Sea Limited (NYSE:SE) (“Sea” or the “Company”) today announced

its financial results for the quarter ended June 30, 2018.

“Sea again delivered strong results in the second quarter of

2018 as we capitalized on our ability to anticipate and quickly

adapt to evolving industry dynamics,” said Forrest Li, Chairman and

Group Chief Executive Officer of Sea. “Shopee continued to expand

rapidly across all markets, strengthening its leadership in the

region. Our monetization strategy for Shopee is delivering ahead of

expectations, even at this early stage. Marketplace revenue surged

by more than 69% sequentially to US$37.3 million, as more merchants

invested in our value-added services to deepen engagement with

their customers. GMV increased more than 14% sequentially to US$2.2

billion, while sales and marketing expenses as a percentage of GMV

continued to decline as our growing scale enabled further cost

efficiencies.”

Mr. Li continued, “In digital entertainment, our efforts to

deepen our diversification into mobile games, self-development, and

new markets globally are yielding encouraging results. In the month

of June, self-developed game revenue accounted for approximately

13% of adjusted digital entertainment revenue, a new record high,

driven by the breakout success of our first self-developed global

hit, Free Fire.”

Second Quarter 2018 Key Metrics

- Group

- Total adjusted revenue was US$219.6

million, up 71.0% year-on-year from US$128.4 million for the second

quarter of 2017 and up 11.4% quarter-on-quarter from US$197.0

million for the first quarter of 2018.

- Total adjusted EBITDA was US$(161.9)

million, compared to US$(50.9) million for the second quarter of

2017 and US$(144.7) million for the first quarter of 2018.

- Digital Entertainment

- Adjusted revenue was US$139.1 million,

up 19.0% year-on-year from US$116.9 million for the second quarter

of 2017 and a decrease of 4.7% quarter-on-quarter from US$146.0

million for the first quarter of 2018. The quarter-on-quarter drop

was primarily attributable to a decrease in the number of paying

users in Vietnam, as a result of measures launched in April by

Vietnam’s leading mobile operators to restrict the use of prepaid

telco cards for online game top-ups. We are actively strengthening

alternative top-up channels to assist our paying users in

Vietnam.

- Adjusted EBITDA was US$48.6 million, up

20.8% year-on-year from US$40.2 million for the second quarter of

2017 and decreased 11.6% quarter-on-quarter from US$55.0 million

for the first quarter of 2018.

- Quarterly active users (“QAUs”) reached

160.6 million, an increase of 150.2% year-on-year from 64.2 million

for the second quarter of 2017 and up 26.8% quarter-on-quarter from

126.7 million for the first quarter of 2018.

- Average revenue per user (“ARPU”) was

US$0.9 compared to US$1.8 for the second quarter of 2017 and US$1.2

for the first quarter of 2018.

- E-commerce

- Gross merchandise value (“GMV”) was

US$2.2 billion, an increase of 170.6% year-on-year from US$821.2

million for the second quarter of 2017 and up 14.4%

quarter-on-quarter from US$1.9 billion for the first quarter of

2018.

- Gross orders for the quarter totaled

127.8 million, an increase of 180.9% year-on-year from 45.5 million

for the second quarter of 2017 and up 14.7% quarter-on-quarter from

111.4 million for the first quarter of 2018.

- Adjusted revenue was US$58.8 million,

up 2,164.7% year-on-year from US$2.6 million for the second quarter

of 2017 and up 74.3% quarter-on-quarter from US$33.7 million for

the first quarter of 2018. Adjusted revenue included US$37.3

million of marketplace revenue1 and US$21.5 million of product

revenue2.

- Adjusted EBITDA was US$(188.3) million,

compared to US$(76.2) million for the second quarter of 2017 and

US$(179.6) million for the first quarter of 2018.

- Sales and marketing as a percentage of

GMV stood at 6.2%, and improved from 6.8% for the second quarter of

2017 and 6.6% for the first quarter of 2018.

- Digital Financial Services

- Gross transaction value of our digital

financial services as a whole (“GTV”) was US$2.5 billion, an

increase of 608.0% year-on-year from US$348.0 million for the

second quarter of 2017 and up 44.7% quarter-on-quarter from US$1.7

billion for the first quarter of 2018. The growth was

attributable to the payment processing services provided by AirPay

to Shopee in most of our markets, which, depending on the

operational arrangement in each relevant market, may include

payments from buyers to Shopee accounts under Shopee Guarantee as

well as outgoing payments from Shopee accounts to Shopee seller

accounts that are operationally handled by AirPay.

