Salesforce.com to Acquire MuleSoft in $6.5 Billion Deal -- WSJ

March 21 2018 - 3:02AM

Dow Jones News

By Austen Hufford and Jay Greene

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (March 21, 2018).

Salesforce.com Inc. is buying MuleSoft Inc. in a deal valuing

the firm at $6.5 billion as Salesforce adds technology to help

customers tap data from older computer systems as they move to the

cloud.

MuleSoft's web-based service, Anypoint, lets developers connect

multiple sources of data that run in their own data centers as well

as on cloud services. That way, customers tap can tap that

information to create new applications as well as helping them

update their legacy applications and move them to the cloud.

MuleSoft has more than 1,200 customers, including Coca-Cola Co. and

Unilever NV, and has seen double-digit revenue growth in recent

years.

Salesforce's president and chief operating officer, Keith Block,

said the deal was driven, in part, from conversations with customer

CEOs who complain that "data locked in their legacy systems is

holding them back."

The deal is Salesforce's largest, topping the $2.8 billion

acquisition of Demandware Inc. for $2.8 billion in 2016.

Salesforce reached a deal to buy MuleSoft for about $44.89 a

share, composed of $36 in cash and 0.0711 share of Salesforce

stock. The deal is a 36% premium over MuleSoft's closing share

price Monday.

The deal opens new markets for Salesforce, finance chief Mark

Hawkins said during a conference call with analysts. He said the

deal will raise Salesforce's revenue target to $21 billion to $23

billion by its 2022 fiscal year, a $1 billion jump.

"We see significant revenue opportunity," Mr. Block said.

MuleSoft Chief Executive Greg Schott said he would remain CEO of

the company after the merger closes.

Reuters reported earlier on Tuesday about deal talks, and shares

in MuleSoft rose 27% during the trading day. Shares gained 4.4% to

$43.85 in post-market trading after the deal was announced.

Shares of Salesforce, which rose 0.1% during Tuesday trading,

fell 2.3% to $122.20 after hours.

Stockholders of MuleSoft owning about 30% of its shares have

already agreed to support the deal, Salesforce said. The purchase

is expected to close in Salesforce's fiscal second quarter, which

ends July 31.

Salesforce said it would fund the transaction with both cash on

hand and about $3 billion from loans and debt.

Write to Austen Hufford at austen.hufford@wsj.com and Jay Greene

at Jay.Greene@wsj.com

(END) Dow Jones Newswires

March 21, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

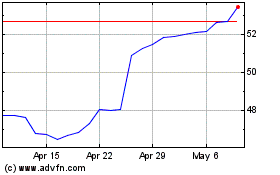

Unilever (NYSE:UL)

Historical Stock Chart

From Mar 2024 to Apr 2024

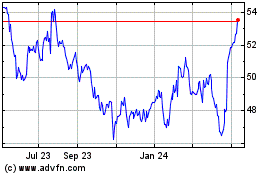

Unilever (NYSE:UL)

Historical Stock Chart

From Apr 2023 to Apr 2024