Ratepayers Seek Seat in PG&E Negotiations -- WSJ

April 20 2019 - 3:02AM

Dow Jones News

By Peg Brickley

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (April 20, 2019).

A push for an official voice for ratepayers in PG&E Corp.'s

bankruptcy case is gaining momentum as California's largest utility

confronts the fallout from years of wildfires linked to its

equipment.

The Utility Reform Network, or Turn, is asking for a seat at the

bargaining table for customers as PG&E negotiates with

investors and wildfire victims over its future.

Ratepayers want to make sure they don't have to pay the price

for PG&E's safety failures, said Turn Executive Director Mark

Toney in an interview. Backed by representatives of big utility

customers and the Public Advocate's Office of the California Public

Utilities Commission, the nonprofit is campaigning for the

appointment of an official committee in PG&E's bankruptcy

case.

"We want to protect the ratepayers' interests as creditors,"

said Mr. Toney.

PG&E filed for chapter 11 protection at the end of January,

after being hit with claims for an estimated $30 billion in damage

from wildfires. PG&E hasn't responded to the request for a

ratepayer committee, which came in a series of filings in the U.S.

Bankruptcy Court in San Francisco.

California Gov. Gavin Newsom has suggested a state fund be

created to cushion utilities against the shock of wildfire damages,

exciting both shareholders and bondholders.

Ultimately, someone will have to pay, either shareholders or

ratepayers, for such a fund, which is being talked about as a fund

of $15 billion or more, according to a recent report from Moody's

Investors Service.

"If the fund is financed through higher rates, the burden would

be borne by customers," Moody's analysts warned.

The lawsuits that pushed PG&E into bankruptcy blame lax

safety practices for the wildfires, but the utility's plight has

spurred discussions of the role of climate change in the risks

faced by energy companies.

Southern California Edison this month asked the Federal Energy

Regulatory Commission to adjust its return on equity to account for

"extraordinary" wildfire risk, citing uncertainty about how

utilities would recover the costs stemming from escalated chances

of fire.

This is PG&E's second trip through bankruptcy. In the first

chapter 11 proceeding, which began in April 2001, PG&E

convinced U.S. District Judge Dennis Montali to disband a

ratepayers committee that had been appointed by federal bankruptcy

watchdogs. Judge Montali is also presiding over the new case.

In the new case, there are official committees representing

creditors and for people with damage claims from the fires. The

committee representing bondholders and trade creditors has asked

court permission to hire a lobbying firm, to advance the agenda of

financial creditors before governmental bodies, in addition to its

lawyers and other advisers.

"This is not a slam dunk by any means," Mr. Toney said. However,

Turn and allied ratepayer groups decided to try for a voice in

bankruptcy court because so much is at stake, he said.

"We want to make sure that ratepayers don't get hosed as we did

in the last settlement," he said. "All creditors got 100 cents on

the dollar at the expense of ratepayers being soaked for

approximately $7 billion."

Write to Peg Brickley at peg.brickley@wsj.com

(END) Dow Jones Newswires

April 20, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

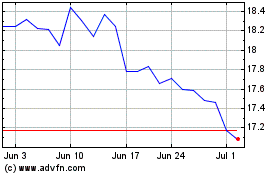

PG&E (NYSE:PCG)

Historical Stock Chart

From Mar 2024 to Apr 2024

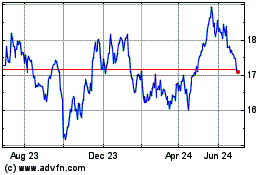

PG&E (NYSE:PCG)

Historical Stock Chart

From Apr 2023 to Apr 2024