|

|

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

(5)

|

Total fee paid:

|

|

|

|

o

|

Fee paid previously with preliminary materials.

|

|

|

|

o

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

(3)

|

Filing Party:

|

|

|

(4)

|

Date Filed:

|

AUSCRETE CORPORATION

504 East First St. P.O. Box 847

Rufus, OR 97050

PRELIMINARY INFORMATION STATEMENT

WE ARE NOT ASKING YOU FOR A PROXY,

AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

INTRODUCTION

This Information Statement is furnished to the stockholders of Auscrete Corporation, a Wyoming corporation, in connection with action taken by our board of directors and the holders of a majority in interest of our voting capital stock to effect an amendment and restatement of our Articles of Incorporation (

“

Restatement

”

) to increase the authorized common shares of common stock and to effect a 1 for 100 reverse split of our common stock (

“

Reverse Split

”

). The foregoing actions have been ratified by the written consent of the holders of a majority in interest of our voting capital stock, consisting of our outstanding common as well as our board of directors, by written consent on June 6, 2017. We anticipate that a copy of this Definitive Information Statement will be mailed to our shareholders as of the date hereof. We have attached a copy of the Restatement to this Information Statement for your reference.

The Restatement and Reverse Split were effected as of June 6, 2017 but, under federal securities laws, are not effective until at least 20 days after the mailing of this Information Statement. We anticipate that the effective date for the Restatement and Reverse Split will be on or about June 26, 2017.

RECORD DATE, VOTE REQUIRED AND RELATED INFORMATION

If the Restatement and Reverse Split were not adopted by majority written consent, it would have been required to be considered by our stockholders at a special stockholders

’

meeting convened for the specific purpose of approving the Restatement and Reverse Split. The elimination of the need for a special meeting of stockholders to approve the Restatement and Reverse Split is made possible by § 17-16-704 of the Wyoming Business Corporation Act (the

“

Act

”

), which provides that the written consent of the holders of outstanding shares of voting capital stock, having not less than the minimum number of votes which would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted, may be substituted for such a special meeting. Pursuant to the Act, a majority in interest of our capital stock entitled to vote thereon is required in order to approve the Restatement and Reverse Split. In order to eliminate the costs and management time involved in holding a special meeting, our Board of Directors determined that it was in the best interests of all of our shareholders that the Restatement and Reverse Split be adopted by majority written consent and this Information Statement to be mailed to all stockholders as notice of the action taken.

The record date for purposes of determining the number of outstanding shares of our voting capital stock, and for determining stockholders entitled to vote, is the close of business on June 6, 2017 (the

“

Record Date

”

). As of the Record Date, we had outstanding:

(i)

534,824,788 shares of common stock; and

(ii)

4 shares of Series A Preferred Stock, which are collectively entitled to 4 times the aggregate votes of all other classes of capital stock of the Company, and may vote with holders of the Company

’

s common stock on all matters which common stockholders may vote;

(iii)

0 shares of Series B Preferred Stock, which are entitled to ten votes per share, and may vote with holders of the Company

’

s common stock on all matters which common stockholders may vote;

The transfer agent for our common stock is Colonial Stock Transfer Company, Inc., 66 Exchange Place, Suite 100, Salt Lake City, UT 841119.

NO MEETING OF STOCKHOLDERS REQUIRED

We are not soliciting any votes in connection with the Restatement and Reverse Split. The persons that have consented to the Restatement and Reverse Split hold a majority of the Company

’

s outstanding voting rights and, accordingly, such persons have sufficient voting rights to approve the Restatement and Reverse Split.

REVERSE STOCK SPLIT

On June 6, 2017, our board of directors and holders of a majority in interest of our voting capital stock approved a 1-for 100 reverse split of our common shares (

“

Reverse Split

”

). This approval is anticipated to be effective 20 days after this Information Statement has been distributed to our shareholders.

As a result of the Reverse Split, each shareholder of record as of June 6, 2017, will receive one (1) share of common stock for each one hundred (100) shares of common stock they held prior to the Reverse Split, provided however, that fractions of a share shall be rounded up to the nearest whole share.

Our board of directors believes that the Reverse Split is advisable and in the best interests of the Company and its stockholders to allow the Company to execute a new business plan and position itself to raise additional investment capital, if needed.

RESTATEMENT OF ARTICLES OF INCORPORATION

We are amending and restating our Articles of Incorporation in their entirety to increase our authorized common stock from 5,000,000,000 to 20,000,000,000 shares.

These changes to our Articles of Incorporation will enable the Company

’

s board of directors, without further authorization from shareholders, to issue up to 20,000,000,000 shares of common stock and up to 10,000,000 shares of preferred stock having such rights, privileges, and preferences as determined by the board of directors, for consideration deemed adequate in exchange for such shares. We have attached a copy of the Restatement to this Information Statement.

