Conference call today at 1:30 p.m. PDT /

4:30 p.m. EDT

Pulse Biosciences, Inc. (Nasdaq: PLSE), a medical technology

company developing a proprietary therapeutic tissue treatment based

on its Nano-Pulse Stimulation platform today reports recent

corporate developments and financial results for the fiscal quarter

and year ended December 31, 2017.

Recent Developments

- Successfully completed patient

treatments and primary follow-up in the Company’s first clinical

study evaluating Nano-Pulse Stimulation for the treatment of a

benign skin condition, Seborrheic Keratosis (SK). The study

resulted in the successful delivery of 472 NPS applications

involving 58 patients and 174 SK lesions, with ZERO ADVERSE EVENTS

reported. The data adds to the mounting evidence regarding the

safety and ease with which patients can be treated with NPS for

skin-based lesions. The study data is scheduled for presentation in

a scientific symposium at the 38th American Society for Laser

Medicine and Surgery (ASLMS) Conference on Energy-Based Medicine

& Science being held April 13-15 in Dallas, Texas. The data

will be made available in a press release issued in conjunction

with the scientific presentation.

- An additional study “A dose-response

study of a novel non-thermal method of selectively modifying

cellular structure in skin with low energy nanosecond electrical

stimulation” was also accepted for presentation at the ASLMS

Conference and awarded “BEST OF SESSION” honors by ASLMS.

- Completed enrollment and follow-up on

five animals in the company’s investigational feasibility study

evaluating NPS for the treatment of late stage oral melanoma in

canines.

- Published “Nano-Pulse Stimulation

induces immunogenic cell death in human papillomavirus-transformed

tumors and initiates an adaptive immune response” in the

peer-reviewed journal, PLOS One.

“2017 was a transformational year for Pulse Biosciences as we

completed patient treatments and follow-up in our first skin lesion

study, advanced our oncology program with preclinical publications

and an investigational feasibility study in veterinary medicine,

welcomed four new board members, and secured the financing

necessary to advance our proprietary technologies,” said Darrin

Uecker, President and Chief Executive Officer. “We are well

positioned to make significant advancements in 2018 and are most

pleased with our successful SK study and look forward to sharing

the results of the study in April.”

Financial Highlights

Cash, cash equivalents, and investments totaled

$38.1 million at December 31, 2017, compared to

$16.4 million at December 31, 2016, reflects the proceeds

from the $30.0 million financing completed in

September of 2017, as well as the Company’s February 2017

financing. Cash use totaled $3.9 million for the fourth

quarter of 2017 and $13.1 million for 2017. 2018 Cash use is

currently anticipated to total $20 million.

Operating expenses for the quarter ended

December 31, 2017, totaled $8.8 million, compared to

$7.5 million for the quarter ended September 30, 2017,

and $2.8 million for the quarter ended December 31, 2016.

The operating expenses for the quarter ended December 31, 2017

included non-cash stock-based compensation of $4.5 million,

compared to $3.4 million for the quarter ended

September 30, 2017 and $0.2 million for the quarter ended

December 31, 2016.

Conference Call Details

Pulse Biosciences’ Darrin Uecker, President and Chief Executive

Officer, and other senior executives will host the investor call on

March 16, 2018, at 1:30 p.m. PDT / 4:30 p.m. EDT. The telephone

dial-in number for the call is (844) 494-0190 (U.S. toll-free) or

(508) 637-5580 (international) using Conference ID 1487908.

Listeners will also be able to access the call via webcast

available on the Investors section of the Company’s website at

www.pulsebiosciences.com.

About Pulse Biosciences

Pulse Biosciences is a clinical stage electroceutical, an

electrical energy based therapeutic company pursuing commercial

applications of its proprietary Nano-Pulse Stimulation (NPS)

technology. NPS is a non-thermal, precise, focal, drug-free tissue

treatment technology utilizing nanosecond (billionth of a second)

range pulsed electric fields that directly affect the cell membrane

and intracellular structures and initiates programmed cell death in

treated cells. The unique ability of NPS to initiate cell death has

the potential to significantly benefit patients in a wide variety

of medical applications including applications in immuno-oncology

and dermatology, and other potential applications we may pursue in

the future. The initiation of programmed cell death by NPS results

in a minimal inflammatory response, which improves healing outcomes

and supports the replacement of treated tissue cells with healthy

tissue cells. In cancerous lesions, NPS has been shown in

preclinical models to induce immunogenic cell death (ICD), which

exposes the unique antigens of the treated cells to the immune

system and enrolls immune system cells, such as cytotoxic T-cells

to mount an adaptive immune response. Pulse Biosciences is

investigating a variety of applications for its technology that

exploits the technology’s unique biologic effect, including

immuno-oncology and dermatology. More information is available at

www.pulsebiosciences.com.

