SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of December, 2017

Commission File Number 1-14732

COMPANHIA SIDERÚRGICA NACIONAL

(Exact name of registrant as specified in its charter)

National Steel Company

(Translation of Registrant's name into English)

Av. Brigadeiro Faria Lima 3400, 20º andar

São Paulo, SP, Brazil

04538-132

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports

under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

São Paulo,

December

22

, 2017

3Q17 Earnings Release

Unaudited

Companhia Siderúrgica Nacional (CSN) (B3 S.A. – BOLSA BRASIL BALCÃO: CSNA3) (NYSE: SID) exceptionally discloses its preliminary and unaudited results for the

third

quarter of 2017 (

3

Q17) and is therefore subject to adjustments and modifications by independent auditors review. The information disclosed in Brazilian Reais and prepared in accordance with International Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board (IASB); and also in accordance with accounting practices adopted in Brazil and fully convergent with international accounting standards, issued by the Accounting Pronouncements Committee (CPC) and referenced by the Brazilian Securities and Exchange Commission (CVM), pursuant to CVM Instruction 485 of 09/01/2010. The below text encompasses the Company's consolidated results for the third quarter of 2017 (3Q17) and comparisons are for the second quarter of 2017 (2Q17) and for the third quarter of 2016 (3Q16) without Metallic, unless otherwise specified. The Real/U.S. Dollar exchange rate was R$3.16

25

on September 30, 2017 and R$3.3076 on June 30, 2017.

The financial information contained herein for the second quarter of 2017 is

preliminary and unaudited

, and is therefore

subject to adjustments and modifications

as a result of an independent auditors' review.

Operating and Financial Highlights

·

EBITDA totaled R$1,213 million

, 35% up on 2Q17, accompanied by an EBITDA margin of 24%, 4.4 p.p. higher than in the same quarter of the previous year.

·

Net revenue stood at R$4,810 million in 3Q17,

the highest output quarter since 2014.

·

Iron ore sales

reached

7,9 million tonnes, 2% higher

than in 2Q17.

·

The net debt/EBITDA ratio closed 3Q17 at 5.5x.

·

Steel lower spending

with scheduled maintenance of LTQ2 and AF3.

·

Fall of R$ 662 million in working capital,

with a focus on inventories reduction and a longer finance cycle.

|

Highlights

|

3Q16

|

2Q17

|

3Q17

|

Change

|

|

3Q17

|

x

|

2Q17

|

3Q17

|

x

|

3Q16

|

|

Steel Sales (thousand t)

|

1,171

|

1,174

|

1,301

|

11%

|

9%

|

|

- Domestic Market

|

62%

|

56%

|

62%

|

6%

|

4%

|

|

- Overseas Subsidiaries

|

34%

|

39%

|

33%

|

-6%

|

-6%

|

|

- Exports

|

4%

|

5%

|

5%

|

0%

|

1%

|

|

Iron Ore Sales (thousand t)1

|

10,230

|

7,818

|

7,953

|

2%

|

-22%

|

|

- Domestic Market

|

89%

|

17%

|

17%

|

0%

|

6%

|

|

- Exports

|

89%

|

83%

|

83%

|

0%

|

-6%

|

|

Consolidated Results (R$ Million)

|

|

|

|

|

|

|

|

|

|

|

Net Revenue

|

4,469

|

4,311

|

4,810

|

12%

|

8%

|

|

Gross Profit

|

1,312

|

985

|

1,213

|

23%

|

-8%

|

|

Adjusted EBITDA

|

1,239

|

896

|

1,213

|

35%

|

-2%

|

|

Adjusted Net Debt

|

25,842

|

26,754

|

25,717

|

-4%

|

0%

|

|

Adjusted Cash Position

|

5,663

|

4,545

|

4,358

|

-4%

|

-23%

|

|

Net Debt / Adjusted EBITDA

|

7.4x

|

5.7x

|

5.5x

|

-0.2x

|

-1.9x

|

Adjusted EBITDA is calculated based on net income/loss, plus depreciation and amortization, income tax, net financial result, results from investees and other operating revenue (expenses), and includes the proportionate share of EBITDA of the jointly-owned subsidiaries MRS Logística and CBSI. It has also included the Company’s stakes of 100% in Congonhas Minérios, 37.27% in MRS and 50% in CBSI as of December 2015.

Adjusted Net Debt and Adjusted Cash Position include the stakes of 100% in Congonhas Minérios, 37.27% in MRS and 50% in CBS excluding Forfaiting and drawee risk operations.

CSN’s Consolidated Results

·

Net revenue

totaled R$4,810 million in 3Q17, 12% up on 2Q17, due to higher steel product sales volume compared with the immediately previous quarter and the slight upturn in shipped volume in the mining segment, with an increase in ore prices.

·

COGS

came to R$3,597 million in 3Q17, 8% higher than in the previous quarter, accompanying the increase in sales volume in the steel segment.

·

Gross profit

totaled R$1,213 million, 23% higher on 2Q17, while the gross margin reached 25,2%, highlight with the strong results in the mining segment.

