UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For

the month of September 2017

Commission

File Number: 001-36298

GeoPark

Limited

(Exact

name of registrant as specified in its charter)

Nuestra

Señora de los Ángeles 179

Las

Condes, Santiago, Chile

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

GEOPARK

LIMITED

TABLE

OF CONTENTS

|

ITEM

|

|

|

1.

|

Press Release dated September 6, 2017 titled

“GeoPark Annouces Proposed Offering of Senior Secured Notes”

|

|

2.

|

Press Release dated September 6, 2017 titled

“GeoPark Latin America Limited Agencia en Chile Announces Commencement of Tender Offer for any and all of its 7.50%

Senior Secured Notes Due 2020”

|

Item

1

FOR IMMEDIATE DISTRIBUTION

GEOPARK ANNOUNCES PROPOSED

OFFERING OF SENIOR SECURED NOTES

Santiago, Chile – September 6, 2017

– GeoPark Limited (“GeoPark” or the “Company”) (NYSE: “GPRK”), an exempted company incorporated

under the laws of Bermuda, today announced that it intends to offer senior secured notes (the “Notes”) in a private

placement to qualified institutional buyers in accordance with Rule 144A under the Securities Act of 1933, as amended (the “Securities

Act”), and outside the United States to non-U.S. persons in accordance with Regulation S under the Securities Act. The Notes

are expected to be secured by the pledge of the Company’s equity interests in certain of its subsidiaries.

The timing of pricing and terms of the Notes

are subject to market conditions and other factors. The net proceeds from the Notes offering will be used by the Company (i) to

make a capital contribution to its wholly-owned subsidiary, GeoPark Latin America Limited Agencia en Chile (“GeoPark LA Agencia”),

providing it with sufficient funds to (a) purchase for cash any and all of the 7.50% senior secured notes due 2020 (the “2020

Notes”) in GeoPark LA Agencia’s concurrently announced tender offer (the “Tender Offer”), (b) pay any related

fees and expenses, including any applicable tender premiums and accrued interest on the 2020 Notes, and (c) redeem and satisfy

and discharge the 2020 Notes, if any, that remain outstanding after the completion of the Tender Offer and (ii) to use the remainder

for general corporate purposes, including capital expenditures.

This press release does not constitute an

offer to sell or a solicitation of an offer to buy these securities, nor will there be any sale of these securities, in any state

or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities

laws of any state or jurisdiction. The Notes have not been registered under the Securities Act, or any applicable state securities

laws, and will be offered only to qualified institutional buyers pursuant to Rule 144A promulgated under the Securities Act and

outside the United States to non-U.S. persons in accordance with Regulation S under the Securities Act. Unless so registered, the

Notes may not be offered or sold in the United States except pursuant to an exemption from the registration requirements of the

Securities Act and any applicable state securities laws. This press release is not an offer to purchase or a solicitation of an

offer to purchase with respect to any 2020 Notes or any other securities, and does not constitute a notice of redemption of the

2020 Notes.

|

For further information,

please contact:

INVESTORS:

|

|

|

Stacy Steimel – Shareholder Value Director

|

ssteimel@geo-park.com

|

|

Santiago, Chile

|

|

|

T: +56 (2) 2242-9600

|

|

|

|

|

|

Dolores Santamarina – Investor Manager

Buenos Aires, Argentina

T: +54 (11) 4312-9400

|

dsantamarina@geo-park.com

|

|

Jared Levy – Sard Verbinnen & Co

|

jlevy@sardverb.com

|

|

New York, USA

|

|

|

T: +1 (212) 687-8080

|

|

|

|

|

|

Kelsey Markovich – Sard Verbinnen & Co

New York, USA

T: +1 (212) 687-8080

|

kmarkovich@sardverb.com

|

*****

ABOUT GEOPARK

AND GEOPARK LA AGENCIA

GeoPark is a leading independent oil and

natural gas exploration and production company with operations in Latin America and a proven track record of growth in production

and reserves since 2006. GeoPark operates in Colombia, Chile, Brazil, Peru and Argentina.

