Report of Foreign Issuer (6-k)

April 30 2018 - 6:52PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF

1934

For the month of April 2018

Commission File Number 001-37678

SPI Energy Co., Ltd.

(Exact name of registrant as specified in

its charter)

Unit 15-16, 19/F, South Wing, Delta House

3 On Yiu Street, Shatin, Shek Mun, NT,

Hong Kong SAR, China

(Address of principal executive office)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F

x

Form 40-F

o

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

o

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

o

SPI Energy Co., Ltd.

As previously reported on January 11,

2018, the Company received a letter from Nasdaq stating that the Company was not in compliance with Nasdaq listing rules because

the Company had not submitted on a Form 6-K an interim balance sheet and income statement for the six-month period ended June 30,

2017. In the letter, Nasdaq requested that the Company submit a plan to regain compliance with Nasdaq listing rules within

60 days.

On March 6, 2018, the Company submitted

to Nasdaq a plan to regain compliance with Nasdaq listing rules and Nasdaq granted an exception to enable the Company to regain

compliance, under the condition that the Company must submit its interim balance sheet and income statement for the six-month period

ended June 30, 2017 on or before April 30, 2018.

The Company hereby furnishes its Unaudited

Condensed Consolidated Statements of Consolidated Balance Sheets and Unaudited Condensed Consolidated Statements of Operations

for the six-month period ended June 30, 2017 (the “Interim Report”) as attached in

Exhibit 99.1

to this

Form 6-K. Upon filing of this Form 6-K, the Company anticipates that it will regain compliance with relevant Nasdaq listing

rules relating to the failure to file its Interim Report.

The Company’s Interim Report is prepared

and presented in accordance with U.S. GAAP. However, the Interim Report has not been audited or reviewed by the Company’s

independent registered accounting firm. During the course of preparing the Interim Report, the Company noted various significant

outstanding and uncertain matters, including but not limited to, its liquidity and ability to continue as a going concern, contingent

liabilities arising from litigations and ongoing dispute with the investors of the Solarbao investment programs provided by the

Company’s subsidiaries in China.

The Company is preparing the consolidated

financial statements as of and for the year ended December 31, 2017. The Interim Report may be adjusted in connection with

the audit of its financial statements for the year ended December 31, 2017. In addition, accounting estimates and assumptions made

in preparing the Company’s consolidated financial statements as of and for the year ended December 31, 2017 may differ

from that used in the Interim Report due to the differences in reporting periods and changes in the Company’s financial conditions

during those periods. As a result, the Company cannot assure you that its consolidated financial statements as of and for the year

ended December 31, 2017 will not contain significant difference, adjustment or discrepancies from its Interim Report. The

Company’s historical results do not necessarily indicate results expected for any future periods.

Cautionary Note about Forward-looking

Statements

. This Form 6-K contains certain “forward-looking statements.” These statements are forward-looking

in nature and subject to risks and uncertainties that may cause actual results to differ materially. All forward-looking statements

are based upon information available to the Company as of the date of this Form 6-K, which may change, and the Company undertakes

no obligation to update or revise any forward-looking statements, except as may be required under applicable securities law.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

|

|

SPI Energy Co., Ltd.

|

|

|

|

|

|

|

|

Date: April 30, 2018

|

By:

|

/s/ Tairan Guo

|

|

|

|

Name: Tairan Guo

|

|

|

|

Title: Chief Financial Officer

|

[Signature Page to Form 6-K]

EXHIBIT INDEX

|

Exhibit Number

|

|

Description

|

|

|

|

|

|

99.1

|

|

SPI Energy Co., Ltd. Unaudited Condensed Consolidated Statements of Consolidated Balance Sheets and Unaudited Condensed Consolidated Statements of Operations for the six-month period ended June 30, 2017.

|

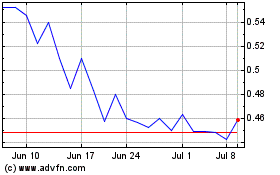

SPI Energy (NASDAQ:SPI)

Historical Stock Chart

From Mar 2024 to Apr 2024

SPI Energy (NASDAQ:SPI)

Historical Stock Chart

From Apr 2023 to Apr 2024