Use these links to rapidly review the document

TABLE OF CONTENTS

Table of Contents

As filed with the Securities and Exchange Commission on August 9, 2018

No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

WideOpenWest, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

Delaware

(State or other jurisdiction of

incorporation or organization)

|

|

46-0552948

(I.R.S. Employer

Identification No.)

|

7887 East Belleview Avenue, Suite 1000

Englewood, Colorado 80111

(720) 479-3500

(Address, including zip code, and telephone number, including

area code, of registrant's principal executive offices)

Craig Martin

General Counsel

7887 East Belleview Avenue, Suite 1000

Englewood, Colorado 80111

(720) 479-3500

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Joshua N. Korff, P.C.

Brian Hecht

Kirkland & Ellis LLP

601 Lexington Avenue

New York, New York 10022

(212) 446-4800

Approximate date of commencement of proposed sale to the public:

From time to time after this Registration Statement becomes effective.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following

box.

o

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of

1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box.

ý

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box

and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities act

registration statement number of the earlier effective registration statement for the same offering.

o

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing

with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box.

o

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities

or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box.

o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an

emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

Large accelerated filer

o

|

|

Accelerated filer

o

|

|

Non-accelerated filer

ý

(Do not check if a

smaller reporting company)

|

|

Smaller reporting company

o

Emerging Growth Company

o

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

o

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class of Securities

to be Registered

|

|

Amount to be

Registered(1)

|

|

Proposed Maximum

Offering Price Per

Share(2)

|

|

Proposed Maximum

Aggregate Offering

Price(2)

|

|

Amount of

Registration Fee

|

|

|

|

Common Stock, $0.01 par value per share

|

|

55,905,512

|

|

$11.05

|

|

$617,755,908

|

|

$76,910.61

|

|

|

-

(1)

-

In

accordance with Rule 416 under the Securities Act of 1933, as amended (the "Securities Act"), this registration statement shall be deemed to cover any

additional shares to be offered or issued from stock splits, stock dividends or similar transactions with respect to the shares being registered.

-

(2)

-

Estimated

solely for the purpose of calculating the registration fee pursuant to Rule 457(c) under the Securities Act, based on the average of the high and

low prices of our common stock on the New York Stock Exchange on August 6, 2018. The proposed maximum offering price per share of common stock will be determined from time to time by the

selling stockholders named herein, or such additional selling stockholders as may be named in one or more prospectus supplements, in connection with, and at the time of, the sale by such selling

stockholders of the shares of common stock registered hereunder.

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall

file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or

until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information contained in this preliminary prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the

Registration Statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not the solicitation of an offer

to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated August 9, 2018

Prospectus

WideOpenWest, Inc.

55,905,512 Shares of Common Stock

The selling stockholders of WideOpenWest, Inc. ("WOW," the "Company," "we" or "us") named in this prospectus or as may be named in one or

more prospectus supplements (the "Selling Stockholders") may offer and sell shares of our common stock from time to time in amounts, at prices and on terms that will be determined at the time of the

offering. We will not receive any of the proceeds from the sale of our common stock offered by the Selling Stockholders.

The

Selling Stockholders may offer and sell shares of our common stock, to or through one or more underwriters, dealers and agents, or directly to purchasers, on a continuous or delayed

basis. This prospectus describes some of the general terms that may apply to these shares of common stock. The specific terms of any shares to be offered will be described in one or more supplements

to this prospectus. You should read this prospectus and the applicable prospectus supplement carefully before you invest. Our registration of the securities covered by this prospectus does not mean

that the Selling Stockholders will offer or sell any shares of our common stock.

Our

common stock is listed on The New York Stock Exchange ("NYSE") under the symbol "WOW." On August 8, 2018, the last reported sale price of our common stock was $10.87 per

share.

Investing in our shares involves a number of risks. See "

Risk Factors

" on page 2 to read about

factors you should consider before investing in our common stock.

This prospectus may not be used to offer and sell any securities unless accompanied by a prospectus supplement.

Neither the Securities and Exchange Commission ("SEC") nor any state securities commission nor any other regulatory body has approved or disapproved of these

securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is ,

2018.

Table of Contents

TABLE OF CONTENTS

Neither we nor the Selling Stockholders have authorized any dealer, salesperson or other person to give any information or to make any representation other than

those contained or incorporated by reference in this prospectus and the accompanying supplement to this prospectus or any associated "free writing prospectus." In this prospectus, any reference to an

applicable prospectus supplement may refer to a "free writing prospectus," unless the context otherwise requires. You must not rely upon any information or representation not contained or incorporated

by reference in this prospectus or the accompanying prospectus supplement. This prospectus and the accompanying prospectus supplement do not constitute an offer to sell or the solicitation of an offer

to buy any securities other than the

registered securities to which they relate, nor do this prospectus and the accompanying prospectus supplement constitute an offer to sell or the solicitation of an offer to buy securities in any

jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction.

i

Table of Contents

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-3 that we filed with the SEC using a "shelf" registration process. Under

this shelf process, the Selling Stockholders may, from time to time, offer and sell shares of our common stock in one or more offerings.

This

prospectus provides you with a general description of the shares of our common stock that the Selling Stockholders may offer. Each time the Selling Stockholders sell shares of our

common stock, we will, to the extent required by law, provide a prospectus supplement that contains specific information about the terms of that offering. This prospectus may not be used to consummate

sales of our common stock unless it is accompanied by a prospectus supplement.

You

should assume that the information appearing in this prospectus and any accompanying prospectus supplement is accurate as of the date on its respective cover, and that any

information incorporated by reference is accurate only as of the date of the document incorporated by reference, unless we indicate otherwise. Our business, financial condition, results of operations

and prospects may have changed since those dates.