GeoPark LA Agencia is an established branch,

under the laws of Chile, of GeoPark Latin America Limited, an exempted company incorporated under the laws of Bermuda, which is

wholly owned by GeoPark Limited, an exempted company incorporated under the laws of Bermuda.

CAUTIONARY

STATEMENT ON FORWARD-LOOKING STATEMENTS

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements often are preceded

by words such as “believes,” “expects,” “may,” “anticipates,” “plans,”

“intends,” “assumes,” “will” or similar expressions. The forward-looking statements contained

herein include statements about the Company’s Notes offering and its intended use of proceeds therefrom. These expectations

may or may not be realized. Some of these expectations may be based upon assumptions or judgments that prove to be incorrect. In

addition, GeoPark’s business and operations involve numerous risks and uncertainties, many of which are beyond the control

of GeoPark, which could result in GeoPark’s expectations not being realized or otherwise materially affect the financial

condition, results of operations and cash flows of GeoPark. Some of the factors that could cause future results to materially differ

from recent results or those projected in forward-looking statements are described in GeoPark’s filings with the United States

Securities and Exchange Commission.

The forward-looking statements are made

only as of the date hereof, and GeoPark does not undertake any obligation to (and expressly disclaims any obligation to) update

any forward-looking statements to reflect events or circumstances after the date such statements were made, or to reflect the occurrence

of unanticipated events. In light of the risks and uncertainties described above, and the potential for variation of actual results

from the assumptions on which certain of such forward-looking statements are based, investors should keep in mind that the results,

events or developments disclosed in any forward-looking statement made in this document may not occur, and that actual results

may vary materially from those described herein, including those described as anticipated, expected, targeted, projected or otherwise.

Item

2

FOR IMMEDIATE DISTRIBUTION

GEOPARK LATIN AMERICA LIMITED AGENCIA

EN CHILE ANNOUNCES COMMENCEMENT OF TENDER OFFER FOR ANY AND ALL OF ITS 7.50% SENIOR SECURED NOTES DUE 2020

Santiago, Chile, September 6, 2017 –

GeoPark Latin America Limited Agencia en Chile (the “Company”) an established branch, under the laws of Chile, of GeoPark

Latin America Limited, an exempted company incorporated under the laws of Bermuda and wholly owned by GeoPark Limited, an exempted

company incorporated under the laws of Bermuda (“GeoPark”) (NYSE: “GPRK”), today announced that it has

commenced a cash tender offer (the “Offer”) to purchase any and all of its outstanding 7.50% Senior Secured Notes due

2020 (the “Notes”). The complete terms and conditions of the Offer are set forth in the offer to purchase dated September

6, 2017 (the “Offer to Purchase”). Capitalized terms used but not defined herein have the meanings set forth in the

Offer to Purchase. Certain information related to the Notes and the Offer is listed in the table below.

|

Security

Description

|

ISIN

Number

|

CUSIP

Number

|

Principal

Amount Outstanding

|

Tender

Consideration

(1)

|

Early

Tender Payment

|

Total

Consideration

(2)

|

|

7.50% Senior Secured Notes due 2020

|

USP4833JAA45 (Regulation S) and

US37253DAA54 (144A)

|

P4833JAA4 (Regulation S) and

37253DAA5 (144A)

|

U.S.$300,000,000

|

U.S.$ 1,011.25

|

U.S.$ 30.00

|

U.S.$ 1,041.25

|

(1)

The amount to be paid for each U.S.$1,000 principal amount of Notes validly tendered and not validly withdrawn after the Early

Tender Time and at or prior to the Expiration Time (as described herein) and accepted for purchase, excluding accrued and unpaid

interest.

(2) The

Tender Consideration plus the Early Tender Payment to be paid for each U.S.$1,000 principal amount of Notes validly tendered and

not validly withdrawn at or prior to the Early Tender Time (as described herein) and accepted for purchase, excluding accrued

and unpaid interest.

