UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the

Registrant ☒ Filed by a Party other than the

Registrant ☐

Check the appropriate box:

|

|

|

|

|

☐

|

|

Preliminary Proxy Statement

|

|

|

|

|

☐

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

☒

|

|

Definitive Proxy Statement

|

|

|

|

|

☐

|

|

Definitive Additional Materials

|

|

|

|

|

☐

|

|

Soliciting Material Pursuant to § 240.14a-12

|

SELLAS LIFE SCIENCES GROUP, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

|

|

|

☒

|

|

No fee required.

|

|

|

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing

fee is calculated and state how it was determined):

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

☐

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

(4)

|

|

Date Filed:

|

315 Madison Avenue, 4

th

Floor, New York, New York

10017

(917) 438-4353

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

Dear Stockholder:

You are cordially invited to attend a

special meeting of stockholders of SELLAS Life Sciences Group, Inc., a Delaware corporation. The meeting will be held on April 25, 2018 at 9:00 a.m. Eastern time at 315 Madison Avenue, 3rd Floor, New York, New York 10017 for the following purposes:

|

(1)

|

To approve, as required by and in accordance with Nasdaq Listing Rule 5635(d), the issuance of securities that are potentially convertible into or exercisable for greater than 20% of our

pre-transaction

outstanding common stock, in a private placement, at a price less than the greater of book or market value, which securities consist of:

|

|

|

i.

|

an aggregate of 1,844,835 shares of our common stock, par value $0.0001 per share, issuable upon conversion of shares of our

non-voting

Series A 20% convertible preferred stock,

or the Series A preferred, issued or issuable pursuant to the Securities Purchase Agreement dated March 7, 2018, or the Purchase Agreement, as set forth in further detail in the accompanying proxy statement;

|

|

|

ii.

|

an aggregate of 1,383,631 shares of our common stock issuable exercise of warrants issued or issuable pursuant to the Purchase Agreement, as set forth in further detail in the accompanying proxy statement; and

|

|

|

iii.

|

any additional shares of our common stock that may be issuable pursuant to the terms of the Series A preferred and warrants, all as set forth in further detail in the accompanying proxy statement; and

|

|

(2)

|

To conduct any other business properly brought before the annual meeting and any adjournment or postponement thereof

|

These items of business are more fully described in the proxy statement accompanying this notice.

The record date for the special meeting is March 21, 2018. Only stockholders of record as of the close of business on that date may vote at the meeting

or any adjournment or postponement thereof.

|

|

|

|

|

By Order of the Board of Directors,

|

|

|

|

/s/ Angelos M. Stergiou

|

|

Angelos M. Stergiou, M.D., Sc.D., h.c.

|

|

President/CEO

|

New York, New York

April 6, 2018

You are cordially invited to attend the meeting in person. Whether or not you expect to attend the meeting, please complete, date, sign and

return the enclosed proxy, or vote over the telephone or the internet as instructed in these materials, as promptly as possible in order to ensure your representation at the meeting. Even if you have voted by proxy, you may still vote in person if

you attend the meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the meeting, you must obtain a proxy issued in your name from that record holder.

Table of Contents

SELLAS LIFE SCIENCES GROUP, INC.

315 Madison Avenue, New York, New York 10017

(917) 438-4353

PROXY STATEMENT FOR THE

SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON APRIL 25, 2018

QUESTIONS AND ANSWERS ABOUT THE SPECIAL MEETING

Why am I receiving these materials?

We have sent you

this proxy statement and the proxy card, or collectively, the proxy materials, because the Board of Directors of SELLAS Life Sciences Group, Inc. (sometimes referred to as our company or SELLAS) is soliciting your proxy to vote at the special

meeting of stockholders, including any adjournment or postponement thereof. This proxy statement summarizes the information you will need to know to cast an informed vote at the special meeting. You are invited to attend the special meeting to vote

on the proposals described in this proxy statement. However, you do not need to attend the meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card, or follow the instructions below to submit your proxy

over the telephone or through the internet.

We intend to begin mailing these proxy materials on or about April 6, 2018 to all stockholders of

record entitled to vote at the special meeting.

Will I receive any other proxy materials?

Rules adopted by the Securities and Exchange Commission, or the SEC, allow companies to send stockholders a notice of internet availability of proxy materials,

rather than mail them full sets of proxy materials. For this special meeting, we chose to mail full packages of proxy materials to stockholders. However, in the future we may take advantage of the internet distribution option. If, in the future, we

choose to send such notices, they would contain instructions on how stockholders can access our notice of the special meeting and proxy statement via the internet. They would also contain instructions on how stockholders could request to receive

their materials electronically or in printed form on a

one-time

or ongoing basis.

How do I attend the Special

Meeting?

