SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of December, 2017

Commission File Number 1-14732

COMPANHIA SIDERÚRGICA NACIONAL

(Exact name of registrant as specified in its charter)

National Steel Company

(Translation of Registrant's name into English)

Av. Brigadeiro Faria Lima 3400, 20º andar

São Paulo, SP, Brazil

04538-132

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports

under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

COMPANHIA SIDERÚR

GICA NACIONAL

Publicly-held Company

Corporate Taxpayer's ID (CNPJ/MF): 33.042.730/0001-04

State Registry (NIRE): 35300396090

MINUTES OF THE EXTRAORDINARY SHAREHOLDERS’ MEETING OF COMPANHIA SIDERÚRGICA NACIONAL HELD ON DECEMBER 11, 2017, DRAWN UP IN SUMMARY FORM

1. Date, Time and Venue:

December 11, 2017 at 11:00 a.m., at the Company’s headquarters located at Av. Brigadeiro Faria Lima nº 3400, 20

th

floor, in the City and State of São Paulo.

2.

Call Notice:

Call notices were published on November 10, 11 and 14, 2017, in the newspaper

Diário Oficial do Estado de São Paulo

, on pages 20, 9 and 11, respectively, and in the newspaper

Folha de São Paulo de São Paulo

– Regional Edition, on pages A22, A28 and A20, respectively, which will be filed at the Company’s headquarters.

3. Attendance:

The meeting was opened with the presence of shareholders representing 63.06% of the Company’s voting capital, as evidenced by the Shareholders Attendance Book, as well as by the representative from Deloitte Touche Tohmatsu Auditores Independentes, Mr. Gilberto Grandolpho, and the Company’s Executive directors Messrs.

David Moise Salama and Marcelo Cunha Ribeiro.

4. Presiding Board:

Appointed by the Chairman of the Company’s Board of Directors, Mr. David Moise Salama chaired the Meeting and invited Mrs. Sra. Claudia Maria Sarti to act as secretary.

5.

Agenda:

(i) reapprove the Financial Statements for the fiscal year ended December 31, 2015, which were restated by Management; and (ii) acknowledge, examine, discuss and vote on the Company’s Financial Statements for the fiscal year ended December 31, 2016.

6. Resolutions:

The following resolutions were taken, with the voting instructions being filed at the Company’s headquarters:

6.1.

To approve, by unanimous votes, the drawing up of these minutes in summary form and its publication to be made without the signatures of the attending shareholders, as provided respectively by paragraphs 1 and 2 of article 130 of Law 6,404/76 (“Brazilian Corporations Law”).

6.2.

To approve, by unanimous votes, the waiver of the reading of the Financial Statements for the fiscal year ended December 31, 2015 and December 31, 2016, the Management Report and the Independent Auditors’ Report, published on November 23, 2017 in the newspaper

Folha de São Paulo de São Paulo

– Regional Edition (pages 05 to 25) and in

the newspaper

Diário Oficial do Estado de São Paulo

(pages 01 to 09), considering that such information is of full acknowledgement by all the attending shareholders.

6.3.

To reapprove, by majority of the attending shareholders, with 803,363,775 votes in favor and 52,440,357 votes against, with the declarations of vote initialed by the presiding board and duly registered, the Management Accounts and the Financial Statements for the fiscal year ended December 31, 2015, which were voluntarily restated by the Company’s Management, and the Management Report (“Restated Financial Statements”).

6.4.

To approve, by majority of the attending shareholders, with 803,363,775 votes in favor and 52,440,357 votes against, with the declarations of vote initialed by the presiding board and duly registered,

the Management Accounts, Financial Statements and the Management Report for the fiscal year December 31, 2016.

6.5.

It is hereby recorded that the contrary votes to the approval of the matters on the agenda were not accompanied by any technical justification.

6.6.

Considering that a loss was reported for the fiscal year ended December 31, 2015, in the amount of one billion, two hundred and fourteen million, one hundred and twenty thousand and seven hundred and fifty-seven reais and ten centavos (R$1,214,120,757.10), it shall be fully absorbed in the profit reserve, up to the available limit, pursuant to the sole paragraph of article 189 of the Brazilian Corporations Law and the remaining balance shall be allocated to the Accrued Loss Account. It is hereby recorded that, although the General Shareholders’ Meeting for 2016, held on April 28, 2016, provided that the interim dividends declared by the Company in March 2015, in the amount of R$275,000,000.00 would be attributed to the minimum mandatory dividend for the fiscal year ending in 2015, since the Restated Financial Statements did not report a net income for such period, said dividends were distributed to the profit reserve account (statutory reserve of working capital) that existed at the time of distribution.

6.7.

