FORM 6-K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 under

the Securities Exchange Act of 1934

For the month of June 2012

Commission File Number: 1-07952

KYOCERA CORPORATION

6 Takeda Tobadono-cho, Fushimi-ku,

Kyoto 612-8501, Japan

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F

x

Form 40-F

Indicate by check mark if the registrant is submitting the

Form 6-K in paper as permitted by Registration S-T Rule 101(b)(1):

Indicate by check mark if the registrant is

submitting the Form 6-K in paper as permitted by Registration S-T Rule 101(b)(7):

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereto duly authorized.

|

|

|

KYOCERA CORPORATION

|

|

|

|

/s/ S

HOICHI

A

OKI

|

|

Shoichi Aoki

Director,

|

|

Managing Executive Officer and

General Manager of

|

|

Corporate Financial and Business Systems

|

|

Administration Group

|

Date: June 8, 2012

Information furnished on this form:

EXHIBITS

Notice of the 58th Ordinary

General Meeting of Shareholders

to be held in Kyoto, Japan on June 27, 2012

6 Takeda Tobadono-cho, Fushimi-ku, Kyoto, Japan

Please note that this is an English translation of the Japanese original of the Notice of the 58th Ordinary General Meeting of

Shareholders distributed to shareholders in Japan. The translation is prepared solely for the reference and convenience of foreign shareholders. In the event of any discrepancy between this translation and the Japanese original, the latter shall

prevail.

Security Code 6971

June 8, 2012

To our shareholders

Notice of the 58th Ordinary General Meeting of Shareholders

This is to inform you that Kyocera Corporation (the “Company”) will hold its 58th Ordinary General Meeting of Shareholders, as

described below, which you are cordially invited to attend.

If you are unable to attend the Meeting, please exercise your

voting rights in written form (voting card) or electronically (through the Internet, etc.), after examining the attached reference documents for the General Meeting of Shareholders,

no later than 5:30 p.m. Tuesday, June 26, 2012, Japan

time.

|

|

|

|

|

1. Time and Date

|

|

10:00 a.m. on Wednesday, June 27, 2012, Japan time

|

|

|

|

|

2. Place

|

|

20th Floor Event Hall at the head office of the Company,

6 Takeda Tobadono-cho, Fushimi-ku, Kyoto, Japan

|

3. Purpose of the Meeting

Matters to be reported

|

|

(1)

|

Report of the substance of the business report, the consolidated financial statements and the result of audit of consolidated financial statements by the Accounting

Auditor and the Board of Corporate Auditors for the year ended March 31, 2012; and

|

|

|

(2)

|

Report of the substance of the financial statements for the year ended March 31, 2012.

|

Matters to be resolved

|

|

|

|

|

Agendum No. 1

|

|

Disposition of Surplus

|

|

Agendum No. 2

|

|

Partial Amendments to the Articles of Incorporation

|

|

Agendum No. 3

|

|

Election of two (2) Directors

|

|

Agendum No. 4

|

|

Election of three (3) Corporate Auditors

|

- 1 -

4. Matters relating to Exercise of Voting Rights

(1) Method of exercising voting rights in written form (voting card)

Please mark “for” or “against” as to the agenda on the voting card enclosed herewith and return it by the above

deadline in order to exercise voting rights.

(2) Method of exercising voting rights electronically (through the Internet,

etc.)

Please access the Internet website for exercise of voting rights (

http://www.evote.jp/

) through a personal

computer, smartphone or mobile phone. Using the code and password written on the voting card enclosed herewith and following the instructions set forth on the website, please mark “for” or “against” as to the agenda by the above

deadline in order to exercise voting rights.

[Treatment in case of multiple exercises of voting rights by a shareholder]

|

|

(1)

|

In the event that any shareholder exercises voting rights in written form (voting card) as well as electronically (through the Internet, etc.), the electronic exercise

of voting rights shall supersede and be treated as the effective exercise of the voting rights.

|

|

|

(2)

|

In the event of multiple electronic exercises of voting rights (through the Internet, etc.) by a shareholder, the last electronic exercise of voting rights shall

supersede and be treated as the effective exercise of the voting rights.

|

|

|

|

Very truly yours,

|

|

|

|

KYOCERA Corporation

|

|

Tetsuo Kuba

|

|

President and Representative Director

|

Notes:

|

1.

|

If you attend the Meeting, please submit the enclosed form for exercising voting rights to the receptionist.

|

|

2.

|

In the event that any change is necessary in the reference documents for the General Meeting of Shareholders, the business report, the financial statements or the

consolidated financial statements, the Company shall give notice thereof to shareholders by posting it on the Company’s website (

http://global.kyocera.com/ir/index.html

), which can be accessed through the Internet.

|

- 2 -

Reference Documents for General Meeting of Shareholders

Agenda and References are as follows:

Agendum No. 1 Disposition of Surplus

The Company believes that the best way to meet shareholders’ expectations is to improve the consolidated performance of the Company on an ongoing basis.

The Company has adopted the principal guideline that dividend amounts should be within a range based on net income attributable to

shareholders of the Company on a consolidated basis, and has set its consolidated dividend policy to maintain a consolidated dividend ratio at a level of approximately 20% to 25% of consolidated net income. In addition, the Company determines

dividend amounts based on an overall assessment, taking into account various factors including the amount of capital expenditures necessary for the medium to long-term growth of the Company.

Pursuant to this policy and based on full year performance through the year ended March 31, 2012, the Company proposes a year-end

dividend for the year ended March 31, 2012 in the amount of 60 yen per share, a 10 yen decrease as compared with the year ended March 31, 2011. When aggregated with the interim dividend in the amount of 60 yen per share, the total annual

dividend will be 120 yen per share.

The Company also proposes that funds shall be set aside as general reserve, in order to

take into account the necessary reserve amounts for creation of new businesses, development of new markets and new technologies and acquisition of outside management resources needed to achieve stable and sustainable growth of the Company.

The proposed disposition of surplus is as follows:

|

|

|

|

|

|

|

|

|

|

|

1.

|

|

Mattersrelating to year-end dividend

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

|

Type of assets distributed as dividend:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash

|

|

|

|

|

|

|

|

|

|

|

|

(2)

|

|

Matters relating to allocation to shareholders of assets distributed as dividend and aggregate amount thereof:

|

|

|

|

|

|

|

|

|

|

|

|

60 yen per share of Common Stock of the Company.

|

|

|

|

|

|

|

|

|

|

The aggregate amount thereof shall be 11,006,635,200 yen.

|

|

|

|

|

|

|

|

|

|

|

|

(3)

|

|

Effective date of distribution of surplus as dividend:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 28, 2012

|

|

|

|

|

|

|

|

|

|

2.

|

|

Matters relating to general reserve

|

|

|

|

|

|

|

|

|

|

|

(1)

|

|

Category of surplus to increase and amount thereof:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General reserve

|

|

28,000,000,000 yen

|

|

|

|

|

|

|

|

|

|

|

(2)

|

|

Category of surplus to decrease and amount thereof:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unappropriated retained earnings

|

|

28,000,000,000 yen

|

|

|

- 3 -

Agendum No. 2 Partial Amendments to the Articles of Incorporation

|

|

(i)

|

It is proposed to add a corporate object, in order to prepare for expansion and diversification of business in the future (Item 13 of Article 2 of the Proposed

Amendment). In addition, it is proposed to renumber Items 14 and following of Article 2 of the Proposed Amendment.

