Report of Foreign Issuer (6-k)

February 13 2018 - 5:35PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of February, 2018

Commission File Number 001-36906

INTERNATIONAL GAME TECHNOLOGY PLC

(Translation of registrant’s name into English)

66 Seymour Street, Second Floor

London, W1H 5BT

United Kingdom

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F

x

Form 40-F

o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

o

Resolution of Comment Letter Exchange with SEC Staff Regarding Classification of Upfront Payments

made in Connection with the Italian Lotto Concession

As disclosed by International Game Technology PLC (the “Company”) on a Form 6-K furnished with the Securities and Exchange Commission (the “SEC”) on November 14, 2017, the Company received a comment from the SEC’s Division of Corporation Finance on July 27, 2017 relating to the 2016 Form 20-F inquiring about the cash flow classification of the upfront payment of $665.3 million, made in two installments in 2016 to the Italian governmental authority in connection with the Italian Gioco del Lotto service concession (the “Upfront Payment”). After additional correspondence with the SEC and consultation with the SEC’s Office of the Chief Accountant, the Company concluded the Upfront Payment should be classified as an operating activity rather than as an investing activity in the Company’s consolidated statements of cash flows in accordance with ASC 230, Statement of Cash Flows. Following these discussions, management recommended to the Company’s Audit Committee that the Company’s consolidated financial statements for the year ended December 31, 2016, be restated to correct the classification of the Upfront Payment as an operating activity. Additionally, in the 2017 fiscal year the Company made the third and final payment of $185.4 million. The Company classified this payment as an investing cash outflow and will similarly change the classification to an operating cash outflow. The Consolidated Statement of Cash Flows will be corrected when the Company files the Form 20-F for the 2017 fiscal year. This change in classification does not and will not have any impact on the Company’s historical balance sheets and income statements, including previously provided GAAP and non-GAAP measures of Net Income, Adjusted EBITDA, net change in cash and cash equivalents, Free Cash Flow, and Net Debt. In addition to this correction, the Consolidated Statements of Cash Flows for fiscal years 2016 and 2015 will be corrected when the Company files its Form 20-F for the 2017 fiscal year to reflect other immaterial accounting adjustments.

Solely as a result of the classification error, the Company determined that there was a material weakness in internal control over financial reporting as of December 31, 2016 and as a result the Company’s internal controls over financial reporting were ineffective as of such date. The Company has modified its technical accounting procedures and implemented additional processes and controls to identify, evaluate, and document significant judgments related to the classification on the statement of cash flows of material upfront payments made to customers.

A copy of the news release relating to the above matters is set forth in Exhibit 99.1, which is being furnished herewith.

|

Exhibit

Number

|

|

Description

|

|

|

|

|

|

99.1

|

|

News Release “International Game Technology PLC to Correct Classification of Upfront Payments to Customers in Consolidated Statements of Cash Flows; Change in Classification will have no Impact on Previously Reported Profitability and Non-GAAP Liquidity Measures,” dated February 13, 2018

|

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

Date: February 13, 2018

|

INTERNATIONAL GAME TECHNOLOGY PLC

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Pierfrancesco Boccia

|

|

|

|

Pierfrancesco Boccia

|

|

|

|

Corporate Secretary

|

4

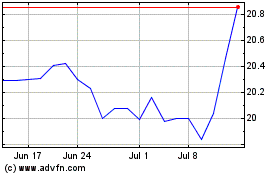

International Game Techn... (NYSE:IGT)

Historical Stock Chart

From Mar 2024 to Apr 2024

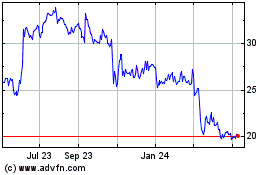

International Game Techn... (NYSE:IGT)

Historical Stock Chart

From Apr 2023 to Apr 2024