If

the description of the offering varies between any prospectus supplement and this prospectus, you should rely on the information in the applicable prospectus supplement. Any statement

made in this prospectus or in a document incorporated by reference in this prospectus will be modified or superseded for purposes of this prospectus to the extent that a statement contained in this

prospectus or in any other subsequently filed document that is also incorporated by reference in this prospectus modifies or supersedes that statement. Any statement so modified or superseded will

not, except as so modified or superseded, constitute a part of this prospectus. Before making an investment in our common stock, you should carefully read this prospectus, any applicable prospectus

supplement and any applicable free writing prospectus, together with the information incorporated and deemed to be incorporated by reference herein as described under "Incorporation of Certain

Information by Reference" and the additional information described under the heading "Where You Can Find More Information."

Except

where the context otherwise requires or where otherwise indicated, references in this prospectus to the "Company," "we," "us," and "our" refer to WideOpenWest, Inc., a

Delaware corporation.

ii

Table of Contents

FORWARD-LOOKING STATEMENTS

This prospectus, any accompanying prospectus supplement and the documents incorporated by reference may contain and refer to certain statements

that are not historical facts that contain "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), and

Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). These forward-looking statements represent our goals, beliefs, plans and expectations about our prospects

for the future and other future events. Such statements involve certain risks, uncertainties and assumptions. Forward-looking statements include all statements that are not historical fact and can be

identified by terms such as "may," "intend," "might," "will," "should," "could," "would," "anticipate," "expect," "believe," "estimate," "plan," "project," "predict," "potential" or the negative of

these terms. Although these forward-looking statements reflect our good-faith belief and reasonable judgment based on current information, these statements are qualified

by important factors, many of which are beyond our control, that could cause our actual results to differ materially from those in the forward-looking statements, including, but not limited

to:

-

•

-

the wide range of competition we face;

-

•

-

competitors that are larger and possess more resources;

-

•

-

competition for the leisure and entertainment time of audiences;

-

•

-

whether our edge-out strategy will succeed;

-

•

-

dependence upon a business services strategy, including our ability to secure new businesses as customers;

-

•

-

conditions in the economy, including potentially uncertain economic conditions, unemployment levels and turbulent developments in the housing

market;

-

•

-

demand for our bundled broadband communications services may be lower than we expect;

-

•

-

our ability to respond to rapid technological change;

-

•

-

increases in programming and retransmission costs;

-

•

-

a decline in advertising revenues;

-

•

-

the effects of regulatory changes in our business;

-

•

-

our substantial level of indebtedness;

-

•

-

certain covenants in our debt documents;

-

•

-

programming exclusivity in favor of our competitors;

-

•

-

inability to obtain necessary hardware, software and operational support;

-

•

-

loss of interconnection arrangements;

-

•

-

failure to receive support from various funds established under federal and state law;

-

•

-

exposure to credit risk of customers, vendors and third parties;

-

•

-

strain on business and resources from future acquisitions or joint ventures, or the inability to identify suitable acquisitions;

-

•

-

potential impairments to our goodwill or franchise operating rights;

-

•

-

our ability to manage the risks involved in the foregoing; and

iii

Table of Contents

-

•

-

other factors described from time to time in our reports filed or furnished with the SEC, and in particular those factors set forth in the

section entitled "Risk Factors" in our Annual Report and Quarterly Reports.

While

we believe that our assumptions are reasonable, we caution that it is very difficult to predict the impact of known factors, and it is impossible for us to anticipate all factors

that could affect our actual results. All forward-looking statements are expressly qualified in their entirety by these cautionary statements. We caution you that the important factors referenced

above may not contain all of the factors that are important to you. In addition, we cannot assure you that we will realize the results or developments we expect or anticipate or, even if substantially

realized, that they will result in the consequences we anticipate or affect us or our operations in the way we expect.

All

forward-looking statements speak only as of the date on which they are made. Factors or events that could cause our actual results to differ may emerge from time to time, and it is

not possible for us to predict all of them. We undertake no obligation to update any forward-looking statement, whether as a result of new information, future developments or otherwise. If we do

update one or more forward-looking statements, there should be no inference that we will make additional updates with respect to those or other forward-looking statements.

iv

Table of Contents

THE COMPANY

We provide high-speed data ("HSD"), cable television ("Video"), and digital telephony ("Telephony") services to residential customers and offer

a full range of products and services to business customers. Led by our robust HSD offering, our products are available either as a bundle or as an individual service to residential and business

service customers.

Since

commencing operations in 2001, our focus has been to offer a competitive alternative cable service and establish a brand with a strong market position. We have scaled our business

through (i) organic subscriber growth and increased penetration within our existing markets and footprint, (ii) edge-outs to grow our footprint, (iii) upgrades to introduce

enhanced broadband services to networks we have acquired, (iv) entry into business services, with a broad range of HSD, Video and Telephony products, and (v) acquisitions and integration

of cable systems.

We

operate primarily in economically stable suburbs that are adjacent to large metropolitan areas as well as secondary and tertiary markets, which we believe have favorable competitive

and demographic profiles and include businesses operating across a range of industries. We benefit from the ability to augment our footprint by pursuing value-accretive network extensions, or

edge-outs, to increase our addressable market and grow our customer base. We have historically made selective capital investments in edge-outs to facilitate growth in residential and business

services.

Corporate Information

Our business commenced operations in 2001. WideOpenWest, Inc. was formed in 2012 and is a Delaware corporation. Our principal executive

offices are located at 7887 East Belleview Avenue, Suite 1000, Englewood, Colorado 80111. Our telephone number is (720) 479-3500. Our website can be found at

www.wowway.com

. The

information contained on our website or that can be accessed through our website is not part of this prospectus and you should not

rely on that information when making a decision whether to invest in our common stock.

Our

common stock is listed on the NYSE under the symbol "WOW."

1

Table of Contents

RISK FACTORS

Investing in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described under the

caption "Risk Factors" in our Annual Report and Quarterly Reports, which are incorporated by reference herein. You should also consider any "Risk Factors" contained in any applicable prospectus

supplement, and in any document that we file with the SEC after the date of this prospectus that is incorporated by reference herein. Our business, financial condition or results of operations could

be materially adversely affected by any of these risks. The market or trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment. Please

note that additional risks not presently foreseen by us or that we currently deem immaterial may also impair our business and operations.