|

|

|

(ii)

|

It is proposed to amend the maximum number of Corporate Auditors, in order to enhance the audit system (Article 28 of the Proposed Amendment).

|

|

2.

|

Substance of Amendments

|

The

contemplated amendments are as follows:

(The underlined portion shows the proposed amendments.)

|

|

|

|

|

|

|

|

|

Present Article

|

|

Proposed Amendment

|

|

Article 2. Objects

|

|

Article 2. Objects

|

|

|

|

|

The objects of the Company shall be to engage in the following businesses:

|

|

The objects of the Company shall be to engage in the following businesses:

|

|

|

|

|

|

|

(1) Manufacture and sale of and research on fine ceramics and various kinds of products utilizing fine

ceramics;

|

|

(1)

|

|

|

|

|

|

(2) Manufacture and sale of and research on single crystal materials and various kinds of products

utilizing single crystal materials;

|

|

(2)

|

|

|

|

|

(3) Manufacture and sale of and research on composite materials;

|

|

(3)

|

|

|

|

|

(4) Manufacture and sale of and research on specialty plastics;

|

|

(4)

|

|

|

|

|

(5) Manufacture and sale of and research on measurement instruments for electronics;

|

|

(5)

|

|

|

(Not amended)

|

|

(6) Manufacture and sale of and research on electronic and electric instruments and parts

thereof;

|

|

(6)

|

|

|

|

(7) Manufacture and sale of and research on component parts of automobiles;

|

|

(7)

|

|

|

|

|

(8) Manufacture and sale of and research on precious metals, precious stones and semiprecious stones and

various kinds of products utilizing precious metals, precious stones and semiprecious stones;

|

|

(8)

|

|

|

|

|

(9) Manufacture and sale of and research on accessories and interior and exterior decorations and

ornaments;

|

|

(9)

|

|

|

|

|

(10) Wholesales and retail sale of health foods;

|

|

(10)

|

|

|

|

|

(11) Manufacture and sale of and research on material and equipment for medical use;

|

|

(11)

|

|

|

|

|

(12) Manufacture and sale of and research on equipment utilizing solar energy;

|

|

(12)

|

|

|

|

|

|

|

|

<Newly added>

|

|

(13) Construction and sale of power plants, and power generation business and management and operation

thereof;

|

- 4 -

|

|

|

|

|

|

|

|

|

Present Article

|

|

Proposed Amendment

|

|

|

|

|

|

|

(13)

Manufacture and sale of and research on optical machinery and instruments and precision machinery and

instruments and parts hereof;

|

|

(14)

|

|

|

|

|

|

(14)

Manufacture and sale of and research on machinery and equipment for business use and machinery and

equipment for industrial use and parts thereof;

|

|

(15)

|

|

|

|

|

(15)

Manufacture and sale of and research on photosensitive materials for photographic use;

|

|

(16)

|

|

|

|

|

(16)

Design, control and contract of construction relating to public works, building, electric equipment and

piping construction;

|

|

(17)

|

|

|

|

|

(17)

Sale, purchase, lease, maintenance and brokerage of real estate;

|

|

(18)

|

|

|

(Not amended. Same as Present

Articles (13) - (25))

|

|

(18)

Lease, maintenance and management of facilities relating to sports, recreation, medical

care, hotels and restaurants, and the travel agency business;

|

|

(19)

|

|

|

|

(19)

Road freight handling and warehousing;

|

|

(20)

|

|

|

|

|

(20)

Business relating to non-life insurance agency and life insurance canvassing, and general leasing,

factoring and finance business;

|

|

(21)

|

|

|

|

|

(21)

Sale and purchase of various kinds of plants and technology related thereto;

|

|

(22)

|

|

|

|

|

(22)

Design and sale of software relating to computers;

|

|

(23)

|

|

|

|

|

(23)

Disposition through sale and the like and acquisition through purchase and the like of patents and other

industrial property rights and know-how appertaining to the preceding items and acting as intermediary in such transactions;

|

|

(24)

|

|

|

|

|

(24)

Businesses relating to import and export of any of the foregoing items; and

|

|

(25)

|

|

|

|

|

(25)

All commercial activities relating or incidental to any of the foregoing.

|

|

(26)

|

|

|

|

|

Article

28. Number of Corporate Auditors

|

|

Article 28. Number of

Corporate Auditors

|

|

|

|

|

The Company shall have not more than

five

Corporate Auditors.

|

|

The Company shall have not more than

six

Corporate Auditors.

|

- 5 -

Agendum No. 3 Election of two (2) Directors

Messrs. Hisao Hisaki and Rodney N. Lanthorne will resign from the office of Director at the close of this Meeting. Accordingly, the

Company proposes that two (2) Directors be newly elected.

Pursuant to Paragraph 2 of Article 21 of the Articles of

Incorporation of the Company, the term of the office of the Directors to be elected at this Meeting will expire when the term of the other Directors currently in office expires.

The candidates for Director are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

No.

|

|

Name

(Date of birth)

|

|

Brief Personal History, Title,

Other Significant Responsibilities

|

|

Number of the

Company’s

shares held

|

|

|

|

|

|

|

|

|

1

*

|

|

Ken Ishii

(Oct. 6, 1953)

|

|

Mar. 1977

|

|

Joined the Company

|

|

|

1,957

|

|

|

|

|

Jun. 2005

|

|

Deputy General Manager of Corporate Cutting Tool Group of the Company

|

|

|

|

|

|

|

|

Apr. 2009

|

|

Executive Officer of the Company

General Manager of Corporate Cutting Tool Group of the Company [Present]

|

|

|

|

|

|

|

|

Apr. 2011

|

|

Senior Executive Officer of the Company

|

|

|

|

|

|

|

|

Apr. 2012

|

|

Managing Executive Officer of the Company [Present]

|

|

|

|

|

|

|

|

|

|

|

|

2

*

|

|

John S. Rigby

(May 13, 1955)

|

|

Aug. 1981

|

|

Joined Kyocera International, Inc.

|

|

|

(713 ADR

|

)

|

|

|

|

Apr. 1990

|

|

Transferred to Kyocera Industrial Ceramics Corporation

|

|

|

|

|

|

|

|

Apr. 1997

|

|

Vice President of Kyocera Industrial Ceramics Corporation

|

|

|

|

|

|

|

|

Apr. 1999

|

|

Executive Vice President of Kyocera Industrial Ceramics Corporation (in charge of sales)

|

|

|

|

|

|

|

|

Apr. 2001

|

|

President and Director of Kyocera Industrial Ceramics Corporation

|

|

|

|

|

|

|

|

Apr. 2002

|

|

Director of Kyocera International, Inc.

|

|

|

|

|

|

|

|

Jun. 2005

|

|

Executive Officer of the Company [Present]

|

|

|

|

|

|

|

|

Apr. 2010

|

|

President and Director of Kyocera International, Inc. [Present]

|

|

|

|

|

Notes:

|

1.

|

Mr. Ken Ishii is a Representative Director of Kyocera Precision Tools Korea Co., Ltd., with which the Company engages in transactions relating to sale and purchase

of cutting tools, etc. There are no special interests between the other candidate and the Company.

|

|

2.

|

Mr. John S. Rigby beneficially owns 713 shares of Common Stock of the Company by way of American Depositary Receipts (ADRs).

|

|

3.

|

Asterisks (*) above denote new candidates.

|

- 6 -

Agendum No. 4 Election of three (3) Corporate Auditors

The term of office of Corporate Auditors, Messrs. Osamu Nishieda and Kazuo Yoshida, will expire at the close of this Meeting. Accordingly,

the Company proposes that three (3) Corporate Auditors be elected, increasing the number thereof by one (1) Corporate Auditor in order to further enhance the audit system of the Company.