The meeting will be held on April 25, 2018 at 9:00 a.m. Eastern Time at 315 Madison Avenue, 3rd Floor, New York, New York 10017.

Information on how to vote in person at the special meeting is discussed below.

Who can vote at the Special Meeting?

Only stockholders of record at the close of business on March 21, 2018 will be entitled to vote at the special meeting. On this record date, there

were 6,057,115 shares of common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If on March 21, 2018 your shares of common stock were registered directly in your name with SELLAS’s transfer agent, Computershare Trust

Company, N.A., or Computershare, then you are a stockholder of record. As a stockholder of record, you may vote in person at the meeting or vote by proxy. Whether or not you plan to attend the meeting, we urge you to fill out and return the enclosed

proxy card or vote by proxy over the telephone or on the internet as instructed below to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on March 21, 2018 your shares of common stock were held, not in your name, but rather in an account at a brokerage firm, bank, dealer or other similar

organization, then you are the beneficial owner of shares held in “street name” and

t

hese proxy materials are

being forwarded to you by that organization. The organization holding your account is considered to be the

stockholder of record for purposes of voting at the special meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend the annual meeting.

However, because you are not the stockholder of record, you may not vote your shares in person at the meeting unless you request and obtain a valid proxy from your broker or other agent.

What am I voting on?

There is only one matter scheduled

for a vote, Proposal No. 1. Proposal No. 1 seeks approval as required by Nasdaq Listing Rule 5635(d), of the issuance of securities that are potentially convertible into or exercisable for greater than 20% of our

pre-transaction

outstanding common stock, in a private placement, at a price less than the greater of book or market value.

What if another matter is properly brought before the meeting?

The Board of Directors knows of no other matters that will be presented for consideration at the special meeting. If any other matters are properly brought

before the meeting, it is the intention of the persons named in the accompanying proxy to vote on those matters in accordance with their best judgment.

How do I vote?

You may vote “For” or

“Against” or abstain from voting.

The procedures for voting are fairly simple:

Stockholder of Record: Shares Registered in Your Name

If

you are a stockholder of record, you may vote in person at the special meeting, vote by proxy using the enclosed proxy card, vote by proxy over the telephone, or vote by proxy through the internet. Whether or not you plan to attend the meeting, we

urge you to vote by proxy to ensure your vote is counted. You may still attend the meeting and vote in person even if you have already voted by proxy.

|

|

•

|

|

To vote in person, come to the special meeting and we will give you a ballot when you arrive.

|

|

|

•

|

|

To vote using the proxy card, simply complete, sign and date the enclosed proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the special meeting, we will vote

your shares as you direct.

|

|

|

•

|

|

To vote over the telephone, dial toll-free 1-800-652-VOTE (8683) using a touch-tone phone and follow the recorded instructions. You will be asked to provide the company number and control number from the enclosed

proxy card. Your telephone vote must be received by 1:00 a.m., Eastern Time on April 25, 2018 to be counted.

|

|

|

•

|

|

To vote through the internet, go to www.envisionreports.com/SLS to complete an electronic proxy card. You will be asked to provide the company number and control number from the enclosed proxy card. Your internet vote

must be received by 1:00a.m., Eastern Time on April 25, 2018 to be counted.

|

Beneficial Owner: Shares Registered in the Name of

Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received a voting

instruction form with these proxy materials from that organization rather than from SELLAS.

2.

Simply complete and mail the voting instruction form to ensure that your vote is counted. Alternatively, you may vote by telephone or over the internet as instructed by your broker or bank. To

vote in person at the special meeting, you must obtain a valid proxy from your broker, bank or other agent. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a proxy form.

Internet proxy voting may be provided to allow you to vote your shares online, with procedures designed to ensure the authenticity and

correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your internet access, such as usage charges from internet access providers and telephone companies.

How many votes do I have?

You have one vote for each

share of common stock you own as of the close of business on March 21, 2018.

What happens if I do not vote?

Stockholder of Record: Shares Registered in Your Name

If

you are a stockholder of record and do not vote by completing your proxy card, by telephone, through the internet or in person at the annual meeting, your shares will not be voted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank (Broker

non-votes)

If you are a beneficial owner and do not instruct your broker, bank, or other agent how to vote your shares, the question of whether your broker or nominee

will still be able to vote your shares depends on whether the New York Stock Exchange, or NYSE, deems the particular proposal to be a “routine” matter. Brokers and nominees can use their discretion to vote “uninstructed” shares

with respect to matters that are considered to be “routine,” but not with respect to

“non-routine”

matters. Under the rules and interpretations of the NYSE,

“non-routine”

matters are matters that may substantially affect the rights or privileges of stockholders. Accordingly, your broker or nominee may not vote your shares on Proposal No. 1 without

your instructions.