Considering that a net loss was reported for the fiscal year ended December 31, 2016, in the amount of nine hundred and thirty-four million, seven hundred and forty-six thousand, six hundred and twenty-four reais and twenty-eight centavos (R$934,746,624.28), such loss shall be allocated to the Accrued Loss Account.

7. Closure:

There being no further business to discuss, the meeting was adjourned for the time necessary to draw up these Minutes. The meeting was resumed and these minutes were read, found in compliance and signed by the Chairman, the Secretary and all attending shareholders.

8. Documents Filed

: The documents filed at the Company’s headquarters are: Call Notices for the Extraordinary Shareholders’ Meeting, Management Proposal, Financial Statements, Management Report, Independent Auditors’ Report and the voting instructions that were presented.

9. Signatures:

DAVID MOISE SALAMA – CHAIRMAN; CLAUDIA MARIA SARTI – SECRETARY; GILBERTO GRANDOLPHO – DELOITTE TOUCHE TOHMATSU AUDITORES INDEPENDENTES; MARCELO CUNHA RIBEIRO – CFO; Shareholders: VICUNHA TÊXTIL S.A.; VICUNHA AÇOS S.A.; RIO IACO PARTICIPAÇÕES S.A.; CFL PARTICIPAÇÕES S.A.; CAIXA BENEFICIENTE DOS EMPREGADOS DA CSN –