_____________________________________1 Marketplace revenue

mainly consists of commission and advertising income and revenue

generated from other value-added services.2 Product revenue mainly

consists of revenue generated from direct sales.

Strategic Business Updates

Digital Entertainment

As growing smartphone penetration continues to improve access to

online games globally, Garena has taken steps to leverage our

leading position in the industry and our clear competitive

strengths to capture the growth opportunities ahead. In particular,

we have focused on three key strategic initiatives – moving from

PC-only to mobile-first, moving from pure game publishing to both

game publishing and development, and expanding from a regional

footprint to a global presence.

These efforts continue to generate positive results. In June

2018, approximately 73% of our adjusted revenue for digital

entertainment was derived from mobile games, approximately 13% was

generated by our self-developed game, and approximately 7% was

derived from outside the seven core markets in our region.

Free Fire, our first self-developed hit game, remains one of the

leading games in the battle royale category in our region, and

during the quarter was among the top-ranked games in its category

in the App Store and on the Google Play Store in several non-core

markets, including Brazil and Mexico. Its daily active user (“DAU”)

count has reached a record high of more than 16 million. With the

development of various monetization features in the game such as

the season pass concept, we see encouraging results from monetizing

the game, which accounted for an increasingly significant share of

our adjusted revenue for digital entertainment.

Moreover, we continue to explore opportunities to expand the

focus of our game business to capture new trends and opportunities,

including those related to esports and game streaming, to further

enhance our user engagement and develop additional avenues of

income.

For example, Garena was one of the organizers of the Arena of

Valor World Cup (“AOV World Cup”) held in Los Angeles in late July.

Garena organized a series of tournaments across the region leading

to the final. In our markets, the competitions in aggregate

attracted over 33 million views online across all streaming

platforms, with the final attracting over 5 million views. We

believe the enthusiasm generated by the esports and streaming

activities further enhanced the user engagement of the game, which

has recently achieved a record high DAU count of more than 14

million.

Our efforts to foster strong community engagement around our key

titles on streaming platforms continued to gain traction. According

to research by Newzoo on the global esports streaming market, two

of our esports channels – Garena and Vietnam Esports TV – ranked in

the top five Youtube channels globally in terms of esports hours

viewed during the first quarter of 2018.

E-commerce

In the second quarter of 2018, Shopee continued to demonstrate

robust growth in GMV, gross orders, and adjusted revenue,

complemented by continuing efficiency improvements.

We also recorded significant growth in marketplace revenue of

69.3% quarter-on-quarter, well ahead of the GMV growth rate, as a

larger number of sellers made use of our expanding suite of

offerings, from advertising tools to value-added services such as

fulfillment and logistics.

Shopee is also benefiting from ever-improving economies of scale

as the number of buyers and sellers on the platform grows, and

users build greater loyalty to the platform. During the quarter,

sales and marketing expenses as a percentage of GMV fell once again

to 6.2%, compared to 6.6% in the first quarter of 2018.

Other Developments

Convertible Notes Offering

In June 2018, we raised US$575 million in aggregate principal

amount of 2.25% convertible senior notes due 2023. The offering

size was increased from the original US$400 million to US$500

million to address investor demand, and the subsequent full

exercise by the initial purchasers of a 15% ‘greenshoe’ option

brought the total offering to US$575 million.

The additional capital further bolsters our balance sheet, and

strengthens our ability to address the evolving needs of the users

in our region, be they in digital entertainment, e-commerce, or

digital financial services. The net proceeds from this offering

will be used for business expansion and other general corporate

purposes.

Unaudited Summary of Financial

Results

(Amounts are expressed in thousands of US

dollars “$”)

For the Three Months

ended June 30,

2017 2018 $ $ YOY%

Revenue Digital Entertainment 91,459 108,029 18.1 %

Others 10,088 75,750 650.9 %

101,547 183,779 81.0 %

Cost of revenue Digital

Entertainment (52,892 ) (61,981 ) 17.2 % Others (22,814 )

(113,216 ) 396.3 % (75,706 )

(175,197 ) 131.4 %

Gross profit 25,841

8,582 (66.8 )% Other operating income 163 1,707 947.2

% Sales and marketing expenses (74,087 ) (165,075 ) 122.8 % General

and administrative expenses (27,644 ) (51,849 ) 87.6 % Research and

development expenses (6,739 ) (12,882 ) 91.2 %

Total operating expenses (108,307 )

