Rio Tinto Benefits From High Prices for Premium Ore -- Commodity Comment

July 16 2018 - 9:08PM

Dow Jones News

By Rhiannon Hoyle

SYDNEY--Rio Tinto PLC (RIO.LN) on Tuesday published its

half-year operations report, in which the miner recorded a sharp

rise in iron-ore shipments, particularly for premium products

currently in demand among China steelmakers. Here are some remarks

from the company's report.

On Pilbara iron ore output:

"Pilbara operations produced 168.7 million tons (Rio Tinto

share: 140.5 million tons) in the first half of 2018, 7% higher

than the same period of 2017. Second-quarter production of 85.5

million tons (Rio Tinto share: 71.5 million tons) was also 7%

higher than the second quarter of 2017, reflecting favorable

weather conditions compared to last year, the ramp-up of

Silvergrass and the ongoing implementation of productivity

improvements across the integrated system."

On 2018 iron-ore exports:

"As a result of the strong performance in the first half, Rio

Tinto's Pilbara shipments in 2018 are expected to be at the upper

end of the existing guidance range (330 to 340 million tons, 100%

basis). For the current year, shipments are expected to be more

evenly distributed between the first and second halves compared to

prior years, when shipments have typically been skewed to the

second half following seasonal disruption in the first half."

On iron ore prices:

"The continued improvement in productivity and flexibility

across the system enabled Rio Tinto to benefit from strong lump

premiums during the first half, with record lump sales achieved in

the second quarter. Achieved average pricing in the first half of

2018 was $57.9 per wet metric ton on an FOB basis (equivalent to

$63.0 per dry metric ton). In 2017, the full year price achieved

was $59.6 per wet metric ton (equivalent to $64.8 per dry metric

ton)."

On aluminum contracts:

"Following the announcement by the United States Treasury

Department on April 6, 2018, that it was implementing sanctions on

various Russian individuals and companies, Rio Tinto announced on

April 13, 2018, that it had reviewed arrangements it had with

impacted entities and was in the process of declaring force majeure

on certain contracts. However, the wind-down period was extended

until Oct. 23, 2018, and no force majeure declarations have been

made to date. Rio Tinto continues to monitor this situation

closely."

On aluminum cost pressures:

"As previously guided, significant raw material cost headwinds

have been experienced by the aluminum business, with the impact

during the first half of 2018 already considerably exceeding the

full year 2017 impact. This is expected to continue into the second

half of 2018."

On Escondida copper production:

"Second quarter mined copper production at Escondida was 35%

higher than the same period of 2017, with first half production

being 92% higher than the first half of last year, which was

impacted by a labor union strike. This performance also reflects

the ramp-up of Escondida production to nameplate capacity following

commissioning of the Los Colorados concentrator in the second half

of 2017. Escondida's current labor agreement expires on Aug. 1,

2018, and negotiations for a new agreement are in progress."

On diamond production:

"At Argyle, carat production was 8% higher than the second

quarter of 2017 due to an increase in tons processed following

improved plant availability. At Diavik, carats recovered in the

second quarter of 2018 were 3% higher than the corresponding period

in 2017 due to higher plant throughput. Development of the A21

project is ahead of schedule with first ore uncovered in March and

the mine is expected to be at full production capacity during the

fourth quarter of 2018."

-Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

(END) Dow Jones Newswires

July 16, 2018 20:53 ET (00:53 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

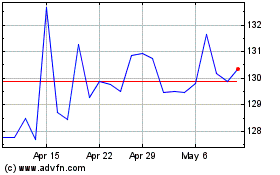

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Apr 2023 to Apr 2024