Report of Foreign Issuer (6-k)

February 17 2017 - 11:44AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the

month of February

2017

RYANAIR HOLDINGS PLC

(Translation

of registrant's name into English)

c/o Ryanair Ltd Corporate Head Office

Dublin

Airport

County Dublin Ireland

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file

annual

reports

under cover Form 20-F or Form 40-F.

Form

20-F..X.. Form 40-F

Indicate

by check mark whether the registrant by furnishing the

information

contained

in this Form is also thereby furnishing the information to

the

Commission

pursuant to Rule 12g3-2(b) under the Securities

Exchange

Act of

1934.

Yes

No ..X..

If

"Yes" is marked, indicate below the file number assigned to the

registrant

in

connection with Rule 12g3-2(b): 82- ________

AMERICAN DEPOSITARY SHARE BUY-BACK PROGRAMME

Following

completion of Ryanair's latest share buy-back programme

(€550m) announced on 08 November 2016 and as outlined in the

Q3 results on 06 February 2017, Ryanair Holdings plc (the

"Company") announces that it has entered into arrangements with its

brokers, Citigroup Global Markets Limited ("Citigroup") and J&E

Davy ("Davy"), to commence an ADS buy-back programme to repurchase

on its behalf, ordinary shares of €0.006 each (the "Shares")

underlying American Depositary Shares ("ADS"), during the period

commencing on 17 February 2017 and ending on such date as the

Company may announce. These arrangements include the provision for

the Company to give irrevocable instructions to Citigroup and Davy

to purchase ADS during the Company's closed periods without

influence from the Company. The purpose of the ADS buy-back

programme is to reduce the share capital of the Company.

Accordingly, all Shares repurchased will be cancelled.

These

arrangements are in accordance with the Company's general authority

to repurchase Shares and Shares underlying ADS, Chapter 9 of the

Listing Rules of the Irish Stock Exchange, the applicable laws and

regulations of the Irish Stock Exchange and where relevant, those

provisions of Market Abuse Regulation 596/2014/EU dealing with

buy-back programmes and Rule 10b-18 and Rule 10b-5 of the

Securities Exchange Act of 1934. Citigroup and/or Davy may be

undertaking transactions in the Shares (which may include

participation in block purchases) during this period in order to

meet their respective obligations pursuant to this

buy-back.

The

maximum consideration payable by the Company in respect of

repurchases of Shares underlying ADS under these arrangements is up

to €150 million. The timing and the actual number of Shares

repurchased will be dependent on market conditions, legal and

regulatory requirements and the other terms and limitations

contained in the plans.

For further information

please

contact:

Robin

Kiely

Piaras Kelly

Ryanair

DAC

Edelman Ireland

Tel:

+353-1-9451271

Tel: +353-1-6789 333

press@ryanair.com

ryanair@edelman.com

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

Registrant has duly caused this report to be signed on its behalf

by the undersigned, hereunto duly authorized.

Date: 17

February, 2017

|

|

By:___/s/

Juliusz Komorek____

|

|

|

|

|

|

Juliusz

Komorek

|

|

|

Company

Secretary

|

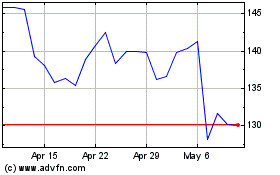

Ryanair (NASDAQ:RYAAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

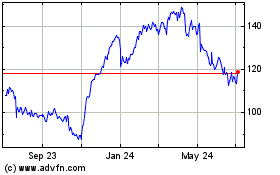

Ryanair (NASDAQ:RYAAY)

Historical Stock Chart

From Apr 2023 to Apr 2024