Securities Registration: Employee Benefit Plan (s-8)

December 11 2017 - 6:03AM

Edgar (US Regulatory)

REGISTRATION NO. 333-163815

========================================

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form S-8

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

Viva Entertainment

Group Inc.

(Exact name of Registrant

as specified in its charter)

|

Nevada

|

98-0642409

|

|

(State or other jurisdiction of incorporation or organization)

|

(IRS Employer Identification

No.)

|

143-41 84

th

Drive

Briarwood, NY 11435

(Address of Principal Executive Offices, including

ZIP Code)

2017 Non-Qualified Stock Compensation Plan

(Full title of the plan)

Business Filings Incorporated

6100 Neil Road, Suite 500

Reno, NV 89511

(Name and address of agent for service)

(608)-827-5300

(Telephone number, including area code, of agent

for service)

Harold H. Martin, Esq.

Law Offices of Harold H. Martin, P.A.

19720 Jetton Road, 3

rd

Floor

Cornelius,

North Carolina 28031

(Communications To)

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated

filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check

one):

|

Large accelerated filer

☐

|

|

Accelerated filer

☐

|

|

|

Non-accelerated filer

☐

(Do not check if a smaller reporting company)

|

|

Smaller reporting company

☒

|

|

|

|

|

Emerging Growth

Company ☐

|

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(b) of the Securities

Act. ☐

CALCULATION OF REGISTRATION FEE

|

Title of Securities

to be Registered

|

Amount of

Shares

to be Registered

|

Proposed

Maximum

Offering

Price Per Share

|

Proposed

Maximum

Aggregate

Offering Price

(1)

|

Amount of

Registration

Fee

|

|

|

$.00001 par value

common stock

|

|

|

|

500,000,000

|

|

|

|

$0.0017 (1)

|

|

|

$

|

800,000

|

|

|

$

|

64.72

|

|

|

|

TOTALS

|

|

|

|

500,000,000

|

|

|

|

$0.0017 (1)

|

|

|

$

|

800,000

|

|

|

$

|

64.72

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

This calculation is made solely for the purposes of determining the registration fee pursuant

to the provisions of Rule 457(c) under the Securities Act of 1933, as amended, and is calculated on the basis of the average of

the high and low prices reported on the OTC Bulletin Board as of December 5, 2017.

|

PROSPECTUS

Viva Entertainment Group, Inc.

500,000,000 Shares Of Common Stock

This prospectus relates

to the offer and sale by Viva Entertainment Group Inc., a Nevada corporation (“OTTV”), of shares of its $.00001 par

value per share common stock to employees, directors, officers, consultants, advisors and other persons associated with OTTV pursuant

to the 2017 Non-Qualified Stock Compensation Plan (the “Stock Plan”). Pursuant to the Stock Plan, OTTV is registering

hereunder and then issuing, upon receipt of adequate consideration therefore, 500,000,000 shares of common stock.

The common stock is not

subject to any restriction on transferability. Recipients of shares other than persons who are “affiliates” of OTTV

within the meaning of the Securities Act of 1933 (the “Act”) may sell all or part of the shares in any way permitted

by law, including sales in the over-the-counter market at prices prevailing at the time of such sale. An affiliate is summarily,

any director, executive officer or controlling shareholder of OTTV or any one of its subsidiaries. An “affiliate” of

OTTV is subject to Section 16(b) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The common

stock is traded on the OTC Bulletin Board under the symbol “OTTV.”

These Securities Have Not Been Approved

Or Disapproved By The Securities And Exchange Commission Nor Has The Commission Passed Upon The Accuracy Or Adequacy Of This Prospectus.

Any Representation To The Contrary Is A Criminal Offense.

The date of this prospectus is December 6, 2017

This prospectus is part

of a registration statement which was filed and became effective under the Securities Act of 1933, as amended (the “Securities

Act”), and does not contain all of the information set forth in the registration statement, certain portions of which have

been omitted pursuant to the rules and regulations promulgated by the U.S. Securities and Exchange Commission (the “Commission”)

under the Securities Act. The statements in this prospectus as to the contents of any contract or other documents filed as an exhibit

to either the registration statement or other filings by OTTV with the Commission are qualified in their entirety by reference

thereto.

A copy of any document

or part thereof incorporated by reference in this prospectus but not delivered herewith will be furnished without charge upon written

or oral request. Requests should be addressed to: Viva Entertainment Group Inc., 143-41 84

th

Drive, Briarwood, NY 11435.

OTTV’s telephone number is (347) 681-1668.