What if I return a proxy card or otherwise vote but do not make specific choices?

If you return a signed and dated proxy card or otherwise vote without marking voting selections on matters on which you are entitled to cast votes, your shares

will be voted, as applicable, “For” Proposal No. 1. If any other matter is properly presented at the meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

Who is paying for this proxy solicitation?

We

will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any

additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one set of proxy materials?

If you receive more than one set of proxy materials, your shares may be registered in more than one name or in different accounts. Please follow the voting

instructions on the proxy cards in the proxy materials to ensure that all of your shares are voted.

3.

Can I change my vote after submitting my proxy?

Stockholder of Record: Shares Registered in Your Name

Yes. You can revoke your proxy at any time before the final vote at the meeting. If you are the record holder of your shares, you may revoke your proxy in any

one of the following ways:

|

|

•

|

|

You may submit another properly completed proxy card with a later date.

|

|

|

•

|

|

You may grant a subsequent proxy by telephone or through the internet.

|

|

|

•

|

|

You may send a timely written notice that you are revoking your proxy to SELLAS’ Corporate Secretary at 315 Madison Avenue, 4

th

Floor, New York, New York, 10017.

|

|

|

•

|

|

You may attend the annual meeting and vote in person. Simply attending the meeting will not, by itself, revoke your proxy.

|

Your most current proxy card or telephone or internet proxy is the one that is counted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank.

How are votes counted?

Votes will be counted by the

inspector of election appointed for the meeting, who will separately count, for Proposal No. 1, votes “For” and “Against,” abstentions and, if applicable, broker

non-votes.

Broker

non-votes

have no effect and will not be counted towards any proposal.

How many votes are needed to approve Proposal

No. 1?

Proposal No. 1 needs “For” votes from the holders of a majority of votes cast. Abstentions and broker

non-votes

will have no effect.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders

holding

at least a majority of the voting

power of the outstanding shares of stock entitled to vote are present at the meeting in person or represented by proxy. On the record date, there were 6,057,115 shares

of common stock outstanding and entitled to vote.

Thus, the holders of

3,028,558

shares must be present in person or represented by proxy at the meeting to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or

if you vote in person at the meeting. Abstentions and broker

non-votes

will be counted towards the quorum requirement. If there is no quorum, the chairman of the meeting in person or represented by proxy may

adjourn the meeting to another date.

How can I find out the results of the voting at the special meeting?

Preliminary voting results will be announced at the special meeting. In addition, final voting results will be published in a current report on Form

8-K

that we expect to file within four business days after the special meeting. If final voting results are not available to us in time to file a

Form 8-K

within four

business days after the meeting, we intend to file a

Form 8-K

to publish preliminary results and, within four business days after the final results are known to us, file an additional

Form 8-K

to publish the final results.

4.

PROPOSAL NO. 1

APPROVAL OF THE STOCK ISSUANCE

We are

seeking stockholder approval, as required by Nasdaq Listing Rule 5635(d), of the potential issuance of securities convertible into, or exercisable for, shares of our common stock, par value $0.0001 per share, in excess of 20% of our

pre-transaction

outstanding shares of common stock, in a private placement at a price per share lower than the greater of book or market value of our shares of common stock on March 7, 2018, the date we entered

into the Purchase Agreement. Under the Purchase Agreement, we are obligated to seek stockholder approval no later than May 7, 2018 (within 60 days of the date of the Purchase Agreement), and are filing this proxy statement with the SEC in

connection therewith.

Background

Private

Placement

As disclosed in a Form

8-K

filed with the SEC on March 12, 2018, on March 7, 2018, we

entered into a Securities Purchase Agreement, or the Purchase Agreement, with a group of investors pursuant to which we agreed to sell to the investors, in a private placement pursuant to Rule 4(a)(2) and Regulation S under the Securities Act of

1933, as amended, or the Act, an aggregate of 10,700 shares of our newly-created

non-voting

Series A 20% Convertible Preferred Stock, par value $0.0001 per share, or the Series A Preferred, and warrants to

acquire an aggregate 1,383,631 shares of our common stock, par value $0.0001 per share, at an aggregate purchase price of $10,700,000. The Series A Preferred is initially convertible into 1,844,835 shares of our common stock based on an initial

conversion price of $5.80 per share.

At the first closing of the private placement on March 9, 2018, we issued an aggregate 5,987 shares of Series A

Preferred and warrants to acquire an aggregate 774,186 shares of our common stock for aggregate gross proceeds of $5,987,000. The second closing of the remaining 4,713 shares of Series A Preferred and warrants to acquire an aggregate of 609,445

shares of our common stock, for aggregate gross proceeds of $4,713,000, will occur within five business days of receipt of necessary stockholder approval of this Proposal No. 1 under the applicable rules and regulations of the Nasdaq Stock

Market LLC, as well as other customary closing conditions.