(228,099 ) 110.6 %

Operating loss (82,466 ) (219,517 ) 166.2

% Non-operating loss, net (7,193 ) (30,752 ) 327.5 % Income tax

(expense) credit (2,230 ) 170 (107.6 )% Share of results of equity

investees (230 ) (689 ) 199.6 %

Net

loss (92,119 ) (250,788 ) 172.2 %

Adjusted net loss (1) (86,871 )

(198,715 ) 128.7 % Adjusted revenue of Digital Entertainment

(1) 116,892 139,102 19.0 % Adjusted revenue of E-commerce (1) 2,597

58,815 2,164.7 % Adjusted revenue of Digital Financial Services (1)

5,342 3,413 (36.1 )% Revenue of Other Services 3,596

18,229 406.9 %

Total adjusted revenue

(1) 128,427 219,559 71.0 %

Adjusted EBITDA for Digital Entertainment (1) 40,243 48,612

20.8 % Adjusted EBITDA for E-commerce (1) (76,233 ) (188,315 )

(147.0 )% Adjusted EBITDA for Digital Financial Services (1)

(11,044 ) (6,780 ) 38.6 % Adjusted EBITDA for Other Services (1)

(2,664 ) (12,937 ) (385.6 )% Unallocated expenses (2) (1,165

) (2,510 ) (115.5 )%

Total adjusted EBITDA (1)

(50,863 ) (161,930 ) (218.4 )%

(1) For a discussion of the use of non-GAAP financial measures,

see “Non-GAAP Financial Measures.”(2) Unallocated expenses are

mainly related to share-based compensation and general and

corporate administrative costs such as professional fees and other

miscellaneous items that are not allocated to segments. These

expenses are excluded from segment results as they are not reviewed

by the Chief Operation Decision Maker (“CODM”) as part of segment

performance.

Three Months Ended June 30, 2018 Compared to Three Months

Ended June 30, 2017

Revenue

The table below sets forth revenue generated from our reported

segments. Amounts are expressed in thousands of US dollars

(“$”).

For the Three Months ended June 30,

2017 2018 $

% ofrevenue

$

% ofrevenue

YOY%

Revenue Digital Entertainment

91,459

90.1

108,029

58.8

18.1 % E-commerce 1,150 1.1 54,655 29.7 4,652.6 % Digital Financial

Services 5,342 5.3 2,866 1.6 (46.3 )% Other Services 3,596

3.5 18,229 9.9 406.9 % 101,547

100.0 183,779 100.0 81.0 %

2017

2018 $

% of totaladjustedrevenue

$

% of totaladjustedrevenue

YOY% Adjusted revenue of Digital Entertainment 116,892 91.0

139,102 63.4 19.0 % Adjusted revenue of E-commerce 2,597 2.0 58,815

26.8 2,164.7 % Adjusted revenue of Digital Financial Services 5,342

4.2 3,413 1.6 (36.1 )% Revenue of Other Services 3,596

2.8 18,229 8.2 406.9 %

Total adjusted

revenue 128,427 100.0 219,559 100.0

71.0 %

Our total revenue increased by 81.0% to US$183.8 million in the

second quarter of 2018 from US$101.5 million in the second quarter

of 2017. Our total adjusted revenue increased by 71.0% to US$219.6

million in the second quarter of 2018 from US$128.4 million in the

second quarter of 2017. These increases were mainly driven by the

growth in each of the segments detailed as follows:

- Digital Entertainment: Revenue

increased by 18.1% to US$108.0 million in the second quarter of

2018 from US$91.5 million in the second quarter of 2017. Adjusted

revenue increased by 19.0% to US$139.1 million in the second

quarter of 2018 from US$116.9 million in the second quarter of

2017. This increase was primarily due to improvements in

monetization of our existing games and the launch of new

games.

- E-commerce: Revenue increased by

4,652.6% to US$54.7 million in the second quarter of 2018 from

US$1.2 million in the second quarter of 2017. Adjusted revenue

increased by 2,164.7% to US$58.8 million in the second quarter of

2018 from US$2.6 million in the second quarter of 2017. This

increase was primarily due to the growth of our GMV and the

additional services and product offerings we introduced to sellers

under ‘Service by Shopee,’ ‘Shopee Logistics Service,’ as well as

the other value-added services.

- Digital Financial Services: Revenue

decreased by 46.3% to US$2.9 million in the second quarter of 2018

from US$5.3 million in the second quarter of 2017. Adjusted revenue

decreased by 36.1% to US$3.4 million in the second quarter of 2018

from US$5.3 million in the second quarter of 2017, as we switched

to focus our efforts on strengthening our infrastructure to support

our existing platforms. The decrease was also in part due to the

restrictive measures imposed by Vietnam’s leading mobile operators

on using prepaid telco cards for online game top-ups.