·

Selling, general and administrative expenses

amounted to R$491 million in 3Q17, 17% less than in 2Q17, especially due to the lower share of iron ore CIF sales in the mix in the previous quarter.

·

Other operating income (expenses)

was a net expense of R$98 million in 3Q17, in line with the previous quarter.

·

In 3Q17, the

net financial result

was negative by R$278 million, i) as a result of financial expenses of R$348 million, partial compensated by the financial revenue of R$71 million. The foreign exchange variation of the dollar-denominated debt was positive in R$ 473 million.

|

Financial Result (R$ million)

|

3Q16

|

2Q17

|

3Q17

|

|

Financial Result - IFRS

|

(744)

|

(829)

|

(278)

|

|

Financial Revenue

|

139

|

84

|

71

|

|

Financial Expenses

|

(884)

|

(912)

|

(348)

|

|

Financial Expenses (ex-exchange variation)

|

(823)

|

(683)

|

(629)

|

|

Result with Exchange Variation

|

(60)

|

(229)

|

280

|

|

Monetary and Exchange Variation

|

(131)

|

(461)

|

473

|

|

Hedge Accounting

|

68

|

227

|

(202)

|

|

Derivative Result

|

3

|

5

|

10

|

|

|

|

|

|

·

CSN’s

equity result

was a positive R$38 million in 3Q17, versus R$

39

million in 2Q17.

|

Share of Profit (Loss) of Investees (R$ million)

|

3Q16

|

2Q17

|

3Q17

|

Change

|

|

3Q17

|

x

|

2Q17

|

3Q17

|

x

|

3Q16

|

|

MRS Logística

|

42

|

54

|

54

|

-

|

29%

|

|

CBSI

|

1

|

1

|

1

|

-

|

-

|

|

TLSA

|

(6)

|

(5)

|

(11)

|

133%

|

76%

|

|

Arvedi Metalfer BR

|

2

|

1

|

-

|

-

|

-

|

|

Eliminations

|

(13)

|

(12)

|

(6)

|

(47%)

|

(52%)

|

|

Unrealized Profit

|

1

|

-

|

-

|

-

|

|

|

Share of Profits (Losses) of Investees

|

26

|

39

|

38

|

(3%)

|

45%

|

·

CSN recorded a third-quarter net income of R$256 million, versus net loss of R$640 million in 2Q17. In 3Q17 was reflected by a better operating margin in steel and mining, as well as financial results.

|

Adjusted EBITDA (R$ million)

|

3Q16

|

2Q17

|

3Q17

|

Change

|

|

3Q17

|

x

|

2Q17

|

3Q17

|

x

|

3Q16

|

|

Profit (Loss) for the Period

|

(67)

|

(640)

|

256

|

-

|

-

|

|

(-) Depreciation

|

311

|

356

|

344

|

(3%)

|

11%

|

|

(+) Income Tax and Social Contribution

|

123

|

145

|

128

|

(12%)

|

4%

|

|

(-) Net Financial Result

|

744

|

829

|

278

|

(66%)

|

(63%)

|

|

EBITDA (CVM Instruction 527)

|

1,118

|

689

|

1,006

|

46%

|

(10%)

|

|

(+) Other Operating Income/Expenses

|

8

|

99

|

98

|

(1%)

|

-

|

|

(+) Share of Profit (Loss) of Investees

|

(26)

|

(39)

|

(38)

|

(3%)

|

46%

|

|

(-) Proportionate EBITDA of Jointly-Owned Subsidiaries

|

138

|

148

|

147

|

(1%)

|

7%

|

|

Adjusted EBITDA

|

1,232

|

896

|

1,213

|

35%

|

(2%)

|

|

¹The Company discloses adjusted EBITDA excluding interests in investments and other operating income (expenses) in the belief that these items should not be considered when calculating recurring operating cash flow

.

|

·

Adjusted EBITDA

amounted to R$1,213 million in 3Q17, versus R$896 million in the previous quarter, 35% up, accompanied by an adjusted EBITDA margin of 24%, due to higher performance of iron and steel.

¹The adjusted EBITDA margin is calculated as the ratio between adjusted EBITDA and adjusted net revenue, considering the stakes of 100% in Congonhas Minérios, 37.27% in MRS and 50% in CBSI.

Debt

The adjusted amounts of EBITDA, debt and cash include the stakes of 100% in Congonhas Minérios, 37.27% in MRS and 50% in CBSI, as well as financial investments used as collateral for exchange operations on the B3 S.A. – BOLSA BRASIL BALCÃO. On June 30, 2017, consolidated net debt totaled R$26,754 million, while the net debt/EBITDA ratio, calculated based on LTM adjusted EBITDA, stood at 5.5x.

Foreign Exchange Exposure

The FX exposure of our consolidated balance sheet on September 30, 2017 was US$742 million, as shown in the table below.