We intend to use the net proceeds from the private placement, primarily for the continued

advancement of our cancer immunotherapy pipeline, including our lead asset,

galinpepimut-S,

or GPS, which targets malignancies and tumors characterized by an overexpression of the Wilms’ Tumor 1, or WT1,

antigen, and for general corporate purposes.

The Purchase Agreement contains ordinary and customary provisions for agreements of its nature, such as

representations, warranties, covenants and indemnification obligations. The Purchase Agreement may be terminated prior to closing the sale of the remaining securities if the second closing shall not have occurred prior to June 5, 2018 (90 days

after the date of the Purchase Agreement). Stockholder approval of this Proposal No. 1 is a condition to the second closing.

Qualified Offering is

defined in the Purchase Agreement and the Certificate of Designation (as defined below) as a public offering raising aggregate gross proceeds of no less than $20.0 million. In the event of a Qualified Offering, under the Purchase Agreement,

investors have the right to acquire the securities sold in such Qualified Offering by converting their shares of Series A Preferred into the same securities on a $1.00 for $1.00 basis based on the stated value of their shares of Series A Preferred.

We may also be required to issue additional shares of our common stock pursuant to the terms of the Series A Preferred, as the Series A Preferred are

entitled to a dividend, which accrues at a rate of 20% per annum, and is payable in cash or shares of our common stock at our option. Accordingly, we may issue additional shares of our common stock to the investors as payment of the dividend. The

Series A Preferred and warrants also include anti-dilutions provisions that could result in the issuance of additional shares of our common stock upon conversion or exercise thereof, in particular if we issue securities at a price per share below

the then applicable conversion price or exercise price, as the case may be, subject to certain limitations as described below.

5.

In this Proposal No. 1, we are seeking stockholder approval for (a) the issuance of the common stock

upon conversion of the Series A Preferred, (b) the issuance of the common stock upon exercise of the warrants and (c) issuance of additional shares of common stock as contemplated by the terms of the Series A Preferred as reflected in the

Certificate of Designation and warrant terms, each as described below.

Certificate of Designation

On March 8, 2018, we filed a Certificate of Designation of Preferences, Rights and Limitations of Series A 20% Convertible Preferred Stock, or the

Certificate of Designation, with the Secretary of State of the State of Delaware, which designated up to 17,500 shares of Series A Preferred. The shares of Series A Preferred have a stated value equal to $1,000 and bear cumulative dividends, payable

in cash or shares of our common stock at our option, at a rate of 20% per annum, payable semiannually in arrears on June 30 and December 31, beginning on the first such date after issuance, and upon conversion if accrued and unpaid at such

time. Such dividends cease to accrue upon the consummation of a Qualified Offering (as defined therein).

Shares of Series A Preferred are

convertible into our common stock at the option the holder from time to time. Prior to receipt of stockholder approval, such conversion is limited to an investor’s

pro rata

share of the aggregate 19.99% limit under applicable Nasdaq

rules and regulations. Following receipt of stockholder approval of this Proposal No. 1, conversion will be subject to a beneficial ownership limitation of 4.99% (or 9.99% at the option of the investor).

The initial conversion price is $5.80 per share of common stock, subject to standard adjustments for certain transactions affecting our securities (such as

stock dividends, stock splits, and the like). Until consummation of a Qualified Offering, such conversion price is also subject to anti-dilution price protection in the event of

non-exempt

equity issuances at

a price per share lower than the then applicable conversion price. If we have not consummated a Qualified Offering (as defined in the Certificate of Designation) on or before September 9, 2018 (the six month anniversary of the first closing),

on each of the six month anniversary of the first and the second closings, the conversion price shall be reduced to the lesser of (x) the then applicable conversion price, as adjusted, (y) $3.00 (subject to adjustment for forward and reverse

stock splits and the like) and (z) the lowest volume weighted average price for any trading day during the five trading days immediately following each such adjustment date.

The Series A Preferred generally have no voting rights. However, for so long as any shares of Series A Preferred are outstanding, the affirmative vote of the

holders of a majority of the then outstanding shares of the Series A Preferred is required to: (a) alter or change adversely the powers, preferences or rights given to the Series A Preferred or alter or amend the Certificate of Designation,

(b) authorize or create any class of stock ranking as to dividends, redemption or distribution of assets upon a Liquidation (as defined in the Certificate of Designation) senior to, or otherwise

pari passu

with, the Series A Preferred

(c) amend its certificate of incorporation or other charter documents in any manner that adversely affects any rights of the holders of Series A Preferred, (d) increase the number of authorized shares of Series A Preferred, or

(e) enter into any agreement with respect to any of the foregoing.