Approval of Agendum No. 2 “Partial Amendments to the Articles of Incorporation” is required for three (3) Corporate

Auditors to be elected. With respect to this Agendum, consent from the Board of Corporate Auditors has been obtained.

The

candidates for Corporate Auditor are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

No.

|

|

Name

(Date of birth)

|

|

Brief Personal History, Title,

Other Significant Responsibilities

|

|

Number of

the Company’s

shares held

|

|

|

|

|

|

|

|

|

1

|

|

Osamu Nishieda

(Jan. 10, 1943)

|

|

Apr. 1975

|

|

Admitted to the Bar, Registered in the Osaka Bar Association [Present]

|

|

|

306,146

|

|

|

|

|

|

Feb. 1986

|

|

Legal counsel to the Company [Present]

|

|

|

|

|

|

|

|

|

Jun. 1993

|

|

Corporate Auditor of the Company [Present]

|

|

|

|

|

|

|

|

|

|

|

2

*

|

|

Yoshinori Yasuda

(Nov. 24, 1946)

|

|

Apr. 1988

|

|

Assistant Professor, International Research Center for Japanese Studies

|

|

|

0

|

|

|

|

|

|

Apr. 1994

|

|

Professor, International Research Center for Japanese Studies

|

|

|

|

|

|

|

|

|

|

|

Professor, Graduate University for Advanced Studies

|

|

|

|

|

|

|

|

|

Apr. 1995

|

|

Visiting Professor, Reitaku University [Present]

|

|

|

|

|

|

|

|

|

Oct. 1996

|

|

Visiting Professor, Humboldt University of Berlin

|

|

|

|

|

|

|

|

|

Apr. 1997

|

|

Professor, Graduate School of Science, Kyoto University

|

|

|

|

|

|

|

|

|

Apr. 2004

|

|

Deputy-Director, International Research Center for Japanese Studies

|

|

|

|

|

|

|

|

|

Apr. 2006

|

|

Member of the Royal Swedish Academy of Sciences [Present]

|

|

|

|

|

|

|

|

|

Apr. 2007

|

|

Senior Fellow, The Tokyo Foundation [Present]

|

|

|

|

|

|

|

|

|

Mar. 2009

|

|

Member of the Board of Governance, Japan Broadcasting Corporation

|

|

|

|

|

|

|

|

|

Apr. 2012

|

|

Professor Emeritus, International Research Center for Japanese Studies [Present]

|

|

|

|

|

|

|

|

|

|

|

Professor, Graduate School of Environmental Studies, Tohoku University

[Present]

|

|

|

|

|

|

|

|

|

|

|

3

*

|

|

Nichimu Inada

(Nov. 24, 1940)

|

|

Mar. 1962

|

|

Founded Inamasa Bannou Kougeisha (current Family Co., Ltd.)

|

|

|

525

|

|

|

|

|

|

Aug. 1966

|

|

Established Chuou Bussan Co., Ltd. (current Family Co., Ltd.) President and Representative Director [Present]

|

|

|

|

|

|

|

|

|

Jun. 2007

|

|

Executive Director, The Japan Federation of Medical Devices Associations [Present]

|

|

|

|

|

|

|

|

|

Jul. 2007

|

|

Chairman, The Japan Home-Health Apparatus Industrial Association

[Present]

|

|

|

|

|

- 7 -

Notes:

|

1.

|

The Company has a retainer agreement with the candidate Mr. Osamu Nishieda to retain him as the Company’s legal counsel. There are no special interests

between either of the other candidates and the Company.

|

|

2.

|

The number of shares of the Company held by the candidates above includes his ownership in the Stock Purchase Plan for Kyocera Group Executives.

|

|

3.

|

Asterisks (*) above denote new candidates.

|

|

4.

|

The Company nominated Mr. Osamu Nishieda as a candidate for Corporate Auditor because the Company believes that he continues to be capable of conducting a general

audit of corporate activities as a Corporate Auditor based on his familiarity with the Company’s internal affairs and his abundant knowledge and experience as an attorney at law.

|

|

5.

|

Matters with respect to outside Corporate Auditors are as follows:

|

|

|

(1)

|

Messrs. Yoshinori Yasuda and Nichimu Inada are candidates for outside Corporate Auditor.

|

|

|

(2)

|

Reason for nomination of Messrs. Yoshinori Yasuda and Nichimu Inada as candidates for outside Corporate Auditor:

|

|

|

(i)

|

Mr. Yoshinori Yasuda has cultivated exceptional insight through his career as professor at International Research Center for Japanese Studies and other

universities. He has also served as a member of the Board of Governance at Japan Broadcasting Corporation. The Company believes that he will be capable of conducting a general audit of corporate activities as an outside Corporate Auditor from the

broad perspective derived from his experience.

|

|

|

(ii)

|

The Company believes that Mr. Nichimu Inada will be capable of conducting a general audit of corporate activities as an outside Corporate Auditor based on his

abundant management experience and exceptional insight as a corporate executive.

|

|

(3)

|

The Company will enter into agreements with Messrs. Yoshinori Yasuda and Nichimu Inada upon their election as outside Corporate Auditors regarding limitation of their

liability for damages due to negligence in the performance of their tasks, in accordance with Paragraph 1 of Article 427 of the Corporation Act and Article 35 of the Articles of Incorporation of the Company. The amounts of liability, as set under

such agreements, shall be limited to the smallest amounts permitted under applicable laws and regulations.

|

|

(4)

|

The Company will designate Messrs. Yoshinori Yasuda and Nichimu Inada as independent auditors as provided for in the rules of the Tokyo Stock Exchange and the Osaka

Securities Exchange upon their election as outside Corporate Auditors.

|

- END -

- 8 -

|

|

|

|

|

|

Security Code 6971

|

Report for the year ended March 31, 2012

(Accompanying documents

for the 58th Ordinary General Meeting of Shareholders)

Please note that this is an English translation of the Japanese original of the Report for the year

ended March 31, 2012 of Kyocera Corporation distributed to shareholders in Japan. The translation is prepared solely for the reference and convenience of foreign shareholders. In the event of any discrepancy between this translation and the

Japanese original, the latter shall prevail.

Table of Contents

Kyocera Management Philosophy

Corporate Motto

“Respect the Divine and Love People”

Preserve the spirit to work fairly and honorably,

respecting people, our work, our company and our global community.

Management

Rationale

To provide opportunities for the material and intellectual growth of all our

employees, and through our joint efforts, contribute to the advancement of

society and humankind.

Management Philosophy

To coexist harmoniously with our society, our global

community and nature.

Harmonious coexistence is the underlying foundation of all our business

activities as we work to create a world of prosperity and peace.

Management Based on the Bonds of Human Minds

When I founded Kyocera, I

didn’t have sufficient funding, let alone decent facilities or equipment. However, I was fortunate enough to have associates with whom I felt a spiritual bond. We shared every joy and pain, just like a family. I therefore decided to run this

company with faith in the human spirit. The human spirit is said to be easily changed. Yet, when a deep sense of trust exists, I have found that there is nothing stronger or more reliable than our spiritual ties. Today, this faith in the human

spirit forms the very heart of Kyocera.

