Russia Raises Rate For First Time Since 2014 In Surprise Move

September 14 2018 - 5:23AM

RTTF2

Russia's central bank unexpectedly raised its key interest rate

for the first time since 2014 on Friday, citing significant

increase in inflation risks due to highly uncertain external

conditions.

The Board of Directors decided to raise the key rate by 0.25

percentage points to 7.50 percent, the Bank of Russia said in a

statement. Economists had expected the bank to hold the rate

steady.

The bank also decided to suspend foreign currency purchases in

the domestic market through the end of the year. This move is

expected to help to curtail the exchange rate volatility and its

influence on inflation, over the next few quarters.

Following the announcement, Bank of Russia Governor Elvira

Nabiullina said risks referred to those of mounting inflation and

inflation expectations in response to exchange rate volatility as

well as the forthcoming VAT rise.

"Moving forward, we will look into how feasible a further

increase in the key rate will be, taking into account inflation

movements and economic performance against the forecast, as well as

external environment-side risks and financial markets' response,"

she said.

The central bank forecast annual inflation to be 3.8-4.2 percent

this year, 5-5.5 percent in 2019 and return to 4 percent in

2020.

Growth forecast for this year was left unchanged at 1.5-2

percent. The projections for next year was updated to 1.2-1.7

percent, considering the upcoming VAT increase and a boost in

government spending. The forecast for 2020 was raised to 1.8-2.3

percent.

"Economic growth might accelerate over the next few years

provided that structural changes are successfully implemented,"

Nabiullina said.

"Economic growth pick-up will come without greater inflationary

pressure," she added.

"Together with the ban on FX purchases, this [the rate hike]

will add stability to the local FX market," ING Bank analyst Egor

Fedorov said. The analyst expects more aggressive sanctions against

Russia to be debated in the US Congress into and after mid-term

elections.

"Given a backdrop of rising US rates and unresolved trade

issues, we maintain a view that USD/RUB will be trading back above

70 over coming weeks and months," Fedorov added.

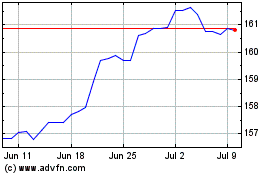

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Apr 2023 to Apr 2024