CBS; CLUBE DE INVESTIMENTO FIBRA; CSN INVEST FUNDO DE INVESTIMENTO EM AÇÕES; CLUBE DE INVESTIMENTO GUIDARA; CLUBE DE INVESTIMENTO KOKUREN; GERAÇÃO FUTURO L.PAR FUNDO DE INVESTIMENTO EM AÇÕES; AMERICAN HEART ASSOCIATION, INC.; ADVANCED SERIES TRUST - AST PARAMETRIC EME PORTFOLIO; ARIZONA PSPRS TRUST; AT&T UNION WELFARE BENEFIT TRUST; BLACKROCK CDN MSCI EMERGING MARKETS INDEX FUND; BLACKROCK INSTITUTIONAL TRUST COMPANY NA; BOARD OF PENSIONS OF THE EVANGELICAL LUTHERAN CHURCH IN AMER; BMO MSCI EMERGING MARKETS INDEX ETF; CAISSE DE DEPOT ET PLACEMENT DU QUEBEC; CALIFORNIA PUBLIC EMPLOYEES RETIREMENT SYSTEM; CASEY FAMILY PROGRAM; CF DV EMERGING MARKETS STOCK INDEX FUND; CHEVRON MASTER PENSION TRUST; COLLEGE RETIREMENT EQUITIES FUND; COMMONWEALTH OF PENNSYLV.PUB.SCHOOL EMP RET S; COMMONWEALTH SUPERANNUATION CORPORATION; DEUTSCHE X-TRACKERS MSCI ALL WORLD EX US HEDGED EQUITY ETF; DIVERSIFIED MARKETS (2010) POOLED FUND TRUST; EATON VANCE COLLECTIVE INVESTMENT TFE BEN PLANS EM MQ EQU FD; EMERGING MARKETS EQUITY INDEX MASTER FUND; EMERGING MARKETS EQUITY INDEX PLUS FUND; EMERGING MARKETS EX-CONTROVERSIAL WEAPONS EQUITY INDEX FD B; EMERGING MARKETS INDEX NON-LENDABLE FUND; EMERGING MARKETS INDEX NON-LENDABLE FUND B; EMERGING MARKETS SUDAN FREE EQUITY INDEX FUND; EVTC CIT FOF EBP-EVTC PARAMETRIC SEM CORE EQUITY FUND TR; FSS EMERGING MARKET EQUITY TRUST; FIDELITY SALEM STREET T: FIDELITY E M INDEX FUND; FIDELITY SALEM STREET T; FIDELITY TOTAL INTE INDEX FUND; FIDELITY SALEM STREET T: FIDELITY G EX U.S INDEX FUND; FIDELITY SALEM STREET TRUST: FIDELITY SAI EMERGING M I FUND; FIDELITY SALEM STREET TRUST: FIDELITY SERIES G EX US I FD; FIRST TRUST BRAZIL ALPHADEX FUND; FIRST TRUST LATIN AMERICA ALPHADEX FUND; FUTURE FUND BOARD OF GUARDIANS; GE INVESTMENTS FUNDS, INC; GOLDMAN SACHS TRUST II- GOLDMAN SACHS MULTI-MANAGER G E FUND; GOVERNMENT EMPLOYEES SUPERANNUATION BOARD; HIGHLAND COLLECTIVE INVESTMENT TRUST; IBM 401 (K) PLUS PLAN; ISHARES III PUBLIC LIMITED COMPANY; ISHARES MSCI ACWI EX U.S. ETF; ISHARES MSCI BRAZIL CAPPED ETF; ISHARES MSCI BRIC ETF; ISHARES MSCI EMERGING MARKETS ETF; JAPAN TRUSTEE SERVICES BK, LTD. RE: RTB NIKKO BEA MOTHER FD; JAPAN TRUSTEE SERVICES BANK, LTD. RE: STB DAIWA E E F I M F; JOHN HANCOCK FUNDS II INTERNATIONAL STRATEGIC EQUITY ALLOCAT; JOHN HANCOCK FUNDS II STRATEGIC EQUITY ALLOCATION FUND; JOHN HANCOCK VARIABLE INS TRUST INTERN EQUITY INDEX TRUST B; LEGAL & GENERAL COLLECTIVE INVESTMENT TRUST; LEGAL AND GENERAL ASSURANCE PENSIONS MNG LTD; LEGAL & GENERAL GLOBAL EMERGING MARKETS INDEX FUND; LEGAL & GENERAL GLOBAL EQUITY INDEX FUND; LEGAL & GENERAL INTERNATIONAL INDEX TRUST; MANAGED PENSION FUNDS LIMITED; MERCER QIF FUND PLC; MUNICIPAL E ANNUITY A B FUND OF CHICAGO; NATIONAL COUNCIL FOR SOCIAL SECURITY FUND; NEW YORK STATE TEACHERS RETIREMENT SYSTEM; NEW ZEALAND SUPERANNUATION FUND; NORTHERN EMERGING MARKETS EQUITY INDEX FUND; NORTHERN TRUST INVESTIMENT FUNDS PLC; NORTHERN TRUST COLLECTIVE ALL COUNTRY WORLD I (ACWI) E-U F-L; NORTHERN TRUST COLLECTIVE EMERGING MARKETS INDEX FUND-LEND; NORTHERN TRUST UCITS FGR FUND; NTGI QM COMMON DAILY ALL COUNT WORLD EXUS EQU INDEX FD LEND; NTGI-QM COMMON DAC WORLD EX-US INVESTABLE MIF – LENDING; NTGI-QM COMMON DAILY EMERGING MARKETS EIF – LENDING; NTGI-QM COMMON DAILY EMERGING MARKETS EQUITY I F- NON L; OLD WESTBURY LARGE CAP STRATEGIES FUND; OPPENHEIMER EMERGING MARKETS REVENUE ETF; PANAGORA RISK PARITY MULTI ASSET MASTER FUND, LTD; PARAMETRIC EMERGING MARKETS FUND; PARAMETRIC TAX-MANAGED EMERGING MARKETS FUND; PICTET - EMERGING MARKETS INDEX; POWERSHARES FTSE RAFI EMERGING MARKETS PORTFOLIO; PUBLIC SECTOR PENSION INVESTMENT BOARD; RETAIL EMPLOYEES S PTY. LIMITED; SCHWAB EMERGING MARKETS EQUITY ETF; SCHWAB FUNDAMENTAL EMERG0ING MARKETS LARGE COMPANY INDEX ETF; SCHWAB FUNDAMENTAL EMERGING MARKETS LARGE COMPANY INDEX FUND; SCOTTISH WIDOWS INVESTMENT SOLUTIONS FUNDS ICVC- FUNDAMENTAL; SPARTAN GROUP TRUST FOR EMPLYEE BENEFIT PLANS; SPDR MSCI EMERGING MARKETS STRATEGICFACTORS ETF; SPDR S&P EMERGING MARKETS FUND; SSGA SPDR ETFS EUROPE I PLC; SSGA MSCI BRAZIL INDEX NON-LENDING QP COMMON TRUST FUND; STATE OF MINNESOTA STATE EMPLOYEES RET PLAN; STATE OF NEW JERSEY COMMON PENSION FUND D; STATE STREET EMERGING MARKETS EQUITY INDEX FUND; STATE STREET GLOBAL ADVISORS LUX SICAV - S S G E