OTTV is subject to the

reporting requirements of the Securities Exchange Act of 1934 (the “Exchange Act”) and in accordance therewith files

reports and other information with the Commission. These reports, as well as the proxy statements and other information filed by

OTTV under the Exchange Act may be inspected and copied at the public reference facilities maintained by the Commission at 100

F Street, N.E., Washington D.C. 20549. In addition, the Commission maintains a World Wide Website on the Internet at http://www.sec.gov

that contains reports, proxy and information statements and other information regarding registrants that file electronically with

the Commission

No person has been authorized

to give any information or to make any representation, other than those contained in this prospectus, and, if given or made, such

other information or representation must not be relied upon as having been authorized by OTTV. This prospectus does not constitute

an offer or a solicitation by anyone in any state in which such is not authorized or in which the person making such is not qualified

or to any person to whom it is unlawful to make an offer or solicitation.

Neither the delivery of

this prospectus nor any sale made hereunder shall, under any circumstances, create any implication that there has not been a change

in the affairs of OTTV since the date hereof.

TABLE OF CONTENTS

|

Information Required in the Section 10(a) Prospectus

|

4

|

|

Item 1.

|

The Plan Information

|

4

|

|

|

|

|

|

Item 2.

|

Registrant Information and Employee Plan Annual Information

|

5

|

|

Information Required in the Registration Statement

|

5

|

|

Item 3.

|

Incorporation of Documents by Reference

|

5

|

|

|

|

|

|

Item 4.

|

Description of Securities

|

6

|

|

|

|

|

|

Item 5.

|

Interests of Named Experts and Counsel

|

6

|

|

|

|

|

|

Item 6.

|

Indemnification of Directors and Officers

|

6

|

|

|

|

|

|

Item 7.

|

Exemption from Registration Claimed

|

6

|

|

|

|

|

|

Item 8.

|

Exhibits

|

7

|

|

|

|

|

|

Item 9.

|

Undertakings

|

8

|

|

|

|

|

PART 1

INFORMATION REQUIRED IN THE SECTION

10(a)

PROSPECTUS

Item 1. The Plan Information.

The Company

Viva Entertainment Group

Inc. has its principal executive offices at 143-41 84

th

Drive, Briarwood, NY 11435. OTTV’s telephone number is

(347) 681-1668.

Purpose

OTTV will issue common

stock and common stock upon exercise of options to employees, directors, officers, consultants, advisors and other persons associated

with OTTV pursuant to the Stock Plan, which has been approved by the Board of Directors of OTTV. The Stock Plan is intended to

provide a method whereby OTTV may be stimulated by the personal involvement of its employees, directors, officers, consultants,

advisors and other persons in OTTV’s business and future prosperity, thereby advancing the interests of OTTV and all of its

shareholders. A copy of the Stock Plan has been filed as an exhibit to this registration statement.

Common Stock

The Board has authorized

the issuance of 500,000,000 shares of the common stock to certain of the above-mentioned persons upon effectiveness of this registration

statement.

No Restrictions on Transfer

Recipients of shares of

common stock will become the record and beneficial owner of the shares of common stock upon issuance and delivery and are entitled

to all of the rights of ownership, including the right to vote any shares awarded and to receive ordinary cash dividends on the

common stock.

Tax Treatment to the Recipients

The common stock is not

qualified under Section 401(a) of the Internal Revenue Code. A recipient, therefore, will be required for federal income tax purposes

to recognize compensation during the taxable year of issuance unless the shares are subject to a substantial risk of forfeiture.

Accordingly, absent a specific contractual provision to the contrary, the recipient will receive compensation taxable at ordinary

rates equal to the fair market value of the shares on the date of receipt since there will be no substantial risk of forfeiture

or other restrictions on transfer. Each recipient is urged to consult his tax advisors on this matter.

Tax Treatment to the Company

The amount of income recognized

by a recipient hereunder in accordance with the foregoing discussion will be a tax deductible expense by OTTV for federal income

tax purposes in the taxable year of OTTV during which the recipient recognizes income.

Restrictions on Resale

In the event that an affiliate

of OTTV acquires shares of common stock hereunder, the affiliate will be subject to Section 16(b) of the Exchange Act. Further,

in the event that any affiliate acquiring shares hereunder has sold or sells any shares of common stock in the six months preceding

or following the receipt of shares hereunder, any so called “profit”, as computed under Section 16(b) of the Exchange

Act, would be required to be disgorged from the recipient to OTTV. Services rendered have been recognized as valid consideration

for the “purchase” of shares in connection with the “profit” computation under Section 16(b) of the Exchange

Act. OTTV has agreed that for the purpose of any “profit” computation under Section 16(b), the price paid for the common

stock issued to affiliates is equal to the value of services rendered. Shares of common stock acquired hereunder by persons other

than affiliates are not subject to Section 16(b) of the Exchange Act.

