Q2 ETF Asset Report: Bond Funds Lead the Charge - ETF News And Commentary

July 03 2012 - 6:23AM

Zacks

The second quarter was, despite the overall market turmoil, a

pretty solid one for the broad ETF industry. A handful of new funds

hit the markets in a variety of industries while aggregate inflows

for the quarter approached $20 billion, cementing the industry over

the $1.1 trillion mark in terms of total AUM.

While the time period was undoubtedly an overall positive for

the broad ETF world, a few funds certainly led the way in terms of

asset accumulation. In fact, the seven biggest winners in terms of

inflows accounted for nearly $11.11 billion in new assets combined

(read The Five Best ETFs over the Past Five Years).

Interestingly, all of these funds are focused either on bonds or

large cap stocks, giving investors some insight into how market

participants have been positioning themselves over the past few

months. As you can see in the chart below, clearly ‘safer’ bond

ETFs have been in vogue, while more assets have also flowed into

S&P 500-centric funds as well:

|

ETF

|

Inflows for Q2

|

|

Vanguard MSCI Emerging Markets ETF (VWO)

|

$997.5 million

|

|

SPDR S&P 500 ETF (SPY)

|

$1.39 billion

|

|

Vanguard REIT Index ETF (VNQ)

|

$1.39 billion

|

|

PIMCO Total Return ETF (BOND)

|

$1.42 billion

|

|

Vanguard S&P 500 ETF (VOO)

|

$1.44 billion

|

|

Vanguard Total Bond Market ETF (BND)

|

$1.91 billion

|

|

iShares iBoxx $ Investment Grade Corporate Bond ETF

(LQD)

|

$2.56 billion

|

|

Data as of 7/3/2012 courtesy of XTF.com

|

|

Furthermore, it is important to note that while LQD saw huge

inflows, one of the most popular junk bond ETFs, JNK, was among the

biggest losers of assets in the time period, hemorrhaging close to

$1.2 billion in the time frame. Apparently, some investors focused

in on the high quality space instead of the high yield market

during the turmoil of the second quarter (read Seven Biggest Bond

ETFs by AUM).

This trend is further reflected by the next two bond products on

the list of the biggest winners, BND and BOND. While these two

funds do have the ability to hold high yield bonds, they both focus

on high quality or government debt, easily one of the key reasons

why they saw so much interest over the past few months.

In terms of equity assets, the relatively safe VOO and SPY were

among the biggest gainers while ETFs like QQQ, EEM and DIA, were

the only three equity funds to lose more than $1 billion in assets

during the second quarter. Curiously, QQQ and

DIA also follow benchmarks of high quality

companies but they are both heavily concentrated in just a few

names, suggesting that diversification was a key theme for

investors during the quarter (read Three ETFs with Incredible

Diversification).

Lastly, investors should also note the interesting juxtaposition

of the path of VWO and EEM, not only in this most

recent quarter but over the past few years as well. VWO added

nearly a billion dollars in assets in the time period while EEM

lost about $2 billion (see The Guide to the 25 Most Liquid

ETFs).

This might be somewhat curious given that both of the products

track the MSCI Emerging Markets Index, offering similar exposure to

a basket of (mainly) large cap stocks based in developing nations.

However, VWO charges investors just 20 basis points a year in fees

compared to 0.67% for EEM.

Thanks to this distinction, and the fact that both of the funds

track the same benchmark, VWO has managed to become the top ETF in

the emerging market space and is seemingly widening its lead on a

monthly basis. In fact, VWO has actually added over $41 billion in

the past three years while EEM has lost nearly $900 million in the

same time frame, demonstrating just how important expenses are to

some investors.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

Follow @Eric Dutram on Twitter

Author is long VWO.

VANGD-TOT BOND (BND): ETF Research Reports

PIMCO-TOT RETRN (BOND): ETF Research Reports

ISHARES GS CPBD (LQD): ETF Research Reports

SPDR-SP 500 TR (SPY): ETF Research Reports

VIPERS-REIT (VNQ): ETF Research Reports

VANGD-SP5 ETF (VOO): ETF Research Reports

VIPERS-M EM MKT (VWO): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

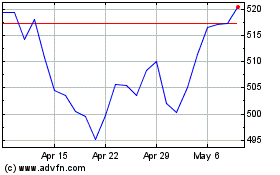

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Mar 2024 to Apr 2024

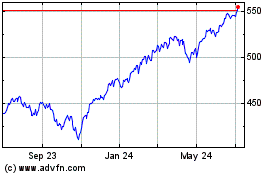

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Apr 2023 to Apr 2024