UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form

6-K

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE

13a-16

OR

15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 2017

Commission File Number

001-34667

Seadrill Limited

(Exact

name of Registrant as specified in its Charter)

Par-la-Ville

Place, 4th Floor

14

Par-la-Ville

Road

Hamilton HM 08 Bermuda

(Address of principal executive office)

Indicate by

check mark whether the registrant files or will file annual reports under cover of Form

20-F

or

Form 40-F. Form 20-F ☒ Form

40-F ☐

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by

Regulation

S-T

Rule 101 (b)(1). Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by

Regulation

S-T

Rule 101 (b)(7). Yes ☐ No ☒

Entry into Restructuring Support and

Lock-Up

Agreement and

Commencement of Chapter 11 Cases

On September 12, 2017, Seadrill Limited (“Seadrill” or the “Company”)

entered into a restructuring support and

lock-up

agreement (the “RSA”) with a group of bank lenders, bondholders, certain other stakeholders, and

new-money

providers. Seadrill’s consolidated subsidiaries North Atlantic Drilling Ltd. (“NADL”) and Sevan Drilling Limited (“Sevan”), together with certain other of Seadrill’s consolidated subsidiaries (collectively with

Seadrill, the “Company Parties”) entered into the RSA together with Seadrill. The parties to the RSA represent more than 97% of the loans under the Seadrill group’s 12 credit facilities and approximately 40% of the Seadrill and NADL

bonds. Ship Finance International Limited and three of its subsidiaries (“SFL”), which charter three drilling units to the Company Parties, also executed the RSA. In connection with the RSA, the Company Parties entered into an investment

agreement (the “Investment Agreement”) under which Hemen Investments Limited, an affiliate of Seadrill’s largest shareholder Hemen Holding Ltd. and a consortium of investors, including the bondholder parties to the RSA, committed to

provide $1.06 billion in new cash commitments.

On September 12, 2017, to implement the transactions contemplated by the RSA and

Investment Agreement, the Company Parties’ commenced prearranged reorganization proceedings under chapter 11 of title 11 of the United States Code in the Southern District of Texas. At the point of filing, Seadrill has over $1 billion in cash

and does not require debtor-in-possession financing. As part of the chapter 11 cases, the Company Parties have filed “first day” motions that, when granted, will enable the Company Parties’

day-to-day

operations to continue as usual. Specifically, the Company Parties requested authority to pay trade creditors and employee wages and benefits without change or interruption. Additionally, the

Company Parties will pay all suppliers and vendors in full under normal terms for goods and services provided during the chapter 11 cases.

Overview of

RSA and Investment Agreement

The RSA contemplates that each of the Company Parties’ credit facilities will be amended to provide,

among other things:

|

|

•

|

|

approximately 4 to 5.5 year maturity extensions;

|

|

|

•

|

|

significant amortization relief with no amortization payments until 2020;

|

|

|

•

|

|

no maintenance covenants except minimum liquidity until Q1 2021; and

|

|

|

•

|

|

cross-collateralization of the existing credit facilities.

|

The RSA and Investment Agreement contemplate the formation of an intermediate holding company to issue the new secured notes.

Rig-owning

entities and certain other assets will be contributed to a subsidiary of that intermediate holding company, which will guarantee and facilitate cross-collateralization of the amended credit facilities.

The RSA provides for amendments to SFL’s charter agreements with the Company Parties on terms generally consistent with the credit facility amendments.

The Investment Agreement provides for the issuance of $860 million of new senior secured notes and $200 million of new Seadrill

equity. The new secured notes will mature on the seventh anniversary of the closing and bear interest at a fixed rate of 12% annually consisting of 4% annually payable in cash and 8% annually payable in kind. The new secured notes will be secured

by, among other things, first ranking security interests in unencumbered assets and $227.5 million in a cash escrow account, subject to reduction under certain circumstances, plus second ranking security over other assets.

The RSA and Investment Agreement both require the restructuring to close within 11 months, and both are subject to customary closing

conditions and termination events. The Investment Agreement obligated Seadrill to pay cash commitment fees equal to 5% of the total debt and equity commitment at signing. The Investment Agreement also provides for an additional cash fee equal to 1%

of the new senior secured notes, a primary structuring fee consisting of 5% of the new Seadrill equity (post-dilution), and an additional structuring fee consisting of 0.5% of the new Seadrill equity

(pre-dilution),

payable to certain parties to the Investment Agreement at closing.