Item 2. Registrant Information and Employee Plan Annual Information

A copy of any document or part thereof incorporated

by reference in this registration statement but not delivered with this prospectus or any document required to be delivered pursuant

to Rule 428(b) under the Securities Act will be furnished without charge upon written or oral request. Requests should be addressed

to: Viva Entertainment Group Inc., 143-41 84

th

Drive, Briarwood, NY 11435, where its telephone number is (347) 681-1668.

PART II

INFORMATION REQUIRED IN THE REGISTRATION

STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents

filed with the Securities and Exchange Commission (the "Commission") by Viva Entertainment Group Inc., a Nevada corporation

(the "Company"), are incorporated herein by reference:

|

|

a.

|

The Company's latest Annual Report on Form 10-K for the year ended

October 31, 2016, filed with the Securities and Exchange Commission;

|

|

|

b.

|

The reports of the Company filed pursuant to Section 13(a) or 15(d) of the Securities Exchange

Act of 1934, as amended (the "Exchange Act") since the fiscal year ended October 31, 2016; and

|

|

|

c.

|

All other documents filed by the Company after the date of this registration statement pursuant

to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act, prior to the filing of a post-effective amendment to this registration

statement which de-registers all securities then remaining unsold, shall be deemed to be incorporated by reference in this registration

statement and to be a part hereof from the date of filing such documents.

|

Item 4. Description of Securities.

Not applicable.

Item 5. Interests of Named Experts and Counsel.

The audited balance

sheet of OTTV as of October 31, 2016 and 2015, and the related statements of operations, shareholders’ equity and cash flows

for the year then ended are incorporated by reference in this prospectus and have been audited by M&K CPAS, PLLC, an independent

registered public accounting firm. The incorporation by reference herein of such financial statements is in reliance upon the authority

of said firm as experts in auditing and accounting.

The Law Offices

of Harold H. Martin, P.A. has rendered an opinion on the validity of the securities being registered. Neither Mr. Martin nor the

Law Offices of Harold H. Martin, P.A. are affiliates of OTTV.

Item 6. Indemnification of Directors

and Officers.

Under Nevada law, a corporation

may indemnify its directors, officers, employees and agents under certain circumstances, including indemnification of such persons

against liability under the Securities Act of 1933, as amended. In addition, a corporation may purchase or maintain insurance on

behalf of its directors, officers, employees or agents for any liability incurred by him in such capacity, whether or not the corporation

has the authority to indemnify such person. A true and correct copy of Section 78.7502 of Nevada Revised Statutes that addresses

indemnification of directors, officers, employees and agents is attached as Exhibit 99.1.

Article IX of the OTTV’s

By-Laws provides, among other things, that a the Corporation shall indemnify any Director, Trustee, Officer, employee or agent

of the Corporation who was or is a party or is threatened to be made a party to any proceeding, whether civil, criminal, administrative

or investigative (other than an action by or in the right of the Corporation) by reason of the fact that such person is or was

a Director, Trustee, Officer, employee or agent of the Corporation, or is or was serving at the request of the Corporation as a

Director, Trustee, Officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against

expenses (including attorneys' fees), judgment, fines and

amounts paid in settlement actually and reasonably

incurred by such person in connection with such action, suit or proceeding if such person acted in good faith and in a manner such

person reasonably believed to be in or not opposed to the best interests of the Corporation, and with respect to any criminal action

or proceeding, had no reasonable cause to believe such person's conduct was unlawful.

The effect of these provisions

may be to eliminate the rights of OTTV and its stockholders (other than through stockholder derivative suits on behalf of OTTV)

to recover monetary damages against a director, officer, employee or agent for breach of fiduciary duty.

Insofar as

indemnification

for liabilities arising under the Securities Act of 1933, as amended, may be provided for directors, officers, employees, agents

or persons controlling an issuer pursuant to the foregoing provisions, the opinion of the Commission is that such

indemnification

is against public policy as expressed in the Securities Act of 1933, as amended, and is therefore unenforceable.

Item 7. Exemption from Registration Claimed.

Not applicable.