- Other Services: Revenue increased by

406.9% to US$18.2 million in the second quarter of 2018 from US$3.6

million in the second quarter of 2017. The increase was primarily

due to ancillary services we provide to our e-commerce platform

users.

Cost of Revenue

Our total cost of revenue increased by 131.4% to US$175.2

million in the second quarter of 2018 from US$75.7 million in the

second quarter of 2017.

- Digital Entertainment: Cost of revenue

increased by 17.2% to US$62.0 million in the second quarter of 2018

from US$52.9 million in the second quarter of 2017. The increase

was primarily due to the increase in royalty payments to game

developers as well as in other costs directly associated with our

digital entertainment segment which were largely in line with the

revenue growth of our business.

- Others: Cost of revenue for our other

segments combined increased by 396.3% to US$113.2 million in the

second quarter of 2018 from US$22.8 million in the second quarter

of 2017. The increase was primarily due to the costs incurred

following the launch of ‘Service by Shopee,’ ‘Shopee Logistics

Service,’ and direct sales at the end of 2017; higher bank

transaction fees driven by GMV growth from our e-commerce business;

higher costs associated with other ancillary services we provided

to our e-commerce platform users; as well as higher staff

compensation and benefit costs.

Sales and Marketing Expenses

Our total sales and marketing expenses increased by 122.8% to

US$165.1 million in the second quarter of 2018 from US$74.1 million

in the second quarter of 2017. The table below sets forth the

breakdown of our sales and marketing expenses of our two major

reporting segments. Amounts are expressed in thousands of US

dollars (“$”).

For the Three Months

ended June 30,

2017

2018

YOY%

Sales and Marketing Expenses $ $

Digital Entertainment 11,858 18,916 59.5 % E-commerce 55,906

138,042 146.9 %

- Digital Entertainment: Sales and

marketing expenses increased by 59.5% to US$18.9 million in the

second quarter of 2018 from US$11.9 million in the second quarter

of 2017. The increase was primarily due to the launch of new games

and our continued efforts to expand the user bases of our existing

games.

For the Three Months

ended June 30,

2017 2018 Digital Entertainment $ $

Sales and marketing expenses 11,858

18,916 Adjusted revenue 116,892 139,102

Sales and marketing expenses as a percentage of adjusted

revenue 10.1 % 13.6 %

Sales and marketing expenses as a percentage of adjusted revenue

increased to 13.6% in the second quarter of 2018 from 10.1% in the

second quarter of 2017. This was mainly due to increased expenses

on the launching of new games, while the monetization impact of

these new games was not fully captured within the same period.

- E-commerce: Sales and marketing

expenses increased by 146.9% to US$138.0 million in the second

quarter of 2018 from US$55.9 million in the second quarter of 2017.

The increase in marketing efforts was aligned with our strategy to

fully capture the market growth opportunity and was primarily

attributable to shipping and other promotions on our platform that

were designed to increase our user base and enhance user

engagement.

For the Three Months

ended June 30,

2017 2018 E-commerce $ $ Sales

and marketing expenses 55,906 138,042

GMV 821,175 2,221,789 Sales and

marketing expenses as a percentage of GMV 6.8 % 6.2 %

Sales and marketing expenses as a percentage of GMV was 6.2% in

the second quarter of 2018 and improved from 6.8% in the second

quarter of 2017.

General and Administrative Expenses

Our general and administrative expenses increased by 87.6% to

US$51.8 million in the second quarter of 2018 from US$27.6 million

in the second quarter of 2017. This increase was primarily due to

the expansion of our staff force, the increase in office facilities

and related expenses, as well as the increase in professional fees

and other expenses.

Research and Development Expenses

Our research and development expenses increased by 91.2% to

US$12.9 million in the second quarter of 2018 from US$6.7 million

in the second quarter of 2017, primarily due to the increase in our

research and development staff force as we expanded and enriched

our product offerings.

Non-operating Income or Losses, Net

Non-operating income or losses consists of interest income,

interest expense, investment gain (loss), fair value change for

convertible debts and foreign exchange gain (loss). The amount was

a net non-operating loss of US$30.8 million in the second quarter

of 2018, compared to a net non-operating loss of US$7.2 million in

the second quarter of 2017. This was primarily due to a fair value

loss of US$37.2 million recognized in the quarter arising from the

fair value accounting treatment for the convertible debts raised

before our initial public offering.

Income Tax Expense

We had a net income tax benefit of US$0.2 million in the second

quarter of 2018, which was primarily due to the deferred tax assets

we recognized in our digital entertainment segment in the second

quarter of 2018.

