Report of Foreign Issuer (6-k)

January 17 2018 - 5:07PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

6-K

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE

13a-16

OR

15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

Dated: January 17, 2018

Commission File

No. 001-33311

NAVIOS MARITIME HOLDINGS INC.

7 Avenue de

Grande Bretagne, Office 11B2

Monte Carlo, MC 98000 Monaco

(Address of Principal Executive Offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover Form

20-F

or Form

40-F:

Form 20-F ☒

Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by Regulation

S-T

Rule 101(b)(1):

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by Regulation

S-T

Rule 101(b)(7):

Yes ☐ No ☒

DVB Bank Facility Agreement

On December 21, 2017, Kleimar NV., a wholly owned subsidiary of Navios Maritime Holdings Inc. (“Navios Holdings” or the

“Company”), entered into a facility agreement (the “Facility Agreement”) with DVB Bank SE for an amount up to $18,253,968.25 relating to the financing of the Navios Taurus, the Navios Northern Star and the Navios Amitie

(“the DVB Facility”). The facility bears interest at a rate of LIBOR plus 325 basis points. The DVB Facility is repayable in 14 quarterly installments of $730,158.73 followed by a final balloon installment of $8,031,746.03. To date, the

Facility Agreement has been fully drawn.

The Company is a guarantor of the obligations under the Facility Agreement. The Facility

Agreement also requires compliance with certain financial covenants, including covenants under the indenture for Navios Holdings’ outstanding secured notes. Among other events, it will be an event of default under the Facility Agreement if the

financial covenants are not complied with or if Angeliki Frangou and her affiliates, together, own less than 20% of the outstanding share capital of Navios Holdings.

The foregoing description is subject in all respects to the actual terms of the Facility Agreement. A copy of the Facility Agreement is

furnished as Exhibit 10.1 to this Report and is incorporated herein by reference.

Results of the Annual Meeting of Stockholders

On December 15, 2017, the Company held its 2017 Annual Meeting of Stockholders (the “Annual Meeting”). The record date for the

Annual Meeting was October 17, 2017. As of the record date, a total of 119,547,372 shares of the Company’s common stock were entitled to vote at the Annual Meeting. There were 55,614,564 shares of common stock present in person or by proxy

at the Annual Meeting. Set forth below are the matters acted upon by the stockholders, and the final voting results of each such proposal.

|

|

1.

|

Election of Directors

. The Company’s stockholders voted to elect Angeliki Frangou and Vasiliki Papaefthymiou as Class C Directors of the Company, whose terms, upon election, will expire in 2020.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For

|

|

|

Withhold

|

|

|

Angeliki Frangou

|

|

|

54,664,822

|

|

|

|

949,742

|

|

|

Vasiliki Papaefthymiou

|

|

|

54,068,366

|

|

|

|

1,546,198

|

|

|

|

2.

|

Approval of an amendment to the Charter

. Consistent with the Certificates of Designation for the Company’s Series G and Series H Preferred Stock (the “Certificates of Designation”), the Company

proposed an amendment to the Charter to effectuate any and all such changes as may be necessary to permit the Series G and/or Series H Holders the ability to exercise certain voting rights pursuant to the Certificates of Designation. This proposal

failed to receive the affirmative vote of holders of

two-thirds

of the Company’s issued and outstanding common stock entitled to vote at the Annual Meeting which was required to approve the proposal.

|

|

|

|

|

|

|

|

For

|

|

Against

|

|

Abstain

|

|

54,511,058

|

|

871,712

|

|

231,794

|

|

|

3.

|

Ratification of appointment of PricewaterhouseCoopers

. The Company’s stockholders voted to ratify the appointment of PricewaterhouseCoopers as the Company’s independent public accountants for the year

ending December 31, 2017.

|

|

|

|

|

|

|

|

For

|

|

Against

|

|

Abstain

|

|

55,172,276

|

|

384,910

|

|

57,378

|

Operational and Financial Results

On November 21, 2017, the Company issued a press release announcing the operational and financial results for the three and nine months periods ended

September 30, 2017. A copy of the press release is furnished as Exhibit 99.1 to this Report and is incorporated herein by reference.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

NAVIOS MARITIME HOLDINGS INC.

|

|

|

|

|

By:

|

|

/s/ Angeliki Frangou

|

|

|

|

Angeliki Frangou

|

|

|

|

Chief Executive Officer

|

|

|

|

Date: January 17, 2018

|

EXHIBIT INDEX

|

|

|

|

|

Exhibit

No.

|

|

Exhibit

|

|

|

|

|

10.1

|

|

Facility Agreement relating to a facility of up to $18,253,968.25, dated December 21, 2017, between Kleimar NV. and DVB Bank SE

|

|

|

|

|

99.1

|

|

Press Release, dated November 21, 2017: Navios Maritime Holdings Inc. Reports Financial Results for the Third Quarter and Nine Months Ended September 30, 2017.

|

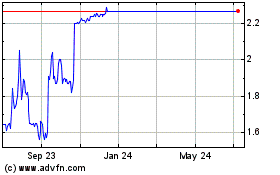

Navios Maritime (NYSE:NM)

Historical Stock Chart

From Mar 2024 to Apr 2024

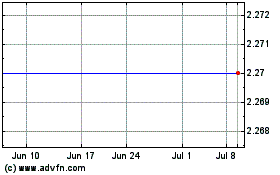

Navios Maritime (NYSE:NM)

Historical Stock Chart

From Apr 2023 to Apr 2024