2

Table of Contents

USE OF PROCEEDS

All shares of common stock sold in this offering will be sold by the Selling Stockholders. We will not receive any of the proceeds from such

sales.

3

Table of Contents

SELLING STOCKHOLDERS

This prospectus relates to the possible resale by the Selling Stockholders of up to 55,905,512 shares of our common stock. The Selling

Stockholders may from time to time offer and sell any or all of the shares of common stock set forth below pursuant to this prospectus and any prospectus supplement. When we refer to the "Selling

Stockholders" in this prospectus, we mean the entities listed in the table below, and the pledgees, donees, transferees, assignees, successors and others who later come to hold any of the Selling

Stockholders' interest in shares of our common stock other than through a public sale.

The

following table sets forth, as of the date of this prospectus, the name of the Selling Stockholders and the aggregate amount of shares of common stock that the Selling Stockholders

may offer pursuant to this prospectus. The percentage of common stock owned by the Selling Stockholders, both prior to and following the offering of any shares of common stock pursuant to this

prospectus, is based on 82,655,561 shares of common stock outstanding as of August 6, 2018. Information with respect to beneficial ownership is based on information obtained from such Selling

Stockholder and publicly available information. Information with respect to shares beneficially owned after the offering assumes the sale of all the shares offered and no other purchases or sales of

common stock. Information about other Selling Stockholders, including their identities, the common stock to be registered on their behalf and the amounts to be sold by them, will be set forth in a

prospectus supplement.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Before the Offering

|

|

|

|

After the Offering

|

|

|

Name and Address of Beneficial Owner

|

|

Number of

Shares

|

|

Percentage of

Outstanding

Shares

|

|

Number of

Shares Being

Offered

|

|

Number of

Shares

|

|

Percentage of

Outstanding

Shares

|

|

|

Avista(1)

|

|

|

27,086,225

|

|

|

32.8

|

%

|

|

27,086,225

|

|

|

—

|

|

|

—

|

|

|

Crestview(2)

|

|

|

28,819,287

|

|

|

34.9

|

%

|

|

28,819,287

|

|

|

—

|

|

|

—

|

|

-

(1)

-

Includes

47,494 shares beneficially owned by Avista Capital Holdings, L.P., 5,189,636 shares held by Avista Capital Partners III, L.P.,

1,531,596 shares held by Avista Capital Partners (Offshore) III, L.P., 1,362,097 shares held by Avista Capital Partners (Offshore) III-A, L.P., 18,059,208 shares held by

ACP Racecar Co-Invest, LLC and 896,194 shares held by ACP Racecar Co-Invest II, LLC (collectively, the "Avista Entities"). Avista Capital Managing Member, LLC exercises

voting and dispositive power over the shares held by the Avista Entities. Voting and disposition decisions at Avista Capital Managing Member, LLC are made by an investment committee, the

members of which are Thompson Dean, Steven Webster, David Burgstahler and Sriram Venkataraman. None of the foregoing persons has the power individually to vote or dispose of any shares. Each of the

foregoing individuals disclaims beneficial ownership of all such shares, except to the extent of his pecuniary interest. The address of each of the foregoing is c/o Avista Capital Partners,

65 E. 55th Street, 18th Floor, New York, New York 10022.

-

(2)

-

Includes

4,572,985 shares held by Crestview W1 Co-Investors, LLC, 1,139,859 shares held by Crestview W1 TE Holdings, LLC, 23,035,202 shares held by

Crestview W1 Holdings, L.P. and 71,241 beneficially owned by Crestview Advisors, L.L.C. (including 20,130 shares held by Crestview Advisors, L.L.C. and

51,111 restricted stock units by directors which have been assigned to Crestview Advisors, L.L.C.). Crestview Partners III GP, L.P. exercises voting and dispositive power

over the shares held by Crestview W1 Co-Investors, LLC, Crestview W1 TE Holdings, LLC, Crestview W1 Holdings, L.P., and Crestview Advisors, L.L.C provides investment

management and advisory services to certain of the foregoing entities. Voting and disposition decisions of Crestview Partners III GP, L.P. are made by an investment committee, the

members of which are Barry Volpert, Robert Delaney, Jr., Thomas Murphy, Jr., Brian Cassidy, Jeffrey Marcus, Robert Hurst, Alexander Rose, Richard DeMartini and Adam Klein. None of the

foregoing persons has the power individually to vote or dispose of any shares. Each of the foregoing individuals disclaims beneficial ownership of all such shares. The address of each of the foregoing

is c/o Crestview Partners, 667 Madison Avenue, 10th Floor, New York, New York 10065.

4

Table of Contents

DESCRIPTION OF CAPITAL STOCK

The following is a description of our capital stock. The following is a summary, does not purport to be complete and is

subject to our amended and restated certificate of incorporation, our amended and restated bylaws and the provisions of applicable law. Copies of our amended and restated certificate of incorporation

and amended and restated bylaws have been filed as exhibits to the registration statement of which this prospectus forms a part.

Authorized Capitalization

General

The total amount of our authorized capital stock consists of 700,000,000 shares of common stock, par value $0.01 per share, and 100,000,000

shares of undesignated preferred stock. As of August 6, 2018, we had outstanding 82,655,561 shares of common stock.

Common Stock

As of August 6, 2018, there were 61 stockholders of record of our common stock. Our common stock is not entitled to preemptive or other

similar subscription rights to purchase any of our securities. Our common stock is neither convertible nor redeemable.

Preferred Stock

Our Board of Directors has the authority to issue shares of preferred stock from time to time on terms it may determine, to divide shares of

preferred stock into one or more series and to fix the designations, preferences, privileges and restrictions of preferred stock, including dividend rights, conversion rights, voting rights, terms of

redemption, liquidation preference, sinking fund terms and the number of shares constituting any series or the designation of any series to the fullest extent permitted by the General Corporation Law

of the State of Delaware (the "DGCL"). The issuance of our preferred stock could have the effect of decreasing the trading price of our common stock, restricting dividends on our

capital stock, diluting the voting power of our common stock, impairing the liquidation rights of our capital stock, or delaying or preventing a change in control of our company.