Share of Results of Equity Investees

We had share of losses of equity investees of US$0.7 million in

the second quarter of 2018, compared with US$0.2 million in the

second quarter of 2017.

Net Loss

As a result of the foregoing, we had net losses of US$250.8

million and US$92.1 million in the second quarter of 2018 and 2017,

respectively.

Adjusted Net Loss

Adjusted net loss, which is net loss adjusted to remove

share-based compensation expenses and fair value change for

convertible debts, was US$198.7 million and US$86.9 million in the

second quarter of 2018 and 2017, respectively.

Webcast and Conference Call Information

Mr. Forrest Li, Founder, Chairman and Group Chief Executive

Officer; Mr. Tony Hou, Group Chief Financial Officer; and Mr. Alan

Hellawell, Group Chief Strategy Officer, will host a conference

call today to review Sea’s business and financial performance.

Details of the conference call and webcast are as follows:

Date and time: 8:00 PM U.S. Eastern Time on 21 August 2018

8:00 AM Singapore / Hong Kong Time on 22 August 2018 Webcast

link:

https://services.choruscall.com/links/se180821.html

Dial in numbers: US Toll Free: 1-888-317-6003 Hong Kong:

800-963-976 International: 1-412-317-6061 Singapore: 800-120-5863

United Kingdom: 08-082-389-063 Passcode for participants:

1518348

A replay of the conference call will be available at the

Company’s investor relations website

(https://www.seagroup.com/investor/financials). An archived webcast

will be available at the same link above.

About Sea Limited

Sea’s mission is to better the lives of the consumers and small

businesses of our region with technology. Our region includes the

key markets of Indonesia, Taiwan, Vietnam, Thailand, the

Philippines, Malaysia and Singapore. Sea operates three platforms

across digital entertainment, e-commerce, and digital financial

services, known as Garena, Shopee, and AirPay, respectively.

Forward-Looking Statements

This announcement contains forward-looking statements. These

statements are made under the “safe harbor” provisions of the U.S.

Private Securities Litigation Reform Act of 1995. These

forward-looking statements can be identified by terminology such as

“will,” “expects,” “anticipates,” “future,” “intends,” “plans,”

“believes,” “estimates,” “confident,” “guidance,” and similar

statements. Among other things, statements that are not historical

facts, including statements about Sea’s beliefs and expectations,

the business, financial and market outlook, and projections from

its management in this announcement, as well as Sea’s strategic and

operational plans, contain forward-looking statements. Sea may also

make written or oral forward-looking statements in its periodic

reports to the U.S. Securities and Exchange Commission (the “SEC”),

in its annual report to shareholders, in press releases, and other

written materials, and in oral statements made by its officers,

directors, or employees to third parties. Forward-looking

statements involve inherent risks and uncertainties. A number of

factors could cause actual results to differ materially from those

contained in any forward-looking statement, including but not

limited to the following: Sea’s goals and strategies; its future

business development, financial condition, financial results, and

results of operations; the growth in, and market size of, the

digital entertainment, e-commerce and digital financial services

industries in the region, including segments within those

industries; changes in its revenue, costs or expenditures; its

ability to continue to source, develop and offer new and attractive

online games and to offer other engaging digital entertainment

content; the growth of its digital entertainment, e-commerce and

digital financial services platforms; the growth in its user base,

level of user engagement, and monetization; its ability to continue

to develop new technologies and/or upgrade its existing

technologies; growth and trends of its markets and competition in

its industries; government policies and regulations relating to its

industries; and general economic and business conditions in the

region. Further information regarding these and other risks is

included in Sea’s filings with the SEC. All information provided in

this press release and in the attachments is as of the date of this

press release, and Sea undertakes no obligation to update any

forward-looking statement, except as required under applicable

law.

Non-GAAP Financial Measures

To supplement our consolidated financial statements, which are

prepared and presented in accordance with U.S. GAAP, we use the

following non-GAAP financial measures to help evaluate our

operating performance:

- “Adjusted revenue” of our digital

entertainment segment represents revenue of the digital

entertainment segment plus change in digital entertainment deferred

revenue. This financial measure is used as an approximation of cash

spent by our users in the applicable period that is attributable to

our digital entertainment segment. Although other companies may

present such measures related to gross billings differently or not

at all, we believe that the adjusted revenue of our digital

entertainment segment provides useful information to investors

about the segment's core operating results, enhancing their

understanding of our past performance and future prospects.

