SurveyMonkey's Upsized IPO Prices Above Range -- Update

September 25 2018 - 7:06PM

Dow Jones News

By Josh Beckerman

SurveyMonkey's initial public offering had a higher price and

larger size than its expected range, with an IPO of 15 million

shares pricing at $12 each Tuesday.

The San Mateo, Calif., company had projected that it would sell

13.5 million shares for $9 to $11 each.

SurveyMonkey is scheduled to begin trading on Nasdaq on

Wednesday under the symbol SVMK.

SurveyMonkey, founded in 1999, provides survey software to

people and companies seeking to gather data. For calendar year

2017, SurveyMonkey's parent company SVMK Inc. posted a net loss of

$24 million on $218.8 million in revenue, compared with a loss of

$76.4 million on $207.3 million in revenue in 2016.

As of late 2014, SurveyMonkey was valued at about $2 billion.

Its largest pre-IPO shareholder, Tiger Global Management, owned a

29.3% stake as of Sept. 13.

Write to Josh Beckerman at josh.beckerman@wsj.com

(END) Dow Jones Newswires

September 25, 2018 18:51 ET (22:51 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

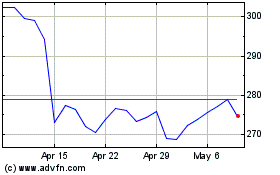

Salesforce (NYSE:CRM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Salesforce (NYSE:CRM)

Historical Stock Chart

From Apr 2023 to Apr 2024