PLANS, ARRANGEMENTS, UNDERSTANDING OR AGREEMENTS, WRITTEN OR ORAL, WITH RESPECT TO THE ISSUANCE OF ANY NEWLY AUTHORIZED SHARES OF COMMON STOCK

We have discussed the possibility of issuing shares of common stock of the Company as a stock dividend, remuneration for management services, debt settlement, and incentive plans for new employees. We do not have any agreements, arrangements, or understandings yet with respect to any further issuances of shares of common stock, but it is likely that we will issue more common stock up to the amount of common stock authorized by our Articles of Incorporation. Any material common stock issuances will be disclosed in accordance with the disclosure requirements of the Securities Exchange Act of 1934.

The following table sets forth the beneficial ownership of each of our directors and executive officers, and each person known to us to beneficially own 5% or more of the outstanding shares of our common stock, and our executive officers and directors as a group, as of June 6, 2017. Beneficial ownership is determined in accordance with the rules of the SEC and includes voting or investment power with respect to the securities. Unless otherwise indicated, we believe that each beneficial owner set forth in the table has sole voting and investment power and has the same address as us. Our address is 504 East First St. P.O. Box 847 Rufus, OR 97050. As of June 6, 2017, we had 534,824,788 shares of common stock, 4 shares of Series A Preferred Stock, and 0 shares of Series B Preferred Stock issued and outstanding. While each share of common stock holds one vote, the shares of Series A Preferred Stock are collectively entitled to 4 times the aggregate votes of all other classes of capital stock of the Company. Shares of Series B Preferred Stock are entitled to ten votes per share. The following table describes the ownership of our voting securities (i) by each of our officers and directors, (ii) all of our officers and directors as a group, and (iii) each person known to us to own beneficially more than 5% of our common stock or any shares of our preferred stock.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amount and Nature of Beneficial Ownership

|

|

|

|

Name

|

|

Sole

Voting and

Investment

Power

|

|

Options

Exercisable

Within

60 Days

|

|

Other

Beneficial

Ownership

|

|

Total

(1)

|

|

Percent

of Class

Outstanding

(2)

|

|

A. John Sprovieri

(3)

|

|

172,265,000

|

|

-

|

|

-

|

|

172,265,000

|

|

32.21%

|

|

Clifford Jett

(4)

|

|

24,810,000

|

|

-

|

|

-

|

|

24,810,000

|

|

4.63%

|

|

All current directors and executive officers as a group (2 persons)

|

|

197,075,000

|

|

-

|

|

-

|

|

197,075,000

|

|

36.85%

|

____________________

*

Indicates less than one percent.

(1)

The calculation of total beneficial ownership for each person in the table above is based upon the number of shares of common stock beneficially owned by such person, together with any options, warrants, rights, or conversion privileges held by such person that are currently exercisable or exercisable within 60 days of the date of this prospectus.

(2)

Based on 534,824,788 shares of our common stock, issued and outstanding as of June 6, 2017.

(3)

Director, President and Secretary of the Company. Mr. Sprovieri holds 4 shares of Series A Preferred Stock which collectively hold 2,139,299,152 votes. If the votes of the Series A Preferred Stock are taken into account, Mr. Sprovieri would beneficially hold 86.44% of the voting securities of the Company.

(4)

Director of the Company.

NO DISSENTER

’

S RIGHTS

Under the Act, stockholders are not entitled to dissenter

’

s rights of appraisal with respect to the restatement of our Articles of Incorporation.

PROPOSALS BY SECURITY HOLDERS

No security holder has requested us to include any additional proposals in this Information Statement.

INTEREST OF CERTAIN PERSONS IN OR OPPOSITION TO MATTERS TO BE ACTED UPON

No officer, director or director nominee has any substantial interest in the matters acted upon by our Board and shareholders, other than his role as an officer, director or director nominee. No director has informed us that he intends to oppose the Restatement and Reverse Split.

ADDITIONAL INFORMATION

We file reports with the Securities and Exchange Commission (the

“

SEC

”

). These reports include annual and quarterly reports, as well as other information the Company is required to file pursuant to the Securities Exchange Act of 1934. You may read and copy materials we file with the SEC at the SEC

’

s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at

http://www.sec.gov

.

DELIVERY OF DOCUMENTS TO SECURITY HOLDERS SHARING AN ADDRESS

Only one Information Statement is being delivered to multiple security holders sharing an address unless we received contrary instructions from one or more of the security holders. We shall deliver promptly, upon written or oral request, a separate copy of the Information Statement to a security holder at a shared address to which a single copy of the document was delivered. A security holder can notify us that the security holder wishes to receive a separate copy of the Information Statement by sending a written request to us at 504 East First St. P.O. Box 847 Rufus, OR 97050, or by calling us at (541) 739-8298. A security holder may utilize the same address and telephone number to request either separate copies or a single copy for a single address for all future information statements and proxy statements, if any, and annual reports of the Company.

BY ORDER OF THE BOARD OF DIRECTORS

/s/ John Sprovieri

John Sprovieri

President

June 6, 2017

1

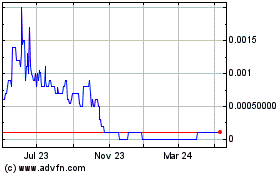

Auscrete (CE) (USOTC:ASCK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Auscrete (CE) (USOTC:ASCK)

Historical Stock Chart

From Apr 2023 to Apr 2024