Qualcomm's Profit Tumbles as Royalty Disputes Continue -- 3rd Update

April 25 2018 - 7:21PM

Dow Jones News

By Ted Greenwald

Qualcomm Inc. said its profit plunged 52% from a year earlier as

it dealt with a tangle of challenges, including Apple Inc. and

Huawei Technologies Co. continuing to withhold royalties for using

the company's patents.

The San Diego-based chip maker reported a profit of $363 million

for its fiscal second quarter. Revenue rose 4.9% to $5.26

billion.

The chip maker's shares were up 1.8% in after-hours trading. The

stock finished Wednesday's session down 0.4% at $49.75, below its

price of $53 a year ago and well below the $79 a share offered by

Broadcom Inc. in an unsuccessful takeover effort that ended in

March.

The results included a $310 million charge resulting from the

company's efforts to save $1 billion in expenses by 2019. That

program recently resulted in 1,500 layoffs in California.

Further cost cuts will be made "over the next few months,"

Qualcomm finance chief George Davis said in an interview.

Qualcomm said revenue from the sales of chips used in mobile

devices rose 6% to $3.9 billion, continuing their steady growth in

recent quarters.

Qualcomm's revenue from licensing patents, though, tumbled 44%

to $1.26 billion, amid fallout from the company's lengthy disputes

with Apple and Huawei, which have withheld billions of dollars in

royalty payments. That part of the business typically contributes

more than half of Qualcomm's pretax earnings.

Patent-licensing revenue will decline further in the months

ahead, Qualcomm said on a conference call with analysts. For the

current fiscal third quarter, it forecast lower revenue in that

division by 10% to 27% from a year earlier. Some of the expected

decline is due to terms of a revised licensing agreement with

Samsung Electronics Co., the company said, and some is attributable

to lower-cost agreements originally negotiated in China that are

being rolled out world-wide.

Qualcomm leads the market in chips used in smartphones. Its

products manage communications in some iPhones and they form the

heart of many Android devices. As a holder of important patents on

cellular technology, Qualcomm collects a royalty on nearly every

smartphone sold world-wide, regardless of whether they include

Qualcomm chips.

But the company in recent years has been beset by one challenge

after another, capped by Broadcom's $117 billion hostile bid in

November that was to become a relentless distraction throughout the

first quarter. The Trump administration in March scuttled

Broadcom's overture to protect Qualcomm's leadership in the

next-generation cellular technology known as 5G.

Now Qualcomm faces several tough tasks: Complete its purchase of

Dutch automotive chip maker NXP Semiconductors NV, a deal that is

stalled in China's regulatory approval process; slash $1 billion in

expenses to meet its profit goals; and settle its disputes with

Apple and Huawei.

"We're executing on the plan we laid out that leads to our 2019

target" of between $6.75 and $7.50 in adjusted per-share earnings

for that fiscal year, Chief Executive Steve Mollenkopf said in an

interview.

Qualcomm is banking on its acquisition of NXP to immediately

contribute $1.50 to its adjusted per-share earnings and broaden its

product line, potentially reducing its dependence on royalties. The

deal has passed muster in eight countries, but Chinese authorities

are giving it a close look amid escalating trade tensions between

the U.S. and China.

The company is "optimistic" about getting approval from China's

Ministry of Commerce, also known as Mofcom, Mr. Mollenkopf said on

the conference call with analysts. But "the environment is

obviously quite difficult from a geopolitical point of view, at

least right now."

He said "the issue is probably more related to the higher-level

discussions between the countries as opposed to any individual

issue related to Mofcom."

Qualcomm and NXP recently extended the deadline for completing

the deal to July 25. "If it doesn't get done, we're going to move

on to another approach," Mr. Mollenkopf said.

Should the deal fall through, Qualcomm has pledged to buy back

enough of its own shares to boost earnings by an equivalent amount.

The buyback would be a "very large program" amounting to $20

billion to $30 billion, Mr. Davis said on the call.

But that wouldn't address the strategic reasons for buying the

automotive specialist, which Qualcomm has said would open a path to

markets it expects to be worth $77 billion by 2020.

In the conference call, Mr. Mollenkopf said Qualcomm has a

backlog of $4 billion in automotive contracts with companies

gearing up for cars enabled for 5G cellular technology in 2021.

Qualcomm reported per-share earnings of 80 cents on an adjusted

basis, omitting share-based compensation and other items. Analysts

had expected 70 cents a share on $5.19 billion in revenue,

according to a survey by Thomson Reuters.

Write to Ted Greenwald at Ted.Greenwald@wsj.com

(END) Dow Jones Newswires

April 25, 2018 19:06 ET (23:06 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

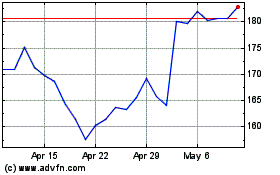

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Apr 2023 to Apr 2024