Upon any liquidation, dissolution or

winding-up

of our company, whether voluntary or involuntary that is not a Fundamental Transaction (as defined in the Certificate of Designation), the holders of Series A Preferred are entitled to receive out

of our assets the same amount they would have received on an as converted basis, disregarding any conversion limitations. Such amounts are paid on a

pari passu

basis with all holders of our common stock.

Warrants

Under the Purchase Agreement, we agreed to

issue warrants to acquire an aggregate of 1,383,631 shares of our common stock, or approximately 75% of the shares of common stock into which the Series A Preferred are initially convertible. The warrants have an initial exercise price of $6.59 per

share, subject to adjustment in certain circumstances, may not be exercised until the date that is six months after issuance, and have a term of five years from the initial exercise date. Prior to receipt of stockholder approval of this Proposal

No. 1, exercise of the warrants is limited to an investor’s

pro rata

share of the aggregate 19.99% limit under applicable Nasdaq rules and regulations. Exercise is also subject to a beneficial ownership limitation of 4.99% (or 9.99%

at the option of the investor).

6.

Voting and

Lock-Up

Agreements

Our directors, executive officers and beneficial owners of more than 10% of our common stock, who collectively hold more than 50% of our outstanding voting

power, entered into voting agreements dated March 9, 2018 pursuant to which they agreed to vote in favor of any resolution presented to our stockholders to approve the issuance, in the aggregate, of greater than 19.99% of our common stock

outstanding prior to the entry into the Purchase Agreement, for less than the greater of the book or market value of our common stock as required by the listing rules of the Nasdaq Stock Market. In addition, such persons also entered into

lock-up

agreements pursuant to which they agreed to refrain from certain transactions in our equity securities until the earlier of (i) September 9, 2018 (the six month anniversary of the first closing)

and (ii) the initial closing date of a Qualified Offering (as such term is defined in the Purchase Agreement). Under the Purchase Agreement, we also agreed to refrain from issuing, or entering into any agreement to issue, or announcing the

issuance or proposed issuance of any shares of our common stock or common stock equivalents (subject to certain exclusions) prior to obtaining the stockholder approval we are seeking in this Proposal No. 1.

Reason for the Private Placement

As disclosed in the

proxy statement/prospectus/consent solicitation statement filed with the SEC on November 8, 2017 pertaining to the proposed business combination with SELLAS Life Sciences Group, Ltd., or Private SELLAS, we noted that the combined company,

following completion of the business combination, would need substantial additional capital to continue the clinical development and manufacturing of GPS. In light of this need, the Board determined that the private placement was in the best

interests of our company and our stockholders because the financing provided for our continuing operations and potential future growth, including development of our product candidates. Notably, the sale of the aggregate Series A Preferred pursuant

to the Purchase Agreement will generate $10.7 million of cash, and the warrants, if exercised for cash, would be a potential source of an additional $9.1 million of cash.

While the private placement is potentially significantly dilutive, if we had not been able to complete the private placement or another similar transaction in

the near term, we may not have the funds necessary to continue as a going concern and to continue to execute on our business strategy. If we are not able to complete the sale of the remaining Series A Preferred and warrants pursuant to the Purchase

Agreement, we could be required to, among other things, reduce our workforce, discontinue our development programs, liquidate all or a portion of our assets, and/or seek protection under the provisions of the U.S. Bankruptcy Code, all of which could

severely harm our business and our prospects and be detrimental to our stockholders.

Nasdaq Listing Rules

Because our common stock is traded on the Nasdaq Capital Market, we are subject to the Nasdaq Listing Rules, including Rule 5635(d).

Pursuant to Listing Rule 5635(d), stockholder approval is required prior to the issuance of securities in connection with a transaction (or a series of

related transactions) other than a public offering involving the sale, issuance or potential issuance of common stock (or securities convertible into or exercisable for common stock) equal to 20% or more of the common stock or 20% or more of the

voting power outstanding before the issuance for less than the greater of book or market value of the stock.

Effect of Issuance of Securities

The potential issuance of (x) the aggregate of 3,228,466 shares of our common stock underlying (i) the shares of Series A Preferred (an aggregate of

1,844,835 shares of common stock), and (ii) warrants (1,383,631shares of common stock) and (y) the potential additional shares of common stock issuable as payment of dividends on the Series A Preferred or pursuant to the anti-dilution

terms of the Series A Preferred and the warrants that are the subject of this Proposal No. 1 would result in an increase in the number of shares of common stock outstanding, and our stockholders will incur dilution of their percentage ownership

to the extent that the investors convert their shares of Series A Preferred or exercise the warrants or additional shares of common stock are issued as dividends or pursuant to the anti-dilution terms of the Series A Preferred as set forth in the

Certificate of Designation or the terms of the warrants.