Subject to the terms and conditions described

in the Offer to Purchase, the Offer is scheduled to expire at 11:59 p.m., New York City time, on October 3, 2017 (the “Expiration

Time”), unless extended by the Company. The total consideration for each U.S.$1,000 principal amount of Notes validly tendered

(and not validly withdrawn) at or prior to 5:00 p.m., New York City time, on September 19, 2017 (the “Early Tender Time”)

and accepted pursuant to the Offer will be U.S.$1,041.25 (the “Total Consideration”). The Total Consideration includes

an early tender payment of U.S.$30.00 per U.S.$1,000 principal amount of Notes (the “Early Tender Payment”). The Early

Tender Payment is payable only to holders who validly tender their Notes at or prior to the Early Tender Time, if such Notes are

accepted pursuant to the Offer. Holders who tender their Notes after the Early Tender Time and at or prior to the Expiration Time

will be entitled to receive the tender consideration, which is equal to the Total Consideration minus the Early Tender Payment

(the “Tender Consideration”), if such Notes are accepted for purchase.

The Company, subject to the terms and conditions

described in the Offer to Purchase, will pay (i) the Total Consideration, plus accrued and unpaid interest up to, but not including

the date of payment, promptly after the Early Tender Time (the “Early Settlement Date”) to all holders who validly

tender and do not validly withdraw their Notes at or prior to the Early Tender Time; and (ii) the Tender Consideration, plus accrued

and unpaid interest, promptly after the Expiration Time (the “Final Settlement Date” and, each of the Early Settlement

Date and the Final Settlement Date, a “Settlement Date”) to all holders who validly tender their Notes after the Early

Tender Time and at or prior to the Expiration Time.

In connection with the Offer, GeoPark has

launched an offering of senior secured notes (the “New Notes Offering”). GeoPark intends to make a capital contribution

to the Company with the proceeds from the sale of the New Notes pursuant to the New Notes Offering. The Offer is subject to the

Company’s receipt from GeoPark of a capital contribution with the proceeds from the New Notes Offering sufficient to purchase

all of the Notes validly tendered, as described more fully in the Offer to Purchase, and to certain customary conditions as described

in the Offer to Purchase. The Offer is not conditioned upon any minimum number of Notes being tendered.

The Company intends to issue a redemption

notice on the Early Settlement Date to redeem any and all Notes not purchased in the Offer, and to satisfy and discharge the Notes

and the indenture governing the Notes on the Early Settlement Date by irrevocably depositing the necessary funds in a trust account

with the trustee, in accordance with the terms of the indenture governing the Notes. This press release does not constitute a notice

of redemption of the Notes.

Tenders of Notes may be validly withdrawn

at any time prior to the withdrawal deadline, which is 5:00 p.m., New York City time, on September 19, 2017, unless extended (such

time and date, as the same may be extended, the “Withdrawal Deadline”). Tendered Notes may not be withdrawn after the

Withdrawal Deadline unless the Company (i) makes a material change in the terms of the Offer that is, in the Company’s determination,

adverse to the interests of tendering holders of the Notes or (ii) is otherwise required by law to permit withdrawal.

The Company is not soliciting consents to

modify any of the covenants in the indenture governing the Notes. Any Notes that remain outstanding after the consummation of the

Offer will continue to be the Company’s obligations, subject to the expected redemption described above. Holders of those

outstanding Notes will continue to have all the rights associated with the Notes and the indenture governing the Notes.

The Company has engaged Credit Suisse Securities

(USA) LLC and Goldman Sachs & Co. LLC to act as dealer managers (the “Dealer Managers”) in connection with the

Offer. Questions regarding the Offer may be directed to Credit Suisse Securities (USA) LLC at +1 (212) 538-2147 (collect) or (800)

820-1653 (U.S. toll-free) and Goldman Sachs & Co. LLC at +1 (212) 902-6595 (collect) or (800) 828-3182 (U.S. toll-free). Requests

for documentation may be directed to D. F. King & Co., Inc., the information and tender agent for the Offer, at +1 (212) 269-5550

(for banks and brokers), (866) 796-6867 (U.S. toll-free) or email at geopark@dfking.com.