The hedge accounting adopted by CSN correlates projected export inflows in dollars with part of the scheduled debt payments in the same currency. Therefore, the exchange variation of the dollar-denominated debt is temporarily booked under shareholders’ equity, being recorded in the income statement when dollar revenues from exports are received.

|

Foreign Exchange Exposure

|

IFRS

|

|

(US$ million)

|

6/30/2017

|

9/30/2017

|

|

Cash

|

890

|

846

|

|

Accounts Receivable

|

404

|

387

|

|

Total Assets

|

1,296

|

1,236

|

|

Borrowings and Financing

|

(4,324)

|

(4,329)

|

|

Suppliers

|

(70)

|

(37)

|

|

Other Liabilities

|

(13)

|

(5)

|

|

Total Liabilities

|

(4,407)

|

(4,370)

|

|

Foreign Exchange Exposure

|

(3,110)

|

(3,135)

|

|

Notional Amount of Derivatives Contracted, Net

|

-

|

-

|

|

Cash Flow Hedge Accounting

|

1,421

|

1,393

|

|

Net Foreign Exchange Exposure

|

(1,689)

|

(1,742)

|

|

Perpetual Bonds

|

1,000

|

1,000

|

|

Net Foreign Exchange Exposure excluding Perpetual Bonds

|

(689)

|

(742)

|

Capex

CSN invested R$293 million in 3Q17. The cumulative amount in 2017 was much lower than 2016..

|

Capex (R$ million)

|

3Q16

|

2Q17

|

3Q17

|

|

Steel

|

133

|

102

|

119

|

|

Mining

|

56

|

106

|

115

|

|

Cement

|

157

|

20

|

34

|

|

Logistics

|

36

|

11

|

19

|

|

Other

|

0

|

0

|

6

|

|

Total Capex - IFRS

|

382

|

239

|

293

|

Working Capital

Working capital invested in the Company’s business totaled R$2.935 million in 3Q17, R$662 million less than in 2Q17, chiefly due to the decrease in inventories and accounts receivable R$ 199 million and R$ 174 million respectively . On a same comparison basis, the average receivable period decreased by four days, while inventory turnover fell by nine days and the average payment period moved up by two days.

In order to calculate working capital, CSN adjusts its assets and liabilities as shown below:

·

Accounts Receivable: Excludes Dividends Receivable, Advances to Employees and Other Credits.

·

Inventories: Includes Estimated Losses and excludes Spare Parts, which is not part of the cash conversion cycle, and will be subsequently booked under Fixed Assets when consumed.

·

Recoverable Taxes: Composed only by the Income (IRPJ) and Social Contribution (CSLL) Taxes amount included in Recoverable Taxes.

·

Taxes Payable: Composed of Taxes Payable under Current Liabilities plus Taxes in Installments.

·

Advances from Clients: Subaccount of Other Liabilities recorded under Current Liabilities.

·

Suppliers: Includes Forfaiting and Drawee Risk.

|

Working Capital (R$ million)

|

3Q16

|

2Q17

|

3Q17

|

|

Change

|

|

|

3Q17

|

x

|

2Q17

|

3Q17

|

x

|

3Q16

|

|

Assets

|

4,953

|

6,252

|

5,868

|

|

(383)

|

915

|

|

Accounts Receivable

|

1,789

|

2,300

|

2,127

|

|

(174)

|

338

|

|

Inventories

|

3,002

|

3,744

|

3,545

|

|

(199)

|

543

|

|

Recoverable Taxes

|

162

|

207

|

196

|

|

(11)

|

34

|

|

Liabilities

|

2,287

|

2,655

|

2,933

|

|

278

|

646

|

|

Suppliers

|

1,690

|

2,078

|

2,250

|

|

172

|

560

|

|

Payroll and Related Charges

|

287

|

294

|

296

|

|

2

|

10

|

|

Taxes Payable

|

248

|

183

|

279

|

|

96

|

31

|

|

Advances from Clients

|

63

|

100

|

108

|

|

9

|

45

|

|

Working Capital

|

2,666

|

3,597

|

2,935

|

|

(662)

|

269

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Period (days)

|

3Q16

|

2Q17

|

3Q17

|

|

Change

|

|

|

3Q17

|

x

|

2Q17

|

3Q17

|

x

|

3Q16

|

|

Receivables

|

34

|

41

|

37

|

|

(4)

|

3

|

|

Supplier Payment

|

49

|

59

|

61

|

|

2

|

12

|

|

Inventories

|

87

|

106

|

97

|

|

(9)

|

10

|

|

Financial Cycle

|

72

|

88

|

73

|

|

(15)

|

1

|

Results by Segment

The Company maintains integrated operations in five business segments: Steel, Mining, Logistics, Cement and Energy. The main assets and/or companies comprising each segment are presented below:

Notes: As of 2013, the Company ceased the proportional consolidation of its jointly-owned subsidiaries Namisa, MRS and CBSI. For the purpose of preparing and presenting the information by business segment, Management opted to maintain the proportional consolidation of its jointly-owned subsidiaries, in line with historical data. In the reconciliation of CSN’s consolidated results, these companies’ results are eliminated in the “Corporate Expenses/Elimination” column.