- “Adjusted revenue” of our e-commerce

segment represents revenue of the e-commerce segment (currently

consisting of marketplace revenue and product revenue) plus

commission income that were net-off against sales incentives. This

financial measure enables our investors to follow trends in our

e-commerce monetization capability over time and is a useful

performance measure.

- “Adjusted revenue” of our digital

financial services segment represents revenue of the digital

financial services segment plus service revenue that were net-off

against sales incentives.

- “Total adjusted revenue” represents the

sum of the adjusted revenue of our digital entertainment segment,

the adjusted revenue of our e-commerce segment, the adjusted

revenue of our digital financial services segment, and the revenue

of our other services. This financial measure enables our investors

to follow trends in our overall group monetization capability over

time and is a useful performance measure.

- “Adjusted net loss” represents net loss

before share-based compensation and changes in fair value of

convertible debts. We believe that the adjusted net loss helps to

identify underlying trends in our business that could otherwise be

distorted by the effect of certain expenses that are included in

net loss. The use of adjusted net loss has its limitations in that

it does not include all items that impact the net loss or income

for the period, and share-based compensation and changes in fair

value of convertible debts are significant expenses.

- “Adjusted EBITDA” for our digital

entertainment segment represents operating income (loss) before

share-based compensation plus (a) depreciation and amortization

expenses, and (b) the net effect of changes in deferred revenue and

its related cost for our digital entertainment segment. Although

other companies may calculate adjusted EBITDA differently or not

present it at all, we believe that the segment adjusted EBITDA

helps to identify underlying trends in our operating results,

enhancing their understanding of the past performance and future

prospects.

- “Adjusted EBITDA” for our e-commerce

segment, digital financial services segment and other services

segment represents operating income (loss) before share-based

compensation plus depreciation and amortization expenses. Although

other companies may calculate adjusted EBITDA differently or not

present it at all, we believe that the segment adjusted EBITDA

helps to identify underlying trends in our operating results,

enhancing their understanding of the past performance and future

prospects.

- “Total adjusted EBITDA” represents the

sum of adjusted EBITDA of all our segments combined, plus

unallocated expenses. Although other companies may calculate

adjusted EBITDA differently or not present it at all, we believe

that the total adjusted EBITDA helps to identify underlying trends

in our operating results, enhancing their understanding of the past

performance and future prospects.

These non-GAAP financial measures have limitations as analytical

tools. None of the above financial measures should be considered in

isolation or construed as an alternative to revenue, net

loss/income, or any other measure of performance or as an indicator

of our operating performance. These non-GAAP financial measures

presented here may not be comparable to similarly titled measures

presented by other companies. Other companies may calculate

similarly titled measures differently, limiting their usefulness as

comparative measures to Sea’s data. We compensate for these

limitations by reconciling the non-GAAP financial measures to their

nearest U.S. GAAP financial measures, all of which should be

considered when evaluating our performance. We encourage you to

review our financial information in its entirety and not rely on

any single financial measure.

The tables below present selected financial information of our

reporting segments, the non-GAAP financial measures that are most

directly comparable to GAAP financial measures, and the related

reconciliations between the financial measures. Amounts are

expressed in thousands of US dollars (“$”).

For the Three Months ended June 30, 2018

Digital

E-

Digital

Other

Unallocated

Consolidated

Entertainment

commerce

Financial

Services(3)

expenses(4)

Services

$ $ $ $ $ $

Revenue 108,029 54,655(1) 2,866 18,229 - 183,779 Changes in

deferred revenue 31,073 - - - - 31,073 Sales incentives net-off -

4,160 547 - - 4,707

Adjusted

revenue 139,102 58,815(2) 3,413 18,229

- 219,559

Operating income (loss)

15,137 (195,034) (7,297) (14,900) (17,423) (219,517)

Net effect of changes in deferred revenue

and its related cost

24,872

-

-

-

-

24,872

Depreciation and amortization 8,603 6,719 517 1,963 - 17,802

Share-based compensation - - - - 14,913

14,913

Adjusted EBITDA 48,612 (188,315)

(6,780) (12,937) (2,510) (161,930)

For the Three Months ended June 30, 2017

Digital

E-

Digital

Other

Unallocated

Consolidated

Entertainment

commerce

Financial

Services(3)

expenses(4)

Services

$ $ $ $ $ $

Revenue 91,459 1,150(1) 5,342 3,596 - 101,547 Changes in

deferred revenue 25,433 - - - - 25,433 Sales incentives net-off -

1,447 - - - 1,447

Adjusted

revenue 116,892 2,597(2) 5,342 3,596

- 128,427

Operating income (loss)

16,020 (77,438) (11,309) (3,326) (6,413) (82,466)

