SUVs, Pickups Continue to Drive U.S. Auto Sales -- WSJ

June 02 2018 - 3:02AM

Dow Jones News

By Adrienne Roberts

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (June 2, 2018).

U.S. auto sales rose in May as demand for sport-utility vehicles

and pickup trucks continued to buoy sales despite rising gas

prices.

Deliveries likely increased nearly 5% during the month compared

with the same period in 2017, according to analyst estimates,

partly because of one more selling day compared with last year. May

is often the biggest month of the year for auto sales, with

Memorial Day sales driving car shoppers to dealerships to kick off

the summer selling season.

SUVs and pickup trucks accounted for about 67% of sales in May,

according to J.D. Power, the highest level ever for May. This mix

benefited auto makers like Ford Motor Co. and Fiat Chrysler

Automobiles NV, whose lineups skew heavily toward SUVs and pickups,

but hurt auto makers like Toyota Motor Corp. and Nissan Motor Co.

who are long known for their strength in sedans.

Ford and Fiat Chrysler are turning away from the sedan market,

under the assumption consumer preference has permanently switched

to SUVs and trucks. Japanese auto makers, meanwhile, continue to

invest in sedans and roll out redesigned models.

The richer mix of SUVs and pickup trucks -- which carry higher

prices than passenger cars -- drove the average transaction price

up nearly $1,200 in May compared with last year, while discounts

remained flat at about $3,665 per vehicle, J.D. Power said.

The shift toward trucks and SUVs continues unabated even though

consumers are paying more at the pump. Regular gasoline surpassed

an average of $2.90 a gallon nationally this week, according to the

U.S. Energy Information Administration. Prices are expected to

continue to rise and could top $3 a gallon through the summer

driving season.

Ford's U.S. sales chief, Mark LaNeve, said while consumer

preference for SUVs and pickup trucks has been shifting for years,

"the move is accelerating."

"Customers can get great fuel economy (in an SUV) compared with

five years ago and certainly 10 years," he said. He said there are

more options available now at a wide range of price points.

Ford reported sales were relatively flat in May, rising 0.5%.

The auto maker sold 241,527 vehicles during the month, with an 11%

increase in sales of the company's F-Series pickup trucks driving

the slight increase.

Fiat Chrysler reported sales were up in May due to a 29%

increase in sales of the company's Jeep brand vehicles. It said

sales were up 11% in May, rising to 214,294 vehicles.

General Motors Co. no longer reports monthly sales, moving to

disclose the numbers on a quarterly basis.

The Japanese auto makers reported mixed results. Toyota Motor

Corp. reported a decrease of 1.3% to 215,321 vehicles in May, with

sales of the auto maker's cars down 11%. Nissan Motor Co. sales

declined 4% to 131,832 units because of a reduction in sales to

fleet buyers and a steep drop in sedan sales.

Honda Motor Co. saw sales rise 3.1% to 153,069 vehicles. The

auto maker's car sales were down 2%, but double-digit gains in

sales of SUVs drove the gain.

Write to Adrienne Roberts at Adrienne.Roberts@wsj.com

(END) Dow Jones Newswires

June 02, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

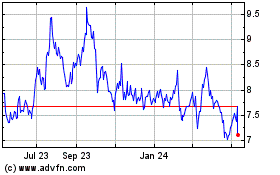

Nissan Motor (PK) (USOTC:NSANY)

Historical Stock Chart

From Mar 2024 to Apr 2024

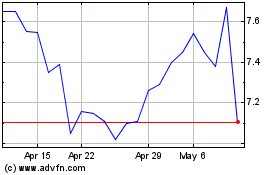

Nissan Motor (PK) (USOTC:NSANY)

Historical Stock Chart

From Apr 2023 to Apr 2024