³Since the end of 2015 results, after the combination of CSN’s mining assets (Casa de Pedra, Namisa and Tecar), the consolidated result have included all the information related to this new company.

Net Revenue by Segment – 3Q17 (R$ million)

Adjusted EBITDA by Segment – 3Q17 (R$ million)

|

|

|

|

Logistics

|

Logistics

|

|

Energy Corporate/Eli

|

|

|

Results 3Q17

|

Steel

|

Mining

|

(Port)

|

(Railways)

|

Cement

|

minations

|

Consolidated

|

|

(R$ MM)

|

|

|

|

|

|

|

|

|

|

Net Revenue

|

3.399

|

1.204

|

60

|

364

|

142

|

103

|

(462)

|

4.810

|

|

Domestic Market

|

2.133

|

218

|

60

|

364

|

142

|

103

|

(638)

|

2.382

|

|

Foreign Market

|

1.265

|

986

|

-

|

-

|

-

|

-

|

176

|

2.427

|

|

Cost of Goods Sold

|

(2.845)

|

(719)

|

(37)

|

(242)

|

(151)

|

(74)

|

471

|

(3.597)

|

|

Gross Profit

|

553

|

486

|

23

|

122

|

(9)

|

29

|

8

|

1.213

|

|

Selling, General and Administrative Expenses

|

(253)

|

(40)

|

(6)

|

(21)

|

(20)

|

(7)

|

(143)

|

(491)

|

|

Depreciation

|

165

|

122

|

4

|

63

|

30

|

5

|

(45)

|

344

|

|

Proportional EBITDA of Jointly Controlled Companies

|

-

|

-

|

-

|

-

|

-

|

-

|

147

|

147

|

|

Adjusted EBITDA

|

465

|

568

|

21

|

164

|

1

|

27

|

(33)

|

1.213

|

|

|

|

|

Logistics

|

Logistics

|

|

Energy Corporate/Eli

|

|

|

Results 2Q17

|

Steel

|

Mining

|

(Port)

|

(Railways)

|

Cement

|

minations

|

Consolidated

|

|

(R$ MM)

|

|

|

|

|

|

|

|

|

|

Net Revenue

|

3.055

|

1.067

|

52

|

364

|

114

|

111

|

(452)

|

4.311

|

|

Domestic Market

|

1.749

|

246

|

52

|

364

|

114

|

111

|

(674)

|

1.963

|

|

Foreign Market

|

1.305

|

821

|

-

|

-

|

-

|

-

|

222

|

2.348

|

|

Cost of Goods Sold

|

(2.628)

|

(742)

|

(38)

|

(244)

|

(126)

|

(71)

|

523

|

(3.326)

|

|

Gross Profit

|

426

|

325

|

15

|

121

|

(13)

|

40

|

71

|

985

|

|

Selling, General and Administrative Expenses

|

(271)

|

(42)

|

(7)

|

(23)

|

(20)

|

(7)

|

(222)

|

(592)

|

|

Depreciation

|

172

|

124

|

4

|

65

|

33

|

6

|

(48)

|

356

|

|

Proportional EBITDA of Jointly Controlled Companies

|

-

|

-

|

-

|

-

|

-

|

-

|

147

|

147

|

|

Adjusted EBITDA

|

327

|

408

|

12

|

163

|

(0)

|

39

|

(53)

|

896

|

Steel

According to the World Steel Association (WSA), global crude steel production totaled 1.1 billion tonnes until August 2017, 4.9% more than in the same period last year.

According to the Brazilian Steel Institute – IABr, domestic crude steel production came to 22.5 million tonnes, 9.3% up. Apparent steel consumption grew by 4.5%, to 12.6 million tonnes, with domestic sales of 11 million tonnes and imports of 1.6 million tonnes. Exports totaled 9.8 million tonnes, 12.9% more than in the same period last year. According to INDA (the Brazilian Steel Distributors’ Association), in the first eight months, steel purchases by distributors declined by 1.9% year-on-year, totaling 1.9 million tonnes. Inventories stood at 897,500 tonnes at the end of August, 2.7% more than in the previous month, while inventory turnover fell to 3 months.

Automotive

According to ANFAVEA (the Auto Manufacturers’ Association), vehicle production totaled 1.9 million units in the first nine months of 2017, 27% up on the same period in 2016. In the same period, new light car, commercial vehicle, truck and bus licensing increased by 11% to 1.4 million units.

Construction

According to ABRAMAT (the Construction Material Manufacturers’ Association), sales of building materials fell by 6.1% in the year through August 2017 over the same period in 2016.

Home Appliances

According to IBGE (the Brazilian Institute of Geography and Statistics), home appliance production in the year through August increased by 10.1% over the same period last year.

Results from CSN’s Steel Operation

|

-

Total sales

came to 1,301 tonnes in 3Q17, 11% higher than 2Q17, broken down as follows: 62% from the domestic market, 32% from our subsidiaries abroad and 6% from exports.

-

In 3Q17, CSN’s

domestic

steel sales came to 802,000 tonnes, 23% higher than in 2Q17. Of this total, 730,000 tonnes corresponded to flat steel and 72,000 tonnes to long steel.