Voting Rights

Each holder of our common stock is entitled to one vote per share on each matter submitted to a vote of stockholders. Our amended and restated

bylaws provide that the presence, in person or by proxy, of holders of shares representing a majority of the outstanding shares of capital stock entitled to vote at a stockholders' meeting shall

constitute a quorum. When a quorum is present, the affirmative vote of a majority of the votes cast is required to take action, unless otherwise specified by law or our certificate of incorporation,

and except for the election of directors, which is determined by a plurality vote. There are no cumulative voting rights.

Dividend Rights

Each holder of shares of our capital stock will be entitled to receive such dividends and other distributions in cash, stock or property as may

be declared by our Board of Directors from time to time out of our assets or funds legally available for dividends or other distributions. These rights are subject to the preferential rights of any

other class or series of our preferred stock.

Other Rights

Each holder of common stock is subject to, and may be adversely affected by, the rights of the holders of any series of preferred stock that we

may designate and issue in the future.

5

Table of Contents

Liquidation Rights

If our company is involved in a consolidation, merger, recapitalization, reorganization, or similar event, each holder of common stock will

participate pro rata in all assets remaining after payment of liabilities, subject to prior distribution rights of preferred stock, if any, then outstanding.

Anti-takeover Effects of our Amended and Restated Certificate of Incorporation and Amended and Restated

Bylaws

Our amended and restated certificate of incorporation and our amended and restated bylaws contain provisions that may delay, defer or discourage

another party from acquiring control of us. We expect that these provisions, which are summarized below, will discourage coercive takeover practices or inadequate takeover bids. These provisions are

also designed to encourage persons seeking to acquire control of us to first negotiate with the Board of Directors, which we believe may result in an improvement of the terms of any such acquisition

in favor of our stockholders. However, they also give the Board of Directors the power to discourage acquisitions that some stockholders may favor.

Action by Written Consent, Special Meeting of Stockholders and Advance Notice Requirements for

Stockholder Proposals

Our amended and restated certificate of incorporation provides that stockholder action can be taken only at an annual or special meeting of

stockholders and cannot be taken by written consent in lieu of a meeting once Avista Capital Partners and Crestview Partners (together, the "Sponsors") cease to beneficially own more than 50% of our

outstanding shares. Our amended and restated certificate of incorporation and bylaws also provide that, except as otherwise required by law, special meetings of the stockholders can be called only

pursuant to a resolution adopted by a majority of the total number of directors that we would have if there were no vacancies or, until the date that the Sponsors cease to beneficially own more than

50% of our outstanding shares, at the request of holders of 50% or more of our outstanding shares. Except as described above, stockholders are not permitted to call a special meeting or to require the

board of directors to call a special meeting.

In

addition, our amended and restated bylaws require advance notice procedures for stockholder proposals to be brought before an annual meeting of the stockholders, including the

nomination of directors. Stockholders at an annual meeting may only consider the proposals specified in the notice of meeting or brought before the meeting by or at the direction of the Board of

Directors, or by a stockholder of record on the record date for the meeting, who is entitled to vote at the meeting and who has delivered a timely written notice in proper form to our secretary, of

the stockholder's intention to bring such business before the meeting.

These

provisions could have the effect of delaying until the next stockholder meeting any stockholder actions, even if they are favored by the holders of a majority of our outstanding

voting securities.

Classified Board

Our Board of Directors is divided into three classes of directors, with the classes as nearly equal in number as possible. As a result,

approximately one-third of our Board of Directors is elected each year. The classification of directors has the effect of making it more difficult for stockholders to change the composition of our

board.

Removal of Directors

Our amended and restated certificate of incorporation provides that directors may be removed with or without cause at any time upon the

affirmative vote of holders of at least a majority of the

6

Table of Contents

votes

to which all the stockholders would be entitled to cast until the Sponsors cease to beneficially own more than 50% of our outstanding shares. After such time, directors may only be removed from

office only for cause and only upon the affirmative vote of at least 75% of the voting power of our outstanding shares of common stock.

Amendment to Certificate of Incorporation and Bylaws

The DGCL provides generally that the affirmative vote of a majority of the outstanding stock entitled to vote on amendments to a corporation's

certificate of incorporation or bylaws is required to approve such amendment, unless a corporation's certificate of incorporation or bylaws, as the case may be, requires a greater percentage. Our

amended and restated bylaws may be amended, altered, changed or repealed by a majority vote of our Board of Directors, provided that, in addition to any other vote otherwise required by law, after the

date on which the Sponsors cease to beneficially own more than 50% of our outstanding shares, the affirmative vote of at least 75% of the voting power of our outstanding shares of common stock will be

required to amend, alter, change or repeal our amended and restated bylaws. Additionally, after the date on which the Sponsors cease to beneficially own more than 50% of our outstanding shares, the

affirmative vote of at least 75% of the voting power of the outstanding shares of capital stock entitled to vote on the adoption, alteration, amendment or repeal of our amended and restated

certificate of incorporation, voting as a single class, will be required to amend or repeal or to adopt any provision inconsistent with specified provisions of our amended and restated certificate of

incorporation. This requirement of a supermajority vote to approve amendments to our amended and restated certificate of incorporation and amended and restated bylaws could enable a minority of our

stockholders to exercise veto power over any such amendments.