M I E FUND; STATE ST B AND T C INV F F T E RETIR PLANS; STATE STREET GLOBAL EQUITY EX-US INDEX PORTFOLIO; STATE STREET IRELAND UNIT TRUST; STATE STREET MSCI ACWI EX USA IMI SCREENED NON-LENDING COMMON TRUST FUND; ST STR RUSSELL FUND GL EX-U.S. INDEX NON-LEND COMMON TR FD; STICHTING PENSIOENFONDS VAN DE ABN AMRO BK NV; TEACHER RETIREMENT SYSTEM OF TEXAS; TEACHERS RETIREMENT SYSTEM OF THE STATE OF ILLINOIS; THE BANK OF NEW YORK MELLON EMP BEN COLLECTIVE INVEST FD PLA; THE BOARD OF.A.C.E.R.S.LOS ANGELES, CALIFORNIA; THE HARTFORD GLOBAL REAL ASSET FUND; THE NOMURA T AND B CO LTD RE I E S INDEX MSCI E NO HED M FUN; THE PENSION RESERVES INVESTMENT MANAG.BOARD; THE REGENTS OF THE UNIVERSITY OF CALIFORNIA; THE SEVENTH SWEDISH NATIONAL PENSION FUND - AP7 EQUITY FUND; THE STATE TEACHERS RETIREMENT SYSTEM OF OHIO; TIAA-CREF FUNDS - TIAA-CREF EMERGING MARKETS EQUITY I F; TIFF MULTI-ASSET FUND; TRUST & CUSTODY SERVICES BANK, LTD. RE: EMERGING E P M F; THE TIFF KEYSTONE FUND, L.P.; UTAH STATE RETIREMENT SYSTEMS; VANGUARD EMERGING MARKETS STOCK INDEX FUND; VANG FTSE ALL-WORLD EX-US INDEX FD, A S OF V INTER E I FDS; VANGUARD FUNDS PUBLIC LIMITED COMPANY; VANGUARD INVESTMENT SERIES PLC; VANGUARD INVESTMENTS FUNDS ICVC-VANGUARD FTSE GLOBAL ALL CAP INDEX FUND; VANGUARD TOTAL WSI FD, A SOV INTERNATIONAL EQUITY INDEX FDS; VOYA EMERGING MARKETS INDEX PORTFOLIO; WASHINGTON STATE INVESTMENT BOARD;WISDOMTREE EMERGING MARKETS EX-STATE-OWNED ENTERPRISES FUND; AQR FUNDS - AQR EMERGING MOMENTUM STYLE FUND; BUREAU OF LABOR FUNDS - LABOR PENSION FUND; CONSTRUCTION & BUILDING UNIONS SUPER FUND; FIDELITY INVESTMENT FUNDS FIDELITY INDEX EMERG MARKETS FUND; JPMORGAN FUNDS (IRELAND) ICAV; JNL/MELLON CAPITAL EMERGING MARKETS INDEX FUND; PUBLIC EMPLOYEES RETIREMENT SYSTEM OF OHIO; RETIREMENT INCOME PLAN OF SAUDI ARABIAN OIL COMPANY; STICHTING DEPOSITARY APG EMERGING MARKETS EQUITY POOL; STICHING PENSIOENFONDS VOOR HUISARTSEN; THE MASTER TRUST BANK OF JAP, LTD. AS TR. FOR MTBJ400045828; THE MASTER TRUST BANK OF JAP LTD. AS TR. FOR MTBJ400045829; THE MASTER TRUST BANK OF JAPAN, LTD. AS T. FOR MTBJ400045833; THE MASTER TRUST BANK OF JAPAN, LTD. AS T. FOR MTBJ400045835; THE MASTER TRUST BANK OF JAPAN, LTD. AS TR FOR MUTB400045792; THE MASTER TRUST BANK OF JAPAN, LTD. AS TRUSTEE FOR MUTB400045795; THE MASTER TRUST BANK OF JAPAN, LTD. AS T. FOR MUTB400045796; VANTAGETRUST III MASTER COLLECTIVE INVESTMENT FUNDS TRUST; VANGUARD TOTAL INTERNATIONAL STOCK INDEX FD, A SE VAN S F; AND NATIONAL GRID UK PENSION SCHEME TRUSTEE LIMITED.

This is a free English translation of the original minutes drawn up in the Company’s records.

São Paulo, December 11, 2017.

_______________________________

Claudia Maria Sarti

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: December 14, 2017

|

COMPANHIA SIDERÚRGICA NACIONAL

|

|

|

|

By:

|

/

S

/ Benjamin Steinbruch

|

|

|

Benjamin Steinbruch

Chief Executive Officer

|

|

|

|

|

|

By:

|

/

S

/ David Moise Salama

|

|

|

David Moise Salama

Executive Officer

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

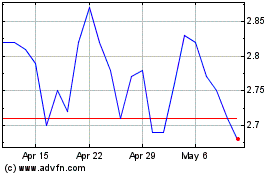

Companhia Siderurgica Na... (NYSE:SID)

Historical Stock Chart

From Mar 2024 to Apr 2024

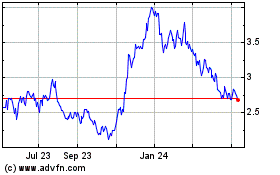

Companhia Siderurgica Na... (NYSE:SID)

Historical Stock Chart

From Apr 2023 to Apr 2024