I

t

em 8. Exhibits.

|

|

(a)

|

The following exhibits are filed as part of this registration statement

pursuant to Item 601 of the Regulation S-K and are specifically incorporated herein by reference:

|

Exhibit No.

Title

5.1 Legal opinion of the Law

Offices of Harold H. Martin, P.A.

|

|

10.1

|

2017 Non-Qualified Stock Compensation Plan

|

|

|

23.1

|

Consent of the Law Offices of Harold H. Martin, P.A.

|

|

|

23.2

|

Consent of M&K CPAS, PLLC

|

|

|

99.1

|

Section 78.7502 of the Nevada Revised Statutes addressing indemnification.

|

Item 9. Undertakings.

The undersigned

registrant hereby undertakes:

|

|

(1)

|

To file, during any period in which offers or sales are being made,

a post-effective amendment to this registration statement to:

|

|

|

(i)

|

include any prospectus required by Section 10(a)(3) of the Securities Act;

|

|

|

(ii)

|

reflect in the prospectus any facts or events arising after the effective date of the registration

statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represents a fundamental

change in the information set forth in the registration statement;

|

|

|

(iii)

|

include any material information with respect to the plan of distribution

not previously disclosed in this registration statement or any material change to such information in this registration statement.

|

Provided, however, that paragraphs

(1)(i) and (1)(ii) shall not apply if the information required to be included in a post-effective amendment by those paragraphs

is contained in periodic reports filed by the registrant pursuant to section 13 or section 15(d) of the Securities Exchange Act

of 1934 that are incorporated by reference in the registration statement.

|

|

(2)

|

That, for the purpose of determining any liability pursuant to the

Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities

offered therein, and the offering of such securities offered at that time shall be deemed to be the initial bona fide offering

thereof.

|

|

|

(3)

|

To remove from registration by means of a post-effective amendment

any of the securities being registered which remain unsold at the termination of the offering.

|

|

|

(4)

|

To deliver or cause to be delivered with the prospectus, to each

person to whom the prospectus is sent or given, the latest annual report to security holders that is incorporated by reference

in the prospectus and furnished pursuant to and meeting the requirements of Rule 14a-3 or Rule 14c-3 under the Securities Exchange

Act of 1934; and, where interim financial information required to be presented by Article 3 of Regulation S-X is not set forth

in the prospectus, to deliver, or cause to be delivered to each person to whom the prospectus is sent or given, the latest quarterly

report that is specifically incorporated by reference in the prospectus to provide such interim financial information.

|

|

|

(5)

|

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to

directors, officers and controlling persons of registrant pursuant to the foregoing provisions, or otherwise, registrant has been

advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed

in the Securities Act and is therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other

than the payment by registrant of expenses incurred or paid by a director, officer or controlling person of registrant in the successful

defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities

being registered, registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit

to a court of appropriate jurisdiction the question whether such indemnification is against public policy as expressed in the Act

and will be governed by the final adjudication of such issue.

|

The undersigned hereby

undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of registrant’s

annual report pursuant to Section 13(a) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee

benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference

in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and

the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

SIGNATURES

Pursuant to the requirements

of the Securities Act of 1933, the Registrant certifies it has reasonable grounds to believe that it meets all of the requirements

for filing on Form S-8 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto

duly authorized in the city of Briarwood, NY on December 6, 2017.

Viva Entertainment Group Inc.

(Registrant)

/s/ Johnny Falcones

Johnny Falcones

Chairman and President

Pursuant to the

requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities

and on the date indicated.

|

Signatures

|

Title

|

Date

|

|

/s/ Johnny Falcones

Johnny Falcones

|

Chairman, Chief Executive Officer, President, Principal Accounting Officer and Director

|

December 6, 2017

|

|

/s/ Michael Nagle

Michael Nagle

|

Director

|

December 6, 2017

|

|

/s/ Anthony Hernandez

Anthony Hernandez

|

Director

|

December 6, 2017

|

INDEX TO EXHIBITS

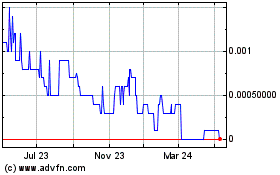

Viva Entertainment (CE) (USOTC:OTTV)

Historical Stock Chart

From Mar 2024 to Apr 2024

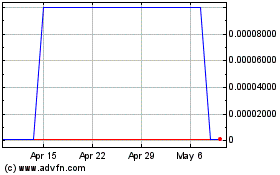

Viva Entertainment (CE) (USOTC:OTTV)

Historical Stock Chart

From Apr 2023 to Apr 2024