Delaware Anti-Takeover Statute

Section 203 of the DGCL provides that if a person acquires 15% or more of the voting stock of a Delaware corporation, such person becomes

an "interested stockholder" and may not engage in certain "business combinations" with the corporation for a period of three years from the time such person acquired 15% or more of the corporation's

voting stock, unless: (1) the board of directors approves the acquisition of stock or the merger transaction before the time that the person becomes an interested stockholder, (2) the

interested stockholder owns at least 85% of the outstanding voting stock of the corporation at the time the merger transaction commences (excluding voting stock owned by directors who are also

officers and certain employee stock plans), or (3) the merger transaction is approved by the board of directors and by the affirmative vote at a meeting, not by written consent, of stockholders

of 2/3 of the holders of the outstanding voting stock which is not owned by the interested stockholder. A Delaware corporation may elect in its certificate of incorporation or bylaws not to be

governed by this particular Delaware law.

Under

our amended and restated certificate of incorporation, we have opted out of Section 203 of the DGCL, and are therefore not subject to Section 203.

Corporate Opportunity

Our amended and restated certificate of incorporation provides that we renounce any interest or expectancy in, or in being offered an

opportunity to participate in, any business opportunity that may from time to time be presented to the Sponsors or any of their officers, directors, agents, stockholders, members, partners, affiliates

and subsidiaries (other than us and our subsidiaries) and that may be a business opportunity for the Sponsors, even if the opportunity is one that we might reasonably have pursued or had the ability

or desire to pursue if granted the opportunity to do so. No such person will be liable to us for breach of any fiduciary or other duty, as a director or officer or otherwise, by reason of the fact

that such person, acting in good faith, pursues or acquires any such business opportunity, directs any such business opportunity to another person or fails to present any such business

7

Table of Contents

opportunity,

or information regarding any such business opportunity, to us unless, in the case of any such person who is our director or officer, any such business opportunity is expressly offered to

such director or officer solely in his or her capacity as our director or officer. Neither the Sponsors, nor any of their representatives has any duty to refrain from engaging directly or indirectly

in the same or similar business activities or lines of business as us or any of our subsidiaries.

Limitations on Liability and Indemnification of Officers and Directors

Our amended and restated certificate of incorporation limits the liability of our directors to the fullest extent permitted by the DGCL, and our

amended and restated bylaws provides that we will indemnify them to the fullest extent permitted by such law. We have entered into indemnification agreements with our current directors and executive

officers and expect to enter into a similar agreement with any new directors or executive officers.

Exclusive Jurisdiction of Certain Actions

Our amended and restated certificate of incorporation requires, to the fullest extent permitted by law, that derivative actions brought in the

name of the Company, actions against directors, officers and employees for breach of fiduciary duty and other similar actions may be brought only in the Court of Chancery in the State of Delaware.

Although we believe this provision benefits the Company by providing increased consistency in the application of Delaware law in the types of lawsuits to which it applies, the provision may have the

effect of discouraging lawsuits against our directors and officers.

Transfer Agent and Registrar

The transfer agent and registrar for our common stock is American Stock Transfer & Trust Company, LLC. Its address is

548 Briana Lane, Hudson, WI 54016.

8

Table of Contents

PLAN OF DISTRIBUTION

The Selling Stockholders, which as used herein includes donees, pledgees, transferees or other successors-in-interest selling our common stock

or interests in our common stock received after the date of this prospectus from the Selling Stockholders as a gift, pledge, partnership distribution or other transfer, may, from time to time, sell,

transfer or otherwise dispose of certain of its shares of common stock or interests in our common stock, on any stock exchange, market or trading facility on which the common stock is traded or in

private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the

time of sale, or at negotiated prices.

The

Selling Stockholders may use any one or more of the following methods when disposing of shares or interests therein:

-

•

-

on the New York Stock Exchange or any other national securities exchange or U.S. inter-dealer system of a registered national securities

association on which our common stock may be listed or quoted at the time of sale;

-

•

-

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

-

•

-

one or more underwritten offerings;

-

•

-

block trades in which the broker-dealer will attempt to sell the shares as agent, but may position and resell a portion of the block as

principal to facilitate the transaction;

-

•

-

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

-

•

-

an exchange distribution in accordance with the rules of the applicable exchange;

-

•

-

privately negotiated transactions;

-

•

-

short sales effected after the date the registration statement of which this prospectus is a part is declared effective by the SEC;

-

•

-

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

-

•

-

broker-dealers may agree with the Selling Stockholders to sell a specified number of such shares at a stipulated price per share; and

-

•

-

a combination of any such methods of sale.

The

Selling Stockholders may, from time to time, pledge or grant a security interest in some of the shares of common stock owned by them and, if the Selling Stockholders default in the

performance of its secured obligations, the pledgees or secured parties may offer and sell the shares, from time to time, under this prospectus, or under an amendment or supplement to this prospectus

amending the list of the Selling Stockholders to include the pledgee, transferee or other successors in interest as the Selling Stockholders under this prospectus. The Selling Stockholders also may

transfer the shares of common stock in other circumstances, in which case the transferees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this

prospectus.

In

connection with the sale of our common stock or interests therein, the Selling Stockholders may enter into hedging transactions with broker-dealers or other financial institutions,

which may in turn engage in short sales of our common stock in the course of hedging the positions they assume. The Selling Stockholders may also sell our common stock short and deliver these

securities to close out their short positions, or loan or pledge our common stock to broker-dealers that in turn may sell these securities. The Selling Stockholders may also enter into option or other

transactions with broker-dealers or other financial institutions or the creation of one or more derivative securities that require the

9

Table of Contents

delivery

to such broker-dealer or other financial institution of shares offered by this prospectus, which shares such broker-dealer or other financial institution may resell pursuant to this

prospectus (as supplemented or amended to reflect such transaction).

The

aggregate proceeds to the Selling Stockholders from the sale of our common stock will be the purchase price of our common stock less discounts or commissions, if any. The Selling

Stockholders reserve the right to accept and, together with their agents from time to time, as applicable, to reject, in whole or in part, any proposed purchase of our common stock to be made directly

or through agents. We will not receive any of the proceeds from any offering by the Selling Stockholders.

The

Selling Stockholders also may in the future resell a portion of the common stock in open market transactions in reliance upon Rule 144 under the Securities Act, provided that

they meet the criteria and conform to the requirements of that rule, or pursuant to other available exemptions from the registration requirements of the Securities Act.