Kazuo Inamori

Chairman Emeritus

Greetings

We are pleased to present to you our Report for the year ended March 31, 2012 (hereinafter, “fiscal 2012” refers to the

fiscal year ended March 31, 2012, and other fiscal years are referred to in a corresponding manner).

Fiscal 2012 started

under extreme conditions due to overall stagnation in domestic production activities resulting from the impact of the Great East Japan Earthquake. Thereafter, continued appreciation of the yen caused by the European financial crisis, coupled with

floods in Thailand, produced an increased feeling of global economic decline and deterioration of the business environment. Amid these circumstances, Kyocera worked to implement measures throughout the Kyocera Group that included reducing costs,

enhancing productivity, introducing new products and cultivating new markets. Demand for digital consumer equipment in particular slumped, however, leading to a decline in sales and profit for fiscal 2012 compared with fiscal 2011.

In fiscal 2013, despite lingering fears over the European economy and exchange rate trends, component demand is expected to recover in

the digital consumer equipment market, a principal market for the Kyocera Group, while demand is expected to increase for environment and energy related products, such as solar cells, due to heightened environmental awareness. In order to swiftly

improve results in each business and drive growth for the Kyocera Group during the recovery phase of these markets, Kyocera will strive to further reduce costs, develop new products and cultivate new markets.

We would very much appreciate your continued support of the Kyocera Group as we forge ahead.

Makoto Kawamura

Chairman of the Board and

Representative Director

Tetsuo Kuba

President and Representative Director

1

(Accompanying documents for the 58th Ordinary General Meeting of Shareholders)

Business Report

(From April 1, 2011 to

March 31, 2012)

1. Current Conditions of

Kyocera Corporation and its Consolidated Subsidiaries

(1) Business Progress and Results

In fiscal 2012, the Japanese economy stagnated overall, due to continued appreciation of the yen against the Euro and the U.S. dollar and

a decrease in exports, despite resolution of disruptions in production activities and the supply chain following the Great East Japan Earthquake. The European economy showed a downturn, due to a reduced willingness to engage in personal consumption

and investment as the financial crisis worsened. In contrast, the U.S. economy continued to recover moderately, due mainly to growth in personal consumption and private capital investment. The Chinese economy continued to expand, primarily supported

by strong domestic demand in spite of signs of a slowdown in export growth.

In the information and communications market,

which is the principal market for Kyocera Corporation and its consolidated subsidiaries (“Kyocera Group” or “Kyocera”), demand for items such as mobile phone handsets, personal computers and flat-screen TVs was sluggish compared

with projections from the beginning of fiscal 2012. In addition, component inventory adjustments at equipment manufacturers persisted due to stagnation in production activities for products, including digital cameras, resulting from the prolonged

impact of floods in Thailand. As a result, component demand, mainly for digital consumer equipment, fell below the level recorded in fiscal 2011.

Average exchange rates for fiscal 2012 were ¥79 to the U.S. dollar, marking appreciation of ¥7 (approximately 8%) from ¥86 for fiscal 2011, and ¥109 to the Euro, marking appreciation of

¥4 (approximately 4%) from ¥113 for fiscal 2011. As a result, net sales and income before income taxes for fiscal 2012 were adversely affected by approximately ¥40 billion and ¥10 billion, respectively, compared with fiscal 2011.

Consolidated net sales for fiscal 2012 decreased by ¥76,054 million, or 6.0%, to ¥1,190,870 million, compared with

¥1,266,924 million for fiscal 2011, due primarily to a decline in component demand for digital consumer equipment and a decrease in sales in the Telecommunications Equipment Group, in addition to the impact of the yen’s appreciation. Profit

from operations decreased by ¥58,249 million, or 37.4%, to ¥97,675 million, compared with ¥155,924 million for fiscal 2011. In addition, income before income taxes decreased by ¥57,439 million, or 33.3%, to ¥114,893 million,

compared with ¥172,332 million for fiscal 2011. Net income attributable to shareholders of Kyocera Corporation for fiscal 2012 decreased by ¥43,091 million, or 35.2%, to ¥79,357 million, compared with ¥122,448 million for fiscal

2011.

2

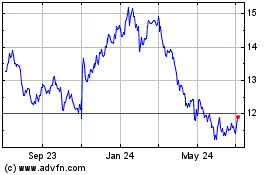

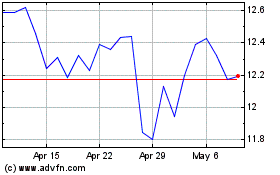

Highlights of Consolidated Results

Notes:

|

1.

|

The amounts, numbers of shares and ratios (%) in this report are rounded to the nearest unit.

|

|

2.

|

Graphs in this report are presented solely for reference.

|

3

Consolidated Results by Reporting Segment

Fine Ceramic Parts Group

|

|

|

|

|

Net sales:

|

|

¥80,372 million, up 5.4% year on year

|

|

Operating profit:

|

|

¥12,622 million, up 5.5% year on year

|

Both sales and operating profit in this reporting segment increased compared with fiscal 2011, due

primarily to an increase in demand for components for the automotive market overseas and LED-related markets.

Semiconductor Parts Group

|

|

|

|

|

Net sales:

|

|

¥153,420 million, down 12.2% year on year

|

|

Operating profit:

|

|

¥27,754 million, down 25.7% year on year

|

The impact of customer inventory adjustments for components used in digital consumer equipment led to

sluggish demand for packages for electronic components and image sensors. As a result, sales and operating profit in this reporting segment decreased compared with fiscal 2011.

4

Applied Ceramic Products Group

|

|

|

|

|

|

|

|

|

Net sales:

|

|

¥179,784 million,

|

|

down 9.0% year on year

|

|

|

|

Operating profit:

|

|

¥6,459 million,

|

|

down 77.8% year on year

|

|

|

In the cutting tool business, demand grew, particularly in the automotive market. The solar energy

business stagnated, however, due to a steep decline in product prices worldwide caused by deterioration in the balance of supply and demand as growth in the European market slowed. As a result, sales and operating profit in this reporting segment

decreased compared with fiscal 2011.

Electronic Device Group

|

|

|

|

|

|

|

|

|

Net sales:

|

|

¥228,721 million,

|

|

down 5.7% year on year

|

|

|

|

Operating profit:

|

|

¥16,036 million,

|

|

down 61.5% year on year

|

|

|

Sales and operating profit in this reporting segment decreased compared with fiscal 2011, due to sluggish

component demand affected by the Great East Japan Earthquake and the floods in Thailand, as well as an impact of the yen's appreciation. In addition, AVX Corporation, a consolidated subsidiary, recorded an environmental remediation charge in fiscal

2012.

5

Telecommunications Equipment Group

|

|

|

|

|

|

|

|

|

Net sales:

|

|

¥178,669 million,

|

|

down 20.7% year on year

|

|

|

|

Operating profit:

|

|

¥1,469 million,

|

|

down 30.7% year on year

|

|

|

Despite aggressive introduction of new products, which included the commencement of smartphone sales for

the Japanese market, sales in this reporting segment decreased compared with fiscal 2011, due to sluggish growth in sales of mobile phone handsets overseas. Operating profit was ensured through efforts to reduce manufacturing costs and to undertake

structural reforms in overseas operations.

