By Ted Greenwald, Kate O'Keeffe and Tripp Mickle

The Trump administration's extraordinary intervention against

the $117 billion takeover of Qualcomm Inc. surfaced suddenly last

week. But it was months in the making.

In December, Qualcomm's leaders, reeling from a year of battles

with customers and regulators in the U.S. and abroad, faced the

prospect of losing the company to a hostile takeover by Broadcom

Ltd. in what would be tech's biggest-ever takeover.

One potential hurdle to the bid, Qualcomm executives discussed,

was a protracted national-security review, according to people

familiar with the matter. Qualcomm lawyers reached out to Covington

& Burling LLP, which suggested filing unilaterally and

proactively for review of a possible deal by the Committee on

Foreign Investment in the U.S. to understand the risks, the people

said.

It was an unusual strategy. Normally both parties in a deal seek

approval by making a joint filing before CFIUS, the secretive

federal panel that vets foreign purchases of U.S. companies on

national-security grounds. And they don't usually file until there

is an actual deal on hand. But in January, Qualcomm approved.

"You don't treat a hostile the same way you do when someone

walks in and says, 'You want to get married?' " said a person

familiar with the discussions.

Qualcomm's Jan. 29 filing to CFIUS helped trigger a chain of

events that culminated in President Donald Trump's decision Monday

to block the deal.

Qualcomm's appeal tapped into gathering concern among some

congressional Republicans and the Trump administration about U.S.

national security and competitiveness with China, especially in

advanced technologies -- sentiment that already was fueling an

effort to expand the power of CFIUS. The company also got help from

sympathetic senators and representatives who pressed the

administration.

The confluence of corporate self-interest and geopolitical

considerations not only enabled Qualcomm to turn the tables on

Broadcom, but canonized the San Diego company as a sort of national

champion essential to battling China's might in the next-generation

wireless communications technology known as 5G.

The administration's intervention was all the more unusual

because it centered less on Broadcom's origin -- it is a

Singapore-domiciled company with about half of its employees in the

U.S. -- than on the idea that its stewardship could undermine

Qualcomm's innovative prowess, and by extension U.S. clout against

China and its tech juggernaut, Huawei Technologies Co.

"The administration's decision is a recognition that, in the

digital age, national security has different requirements," said

James Lewis, a technology-policy specialist at the Center for

Strategic and International Studies in Washington. "The line

between security and industrial policy is almost nonexistent in

this case."

Qualcomm's U.S. government connection dates back to founding in

1985 by Irwin Jacobs and six others who adapted U.S. military

technology known as CDMA, for Code Division Multiple Access, to

transmit digital signals over cellphone equipment. As mobile

networks grew globally, Qualcomm's CDMA technology became the U.S.

standard battling in markets like China against a competing

European technology called GSM.

Broadcom was founded six years after Qualcomm in Los Angeles.

When Broadcom later sought to move into the business of modem chips

-- Qualcomm's specialty -- it triggered a protracted patent dispute

and aroused the ire of Mr. Jacobs and his son, Paul, who thought

Broadcom's technology inferior, former employees said.

In 2016, Singapore-based Avago Technologies Ltd. acquired

Broadcom and took on its name. Avago CEO Hock Tan had built it

through a series of acquisitions, and had a reputation for

emphasizing cost discipline over R&D.

Irwin Jacobs, who served as Qualcomm's chairman until 2009, said

in an interview Monday he and his son had feared Broadcom would

curtail research and development and fundamentally change

Qualcomm's business.

Paul Jacobs, who was Qualcomm executive chairman before stepping

down Friday, dismissed Broadcom's offer as an opportunistic

financial move. He didn't respond to requests for comment.

Qualcomm had suffered setbacks last year, including lawsuits by

Apple Inc. and the U.S. Federal Trade Commission alleging it used

improper tactics to enforce its dominance on certain smartphone

technology. Qualcomm denied those claims, but its stock fell by

more than 20% from January through October. Both cases are

pending.