-

Foreign

steel sales

amounted to 499,000 tonnes in 3Q17, 4% down on the previous three months. Of this total, exports reached 74,000 tonnes, the overseas subsidiaries sold 425,000 tonnes, 155,000 of which by LLC, 177,000 by SWT and 92,000 by Lusosider.

-

In the third quarter, CSN maintained its high

share of coated products

as a percentage of total sales volume, following the strategy of adding more value to its product mix. Sales of coated products such as galvanized

items and tin plate accounted for 56% of flat steel sales, considering all the markets in which

the Company operates. The

foreign market

was one of the quarter's highlights, with the share of coated

products remaining high, at 88% in 3Q17.

-

Net revenue

totaled R$3,399 million in 3Q17, 11% up on 2Q17.

Net average revenue per tonne

stood at R$2,519,in line with 2Q17.

-

The

slab production

reached 1.1 million tonnes in 3Q17, in line with 2Q17. Flat rolled steel production totaled 903,000 tonnes.

|

|

|

|

|

·

The

slab production

reached 1.1 million tonnes in 3Q17, in line with 2Q17. Flat rolled steel production totaled 903,000 tonnes.

|

Flat Steel Production

|

3Q16

|

2Q17

|

3Q17

|

Change

|

|

(thousand tonnes)

|

3Q17

|

x

|

2Q17

|

3Q17

|

x

|

3Q16

|

|

Total Slabs (President Vargas Plant + Third Parties)

|

857

|

1,108

|

1,069

|

(4%)

|

25%

|

|

Slab Production

|

738

|

1,070

|

1,065

|

0%

|

44%

|

|

Third-Party Slabs

|

119

|

38

|

4

|

-

|

(96%)

|

|

Total Rolled Flat Steel

|

835

|

943

|

903

|

(4%)

|

8%

|

|

Total Long Products

|

90

|

56

|

50

|

(10%)

|

(44%)

|

·

COGS

moved up by 8% over the previous quarter, to R$2,845 million, chiefly due the higher sale volume.

·

The

production cost

amounted to R$1,906 million in 3Q17, 9% more than in 2Q17, particularly due to the better prices in purchase of raw material, especially to ore price, increased own consumption of coke, in addition to the end of maintenance of the blast furnace #3 and the hot strip mill.

·

The

slab production cost

came to R$1,286/t, 9% down on 2Q’s R$1,414.

·

Adjusted EBITDA

amounted to R$465 million in 3Q17, 42% up on the R$327 million recorded in 2Q17, accompanied by a 3 p.p. incline the quarter before. Adjusted EBITDA margin increased to 13.7%, 3p.p. higher than in the previous quarter.

Mining

After the sharp drop in prices in 2Q17, the closure of induction furnaces in China was a result of a decrease in steel supply, raising the utilization levels of the plants’ installed capacity and margins. In this context, the commodity’s price averaged US$70.90/dmt (Platts, Fe62%, N. China) in 3Q17, 13% up on the previous quarter.

In 3Q17, seaborne freight charges continued positively impacted by higher export volumes and, additionally, a recovery in oil prices. In this scenario, maritime freight costs on Route CI-C3 (Tubarão-Qingdao) averaged US$15.13/t in 3Q17, 12% up on 2Q17.

Results from CSN’s Mining Operations

·

In 3Q17,

iron ore production

totaled 7.7 million tonnes, 3% down on 2Q17, 1.4 million tonnes volume was purchased by third parties.

·

Iron ore

sales

reached 7.9 million tonnes in 3Q17, 2% up on 2Q17. In the quarter, 1.3 million tonnes from CSN Mineração were sold to CSN’s Presidente Vargas Plant.

|

Production Volume and Mining Sales

|

|

|

|

Change

|

|

(thousand t)

|

3Q16

|

2Q17

|

3Q17

|

3Q17 x 2Q17

|

3Q17 x 3Q16

|

|

Iron Ore Production¹

|

8.553

|

7.948

|

7.738

|

-3%

|

-10%

|

|

Third Parties Purchase

|

797

|

167

|

1.419

|

752%

|

78%

|

|

Total Production + Purchase

|

9.350

|

8.114

|

9.157

|

13%

|

-2%

|

|

UPV Sale

|

1.114

|

1.307

|

1.321

|

1%

|

19%

|

|

Third Parties Sales Volume

|

9.116

|

6.511

|

6.632

|

2%

|

-27%

|

|

Total Sales

|

10.230

|

7.818

|

7.953

|

2%

|

-22%

|

-

Net revenue

from mining operations totaled R$1,204 million, 13% higher than in 2Q17. CFR+FOB unit revenue

stood at US$55,7/t, 13% more than in 2Q17, while the iron ore price index (Platts, 62% Fe, N. China) also fell by

13% in the same period

.

-

Mining

COGS

came to R$719 million in 3Q17, 3% lower than in 2Q17.

-

Adjusted EBITDA

totaled R$568 million in 3Q17, 39% up on 2Q17, with an adjusted EBITDA margin of 47%, 8.9 p.p.

more than in 2Q17.