7.

Required Vote

Stockholder approval of this Proposal No. 1 requires a “FOR” vote from at least a majority of the votes cast. Abstentions and broker

non-votes

are counted towards a quorum, but are not counted for any purpose in determining whether this matter has been approved.

Consequences if Stockholder Approval is Not Obtained

If

we do not obtain approval of this Proposal No. 1 at the special meeting of stockholders, we may not be able to close the sale of the remaining Series A Preferred or warrants pursuant to the Purchase Agreement within the time required, and the

Purchase Agreement could be terminated.

T

HE

B

OARD

OF

D

IRECTORS

R

ECOMMENDS

A V

OTE

IN

F

AVOR

OF

P

ROPOSAL

N

O

. 1.

8.

SECURITY OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information relating to the beneficial ownership of our common stock as of March 21, 2018, by:

|

|

•

|

|

each person, or group of affiliated persons, known by us to beneficially own more than 5% of our outstanding shares of common stock;

|

|

|

•

|

|

each of our named executive officers; and

|

|

|

•

|

|

all of our directors and executive officers as a group.

|

Beneficial ownership is based upon 6,057,115 shares

of common stock issued and outstanding as of March 21, 2018, and determined in accordance with the rules of the SEC and generally includes any shares over which a person exercises sole or shared voting or investment power. Unless otherwise

indicated, the persons or entities identified in this table have sole voting and investment power with respect to all shares shown beneficially owned by them, subject to applicable community property laws. Shares of common stock issuable upon

vesting of outstanding equity awards that are exercisable or subject to vesting within 60 days after March 21, 2018 are deemed beneficially owned and such shares are used in computing the percentage ownership of the person holding the awards,

but are not deemed outstanding for the purpose of computing the percentage ownership of any other person. The information contained in the following table is not necessarily indicative of beneficial ownership for any other purpose, and the inclusion

of any shares in the table does not constitute an admission of beneficial ownership of those shares.

As otherwise noted below, the address for persons

listed in the table is c/o SELLAS Life Sciences Group, Inc., 315 Madison Avenue, 4

th

Floor, New York, New York, 10017.

|

|

|

|

|

|

|

|

|

|

|

Name of Beneficial Owner

|

|

Number

|

|

|

Percentage of

Shares

Beneficially Owned

|

|

|

Five Percent Stockholders (other than directors and officers):

|

|

|

|

|

|

|

|

|

|

Equilibria Capital Management and

affiliates

(1)

|

|

|

3,054,809

|

|

|

|

50.4

|

%

|

|

|

|

|

|

Named Executive Officers and Directors:

|

|

|

|

|

|

|

|

|

|

Angelos M. Stergiou, M.D., Sc.D., h.c.,

President, Chief Executive Officer and

Director

|

|

|

450,135

|

|

|

|

7.4

|

%

|

|

Aleksey Krylov,

Interim Chief Financial Officer

|

|

|

0

|

|

|

|

—

|

|

|

Nicolas J. Sarlis, M.D., Ph.D., FACP

Chief Medical Officer

|

|

|

0

|

|

|

|

—

|

|

|

Gregory M. Torre, Ph.D., J.D.,

Chief Regulatory Officer

|

|

|

0

|

|

|

|

—

|

|

|

Barbara Wood,

General Counsel and Secretary

|

|

|

0

|

|

|

|

—

|

|

|

Jane Wasman,

Chairman of the Board

|

|

|

0

|

|

|

|

—

|

|

|

Stephen Ghighlieri,

Director

(2)

|

|

|

586

|

|

|

|

*

|

|

|

Fabio Lopez,

Director

(3)

|

|

|

3,051,466

|

|

|

|

50.4

|

%

|

|

David L. Scheinberg, M.D., Ph.D.,

Director

|

|

|

0

|

|

|

|

—

|

|

|

Robert Van Nostrand,

Director

|

|

|

0

|

|

|

|

—

|

|

|

John Varian,

Director

|

|

|

0

|

|

|

|

—

|

|

|

All current executive officers and directors as a group (11 persons)

|

|

|

3,508,873

|

|

|

|

57.9

|

%

|

|

*

|

Represents beneficial ownership of less than one percent (1%) of the outstanding common stock.

|

(1) Includes

(i) 1,521,863 shares held directly by EQC Private Markets SAC Fund II Ltd—EQC Biotech Sely S Fund, or Sely S, a Bermuda mutual fund company, (ii) 676,324 shares held directly by EQC Private Markets SAC Fund Ltd—EQC Biotech Sely I