Qualcomm's board rejected Broadcom's initial offer as too low

and subject to regulatory risks, though it later said Broadcom had

agreed to take steps to mitigate those risks. Qualcomm CEO Steve

Mollenkopf and General Counsel Donald Rosenberg argued internally

that Broadcom's approximately 12-month timetable for closing a deal

was unrealistic, according to a person familiar with their

thinking. Broadcom's previous acquisition, a $5.5 billion takeover

of Brocade Communications Systems Inc., had taken longer than

expected because of a CFIUS review.

Mr. Tan had tried to address such concerns. Just before the

Qualcomm bid became public in November, he stood with President

Trump at the White House to announce that Broadcom would redomicile

in the U.S.. That move could have rendered CFIUS review

inapplicable. Broadcom expected to complete the move by spring.

Meanwhile Qualcomm went to lawyers at Covington & Burling to

gauge the likelihood any potential Broadcom deal would pass CFIUS

review, said people familiar with the discussions.

Qualcomm's Jan. 29 CFIUS filing laid out its pitch that a

Broadcom takeover would weaken Qualcomm -- and thereby the U.S.,

according to one of the people.

CFIUS members already were growing wary of deals with potential

national-security ramifications linked to China, and the Trump

administration had declared the establishment of a national 5G

network a priority.

Looming over the considerations was China's Huawei, which had

grown into the No. 1 global supplier of telecom equipment and a

major force in the development of 5G technology despite being

largely blocked from the U.S. market. A 2012 congressional report

had determined that its equipment could be used for spying or

crippling the U.S. telecommunications network, which the company

has denied.

Still, CFIUS remained divided on when it could review Broadcom's

proposed deal for Qualcomm. Qualcomm wanted it to step in before

March 6, when shareholders were to vote on whether to replace six

of its 11 directors with nominees put forward by Broadcom, a result

that could have sealed the takeover.

Qualcomm's concerns were shared on Capitol Hill. Senate Majority

Whip John Cornyn (R., Texas) in November had introduced a bill to

broaden CFIUS's authority, especially to scrutinize Chinese

technology deals.

Mr. Cornyn sent a letter to Treasury Secretary Steven Mnuchin,

who chairs CFIUS, on Feb. 26, requesting the panel review the deal.

Multiple House Republicans also wrote to Mr. Mnuchin about

Qualcomm.

Two days before Qualcomm's March 6 meeting, on Sunday night,

CFIUS told the companies it would review the potential deal

immediately, skipping a typical 30-day preliminary assessment

period and plunging into its investigation of potential national

security threats, according to people familiar with the matter.

Broadcom said it was blindsided.

Broadcom sprang into action. It issued a statement touting its

commitment to invest in Qualcomm's 5G technology, and moved to

accelerate its move from Singapore to the U.S., which required

shareholder approval.

But that only angered CFIUS, which had ordered Broadcom to give

it five days' notice before taking any action to redomicile.

Broadcom says it complied with CFIUS's order and that its deal

presented no national security concerns.

On Sunday, CFIUS sent another letter to Qualcomm and Broadcom,

signaling it would ensure the deal was blocked.

Broadcom's Mr. Tan met with the CFIUS agencies Monday,

expressing why it should be permitted to proceed, according to a

person briefed on the encounter. Officials listened but said

nothing, the person said.

Broadcom published a presentation Monday highlighting its

extensive U.S. operations and "50-year American heritage," and

calling itself "an American success story."

It was too late. Hours after Mr. Tan's meetings, Mr. Trump

issued a presidential order blocking the deal.

--John D. McKinnon contributed to this article.

Write to Ted Greenwald at Ted.Greenwald@wsj.com, Kate O'Keeffe

at kathryn.okeeffe@wsj.com and Tripp Mickle at

Tripp.Mickle@wsj.com

(END) Dow Jones Newswires

March 13, 2018 20:31 ET (00:31 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

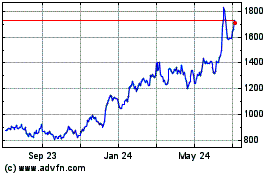

Broadcom (NASDAQ:AVGO)

Historical Stock Chart

From Mar 2024 to Apr 2024

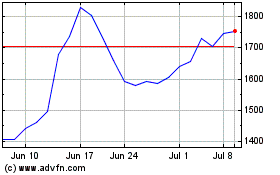

Broadcom (NASDAQ:AVGO)

Historical Stock Chart

From Apr 2023 to Apr 2024