The

Selling Stockholders and any underwriters, broker-dealers or agents that participate in the sale of our common stock or interests therein may be "underwriters" within the meaning of

Section 2(11) of the Securities Act. Any discounts, commissions, concessions or profit they earn on any resale of the common stock may be underwriting discounts and commissions under the

Securities Act. If the Selling Stockholders are "underwriters" within the meaning of Section 2(11) of the Securities Act, then the Selling Stockholders will be subject to the prospectus

delivery requirements of the Securities Act. Underwriters and their controlling persons, dealers and agents may be entitled, under agreements entered into with us and the Selling Stockholders, to

indemnification against and contribution toward specific civil liabilities, including liabilities under the Securities Act.

To

the extent required, the common stock to be sold, the respective purchase prices and public offering prices, the names of any agents, dealers or underwriters, and any applicable

discounts, commissions, concessions or other compensation with respect to a particular offer will be set forth in an accompanying prospectus supplement or, if appropriate, a post-effective amendment

to the registration statement that includes this prospectus.

To

facilitate the offering of the common stock offered by the Selling Stockholders, certain persons participating in the offering may engage in transactions that stabilize, maintain or

otherwise affect the price of our common stock. This may include over-allotments or short sales, which involve the sale by persons participating in the offering of more shares than were sold to them.

In these circumstances, these persons would cover such over-allotments or short positions by making purchases in the open market or by exercising their over-allotment option, if any. In addition,

these persons may stabilize or maintain the price of our common stock by bidding for or purchasing shares in the open market or by imposing penalty bids, whereby selling concessions allowed to dealers

participating in the offering may be reclaimed if shares sold by them are repurchased in connection with stabilization transactions. The effect of these transactions may be to stabilize or maintain

the market price of our common stock at a level above that which might otherwise prevail in the open market. These transactions may be discontinued at any time.

The

Selling Stockholders may use this prospectus in connection with resales of the common stock. The Selling Stockholders may be deemed to be underwriters under the Securities Act in

connection with the shares of common stock they resell and any profits on the sales may be deemed to be underwriting

discounts and commissions under the Securities Act. Unless otherwise set forth in a prospectus supplement, the Selling Stockholders will receive all the net proceeds from the resale of the common

stock sold by them.

10

Table of Contents

LEGAL MATTERS

Kirkland & Ellis LLP, New York, New York will pass upon the validity of the common stock offered hereby on our behalf. If any

legal matters relating to offerings made in connection with this prospectus are passed upon by counsel for underwriters, dealers or agents, such counsel will be named in the prospectus supplement

relating to any such offering.

EXPERTS

The consolidated and combined financial statements as of December 31, 2017 and 2016 and for each of the three years in the period ended

December 31, 2017 incorporated by reference in this prospectus have been so incorporated in reliance on the report of BDO USA, LLP, an independent registered public accounting firm,

incorporated herein by reference, given on the authority of said firm as experts in auditing and accounting.

WHERE YOU CAN FIND MORE INFORMATION

WideOpenWest, Inc. files annual, quarterly and current reports, proxy statements and other information with the SEC. The public may read

and copy the information we file with the SEC at the SEC's Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. The public may obtain information on the operation of the Public

Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains an Internet site that contains reports, proxy and information

statements, and other information regarding issuers that file electronically with the SEC. The address of that site is

www.sec.gov

.

Our

website address is located at

www.wowway.com

. Through links on the "Investor Relations" portion of our website, we make available free

of charge our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and any amendments to those reports filed or furnished pursuant to

Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). Such material is made available through our website as soon as reasonably practicable after we

electronically file the information with, or furnish it to, the SEC.

The information contained on our website is not part of, or incorporated by reference into, this

prospectus.

The

registration statement containing this prospectus, including exhibits to the registration statement, provides additional information about us and the common stock offered under this

prospectus. The registration statement can be read at the SEC website or at the SEC offices referenced above.

11

Table of Contents

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to "incorporate by reference" information into this prospectus, which means that we can disclose important information about

us by referring you to another document filed separately with the SEC. The information incorporated by reference is considered to be a part of this prospectus. This prospectus incorporates by

reference the documents and reports listed below (other than portions of these documents that are either (1) described in paragraph (e) of Item 201 of Registration S-K or

paragraphs (d)(1)-(3) and (e)(5) of Item 407 of Regulation S-K promulgated by the SEC or (2) deemed to have been furnished and not filed in accordance with SEC rules,

including Current Reports on Form 8-K furnished under Item 2.02 or Item 7.01 (including any financial statements or exhibits relating thereto furnished pursuant to

Item 9.01), unless otherwise indicated therein:

-

•

-

Our Annual Report on Form 10-K for the year ended December 31, 2017 (our "Annual Report"), filed with the SEC on March 14,

2018;

-

•

-

Our Quarterly Report on Form 10-Q for the quarter ended March 31, 2018, filed with the SEC on May 11, 2018, and our

Quarterly Report on Form 10-Q for the quarter ended June 30, 2018, filed with the SEC on August 9, 2018 (together, our "Quarterly Reports");

-

•

-

Our Current Reports on Form 8-K filed with the SEC on January 10, 2018, March 27, 2018, April 23, 2018,

May 11, 2018 (only that Form 8-K including Item 5.07) and July 11, 2018; and

-

•

-

The description of our common stock included in the Registration Statement on Form 8-A, filed with the SEC on May 22, 2017 (File

No. 001-38101), including any subsequent amendment or any report filed for the purpose of updating such description.

We

also incorporate by reference the information contained in all other documents we file with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act (other

than portions of these documents that are either (1) described in paragraph (e) of Item 201 of Regulation S-K or paragraphs (d)(1)-(3) and (e)(5) of Item 407

of Regulation S-K promulgated by the SEC or (2) deemed to have been furnished and not filed in accordance with SEC rules, including Current Reports on Form 8-K furnished under

Item 2.02 or Item 7.01 (including any financial statements or exhibits relating thereto furnished pursuant to Item 9.01, unless otherwise indicated therein)) after the date of

this prospectus and prior to the completion of the offering of all securities covered by this prospectus and any accompanying prospectus supplement. The information contained in any such document will

be considered part of this prospectus from the date the document is filed with the SEC.