Information Equipment Group

|

|

|

|

|

|

|

|

|

Net sales:

|

|

¥243,457 million,

|

|

up 1.5% year on year

|

|

|

|

Operating profit:

|

|

¥29,451 million,

|

|

up 14.0% year on year

|

|

|

Sales in this reporting segment increased slightly compared with fiscal 2011, due to increased sales

volume resulting from the aggressive launch of new products and expansion of sales network, mostly offset by the impact of the yen’s appreciation. Operating profit increased compared with fiscal 2011, due to an increase in sales of

high-value-added products, such as color-capable machines and consumables.

6

Others

|

|

|

|

|

|

|

|

|

Net sales:

|

|

¥151,987 million,

|

|

up 9.0% year on year

|

|

|

|

Operating profit:

|

|

¥8,054 million,

|

|

down 16.5% year on year

|

|

|

Sales in this reporting segment increased compared with fiscal 2011, due to sales contributions from new

products such as LED lighting and growth in sales at Kyocera Communication Systems Co., Ltd. Operating profit decreased compared with fiscal 2011, however, due mainly to an increase in R&D expenses for new businesses.

(2) Implemented Management Measures and Significant Management Decisions made in Fiscal 2012

|

i)

|

In July 2011, with the aim of strengthening its cutting tool business, Kyocera acquired 100% of the outstanding common stock of Unimerco Group A/S (now Kyocera Unimerco

A/S (KUA)), a Danish-based industrial cutting tool manufacturing and sales company, and made it a consolidated subsidiary. By making KUA a consolidated subsidiary, Kyocera has added KUA’s high-quality, high-precision, custom-made solid-type

cutting tools for automobile engine processing, as well as aviation and wind-power generation markets to its lineup, while also expanding its sales network, mainly in Europe. Going forward, Kyocera will strive to further expand its cutting tool

business through the pursuit of synergies with KUA.

|

|

ii)

|

In February 2012, in order to expand its liquid crystal displays (LCDs) business, Kyocera acquired 100% of the common stock of Optrex Corporation (now Kyocera Display

Corporation), a specialized manufacturer of LCDs and related products, and made it a consolidated subsidiary. Going forward, Kyocera will take advantage of its strong customer base in LCDs for automotive applications both inside and outside Japan,

with the aim of expanding business in the automotive market.

|

(3) Capital Expenditures

During fiscal 2012, due to the economic decline in Europe, Kyocera substantially slowed its capital expenditures in the solar energy

business. As a result, capital expenditures for fiscal 2012 totaled ¥66,408 million, a decrease of ¥4,272 million, or 6.0%, compared with fiscal 2011.

Required funds for fiscal 2012 were mainly financed from internal resources.

(4) Management

Challenges

During fiscal 2012, Kyocera pushed ahead with initiatives to reduce manufacturing costs and enhance

productivity amidst a tough management environment arising from deterioration in external conditions, including the impact of the Great East Japan Earthquake and floods in Thailand, financial problems in Europe and the yen’s appreciation.

Kyocera also undertook measures to drive future growth in the Kyocera Group, such as strengthening existing businesses by acquiring external management resources.

7

Going forward, Kyocera expects the business environment to continue to be severe, due

primarily to stagnant growth in the global economy, continued appreciation of the yen and intensifying price competition resulting from the rise of Asian manufacturers. Kyocera believes it is necessary to further enhance management foundations and

expand sales in growth markets in order to overcome global competition and drive growth of the Kyocera Group in any business environment, regardless of its severity. Specifically, Kyocera will tackle the following challenges, aiming for acceleration

of global business development to become a high growth, highly profitable company.

i) Enhance management foundations

Kyocera will promote further cost reductions, streamline existing production sites and expand their capacity in order to overcome global

competition. In addition, Kyocera will take other measures, which will include establishment of new production sites, such as those in Vietnam, and will also re-examine its materials procurement methods.

Other efforts aimed at further enhancement of the Group’s management foundations will include strengthening ties among business

divisions and among Group companies, in order to accelerate the development of new technologies and products. Kyocera will also continuously seek opportunities to expand its businesses by acquiring external management resources.

ii) Expand sales in growth markets

Kyocera views the information and communications market and the environment and energy market as future growth markets and will strive to expand sales in these markets in particular.

In the information and communications market, Kyocera anticipates the worldwide proliferation of smartphones and expansion of higher

speed networks going forward. Kyocera will work to increase sales in the Components Business by developing smaller, more advanced components and bolstering its sales system. Efforts will also be made to expand the Equipment Business by introducing

differentiated telecommunications equipment taking advantage of Kyocera’s unique component technologies and by expanding sales networks for information equipment, mainly in emerging markets.

In the environment and energy market, amidst rising awareness of environmental preservation and energy conservation, Kyocera will work to

expand sales by commencing the sale of high-value-added home energy management systems combining various new devices in order to develop new markets, while continuing to pursue sales of existing solar generating systems. Kyocera is also preparing

for entry into large scale solar power generation projects.

Note: Forward-Looking Statements

Certain of the statements made in this report are forward-looking statements (within the meaning of Section 21E of the U.S.

Securities and Exchange Act of 1934), which are based on our current assumptions and beliefs in light of the information currently available to us. These forward-looking statements involve known and unknown risks, uncertainties and other factors.

Such risks, uncertainties and other factors include, but are not limited to the following:

|

(1)

|

General economic conditions in our markets, which are primarily Japan, North America, Europe and Asia;

|

|

(2)

|

Economic, political and legal conditions and unexpected changes therein in countries or areas where we operate;

|

|

(3)

|

Factors that may affect our exports, including a strong yen, political and economic instability, customs, and inadequate protection of our intellectual property;

|

|

(4)

|

Fluctuation in exchange rates that may affect the value of our foreign assets or the prices of our products;

|

8

|

(5)

|

Intensified competition in product pricing, technological innovation, R&D activities, product quality and speed of delivery;

|

|

(6)

|

Manufacturing delays or defects resulting from outsourcing or internal manufacturing processes;

|

|

(7)

|

The possibility that expansion of production capacity and in-process R&D activities may not produce the desired results;

|

|

(8)

|

The possibility that companies or assets acquired by us may not produce the returns or benefits, or bring in business opportunities, which we expect;

|

|

(9)

|

Inability to secure skilled employees, particularly engineering and technical personnel;

|

|

(10)

|

The possibility of divulgence of our trade secrets and infringement of our intellectual property rights;

|

|

(11)

|

The possibility that we may receive notice of claims of infringement of other parties’ intellectual property rights and claims for royalty payments;

|

|

(12)

|

Increases in our environmental liability and in costs and expenses required to observe obligations imposed by environmental laws and regulations in Japan and other

countries;

|

|

(13)

|

Newly enacted laws and regulations or stricter interpretation of existing laws and regulations that may limit our business operations;

|

|

(14)

|

Events that may negatively impact our markets or supply chain, including terrorist acts, plague, war and similar events;

|

|

(15)

|

Earthquakes and other related natural disasters affecting our operational facilities and our markets or supply chain, as well as social and economic infrastructure;

|

|

(16)

|

Exposure to difficulties in collection of trade receivables due to customers’ worsening financial condition;

|

|

(17)

|

The possibility of recognition of impairment losses on investment securities held by us due to declines in their value;

|

|

(18)

|

The possibility that we may record impairment losses on long-lived assets, goodwill and intangible assets;

|

|

(19)

|

The possibility that deferred tax assets may not be realized or additional liabilities for unrecognized tax benefits may be incurred; and

|

|

(20)

|

Changes in accounting principles.

|

Such risks, uncertainties and other factors may cause our actual results, performance, achievements or financial condition to be materially different from any future results, performance, achievements or

financial condition expressed or implied by these forward-looking statements. We undertake no obligation to publicly update any forward-looking statements included in this report.