(CFR + FOB* - US$/wmt delivered to China)

The table above shows the price of the two modalities, CFR+FOB.

Logistics

Railway Logistics:

Net revenue

stood at R$364 million in 3Q17, generating

EBITDA

of R$164 million, accompanied by an

EBITDA margin

of 45%.

Port Logistics

:

Sepetiba Tecon handled nearly 51,000 containers, in addition to 250,000 tonnes of steel products.

Net revenue

totaled R$60 million, generating

EBITDA

of R$21 million, accompanied by an

EBITDA margin

of 35%.

|

|

|

|

|

|

|

|

|

3Q16

|

2Q17

|

3Q17

|

Change

|

|

Sepetiba TECON Highlights

|

3Q17 x 2Q17

|

3Q17 x 3Q16

|

|

Containers Volume (thousand units)

|

34

|

39

|

51

|

31%

|

49%

|

|

Steel Products Volume (thousand t)

|

127

|

212

|

250

|

18%

|

97%

|

|

General Cargo Volume (thousand t)

|

5

|

1

|

0

|

-61%

|

-95%

|

Cement

Preliminary figures from SNIC (

the Cement Industry Association

) indicate domestic cement sales of 40.5 million tonnes from January to September 2017, 7.4% less than in the same period the year before.

Results from CSN’s Cement Operations

In 3Q17,

cement sales

totaled 982,000 tonnes, 17% up on 2Q17, while

net revenue

amounted to R$142 million.

|

|

|

|

|

|

|

|

Cement Highlights

|

3Q16

|

2Q17

|

3Q17

|

Change

|

|

(thousand t)

|

3Q17 x 2Q17

|

3Q17 x 3Q16

|

|

Total Production

|

859,78128

|

840,752

|

982

|

17

%

|

14

%

|

|

Total Sales

|

849,95745

|

830,625

|

998

|

20

%

|

17

%

|

Energy

According to the Energy Research Company (EPE),

the

trend of stability in the energy market continued in August, with consumption edging down 0.1% year-over-year, to 37,583 GWh. In the year through August, consumption remained in line with the same period last year. Considering the Brazilian regions, the South grew by 4.0% and the North by 3.4%, while the Northeast fell by 2.1%, the Southeast by 1.3% and the Midwest by 0.1%. The captive market of the distribution companies fell by 6.3% in the month, while free consumption increased by 15.3%.

Results from CSN’s Energy Operations

In 3Q17,

net revenue

from energy operations totaled R$103 million,

EBITDA

stood at R$27 million and

EBITDA margin

was 26.5%.

Capital Market

CSN’s shares appreciated by 32% in 3Q17, while the IBOVESPA moved up by 17%. Daily traded volume on the B3 S.A. – BOLSA BRASIL BALCÃO averaged R$72.6 million. On the New York Stock Exchange (NYSE), CSN’s American Depositary Receipts (ADRs) appreciated by 17%, versus the Dow Jones’ 4% appreciation. On the NYSE, daily traded volume of CSN’s ADRs averaged US$7.4 million.

|

3Q17

|

|

Number of shares in thousands

|

1,387,524

|

|

Market Cap:

|

|

|

Closing price (R$/share)

|

9.61

|

|

Closing price (US$/ADR)

|

2.96

|

|

Market cap (R$ million)

|

13,334

|

|

Market cap (US$ million)

|

4,107

|

|

Total return including dividends and interest on equity

|

|

|

CSNA3

|

32%

|

|

SID

|

32%

|

|

Ibovespa

|

17%

|

|

Dow Jones

|

4%

|

|

Volume

|

|

|

Daily average (thousand shares)

|

8,311

|

|

Daily average (R$ thousand)

|

72,650

|

|

Daily average (thousand ADRs)

|

2,684

|

|

Daily average (US$ thousand)

|

7,405

|

|

Source: Bloomberg

|

|

Webcast - 3Q17 Earnings Presentation

Investor Relations Team

|

Certain of the statements contained herein are forward-looking statements, which express or imply results, performance or events that are expected in the future. These include future results that may be implied by historical results and the statements under ‘Outlook’. Actual results, performance or events may differ materially from those expressed or implied by the forward-looking statements as a result of several factors, such as the general and economic conditions in Brazil and other countries, interest rate and exchange rate levels, protectionist measures in the U.S., Brazil and other countries, changes in laws and regulations and general competitive factors (on a global, regional or national basis).