If

you make a request for such information in writing or by telephone, we will provide you, without charge, a copy of any or all of the information incorporated by reference into this

prospectus. Any such request should be directed to:

WideOpenWest, Inc.

7887 East Belleview Avenue, Suite 1000

Englewood, Colorado 80111

(720) 479-3500

Attention: Investor Relations

You

should rely only on the information contained in, or incorporated by reference into, this prospectus, in any accompanying prospectus supplement or in any free writing prospectus

filed by us with the SEC. We have not authorized anyone to provide you with different or additional information. You should not assume that the information in this prospectus or in any document

incorporated by reference is accurate as of any date other than the date on the front cover of the applicable document.

12

Table of Contents

WideOpenWest, Inc.

Common Stock

PROSPECTUS

Table of Contents

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution

The following table sets forth the various expenses expected to be incurred by the Registrant in connection with the sale and distribution of

the securities being registered hereby, other than underwriting discounts and commissions. All amounts are estimated except the SEC registration fee

|

|

|

|

|

|

|

SEC registration fee

|

|

$

|

76,910.61

|

|

|

Accounting fees and expenses

|

|

|

|

(1)

|

|

Legal fees and expenses

|

|

|

|

(1)

|

|

Printing and engraving expenses

|

|

|

|

(1)

|

|

Registrar and Transfer Agent's fees

|

|

|

|

(1)

|

|

Miscellaneous fees and expenses

|

|

|

|

(1)

|

|

Total

|

|

|

|

(1)

|

-

(1)

-

Estimated

expenses are not presently known. The foregoing sets forth the general categories of expenses (other than underwriting discounts and commissions) that we

anticipate we will incur in connection with the offering of securities under this registration statement on Form S-3.

Item 15. Indemnification of Directors and Officers

We are incorporated under the laws of the State of Delaware. Section 102(b)(7) of the Delaware General Corporation Law

("DGCL") allows a corporation to provide in its certificate of incorporation that a director of the corporation will not be personally liable to the corporation or its stockholders for

monetary damages for breach of fiduciary duty as a director, except where the director breached the duty of loyalty, failed to act in good faith, engaged in intentional misconduct or knowingly

violated a law, authorized the payment of a dividend or approved a stock repurchase in violation of Delaware corporate law or obtained an improper personal benefit. Our amended and restated

certificate of incorporation provides for this limitation of liability.

Section 145

of the DGCL ("Section 145") provides that a Delaware corporation may indemnify any person who was, is or is threatened to be made party to any threatened,

pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (other than an action by or in the right of such corporation), by reason of the fact that such

person is or was an officer, director, employee or agent of such corporation or is or was serving at the request of such corporation as a director, officer, employee or agent of another corporation or

enterprise. The indemnity may include expenses (including attorneys' fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by such person in connection with such

action, suit or proceeding, provided such person acted in good faith and in a manner he reasonably believed to be in or not opposed to the corporation's best interests and, with respect to any

criminal action or proceeding, had no reasonable cause to believe that his or her conduct was illegal. Where an officer or director is successful on the merits or otherwise in the defense of any

action referred to above, the corporation must indemnify him against the expenses which such officer or director has actually and reasonably incurred.

Section 145

further authorizes a corporation to purchase and maintain insurance on behalf of any person who is or was a director, officer, employee or agent of the corporation or

is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation or enterprise, against any liability asserted against him and incurred by him in

any such capacity, or arising out of his or her status as such, whether or not the corporation would otherwise have the power to indemnify him under Section 145.

II-1

Table of Contents

The

Registrant's amended and restated certificate of incorporation provides that we must indemnify our directors and officers to the fullest extent authorized by the DGCL and must also

pay expenses incurred in defending any such proceeding in advance of its final disposition upon delivery of an

undertaking, by or on behalf of an indemnified person, to repay all amounts so advanced if it should be determined ultimately that such person is not entitled to be indemnified.

The

Company has entered into indemnification agreements with each of its current directors and officers. These agreements require the Company to indemnify these individuals to the

fullest extent permitted under Delaware law against liabilities that may arise by reason of their service to the Company, and to advance expenses incurred as a result of any proceeding against them as

to which they could be indemnified.

The

indemnification rights set forth above shall not be exclusive of any other right which an indemnified person may have or hereafter acquire under any statute, provision of the

Company's amended and restated certificate of incorporation, the Company's amended and restated bylaws, agreement, vote of stockholders or disinterested directors or otherwise.

The

Company maintains standard policies of insurance that provide coverage (1) to its directors and officers against loss arising from claims made by reason of breach of duty or

other wrongful act and (2) to the Company with respect to indemnification payments that it may make to such directors and officers.

Item 16. Exhibits and Financial Statement Schedules

-

(a)

-

Exhibits.

The

exhibit index attached hereto is incorporated herein by reference.

Item 17. Undertakings

-

(a)

-

The

undersigned registrant hereby undertakes:

-

(1)

-

To

file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

-

(i)

-

To

include any prospectus required by Section 10(a)(3) of the Securities Act;

-

(ii)

-

To

reflect in the prospectus any facts or events arising after the effective date of the Registration Statement (or the most recent post-effective amendment

thereof) which individually or in the aggregate, represent a fundamental change in the information set forth in the Registration Statement; and

-

(iii)

-

To

include any material information with respect to the plan of distribution not previously disclosed in the Registration Statement or any material change to such

information in the Registration Statement;

provided, however

, that paragraphs (a)(1)(i), (a)(1)(ii) and (a)(1)(iii) of this section do not apply if the information required to be included

in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the SEC by the Registrant pursuant to Section 13 or Section 15(d) of the Exchange Act

that are incorporated by reference in the Registration Statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

-

(2)

-

That,

for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement

relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial

bona fide

offering

thereof.