9

(5) Four-Year Financial Summary

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Yen in millions except per share amounts)

|

|

|

|

|

FY2009

|

|

|

FY2010

|

|

|

FY2011

|

|

|

FY2012

|

|

|

Net sales

|

|

|

1,128,586

|

|

|

|

1,073,805

|

|

|

|

1,266,924

|

|

|

|

1,190,870

|

|

|

|

|

|

|

|

|

Income before income taxes

|

|

|

55,982

|

|

|

|

60,798

|

|

|

|

172,332

|

|

|

|

114,893

|

|

|

|

|

|

|

|

|

Net income attributable to shareholders of Kyocera Corporation

|

|

|

29,506

|

|

|

|

40,095

|

|

|

|

122,448

|

|

|

|

79,357

|

|

|

|

|

|

|

|

|

Basic earnings per share attributable to shareholders of Kyocera Corporation (yen)

|

|

|

157.27

|

|

|

|

218.47

|

|

|

|

667.23

|

|

|

|

432.58

|

|

|

|

|

|

|

|

|

Total assets

|

|

|

1,773,802

|

|

|

|

1,848,717

|

|

|

|

1,946,566

|

|

|

|

1,994,103

|

|

|

|

|

|

|

|

|

Kyocera Corporation shareholders’ equity

|

|

|

1,323,663

|

|

|

|

1,345,235

|

|

|

|

1,420,263

|

|

|

|

1,469,505

|

|

|

|

|

|

|

|

|

Kyocera Corporation shareholders’ equity per share (yen)

|

|

|

7,212.32

|

|

|

|

7,330.14

|

|

|

|

7,739.31

|

|

|

|

8,010.65

|

|

Notes:

|

1.

|

The consolidated financial statements are prepared in conformity with accounting principles generally accepted in the United States.

|

|

2.

|

Basic earnings per share attributable to shareholders of Kyocera Corporation is calculated using the average number of shares in issue during each respective fiscal

year and Kyocera Corporation shareholders’ equity per share is calculated using the number of shares in issue excluding treasury shares at the end of each respective fiscal year.

|

|

3.

|

Consolidated net sales for fiscal 2009 decreased compared with fiscal 2008, due primarily to the impact of a decrease in demand under the influence of the deteriorating

business environment and to appreciation of the yen. Net income attributable to shareholders of Kyocera Corporation decreased compared with fiscal 2008 due mainly to such decrease in demand and to product selling price erosion.

|

|

4.

|

Consolidated net sales for fiscal 2010 decreased compared with fiscal 2009 due to continued deterioration of the business environment until the second quarter and the

impact of appreciation of the yen, despite the recovery of the general business environment. Net income attributable to shareholders of Kyocera Corporation increased compared with fiscal 2009 due to cost-cutting measures and improved productivity.

|

|

5.

|

Consolidated net sales for fiscal 2011 increased compared with fiscal 2010 due to an expansion of the information and communications market despite the impact of

appreciation of the yen. Net income attributable to shareholders of Kyocera Corporation increased compared with fiscal 2010 due to further cost-cutting measures and improved productivity.

|

|

6.

|

Performance for fiscal 2012 is as stated in “(1) Business Progress and Results” on previous pages.

|

10

(6) Principal Businesses

(as of March 31, 2012)

Kyocera manufactures and sells a highly diversified range of products, including components involving fine ceramic technologies and

applied ceramic products, telecommunications and information equipment, etc. The principal products and businesses are as follows:

|

|

|

|

|

Reporting Segments

|

|

Principal Products and Businesses

|

|

Fine Ceramic Parts Group

|

|

Components for Semiconductor Processing Equipment and LCD Manufacturing

Equipment,

Information & Telecommunication Components,

General Industrial Ceramic Components,

Sapphire Substrates,

Automotive Components

|

|

|

|

|

Semiconductor Parts Group

|

|

Ceramic Packages for Crystal and SAW Devices,

CMOS/CCD Image Sensor Ceramic Packages,

LSI Ceramic Packages,

Wireless Communication Device Packages,

Optical

Communication Device Packages and Components,

Organic Multilayer Packages and Substrates

|

|

|

|

|

Applied Ceramic Products Group

|

|

Residential and Industrial Solar Power Generating Systems,

Solar Cells and Modules,

Cutting Tools, Micro Drills,

Medical and Dental Implants,

Jewelry and Fine

Ceramic Application Products

|

|

|

|

|

Electronic Device Group

|

|

Ceramic Capacitors, Tantalum Capacitors,

SAW Devices, RF Modules, EMI Filters,

Clock Oscillators,

Crystal Units, Ceramic Resonators,

Optical Low Pass Filters, Connectors,

Thermal Printheads, Inkjet Printheads,

Amorphous Silicon Photoreceptor Drums,

LCDs, Touch Panels

|

|

|

|

|

Telecommunications Equipment Group

|

|

Mobile Phone Handsets,

PHS related Products such as PHS Mobile Phone Handsets and PHS Base Stations

|

|

|

|

|

Information Equipment Group

|

|

Color and Black & White Office Equipment such as ECOSYS Printers and Multifunction

Peripherals,

Wide Format Multifunctional Systems,

Printer and Multifunction Peripherals Supplies,

Business Solution Services such as Managed Print

Service

|

|

|

|

|

Others

|

|

Information Systems & Telecommunication Services,

Engineering Business, Management Consulting Business,

Epoxy Molding Compounds for Semiconductor Encapsulation,

Electrical Insulators, Flexible Printed Circuit Sheet Materials,

Synthetic Resin Molded Parts,

Realty

Development,

LED Lighting Systems

|

11

(7) Significant Subsidiaries

(as of March 31, 2012)

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Subsidiary

|

|

Amount of Capital

(Yen

in millions

and others

in thousands)

|

|

|

Ownership

by

Kyocera

Corporation

(%)

|

|

|

Principal Business

|

|

Kyocera SLC Technologies Corporation

|

|

|

¥4,000

|

|

|

|

100.00

|

|

|

Development, manufacture and sale of organic multilayer packages and substrates

|

|

|

|

|

|

|

Kyocera Solar Corporation

|

|

|

¥310

|

|

|

|

100.00

|

|

|

Sale of solar energy products

|

|

|

|

|

|

|

Japan Medical Materials Corporation*1

|

|

|

¥2,500

|

|

|

|

77.00

|

|

|

Development, manufacture and sale of medical material

|

|

|

|

|

|

|

Kyocera Elco Corporation*2

|

|

|

¥400

|

|

|

|

100.00

|

|

|

Development, manufacture and sale of electronic devices

|

|

|

|

|

|

|

Kyocera Kinseki Corporation*3

|

|

|

¥16,318

|

|

|

|

100.00

|

|

|

Development and manufacture of electronic devices

|

|

|

|

|

|

|

Optrex Corporation*4

|

|

|

¥4,075

|

|

|

|

100.00

|

|

|

Development, manufacture and sale of electronic devices

|

|

|

|

|

|

|

Kyocera Mita Corporation*5

|

|

|

¥12,000

|

|

|

|

100.00

|

|

|

Development and manufacture of information equipment

|

|

|

|

|

|

|

Kyocera Communication Systems Co., Ltd.