Fund, or Sely I, Bermuda mutual fund company, (iii) 325,799 shares held directly by EQC Private Markets SAC Fund Ltd—EQC Biotech Sely II Fund, or Sely II, Bermuda mutual fund company, (iv) 58,208 shares held by EQC Private Markets II SAC Fund

Ltd—EQC Biotech Sely III Fund, or Sely III, a Bermuda mutual fund company, (v) 149,766 shares held directly by Equilibria Capital Management Limited, or Equilibria, a Bermuda limited liability company, (vi) warrants to purchase 316,163

shares held by Sely I (vii) 3,343 shares held by Varibobi Financial Holdings Limited, a Cyprus limited liability company and (viii) 3,343 shares held by Daniel Tafur. Equilibria manages Sely S, Sely I, Sely II and Sely III and may be deemed to

beneficially hold

9.

shares held directly by such funds. Varibobi Financial Holdings Limited is an owner of Equilibria and may be deemed to beneficially hold shares beneficially owned by Equilibria. Fabio

López is the owner of Varibobi Financial Holdings Limited, a Cyprus limited company and the chief executive officer of Equilibria and may be deemed to be the indirect beneficial owner of the shares owned by Equilibria. Elystone S.A. is an

owner of Equilibria and may be deemed to beneficially hold shares beneficially owned by Equilibria. Luis Palacios is a founder and majority owner of Elystone Capital SA, and may be deemed to be the indirect beneficial owner of the shares owned by

Equilibria. Mr. Tafur is chief investment officer, founder and board member of Equilibria and may be deemed to beneficially own shares beneficially owned by Equilibria. The principal business address of Equilibria is O’Hara House, One

Bermudiana Road, Hamilton, HM08.

(2) Represents shares subject to options.

(3) Includes (i) 3,343 shares held by Varibobi Financial Holdings Limited and (ii) 3,048,123 shares beneficially held by entities

affiliated with Equilibria. Mr. López is the owner of Varibobi Financial Holdings Limited, a Cyprus limited company, and the chief executive officer of Equilibria, and may be deemed to be the indirect beneficial owner of the shares owned

by Equilibria.

10.

HOUSEHOLDING OF PROXY MATERIALS

The SEC has adopted rules that permit companies and intermediaries (

e.g.

, brokers) to satisfy the delivery requirements for annual meeting materials

with respect to two or more stockholders sharing the same address by delivering a single set of annual meeting materials addressed to those stockholders. This process, which is commonly referred to as “householding,” potentially means

extra convenience for stockholders and cost savings for companies.

This year, a number of brokers with account holders who are stockholders will be

“householding” our proxy materials. single set of annual meeting materials will be delivered to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received

notice from your broker that they will be “householding” communications to your address, “householding” will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to

participate in “householding” and would prefer to receive a separate set of annual meeting materials, please notify your broker or us. Direct your written request to SELLAS Life Sciences Group, Inc., Corporate Secretary, 315 Madison

Avenue, 4

th

Floor, New York, New York, 10017. Stockholders who currently receive multiple copies of the annual meeting materials at their addresses and would like to request

“householding” of their communications should contact their brokers.

11.

OTHER MATTERS

The Board of Directors knows of no other matters that will be presented for consideration at the special meeting. If any other matters are properly brought

before the meeting, it is the intention of the persons named in the accompanying proxy to vote on such matters in accordance with their best judgment.

|

|

|

By Order of the Board of Directors

|

|

|

|

/s/ Barbara Wood

|

|

Barbara Wood, Esq.

|

|

Corporate Secretary

|

April 6, 2018

12.

|

|

|

|

|

|

|

|

|

Electronic Voting Instructions

You can vote by Internet or

telephone!

Available 24 hours a day,

7 days a week!

Instead of mailing your proxy, you may choose one of the two

voting methods outlined below to vote your proxy.

VALIDATION DETAILS ARE LOCATED

BELOW IN THE TITLE BAR.

Proxies submitted by the Internet or telephone must be

received by 1:00 a.m. Eastern Time, on April 25, 2018.

|

|

|

|

|

|

Vote by Internet

|

|

|

|

|

• Go to

www.envisionreports.com/SLS

|

|

|

|

|

• Or scan the QR code with your smartphone

|

|

|

|

|

• Follow the steps outlined on the secure website

|

|

|

|

Vote by telephone

|

|

|

|

• Call toll free

1-800-652-VOTE

(8683) within the USA, US territories & Canada on a touch tone telephone

• Follow the instructions

provided by the recorded message

|

|

|

|

|

|

|

|

|

|

|

|

Using a

black ink

pen, mark your votes with an

X

as shown in this example. Please do not write outside the designated areas.

|

|

|

|

|

|

|

|

|

q

IF YOU HAVE NOT VOTED VIA THE

INTERNET

OR

TELEPHONE, FOLD ALONG THE PERFORATION, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE.