This press release is not an offer to purchase

or a solicitation of an offer to purchase with respect to any Notes or any other securities, and is not an offer to sell or a solicitation

of an offer to buy any securities, including the notes being offered in the New Notes Offering. The Offer is being made solely

pursuant to the terms of the Offer to Purchase. The Offer is not being made to holders of Notes in any jurisdiction in which the

making or acceptance thereof would not be in compliance with the securities, blue sky or other laws of such jurisdiction. None

of the Company, GeoPark, the Dealer Managers or D.F. King & Co., Inc. makes any recommendation as to whether holders should

tender or refrain from tendering their Notes. Holders must make their own decision as to whether to tender Notes and, if so, the

principal amount of the Notes to tender. Neither the Company nor GeoPark gives any assurance that the New Notes Offering, if commenced,

can be completed on any terms or at all.

|

For further information,

please contact:

INVESTORS:

|

|

|

Stacy Steimel – Shareholder Value Director

|

ssteimel@geo-park.com

|

|

Santiago, Chile

|

|

|

T: +56 (2) 2242-9600

|

|

|

|

|

|

Dolores Santamarina – Investor Manager

Buenos Aires, Argentina

T: +54 (11) 4312-9400

|

dsantamarina@geo-park.com

|

|

Jared Levy – Sard Verbinnen & Co

|

jlevy@sardverb.com

|

|

New York, USA

|

|

|

T: +1 (212) 687-8080

|

|

|

|

|

|

Kelsey Markovich – Sard Verbinnen & Co

New York, USA

T: +1 (212) 687-8080

|

kmarkovich@sardverb.com

|

ABOUT THE COMPANY

AND GEOPARK

The Company is an established branch, under

the laws of Chile, of GeoPark Latin America Limited, an exempted company incorporated under the laws of Bermuda, which is wholly

owned by GeoPark Limited, an exempted company incorporated under the laws of Bermuda.

GeoPark is a leading independent oil and

natural gas exploration and production company with operations in Colombia, Chile, Brazil, Peru and Argentina and a proven track

record of growth in production and reserves since 2006. GeoPark operates in Colombia, Chile, Brazil, Peru and Argentina.

CAUTIONARY

STATEMENT ON FORWARD-LOOKING STATEMENTS

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements often are proceeded

by words such as “believes,” “expects,” “may,” “anticipates,” “plans,”

“intends,” “assumes,” “will” or similar expressions. The forward-looking statements contained

herein include statements about the Offer. These expectations may or may not be realized. Some of these expectations may be based

upon assumptions or judgments that prove to be incorrect. In addition, GeoPark’s business and operations involve numerous

risks and uncertainties, many of which are beyond the control of GeoPark, which could result in GeoPark’s expectations not

being realized or otherwise materially affect the financial condition, results of operations and cash flows of GeoPark. Some of

the factors that could cause future results to materially differ from recent results or those projected in forward-looking statements

are described in GeoPark’s filings with the United States Securities and Exchange Commission.

The forward-looking statements are made

only as of the date hereof, and neither the Company nor GeoPark undertakes any obligation to (and expressly disclaims any obligation

to) update any forward-looking statements to reflect events or circumstances after the date such statements were made, or to reflect

the occurrence of unanticipated events. In light of the risks and uncertainties described above, and the potential for variation

of actual results from the assumptions on which certain of such forward-looking statements are based, investors should keep in

mind that the results, events or developments disclosed in any forward-looking statement made in this document may not occur, and

that actual results may vary materially from those described herein, including those described as anticipated, expected, targeted,

projected or otherwise.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

|

|

|

GeoPark Limited

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Andrés Ocampo

|

|

|

|

|

|

Name:

|

Andrés Ocampo

|

|

|

|

|

|

Title:

|

Chief FinancialOfficer

|

Date:

September 6, 2017

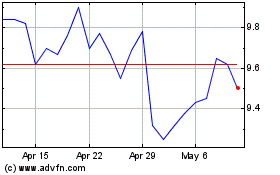

GeoPark (NYSE:GPRK)

Historical Stock Chart

From Mar 2024 to Apr 2024

GeoPark (NYSE:GPRK)

Historical Stock Chart

From Apr 2023 to Apr 2024