Net effect of changes in deferred revenue

and its related cost

17,336

-

-

-

-

17,336

Depreciation and amortization 6,887 1,205 265 662 - 9,019

Share-based compensation - - - - 5,248

5,248

Adjusted EBITDA 40,243 (76,233)

(11,044) (2,664) (1,165) (50,863)

(1) For the second quarter of 2018, revenue of $54,655 included

marketplace revenue of $33,160 and product revenue of $21,495, net

of sales incentives. For the second quarter of 2017, revenue of

$1,150 was entirely marketplace revenue.(2) For the second quarter

of 2018, adjusted revenue of $58,815 included marketplace revenue

of $37,320 and product revenue of $21,495. For the second quarter

of 2017, revenue of $2,597 was entirely marketplace revenue.(3) A

combination of multiple business activities that does not meet the

quantitative thresholds to qualify as reportable segments are

grouped together as “Other Services.”(4) Unallocated expenses are

mainly related to share-based compensation and general and

corporate administrative costs such as professional fees and other

miscellaneous items that are not allocated to segments. The

expenses are excluded from segment results as they are not reviewed

by the CODM as part of segment performance.

UNAUDITED INTERIM CONDENSED

CONSOLIDATED STATEMENT OF OPERATIONS

Amounts expressed in thousands of US

dollars (“$”) except for number of shares & per share

data

For the Six Months

ended June 30,

2017 2018 $ $

Revenue Digital

Entertainment 179,045 218,687 Others 16,447 120,136

Total revenue 195,492 338,823

Cost

of revenue Digital Entertainment (102,169 ) (125,553 ) Others

(40,375 ) (196,163 ) Total cost of

revenue (142,544 ) (321,716 )

Gross

profit 52,948 17,107

Operating income

(expenses): Other operating income 381 2,436 Sales and

marketing expenses (137,985 ) (317,224 ) General and administrative

expenses (52,852 ) (96,336 ) Research and development expenses

(12,991 ) (23,594 )

Total operating

expenses (203,447 ) (434,718 )

Operating loss (150,499 ) (417,611 ) Interest income 473

5,350 Interest expense (8,997 ) (11,555 ) Investment (loss) gain

(359 ) 8,478 Changes in fair value of convertible debts - (55,956 )

Foreign exchange (loss) gain (789 ) 4,684

Loss before income tax and share of results of equity

investees (160,171 ) (466,610 ) Income tax (expense) credit

(4,162 ) 925 Share of results of equity investees (862 ) (1,272 )

Net loss (165,195 ) (466,957 )

Net loss attributable to non-controlling interests 51 641

Net loss attributable to Sea

Limited’s ordinary shareholders (165,144 ) (466,316 )

Adjusted net loss (1) (153,834 ) (385,417 )

Loss per share: Basic and diluted (0.94 ) (1.39 )

Shares used in loss per share computation: Basic and

diluted 174,988,779 336,531,721

(1) For a discussion of the use of non-GAAP financial measures,

see “Non-GAAP Financial Measures.”

UNAUDITED INTERIM CONDENSED

CONSOLIDATED BALANCE SHEETS

Amounts expressed in thousands of US

dollars (“$”)

As of

As of

December 31,

June 30,

2017

2018

$ $

ASSETS Current assets Cash and cash

equivalents 1,347,361 1,477,140 Restricted cash

95,300 154,207 Accounts receivable, net 61,846 55,114 Prepaid

expenses and other assets 186,181 270,026 Inventories, net 9,790

16,906 Short-term investment 18,000 − Amounts due from related

parties 2,235 5,904 Total current

assets 1,720,713 1,979,297

Non-current assets

Property and equipment, net 74,348 121,920 Intangible assets, net

37,333 29,591 Long-term investments 28,216 71,006 Prepaid expenses

and other assets 46,297 63,801 Restricted cash 2,317 2,369 Deferred

tax assets 48,104 56,428 Goodwill 30,952 30,952

Total non-current assets 267,567 376,067

Total assets 1,988,280 2,355,364

UNAUDITED INTERIM CONDENSED

CONSOLIDATED BALANCE SHEETS

Amounts expressed in thousands of US

dollars (“$”)