II-2

Table of Contents

-

(3)

-

To

remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

-

(4)

-

That,

for the purpose of determining liability under the Securities Act to any purchaser:

(A)

Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and

included in the registration statement; and

(B)

Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5) or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant

to Rule 415(a)(1)(i), (vii) or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act shall be deemed to be part of and included

in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described

in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the

registration statement relating to the securities in the registration statement to which the prospectus relates, and the offering of such securities at that time shall be deemed to be the initial

bona fide

offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration

statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a

time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made

in any such document immediately prior to such effective date; and

-

(5)

-

That,

for the purpose of determining liability of the registrant under the Securities Act to any purchaser in the initial distribution of the securities, the

undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the

securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and

will be considered to offer or sell such securities to such purchaser:

-

(i)

-

any

preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

-

(ii)

-

any

free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned Registrant;

-

(iii)

-

the

portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities

provided by or on behalf of the undersigned registrant; and

-

(iv)

-

any

other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

(b)

The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the registrant's annual report pursuant to

Section 13(a) or Section 15(d) of the Exchange Act that is incorporated by reference in the Registration Statement shall be deemed to be a new registration statement relating to the

securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c)

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers, and controlling persons of the registrant pursuant to the foregoing provisions,

or

II-3

Table of Contents

otherwise,

the registrant has been advised that, in the opinion of the SEC, such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the

event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in

the successful defense of any action, suit or proceeding) is asserted by such director, officer, or controlling person in connection with the securities being registered, the registrant will, unless

in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public

policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

II-4

Table of Contents

EXHIBIT INDEX

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

|

1.1

|

|

Form of Underwriting Agreement.*

|

|

4.1

|

|

Amended and Restated Certificate of Incorporation of WideOpenWest, Inc. (incorporated by reference

to Exhibit 3.1 to WideOpenWest, Inc.'s Registration Statement on Form S-1, File No. 333-216894, filed on May 15, 2017).

|

|

4.2

|

|

Amended and Restated Bylaws of WideOpenWest, Inc. (incorporated by reference to Exhibit 3.2 to

WideOpenWest, Inc.'s Registration Statement on Form S-1, File No. 333-216894, filed on May 15, 2017).

|

|

5.1

|

|

Opinion of Kirkland & Ellis LLP.

|

|

23.1

|

|

Consent of BDO USA, LLP.

|

|

23.2

|

|

Consent of Kirkland & Ellis LLP (included in Exhibit 5.1).

|

|

24.1

|

|

Power of Attorney (included on signature page to this Registration Statement).

|

-

*

-

To

be filed, if necessary, after effectiveness of this registration statement by an amendment to the registration statement or incorporated by reference from documents

filed or to be filed with the SEC under the Exchange Act.

II-5

Table of Contents

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all

of the requirements for filing on Form S-3 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Englewood,

State of Colorado, on August 9, 2018.

|

|

|

|

|

|

|

|

|

|

|

WideOpenWest, Inc.

|

|

|

By:

|

|

/s/ TERESA ELDER

|

|

|

|

|

|

Name:

|

|

Teresa Elder

|

|

|

|

|

|

Title:

|

|

Chief Executive Officer

|

POWER OF ATTORNEY

Each officer and director of WideOpenWest, Inc. whose signature appears below constitutes and appoints Teresa Elder, Craig Martin and

Richard E. Fish, Jr., and each of them, his or her true and lawful attorney-in-fact and agent, with full power of substitution and resubstitution, for him or her and in his or her name, place and

stead, in any and all capacities, to execute any or all amendments including any post-effective amendments and supplements to this Registration Statement, and any additional Registration Statements

filed pursuant to Rule 462(b), and to file the same, with all exhibits thereto, and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said

attorney-in-fact and agent full power and authority to do and perform each and every act and thing requisite and necessary to be done, as fully to all intents and purposes as he might or could do in

person, hereby ratifying and confirming all that said attorney-in-fact and agent, or his or her substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

*

* * *

Pursuant

to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons on August 9, 2018 in the capacities indicated:

|

|

|

|

|

Name

|

|

Title

|

|

|

|

/s/ TERESA ELDER

Teresa Elder

|

|

Chief Executive Officer and Director (Principal Executive Officer)

|

/s/ RICHARD E. FISH, JR.

Richard E. Fish, Jr.

|

|

Chief Financial Officer (Principal Financial Officer and Principal Accounting Officer)

|

/s/ JILL BRIGHT

Jill Bright

|

|

Director

|

/s/ DAVID BURGSTAHLER

David Burgstahler

|

|

Director

|

II-6

Table of Contents

|

|

|

|

|

Name

|

|

Title

|

|

|

|

/s/ BRIAN CASSIDY

Brian Cassidy

|

|

Director

|

/s/ DANIEL KILPATRICK

Daniel Kilpatrick

|

|

Director

|

/s/ JEFFREY MARCUS

Jeffrey Marcus

|

|

Director

|

/s/ TOM MCMILLIN

Tom McMillin

|

|

Director

|

/s/ PHIL SESKIN

Phil Seskin

|

|

Director

|

/s/ JOSHUA TAMAROFF

Joshua Tamaroff

|

|

Director

|

II-7

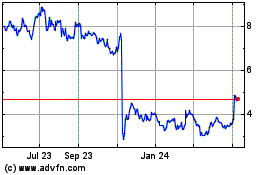

WideOpenWest (NYSE:WOW)

Historical Stock Chart

From Mar 2024 to Apr 2024

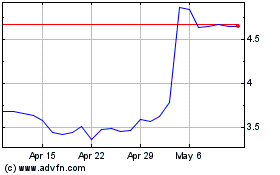

WideOpenWest (NYSE:WOW)

Historical Stock Chart

From Apr 2023 to Apr 2024