q

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A

|

|

Proposals — THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” PROPOSAL 1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FOR

|

|

AGAINST

|

|

ABSTAIN

|

|

|

|

1. To approve, as required by and in accordance with Nasdaq Listing Rule 5635(d), the

issuance of shares of common stock upon conversion of our Series A 20% convertible preferred stock, warrants, and additional shares of our common stock in accordance with the terms of each, which shares of common stock, together, could represent

greater than 20% of our pre-transaction outstanding common stock.

|

|

☐

|

|

☐

|

|

☐

|

|

IF VOTING BY MAIL, YOU

MUST

COMPLETE SECTIONS A - C ON BOTH SIDES OF THIS CARD.

q

IF YOU HAVE NOT VOTED VIA THE INTERNET

OR

TELEPHONE, FOLD ALONG THE PERFORATION, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE.

q

|

|

|

|

|

Proxy — SELLAS Life Sciences Group, Inc.

|

|

|

|

|

|

PROXY FOR APRIL 25, 2018 SPECIAL MEETING OF STOCKHOLDERS

THIS PROXY IS SOLICITED BY THE BOARD OF DIRECTORS OF SELLAS LIFE SCIENCES GROUP, INC. AND MAY BE REVOKED BY THE STOCKHOLDER PRIOR TO ITS EXERCISE.

The undersigned stockholder of SELLAS Life Sciences Group, Inc., a Delaware corporation, acknowledges receipt of the notice of special meeting and proxy

statement dated April 6, 2018. The undersigned stockholder hereby also designates Angelos Stergiou and Aleksey Krylov, and each of them, as proxies and

attorneys-in-fact,

with full power to each other of substitution, on behalf and in the name of the undersigned, to represent the undersigned at the April 25, 2018

Special Meeting of Stockholders of SELLAS Life Sciences Group, Inc. to be held on April 25, 2018, at 9:00 a.m. local time, at the offices of SELLAS Life Sciences Group, Inc., 315 Madison Avenue, 3rd floor, New York, New York, and at any

adjournment or postponement thereof, and to vote all shares of Common Stock that the undersigned would be entitled to vote, if then and there personally present, on the matters set forth on the reverse side. The undersigned hereby revokes any

proxies previously given.

THE SHARES PRESENTED BY THIS PROXY WILL BE VOTED AS DIRECTED, OR IF NO CONTRARY DIRECTION IS INDICATED, WILL BE VOTED

“FOR” PROPOSAL 1 AND AS SAID PROXIES (OR ANY OF THEM) DEEM ADVISABLE ON SUCH OTHER MATTERS AS MAY PROPERLY COME BEFORE THE MEETING OR ANY POSTPONEMENT OR ADJOURNMENT THEREOF. THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE

“FOR” PROPOSAL 1.

Important Notice Regarding the Availability of Proxy Materials for the April 25, 2018 Special Meeting of

Stockholders to be held on April 25, 2018.

The Notice and Proxy Statement for the Special Meeting are available at www.envisionreports.com/SLS.

CONTINUED AND TO BE SIGNED ON REVERSE SIDE

|

|

|

|

|

|

|

Change of Address

— Please print new address below.

|

|

Meeting Attendance

|

|

|

|

|

|

Mark box to the right if

you plan to attend the

Special Meeting.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C

|

|

Authorized Signatures — This section must be completed for your vote to be counted. — Date and Sign Below

|

|

|

|

Please sign exactly as your name(s) appear(s) hereon. All holders must sign. When signing in a fiduciary capacity, please indicate full title as such. If a corporation or partnership, please sign in full corporate or partnership

name by authorized person.

|

|

|

|

|

|

|

|

|

|

|

|

Date (mm/dd/yyyy) — Please print date below.

|

|

|

|

Signature 1 — Please keep signature within the box.

|

|

|

|

Signature 2 — Please keep signature within the box.

|

|

|

|

|

|

|

|

/

/

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IF VOTING BY MAIL, YOU

MUST

COMPLETE SECTIONS A - C ON BOTH SIDES OF THIS CARD.

|

|

|

|

|

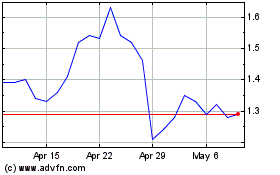

SELLAS Life Sciences (NASDAQ:SLS)

Historical Stock Chart

From Mar 2024 to Apr 2024

SELLAS Life Sciences (NASDAQ:SLS)

Historical Stock Chart

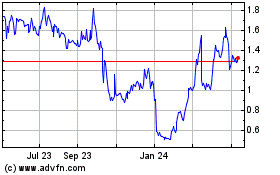

From Apr 2023 to Apr 2024