As of

As of

December 31,

June 30,

2017

2018

$ $

LIABILITIES AND SHAREHOLDERS’ EQUITY Current

liabilities Accounts payable 8,644 33,920 Accrued

expenses and other payables 285,248 404,900 Advances from customers

27,155 24,716 Amount due to related parties 36,790 32,668

Short-term bank borrowings 2,013 − Deferred revenue 268,241 273,688

Income taxes payable 9,614 8,031 Total

current liabilities 637,705 777,923

Non-current liabilities Accrued expenses and other

payables 7,547 8,429 Deferred revenue 133,481 184,841 Convertible

debts 726,950 1,145,836 Deferred tax liabilities 4,378 3,954

Unrecognized tax benefits 3,088 2,938

Total non-current liabilities 875,444 1,345,998

Total liabilities 1,513,149 2,123,921

Shareholders’ equity Class A ordinary

shares 91 94 Class B ordinary shares 76 76 Additional paid-in

capital 1,564,656 1,776,246 Accumulated other comprehensive income

10,701 24,984 Statutory reserves 46 46 Accumulated deficit

(1,106,545 ) (1,572,861 )

Total Sea

Limited shareholders’ equity 469,025 228,585 Non-controlling

interests 6,106 2,858

Total

shareholders’ equity 475,131 231,443

Total liabilities and shareholders' equity 1,988,280

2,355,364

UNAUDITED INTERIM CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

Amounts expressed in thousands of US

dollars (“$”)

For the Six Months

ended June 30,

2017

2018

$ $ Net cash used in operating activities

(115,731 ) (283,113 ) Net cash used in investing activities

(17,393 ) (61,851 ) Net cash generated from financing activities

626,976 544,791 Effect of foreign exchange rate changes on cash,

cash equivalents and restricted cash 3,486 (11,089 ) Net increase

in cash, cash equivalents and restricted cash 497,338 188,738 Cash,

cash equivalents and restricted cash at beginning of the period

190,824 1,444,978 Cash, cash

equivalents and restricted cash at end of the period 688,162

1,633,716

1 UNAUDITED SEGMENT

INFORMATION

The Company has three reportable segments, namely digital

entertainment, e-commerce and digital financial services. The Chief

Operation Decision Maker (“CODM”) reviews the performance of each

segment based on revenue and certain key operating metrics of the

operations and uses these results for the purposes of allocating

resources to and evaluating the financial performance of each

segment. Amounts are expressed in thousands of US dollars

(“$”).

For the Three Months ended June 30, 2018

Digital

E-

Digital

Other

Unallocated

Consolidated

Entertainment

commerce

Financial

Services(1)

expenses(2)

Services

$ $ $ $ $ $

Revenue

108,029

54,655 2,866 18,229 - 183,779

Operating income

(loss) 15,137 (195,034 ) (7,297 )

(14,900 ) (17,423 ) (219,517 ) Non-operating loss,

net (30,752 ) Income tax credit 170 Share of results of equity

investees (689 )

Net loss (250,788 )

For

the Three Months ended June 30, 2017

Digital

E-

Digital

Other

Unallocated

Consolidated

Entertainment

commerce

Financial

Services(1)

expenses(2)

Services

$ $ $ $ $ $

Revenue 91,459 1,150 5,342 3,596 - 101,547

Operating income (loss) 16,020 (77,438 )

(11,309 ) (3,326 ) (6,413 ) (82,466 )

Non-operating loss, net (7,193 ) Income tax expense (2,230 ) Share

of results of equity investees (230 )

Net loss (92,119 )

(1) A combination of multiple business activities that does not

meet the quantitative thresholds to qualify as reportable segments

are grouped together as “Other Services.”(2) Unallocated expenses

are mainly related to share-based compensation and general and

corporate administrative costs such as professional fees and other

miscellaneous items that are not allocated to segments. The

expenses are excluded from segment results as they are not reviewed

by the CODM as part of segment performance.

SUPPLEMENTAL OPERATIONAL

METRICS

For the Three Months

For the Three Months

ended March 31,

ended June 30,

2018

2018

Digital Entertainment Unit Quarterly

active users millions

126.7

160.6

Monthly active users (last month) millions 77.4 90.6 Quarterly

paying users millions 7.2 6.6 Average revenue per user US$ 1.2 0.9

Average revenue per paying user US$ 20.3 21.1

E-commerce Gross GMV US$ millions 1,941.4 2,221.8

Gross orders millions 111.4 127.8

Digital Financial

Services GTV US$ millions 1,702.2 2,463.9

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180821005498/en/

For enquiries:Investors / analysts:Yong Cheng

Ongir@seagroup.comorMedia:media@seagroup.com

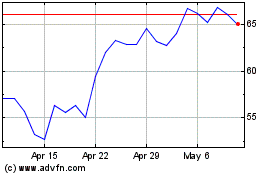

Sea (NYSE:SE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sea (NYSE:SE)

Historical Stock Chart

From Apr 2023 to Apr 2024