|

|

INCOME STATEMENT

|

|

CONSOLIDATED – Corporate Law (In thousand of R$)

|

|

|

3Q16

|

Unaudited

2Q17

|

Unaudited

3Q17

|

|

Net Revenues

|

4,469,240

|

4,310,609

|

4,809,671

|

|

Domestic Market

|

2,100,371

|

1,962,864

|

2,382,265

|

|

Foreign Market

|

2,368,869

|

2,347,745

|

2,427,406

|

|

Cost of Goods Sold (COGS)

|

(3,157,057)

|

(3,325,893)

|

(3,596,936)

|

|

COGS, excluding depreciation

|

(2,851,368)

|

(2,977,952)

|

(3,260,372)

|

|

Depreciation allocated to COGS

|

(305,689)

|

(347,941)

|

(336,564)

|

|

Gross Profit

|

1,312,183

|

984,716

|

1,212,735

|

|

Gross Margin (%)

|

29%

|

23%

|

25%

|

|

Selling expenses

|

(403,112)

|

(477,063)

|

(412,345)

|

|

General and administrative expenses

|

(114,429)

|

(106,801)

|

(70,646)

|

|

Depreciation allocated to SG&A

|

(5,662)

|

(7,829)

|

(7,727)

|

|

Other operation income (expense), net

|

(7,723)

|

(99,025)

|

(97,824)

|

|

Share of profits (losses) of investees

|

26,117

|

39,393

|

38,002

|

|

Operational Income before Financial Results

|

807,374

|

333,391

|

662,195

|

|

Net Financial Results

|

(744,345)

|

(828,619)

|

(277,797)

|

|

Profit before finance income (costs) and taxes

|

63,029

|

(495,228)

|

384,398

|

|

Income Tax and Social Contribution

|

(122,796)

|

(144,728)

|

(128,214)

|

|

Continued operations, net

|

(59,767)

|

(639,956)

|

256,184

|

|

Discontinued Operations, Net

|

(6,984)

|

-

|

|

|

Profit / Loss before period

|

(66,751)

|

(639,956)

|

256,184

|

|

BALANCE SHEET

|

|

Company Corporate Law (In Thousand of R$)

|

|

|

Consolidated

|

|

|

12/31/2016

|

Unaudited

09/31/2017

|

|

Current assets

|

12,444,918

|

11,653,843

|

|

Cash and cash equivalents

|

5,631,553

|

4,138,770

|

|

Trade receivables

|

1,997,216

|

2,240,375

|

|

Inventories

|

3,964,136

|

4,246,458

|

|

Other current assets

|

852,013

|

1,028,240

|

|

Non-current assets

|

31,708,705

|

32,219,870

|

|

Long-term receivables

|

1,745,971

|

1,778,197

|

|

Investments measured at amortized cost

|

4,568,451

|

5,293,244

|

|

Property, plant and equipment

|

18,135,879

|

17,875,819

|

|

Intangible assets

|

7,258,404

|

7,272,610

|

|

Total assets

|

44,153,623

|

43,873,713

|

|

Current liabilities

|

5,496,683

|

|

|

Payroll and related taxes

|

253,837

|

296,167

|

|

Suppliers

|

1,763,206

|

2,249,151

|

|

Taxes payable

|

231,861

|

269,168

|

|

Borrowings and financing

|

2,117,448

|

3,983,810

|

|

Other payables

|

1,021,724

|

950,560

|

|

Provision for tax, social security, labor and civil risks

|

108,607

|

100,068

|

|

Non-current liabilities

|

31,272,419

|

28,058,141

|

|

Borrowings and financing

|

28,323,570

|

25,020,128

|

|

Deferred Income Tax and Social Contribution

|

1,046,897

|

1,167,974

|

|

Other payables

|

131,137

|

129,811

|

|

Provision for tax, social security, labor and civil risks

|

704,485

|

718,592

|

|

Other provisions

|

1,066,330

|

1,021,636

|

|

Shareholders’ equity

|

7,384,521

|

7,966,648

|

|

Paid-in capital

|

4,540,000

|

4,540,000

|

|

Capital reserves

|

30

|

30

|

|

Acumulated Losses

|

(1,301,961)

|

(1,649,259)

|

|

Statutory reserve

|

2,956,459

|

3,804,741

|

|

Non-controlling interests

|

1,189,993

|

1,271,136

|

|

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY

|

44,153,623

|

43,873,713

|

|

CASH FLOW STATEMENT

|

|

CONSOLIDATED - Corporate Law (In Thousand of R$)

|

|

|

Unaudited 2Q17

|

Unaudited 3Q17

|

|

Net cash generated by operating activities

|

(386,723)

|

585,411

|

|

(Net Losses) / Net income attributable to controlling shareholders

|

(659,394)

|

226,466

|

|

Loss for the period attributable to non-controlling interests

|

19,438

|

29,718

|

|

Charges on borrowings and financing

|

616,247

|

561,341

|

|

Depreciation, depletion and amortization

|

366,400

|

355,400

|

|

Share of profits (losses) of investees

|

(39,393)

|

(38,002)

|

|

Deferred income tax and social contribution

|

72,069

|

37,309

|

|

Foreign exchange and monetary variations, net

|

431,813

|

(414,301)

|

|

Write off fixed assets and intangible

|

(17,016)

|

4,484

|

|

Environmental liabilities and Deactvation Provisions

|

(38,076)

|

(9,136)

|

|

Fiscal, Social Security, Labor, Civil and Environmental Provisions

|

31,635

|

(46,068)

|

|

Working Capital

|

(606,281)