|

|

|

¥2,986

|

|

|

|

76.30

|

|

|

Provision of information systems and telecommunication services

|

|

|

|

|

|

|

Kyocera Chemical Corporation

|

|

|

¥10,172

|

|

|

|

100.00

|

|

|

Development, manufacture and sale of electrical insulation materials

|

|

|

|

|

|

|

Shanghai Kyocera Electronics Co., Ltd.

|

|

|

¥17,321

|

|

|

|

100.00

|

|

|

Manufacture and sale of fine ceramic-related products and electronic devices

|

|

|

|

|

|

|

Dongguan Shilong Kyocera Optics Co., Ltd.*6

|

|

|

HK$472,202

|

|

|

|

90.00

|

|

|

Manufacture of cutting tools and thin film components

|

|

|

|

|

|

|

Kyocera (Tianjin) Sales & Trading Corporation

|

|

|

US$10,000

|

|

|

|

90.00

|

|

|

Sale of fine ceramic-related products and cutting tools

|

|

|

|

|

|

|

Kyocera Telecom Equipment (Malaysia) Sdn. Bhd.

|

|

|

MYR28,000

|

|

|

|

100.00

|

|

|

Manufacture of telecommunications equipment

|

|

|

|

|

|

|

Kyocera Asia Pacific Pte. Ltd.

|

|

|

US$105

|

|

|

|

100.00

|

|

|

Sale of fine ceramic-related products, solar energy products and electronic devices

|

|

|

|

|

|

|

Kyocera International, Inc.

|

|

|

US$34,850

|

|

|

|

100.00

|

|

|

Holding company and headquarters in North America

|

|

|

|

|

|

|

AVX Corporation

|

|

|

US$1,763

|

|

|

|

69.06

|

|

|

Development, manufacture and sale of electronic devices

|

|

|

|

|

|

|

Kyocera Fineceramics GmbH

|

|

|

EURO1,687

|

|

|

|

100.00

|

|

|

Sale of fine ceramic-related products, solar energy products and thin film components

|

Asterisks (*) show consolidated subsidiaries the names of which were changed as of April 1, 2012. New company

names are as follows:

*1 Kyocera Medical Corporation, *2 Kyocera Connector Products Corporation, *3 Kyocera Crystal Device Corporation,

*4 Kyocera Display Corporation, *5 Kyocera Document Solutions Inc., *6 Dongguan Shilong Kyocera Co., Ltd.

12

(8) Principal Business Sites

(as of March 31, 2012)

|

|

|

|

|

Headquarters: 6 Takeda Tobadono-cho, Fushimi-ku, Kyoto, Japan

|

|

|

|

|

Japan:

|

|

|

|

|

|

|

Kyocera Corporation:

|

|

|

|

Hokkaido Kitami Plant

|

|

Kyocera SLC Technologies Corporation (Shiga)

|

|

Fukushima Tanagura Plant

|

|

Kyocera Solar Corporation (Kyoto)

|

|

Nagano Okaya Plant

|

|

Japan Medical Materials Corporation (Osaka)*1

|

|

Mie Ise Plant

|

|

Kyocera Elco Corporation (Kanagawa)*1

|

|

Shiga Gamo Plant

|

|

Kyocera Kinseki Corporation (Tokyo)*1

|

|

Shiga Yokaichi Plant

|

|

Optrex Corporation (Tokyo)*1

|

|

Shiga Yasu Plant

|

|

Kyocera Mita Corporation (Osaka)*1

|

|

Kagoshima Sendai Plant

|

|

Kyocera Mita Japan Corporation (Tokyo)*2

|

|

Kagoshima Kokubu Plant

|

|

Kyocera Communication Systems Co., Ltd. (Kyoto)

|

|

Kagoshima Hayato Plant

|

|

Kyocera Chemical Corporation (Saitama)

|

|

Yokohama Office

|

|

Kyocera Optec Co., Ltd. (Tokyo)

|

|

R&D Center, Keihanna (Kyoto)

|

|

Kyocera Realty Development Co., Ltd. (Tokyo)

|

|

R&D Center, Kagoshima

|

|

Hotel Kyocera Co., Ltd. (Kagoshima)

|

|

|

|

Hotel Princess Kyoto Co., Ltd. (Kyoto)

|

|

|

|

|

Overseas

:

|

|

|

|

|

|

|

Shanghai Kyocera Electronics Co., Ltd. (China)

|

|

|

|

Kyocera (Tianjin) Solar Energy Co., Ltd. (China)

|

|

|

|

Dongguan Shilong Kyocera Optics Co., Ltd. (China)*1

|

|

|

|

Kyocera (Tianjin) Sales & Trading Corporation (China)

|

|

|

|

Kyocera Mita Office Equipment (Dongguan) Co., Ltd. (China)*3

|

|

Kyocera Precision Tools Korea Co., Ltd. (Korea)

|

|

|

|

Kyocera Korea Co., Ltd. (Korea)

|

|

|

|

Kyocera Telecom Equipment (Malaysia) Sdn. Bhd. (Malaysia)

|

|

Kyocera Asia Pacific Pte. Ltd. (Singapore)

|

|

|

|

Kyocera International, Inc. (U.S.A.)

|

|

|

|

Kyocera Industrial Ceramics Corporation (U.S.A.)

|

|

|

|

Kyocera America, Inc. (U.S.A.)

|

|

|

|

Kyocera Solar, Inc. (U.S.A.)

|

|

|

|

Kyocera Tycom Corporation (U.S.A.)

|

|

|

|

Kyocera Communications, Inc. (U.S.A.)

|

|

|

|

AVX Corporation (U.S.A.)

|

|

|

|

Kyocera Mita America, Inc. (U.S.A.)*4

|

|

|

|

Kyocera Mita Europe B.V. (Netherlands)*5

|

|

|

|

Kyocera Mita Deutschland GmbH (Germany)*6

|

|

|

|

TA Triumph-Adler GmbH (Germany)

|

|

|

|

Kyocera Fineceramics GmbH (Germany)

|

|

|

|

Kyocera Solar Europe S.R.O. (Czech Republic)

|

|

|

|

Kyocera Unimerco A/S (Denmark)

|

|

|

Asterisks (*) show consolidated subsidiaries the names of which were changed as of April 1, 2012. New company

names are as follows:

*1 See “(7) Significant Subsidiaries” on previous page.

*2 Kyocera Document Solutions Japan Inc., *3 Kyocera Document Technology (Dongguan) Co., Ltd.,

*4 Kyocera Document Solutions America, Inc., * 5 Kyocera Document Solutions Europe B.V.,

*6

Kyocera Document Solutions Deutschland GmbH

13

(9) Employees

(as of March 31, 2012)

i) Consolidated

|

|

|

|

|

|

|

|

|

|

|

Reporting Segments

|

|

Number of Employees

|

|

|

Change from the end of fiscal 2011

|

|

|

Fine Ceramic Parts Group

|

|

|

3,010

|

|

|

|

Increase of 238

|

|

|

Semiconductor Parts Group

|

|

|

8,780

|

|

|

|

Decrease of 1,690

|

|

|

Applied Ceramic Products Group

|

|

|

7,938

|

|

|

|

Increase of 332

|

|

|

Electronic Device Group

|

|

|

25,638

|

|

|

|

Increase of 5,735

|

|

|

Telecommunications Equipment Group

|

|

|

3,888

|

|

|

|

Decrease of 194

|

|

|

Information Equipment Group

|

|

|

15,049

|

|

|

|

Increase of 313

|

|

|

Others

|

|

|

5,589

|

|

|

|

Increase of 187

|

|

|

Headquarters

|

|

|

1,597

|

|

|

|

Decrease of 40

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

71,489

|

|

|

|

Increase of 4,881

|

|

|

|

|

|

|

|

|

|

|

|

Note: Number of employees represents the total number of regular employees who work full-time.

ii) Non-consolidated

|

|

|

|

|

|

|

Number of employees

|

|

|

14,773

|

|

|

Change from the end of fiscal 2011

|

|

|

Increase of 88

|

|

|

Average age

|

|

|

39.5

|

|

|

Average years of service

|

|

|

15.8

|

|

Note: Number of employees represents the total number of regular employees who work full-time.