Terms of the Plan of

Reorganization

The chapter 11 plan of reorganization contemplated by the RSA provides the following distributions, assuming general

unsecured creditors accept the plan:

|

|

•

|

|

purchasers of the new secured notes will receive 57.5% of the new Seadrill equity, subject to dilution by the

primary structuring fee and an employee incentive plan;

|

|

|

•

|

|

purchasers of the new Seadrill equity will receive 25% of the new Seadrill equity, subject to dilution by the

primary structuring fee and an employee incentive plan;

|

|

|

•

|

|

general unsecured creditors of Seadrill, NADL, and Sevan, which includes Seadrill and NADL bondholders, will

receive their pro rata share of 15% of the new Seadrill common stock, subject to dilution by the primary structuring fee and an employee incentive plan, plus certain eligible unsecured creditors will receive the right to participate pro rata in

$85 million of the new secured notes and $25 million of the new equity, provided that general unsecured creditors vote to accept the plan; and

|

|

|

•

|

|

holders of Seadrill common stock will receive 2% of the new Seadrill equity, subject to dilution by the

primary structuring fee and an employee incentive plan, provided that general unsecured creditors vote to accept the plan.

|

Existing claims against and interests in Seadrill, including the economic interests in the existing Seadrill common shares, will be

extinguished under the plan. If Seadrill general unsecured creditors do not accept the plan, they will receive the minimum consideration required under chapter 11, and holders of existing Seadrill common shares will receive no recovery. The RSA

contemplates certain releases and exculpations and implementation of a customary equity-based employee incentive plan at closing. The transactions contemplated by the RSA are subject to court approval and other terms and conditions.

Seadrill’s

non-consolidated

affiliates, including Seadrill Partners LLC, SeaMex Ltd., Archer

Limited, and their respective subsidiaries, did not commence proceedings under chapter 11 and are not parties to the RSA or Investment Agreement. We expect their business operations to continue uninterrupted.

The foregoing description of the RSA, Investment Agreement and terms of the plan of reorganization does not purport to be complete and is

qualified in its entirety by reference to the RSA and the Investment Agreement, which are filed as Exhibit 10.2 and Exhibit 10.3, respectively, to this Form

6-K

and are incorporated herein by reference.

Other Information Regarding Reorganization Proceedings

The Company has engaged Kirkland & Ellis LLP as legal counsel, Houlihan Lokey, Inc. as financial advisor, and Alvarez & Marsal as

restructuring advisor. Slaughter and May has been engaged as corporate counsel, and Morgan Stanley served as co-financial advisor during the negotiation of the restructuring agreement. Advokatfirmaet Thommessen AS is serving as Norwegian counsel.

Conyers Dill & Pearman is serving as Bermuda counsel.

Together with the chapter 11 proceedings, Seadrill, NADL and Sevan are

commencing liquidation proceedings in Bermuda to appoint joint provisional liquidators and facilitate recognition and implementation of the transactions contemplated by the RSA and Investment Agreement, and Simon Edel, Alan Bloom and Roy Bailey of

Ernst & Young are to act as the joint and several provisional liquidators.

Court filings and other information related to the

restructuring proceedings are available at a website administered by the Company’s claims agent, Prime Clerk, at https://cases.primeclerk.com/seadrill or via the information call center at

844-858-8891

(US toll free) or the following international numbers:

Brazil Toll Free:

0-800-591-8054

Mexico

Toll Free:

01-800-681-5354

Nigeria Toll Free:

070-80601847

Norway Toll Free:

800-25-030

Saudi Arabia Toll Free:

800-850-0029

Singapore Toll Free:

800-492-2272

Thailand Toll Free:

1-800-011-156

UAE

Toll Free: 8000-3570-4559

UK Toll Free:

0-800-069-8580

The Company has also posted FAQs on its website at www.seadrill.com/restructuring.

EXHIBITS

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

|

|

|

10.1

|

|

Presentation related to the Company’s restructuring, dated September 12, 2017, to certain of its bondholders.

|

|

|

|

|

10.2

|

|

Restructuring Support and

Lock-up

Agreement, dated September 12, 2017, among the Company, certain of its wholly and partially owned subsidiaries, certain senior secured

lenders, certain bondholders, and certain new money providers, and the exhibits thereto.

|

|

|

|

|

10.3

|

|

Investment Agreement, dated September 12, 2017, among the Company, certain of its wholly and partially owned subsidiaries, and certain new money providers, and the exhibits thereto.

|

|

|

|

|

99.1

|

|

Press release dated September 12, 2017.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed

on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

SEADRILL LIMITED

|

|

|

|

|

|

|

Date: September 13, 2017

|

|

|

|

By:

|

|

/s/ Mark Morris

|

|

|

|

|

|

Name:

|

|

Mark Morris

|

|

|

|

|

|

Title:

|

|

Chief Financial Officer

|

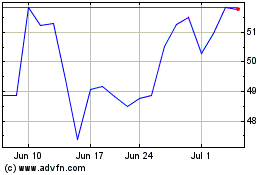

Seadrill (NYSE:SDRL)

Historical Stock Chart

From Mar 2024 to Apr 2024

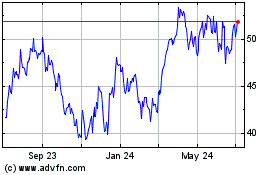

Seadrill (NYSE:SDRL)

Historical Stock Chart

From Apr 2023 to Apr 2024