQUITY Current liabilities Current borrowings $ 86,625 $

183,071 Accounts payable 92,027 69,400 Accrued expenses 96,853

65,149 Current portion of contingent consideration 74,224 587

Payroll and benefit-related liabilities 107,415 82,679 Accrued

interest 6,165 10,450 Income taxes payable 11,514 7,908 Other

current liabilities 9,053 8,402 Total current

liabilities 483,876 427,646 Long-term borrowings 2,162,927 850,252

Deferred tax liabilities 603,676 271,377 Pension and postretirement

benefit liabilities 121,410 133,062 Noncurrent liability for

uncertain tax positions 12,296 17,520 Noncurrent contingent

consideration 197,912 6,516 Other liabilities 168,864 45,499

Total liabilities 3,750,961 1,751,872 Commitments and

contingencies Convertible notes - redeemable equity component —

1,824 Mezzanine equity — 1,824 Shareholders’ equity

Common shares, $1 par value Issued: 2017 — 46,871 shares; 2016 —

45,814 shares 46,871 45,814 Additional paid-in capital 591,721

506,800 Retained earnings 2,285,886 2,194,593 Accumulated other

comprehensive loss (265,091 ) (438,717 ) 2,659,387 2,308,490 Less:

Treasury stock, at cost 228,856 170,973 Total

shareholders' equity 2,430,531 2,137,517 Total

liabilities and shareholders' equity $ 6,181,492 $ 3,891,213

TELEFLEX INCORPORATED CONSOLIDATED

STATEMENTS OF CASH FLOWS Year Ended December 31,

2017 2016 (Dollars in thousands) Cash

flows from operating activities of continuing operations: Net

income $ 152,530 $ 237,841 Adjustments to reconcile net income to

net cash provided by operating activities: Loss (income) from

discontinued operations 2,733 (190 ) Depreciation expense 56,497

54,415 Amortization expense of intangible assets 98,766 63,491

Amortization expense of deferred financing costs and debt discount

5,075 10,440 Loss on extinguishment of debt 5,593 19,261 Fair value

step up of acquired inventory sold 10,442 — Changes in contingent

consideration 3,575 (6,445 ) Impairment of long-lived assets —

2,356 In-process research and development impairment charge —

41,000 Stock-based compensation 19,407 16,871 Net gain on sales of

businesses and assets — (4,367 ) Deferred income taxes, net (41,822

) (29,346 ) Other (18,469 ) (13,311 ) Changes in operating assets

and liabilities, net of effects of acquisitions and disposals:

Accounts receivable (11,039 ) (11,029 ) Inventories (22,363 ) 6,408

Prepaid expenses and other current assets 547 (3,613 ) Accounts

payable and accrued expenses 39,001 15,422 Income taxes receivable

and payable, net 125,828 11,386 Net cash provided by

operating activities from continuing operations 426,301

410,590 Cash flows from investing activities of continuing

operations: Expenditures for property, plant and equipment (70,903

) (53,135 ) Payments for businesses and intangibles acquired, net

of cash acquired (1,768,284 ) (14,040 ) Proceeds from sales of

businesses and assets 6,332 10,201 Net cash used in

investing activities from continuing operations (1,832,855 )

(56,974 ) Cash flows from financing activities of continuing

operations: Proceeds from new borrowings 2,463,500 671,700

Reduction in borrowings (1,239,576 ) (714,565 ) Debt

extinguishment, issuance and amendment fees (26,664 ) (8,958 )

Proceeds from share based compensation plans and the related tax

impacts 5,571 9,068 Payments to noncontrolling interest

shareholders — (464 ) Payments for acquisition of noncontrolling

interest — (9,231 ) Payments for contingent consideration (335 )

(7,282 ) Dividends (61,237 ) (58,960 ) Net cash provided by (used

in) financing activities from continuing operations 1,141,259

(118,692 ) Cash flows from discontinued operations: Net cash

used in operating activities (6,416 ) (2,110 ) Net cash used in

discontinued operations (6,416 ) (2,110 ) Effect of exchange rate

changes on cash and cash equivalents 61,480 (27,391 ) Net

increase (decrease) in cash and cash equivalents (210,231 ) 205,423

Cash and cash equivalents at the beginning of the year 543,789

338,366 Cash and cash equivalents at the end of the

year $ 333,558 $ 543,789 Supplemental cash flow

information: Cash interest paid $ 74,256 $ 44,203 Income taxes

paid, net of refunds $ 49,144 $ 23,955 Non cash investing and

financing activities of continuing operations: Purchases of

businesses and related costs $ 261,733 $ — Settlement and exchange

of convertible notes with common or treasury stock $ 53,207 $

35,286 Acquisition of treasury stock from settlement and exchange

of convertible note hedge and warrants $ 141,405 $ 86,046

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180222005161/en/

Teleflex IncorporatedJake ElguiczeTreasurer and Vice President

of Investor Relations610-948-2836

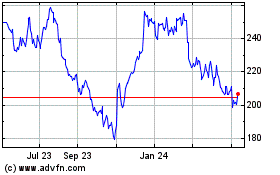

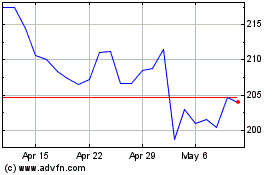

Teleflex (NYSE:TFX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Teleflex (NYSE:TFX)

Historical Stock Chart

From Apr 2023 to Apr 2024