|

502,326

|

|

Accounts Receivable

|

(469,861)

|

163,272

|

|

Trade Receivables – Related Parties

|

39,655

|

(7,165)

|

|

Inventory

|

(136,027)

|

184,935

|

|

Interest receive - Related Parties

|

(4,536)

|

(6,748)

|

|

Judicial Deposits

|

(8,137)

|

(9,323)

|

|

Suppliers

|

104,457

|

183,578

|

|

Taxes and Contributions

|

(61,144)

|

41,197

|

|

Others

|

(70,688)

|

(47,420)

|

|

Others Payments and Receipts

|

(564,165)

|

(624,126)

|

|

Interest Expenses

|

(564,165)

|

(624,126)

|

|

Cash Flow from Investment Activities

|

(234,503)

|

(297,953)

|

|

Fixed Assets/Intangible

|

(239,127)

|

(288,498)

|

|

Derivative transactions

|

4,457

|

10,717

|

|

Loans / Receive loans - related parties

|

2,644

|

|

|

Short-term investment, net of redeemed amount

|

(2,477)

|

(20,172)

|

|

Cash Flow from Financing Companies

|

(92,624)

|

(500,336)

|

|

Borrowings and financing raised, net of transaction costs

|

|

171,000

|

|

Borrowing amortizations - principal

|

(92,624)

|

(671,336)

|

|

Foreign Exchange Variation on Cash and Cash Equivalents

|

(10,607)

|

2,971

|

|

Free Cash Flow

|

(724,457)

|

(209,907)

|

|

|

|

|

|

|

|

|

SALES VOLUME CONSOLIDATED (thousand tonnes)

|

|

|

|

|

|

3Q16

|

2Q17

|

3Q17

|

Change

|

|

|

3Q17

x 2Q17

|

3Q17

x 3Q16

|

|

Flat Steel

|

682

|

592

|

730

|

138

|

48

|

|

Slabs

|

-

|

-

|

1

|

1

|

1

|

|

Hot Rolled

|

233

|

216

|

267

|

52

|

34

|

|

Cold Rolled

|

129

|

117

|

155

|

38

|

27

|

|

Galvanized

|

218

|

191

|

234

|

43

|

15

|

|

Tin Plates

|

102

|

68

|

73

|

4

|

(29)

|

|

Long Steel UPV

|

49

|

60

|

72

|

12

|

24

|

|

DOMESTIC MARKET

|

730

|

652

|

802

|

150

|

72

|

|

|

|

|

3Q16

|

2Q17

|

3Q17

|

3Q17

x 2Q17

|

3Q17

x 3Q16

|

|

Flat Steel

|

282

|

316

|

321

|

5

|

39

|

|

Hot Rolled

|

16

|

14

|

16

|

1

|

(0)

|

|

Cold Rolled

|

19

|

24

|

22

|

(2)

|

3

|

|

Galvanized

|

212

|

232

|

233

|

1

|

20

|

|

Tin Plates

|

35

|

46

|

51

|

5

|

16

|

|

Long Steel (profiles)

|

159

|

205

|

177

|

(27)

|

18

|

|

FOREIGN MARKET

|

441

|

521

|

499

|

(23)

|

58

|

|

|

|

|

3Q16

|

2Q17

|

3Q17

|

3Q17

x 2Q17

|

3Q17

x 3Q16

|

|

Flat Steel

|

964

|

909

|

1.051

|

142

|

87

|

|

Slabs

|

-

|

-

|

1

|

1

|

1

|

|

Hot Rolled

|

249

|

230

|

283

|

53

|

34

|

|

Cold Rolled

|

148

|

141

|

177

|

36

|

29

|

|

Galvanized

|

431

|

423

|

466

|

43

|

35

|

|

Tin Plates

|

136

|

115

|

124

|

9

|

(12)

|

|

Long Steel UPV

|

49

|

60

|

72

|

12

|

23

|

|

Long Steel (profiles)

|

159

|

205

|

177

|

(28)

|

18

|

|

TOTAL MARKET

|

1.172

|

1.174

|

1.301

|

127

|

129

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: December 22, 2017

|

COMPANHIA SIDERÚRGICA NACIONAL

|

|

|

|

By:

|

/

S

/ Benjamin Steinbruch

|

|

|

Benjamin Steinbruch

Chief Executive Officer

|

|

|

|

|

|

By:

|

/

S

/ David Moise Salama

|

|

|

David Moise Salama

Executive Officer

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

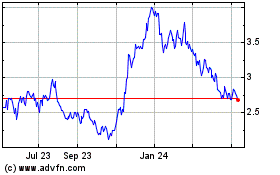

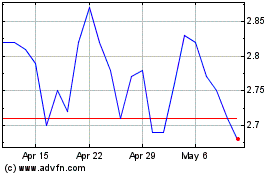

Companhia Siderurgica Na... (NYSE:SID)

Historical Stock Chart

From Mar 2024 to Apr 2024

Companhia Siderurgica Na... (NYSE:SID)

Historical Stock Chart

From Apr 2023 to Apr 2024