14

2. Shares

(as

of March 31, 2012)

|

|

|

|

|

|

|

(1) Total Number of Shares Authorized to be Issued:

|

|

600,000,000

|

|

|

|

|

|

|

|

(2) Total Number of Shares Issued:

|

|

191,309,290

|

|

|

(7,865,370 treasury shares are included in the total number of shares issued set forth above.)

|

|

|

|

|

|

|

(3) Number of Shareholders:

|

|

65,055

|

|

|

(4) Major Shareholders (Top 10)

|

|

|

|

|

|

|

|

|

|

|

Name

|

|

Share Ownership

(in

thousands)

|

|

|

Shareholding

Ratio

(%)

|

|

|

The Master Trust Bank of Japan, Ltd. (Trust Account)

|

|

|

12,999

|

|

|

|

7.09

|

|

|

Japan Trustee Services Bank, Ltd. (Trust Account)

|

|

|

12,814

|

|

|

|

6.99

|

|

|

The Bank of Kyoto, Ltd.

|

|

|

7,218

|

|

|

|

3.93

|

|

|

State Street Bank and Trust Company

|

|

|

6,847

|

|

|

|

3.73

|

|

|

Kazuo Inamori

|

|

|

5,606

|

|

|

|

3.06

|

|

|

The Inamori Foundation

|

|

|

4,680

|

|

|

|

2.55

|

|

|

SSBT OD05 Omnibus Account – Treaty Clients

|

|

|

3,753

|

|

|

|

2.05

|

|

|

KI Enterprise Co., Ltd.

|

|

|

3,550

|

|

|

|

1.94

|

|

|

JPMorgan Securities Japan Co., Ltd.

|

|

|

3,032

|

|

|

|

1.65

|

|

|

Stock Purchase Plan for Kyocera Group Employees

|

|

|

2,689

|

|

|

|

1.47

|

|

Note: Shareholding ratios are calculated after deduction of the treasury shares.

15

3. Directors and Corporate Auditors

(1) List of Directors and Corporate Auditors

(as of March 31, 2012)

|

|

|

|

|

|

|

Title

|

|

Name

|

|

Duties and Other Significant

Responsibilities

|

|

Chairman of the Board and Representative Director

|

|

Makoto Kawamura

|

|

|

|

|

|

|

|

President and Representative Director

|

|

Tetsuo Kuba

|

|

President and Executive Officer

|

|

|

|

|

|

Vice President and Representative Director

|

|

Tatsumi Maeda

|

|

Vice President and Executive Officer

General Manager of Corporate R&D Group and Corporate Solar Energy Group

|

|

|

|

|

|

Vice President and Representative Director

|

|

Hisao Hisaki

|

|

Vice President and Executive Officer

General Manager of Corporate Development Group

|

|

|

|

|

|

Director

|

|

Yasuyuki Yamamoto

|

|

Managing Executive Officer

General Manager of Corporate Communication Equipment Group

|

|

|

|

|

|

Director

|

|

Goro Yamaguchi

|

|

Managing Executive Officer

General Manager of Corporate Semiconductor Components Group

|

|

|

|

|

|

Director

|

|

Shoichi Aoki

|

|

Managing Executive Officer

General Manager of Corporate Financial and Business Systems Administration Group

|

|

|

|

|

|

Director

|

|

Katsumi Komaguchi

|

|

Managing Executive Officer

President and Representative Director of

Kyocera Mita Corporation

|

|

|

|

|

|

Director

|

|

Tsutomu Yamori

|

|

Managing Executive Officer

General Manager of Corporate General Affairs Human Resources Group

|

|

|

|

|

|

Director

|

|

Yoshihito Ohta

|

|

Managing Executive Officer

General Manager of Corporate Office of

the Chief Executives

|

|

|

|

|

|

Director

|

|

Rodney N. Lanthorne

|

|

Vice Chairman of the Board and Director of Kyocera International, Inc.

|

|

|

|

|

|

Director

|

|

John S. Gilbertson

|

|

President and Director and Chief Executive Officer of AVX Corporation

|

|

|

|

|

|

Full-time Corporate Auditor

|

|

Yoshihiko Nishikawa

|

|

|

|

|

|

|

|

Full-time Corporate Auditor

|

|

Yoshihiro Kano

|

|

|

|

|

|

|

|

Corporate Auditor

|

|

Osamu Nishieda

|

|

Attorney at Law

|

|

|

|

|

|

Corporate Auditor

|

|

Kazuo Yoshida

|

|

Professor, Graduate School of Economics,

Kyoto University

|

|

|

|

|

|

Corporate Auditor

|

|

Yoshinari Hara

|

|

Chief Corporate Adviser of Daiwa Securities Group Inc.

|

16

Notes:

|

1.

|

Other significant responsibilities undertaken by Directors and Corporate Auditors in fiscal 2012.

|

|

|

(1)

|

Messrs. Makoto Kawamura, Chairman of the Board and Representative Director, Tetsuo Kuba, President and Representative Director, Tatsumi Maeda, Vice President and

Representative Director and Rodney N. Lanthorne, Director, serve as Directors of AVX Corporation.

|

|

|

(2)

|

Mr. Makoto Kawamura, Chairman of the Board and Representative Director, serves as an outside Director of KDDI Corporation.

|

|

|

|

Mr. Yoshihiko Nishikawa, Corporate Auditor, serves as an outside Corporate Auditor of KDDI Corporation.

|

|

|

(3)

|

Yoshihito Ohta, Director, serves as a Senior Managing Executive Officer of Japan Airlines Co., Ltd.

|

|

|

(4)

|

Mr. Kazuo Yoshida, Corporate Auditor, served as an outside Corporate Auditor of West Japan Railway Company until June 23, 2011. There are no special interests

between West Japan Railway Company and Kyocera Corporation.

|

|

|

(5)

|

Mr. Yoshinari Hara, Corporate Auditor, serves as an outside Director of NEC Corporation, with which Kyocera Corporation engages in transactions relating to sale of

products and purchase of goods.

|

|

|

(6)

|

Mr. Yoshinari Hara, Corporate Auditor, served as an outside Director of Tokyo Stock Exchange Group, Inc. until June 21, 2011. Kyocera Corporation is listed on

the First Section of Tokyo Stock Exchange, Inc., which is a subsidiary of Tokyo Stock Exchange Group, Inc.

|

|

2.

|

Messrs. Osamu Nishieda, Kazuo Yoshida and Yoshinari Hara are outside Corporate Auditors.

|

|

3.

|

Kyocera Corporation has designated Messrs. Kazuo Yoshida and Yoshinari Hara as independent auditors as provided for in the rules of the Tokyo Stock Exchange and the

Osaka Securities Exchange.

|

|

4.

|

“Title” and “Duties and Other Significant Responsibilities” of Directors and Corporate Auditors have been changed as of April 1, 2012, as

follows:

|

|

|

|

|

|