Seadrill Reshuffles Bankruptcy Workout Plan to Build Support

February 26 2018 - 6:39PM

Dow Jones News

By Peg Brickley

Seadrill Ltd., the offshore energy company run by Norwegian

billionaire John Fredriksen, quelled opposition to its bankruptcy

exit plan by making room for more creditors to invest in getting

the company back on its feet.

Weeks of talks headed off a threatened open-court battle over

Seadrill's attempt to reshuffle its debts and bring in new money.

An April 17 court hearing has been set for a chapter 11 plan

confirmation hearing, where a bankruptcy judge in Houston will be

asked to authorize Seadrill to raise new money and refashion its $8

billion load of debt. On Monday, Judge David R. Jones granted

Seadrill permission to start the process of polling creditors on a

chapter 11 restructuring plan designed to get the company in

financial shape to compete for business in the rocky energy

market.

With its profits hurt by a slump in drilling activity, Seadrill

filed for chapter 11 bankruptcy protection last year, having

reached a deal that would allow Mr. Fredriksen, private-equity firm

Centerbridge Partners and a handful of investment firms to raise

more than $1 billion to bail the company out of trouble.

Creditors left on the sidelines, including Barclays Capital and

a cadre of unsecured bondholders, protested, complaining that

Centerbridge and Mr. Fredriksen had unfairly put together a

sweetheart deal for themselves and a few supporters.

The official committee representing all unsecured creditors

agreed, and started getting ready to sue.

On Monday, Seadrill unveiled settlements that will stop the

legal threats and bring support for the chapter 11 turnaround plan

to at least 70% of unsecured bondholders, up from the 40% level of

support the original plan enjoyed.

Barclays and the unsecured bondholder groups are dropping

threats to put together rival restructuring deals, after being

invited into the investment opportunity on favorable terms. The

official committee of unsecured creditors is now urging a "yes"

vote on the revised plan because of the improved treatment,

according to new chapter 11 plan papers filed Monday in the U.S.

Bankruptcy Court in Houston.

Thomas Moers Mayer, lawyer for the committee, said Monday that

Seadrill's banks agreed to stretch out the maturity on their loans,

as long as the company raised at least $1 billion in fresh cash to

shore up its finances to weather tough industry conditions. The

question for Seadrill was "who got the opportunity" to participate

in the bailout, Mr. Mayer said. Under pressure from Barclays and

the bondholder group, Seadrill made room in the deal for more

participants in the investment, and found some cash for junior

creditors that aren't positioned to make the investment.

Seadrill estimates general unsecured creditors are being offered

debt investment rights worth at least $239 million, as well as

equity rights worth at least $136 million, in the revised plan,

court papers say. As a result, some unsecured creditors could

recover as much as 47% of what they are owed, a 15-point

improvement from the original plan, court papers say.

The company also made peace with Samsung Heavy Industries Co.

Ltd. and Daewoo Shipbuilding & Marine Engineering Co. The

shipyard operators together accounted for about $1 billion in

potential claims against Seadrill.

When it filed for bankruptcy, Seadrill had signed contracts for

the construction of new drillships, deals that could have erupted

into litigation. Instead, Daewoo, Samsung and Seadrill agreed to

push the contracts aside for now, and allow the new rigs to be

marketed for sale.

Some things didn't change in the revised turnaround plan. As in

the original plan, top-ranking banks will stretch out the maturity

on their loans, giving Seadrill a longer period of time to recover

from the energy-market turmoil. Seadrill shareholders that fought a

losing battle for better treatment will get a 2% stake in the

reorganized company, less than half of what Mr. Fredriksen's

investment company, Hemen Holding, will collect as a "fee" for

going along with the restructuring.

Mr. Fredriksen, who had negotiated an immunity deal that

shielded him from lawsuits over his handling of the company's

affairs as part of the original turnaround strategy, will continue

to be protected from litigation under the revised plan.

Not long before before Seadrill's September bankruptcy filing,

Seadrill paid a Cyprus affiliate controlled by Mr. Fredriksen about

$21 million. Additionally, the company paid about $23 million in

salaries and bonuses to high-ranking company leaders whom, in a

break from bankruptcy practices in the U.S., it is refusing to

name, according to court papers. Seadrill is resisting pressure

from U.S. bankruptcy watchdogs to disclose the details of payments

to insiders.

Write to Peg Brickley at peg.brickley@wsj.com

(END) Dow Jones Newswires

February 26, 2018 18:24 ET (23:24 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

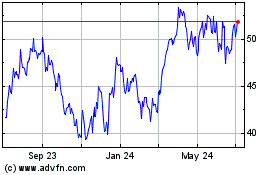

Seadrill (NYSE:SDRL)

Historical Stock Chart

From Mar 2024 to Apr 2024

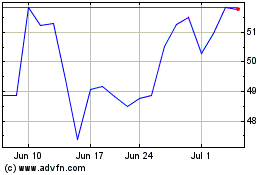

Seadrill (NYSE:SDRL)

Historical Stock Chart

From Apr 2023 to Apr 2024