Forward-Looking Statements

All statements in this press release that are not historical are

forward-looking statements, including, among other things,

statements relating to Pulse Biosciences’ expectations regarding

regulatory clearance and the timing of FDA filings or approvals,

the mechanism of action of NPS treatments, current and planned

future clinical studies, other matters related to its pipeline of

product candidates, future financial performance and other future

events. These statements are not historical facts but rather are

based on Pulse Biosciences’ current expectations, estimates, and

projections regarding Pulse Biosciences’ business, operations and

other similar or related factors. Words such as “may,” “will,”

“could,” “would,” “should,” “anticipate,” “predict,” “potential,”

“continue,” “expects,” “intends,” “plans,” “projects,” “believes,”

“estimates,” and other similar or related expressions are used to

identify these forward-looking statements, although not all

forward-looking statements contain these words. You should not

place undue reliance on forward-looking statements because they

involve known and unknown risks, uncertainties, and assumptions

that are difficult or impossible to predict and, in some cases,

beyond Pulse Biosciences’ control. Actual results may differ

materially from those in the forward-looking statements as a result

of a number of factors, including those described in Pulse

Biosciences’ filings with the Securities and Exchange Commission.

Pulse Biosciences undertakes no obligation to revise or update

information in this release to reflect events or circumstances in

the future, even if new information becomes available.

PULSE BIOSCIENCES, INC. Consolidated Balance

Sheets (Unaudited) December 31,

December 31,

(in

thousands)

2017 2016 ASSETS Current assets: Cash and

investments $ 38,069 $ 16,395 Prepaid expenses and other current

assets 412 268 Total current assets

38,481 16,663 Leasehold improvements and equipment, net of

Accumulated depreciation 2,570 317 Intangible assets, net of

accumulated amortization 5,878 6,543 Goodwill 2,791 2,791 Other

assets 101 - Total assets $ 49,821

$ 26,314

LIABILITIES AND STOCKHOLDERS’

EQUITY Current liabilities: Accounts payable $ 782 $ 265

Accrued expenses 1,034 751 Deferred rent, current 397

- Total current liabilities 2,213 1,016 Long term

liabilities: Deferred rent 1,613 -

Total liabilities 3,826 1,016

Stockholders’ equity: Common stock 84,219 37,911 Accumulated other

comprehensive loss (51 ) (7 ) Accumulated deficit (38,173 )

(12,606 ) Total stockholders’ equity 45,995

25,298 Total liabilities and stockholders’ equity $

49,821 $ 26,314

PULSE BIOSCIENCES,

INC. Condensed Consolidated Statements of Operations

(Unaudited) Three-Month Periods Ended

December 31, September 30, December

31,

(in thousands,

except per share amounts)

2017 2017 2016 Revenue $ — $ — $

— Operating expenses: General and administrative 5,801 4,434

1,027 Research and development 2,864 2,925 1,649 Amortization of

intangible assets 166 166 167

Total operating expenses 8,831 7,525

2,843 Other income: Interest income 128

39 34 Total other income

128 39 34 Net loss $ (8,703 ) $

(7,486 ) $ (2,809 ) Net loss per share: Basic and diluted net loss

per share $ (0.53 ) $ (0.52 ) $ (0.21 ) Weighted average shares

used to compute net loss per common share — basic and diluted

16,574 14,381 13,315

PULSE BIOSCIENCES, INC. Condensed

Consolidated Statements of Operations (Unaudited)

Years Ended December 31, December

31,

(in thousands,

except per share amounts)

2017 2016 Revenue $ — $ — Operating

expenses: General and administrative 15,503 3,415 Research and

development 9,646 5,506 Amortization of intangible assets

665 665 Total operating expenses 25,814

9,586 Other income: Interest income 247

68 247 68 Net loss

$ (25,567 ) $ (9,518 ) Net loss per share: Basic and diluted net

loss per share $ (1.73 ) $ (0.86 ) Weighted average shares used to

compute net loss per common share — basic and diluted 14,754

11,009

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180316005821/en/

Pulse Biosciences, Inc.Investors:Brian DowSr. Vice President and

Chief Financial OfficerIR@pulsebiosciences.comorThe Trout GroupMike

Zanoni, 646-378-2924mzanoni@troutgroup.comorMedia:Sam Brown,

Inc.Christy Curran, 615-414-8668christycurran@sambrown.com

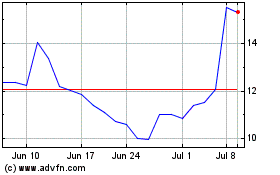

Pulse Biosciences (NASDAQ:PLSE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pulse Biosciences (NASDAQ:PLSE)

Historical Stock Chart

From Apr 2023 to Apr 2024