Filed Pursuant to Rule 424(b)(5)

Registration No. 333-222046

PROSPECTUS SUPPLEMENT

(To Prospectus dated December 22, 2017)

$25,000,000

Common Stock

We have entered into a

common stock sales agreement (“sales agreement”), with H.C. Wainwright & Co., LLC (“Wainwright”), relating

to shares of our common stock, $0.01 par value per share, offered by this prospectus supplement and the accompanying prospectus.

In accordance with the terms of the sales agreement, we may offer and sell shares of our common stock having an aggregate offering

price of not more than $25,000,000.

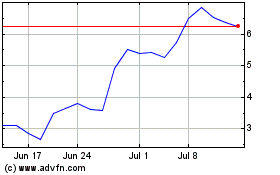

Our common stock is listed

on Nasdaq Capital Market under the symbol “CASI”. The last reported sale price of our common stock on February 22,

2018 was $3.75 per share.

Upon our delivery of a

placement notice and subject to the terms and conditions of the sales agreement, Wainwright may sell shares of our common stock

by methods deemed to be an “at the market offering” as defined in Rule 415 promulgated under the Securities Act of

1933, as amended (“Securities Act”). Wainwright will act as sales agent using its commercially reasonable efforts consistent

with its normal trading and sales practices, on mutually agreed terms between Wainwright and us. There is no arrangement for funds

to be received in any escrow, trust or similar arrangement.

Wainwright will be entitled

to compensation at a fixed commission rate of 3% of the gross proceeds of each sale of shares of our common stock. In connection

with the sale of our shares of common stock on our behalf, Wainwright will be deemed to be an “underwriter” within

the meaning of the Securities Act and the compensation of Wainwright will be deemed to be underwriting commissions or discounts.

We have also agreed to provide indemnification and contribution to Wainwright with respect to certain liabilities, including liabilities

under the Securities Act.

Investing in our

securities involves a high degree of risk. See “Risk Factors,” beginning on page S-5 of this prospectus supplement,

as well as the documents incorporated by reference in this prospectus supplement, for a discussion of the factors you should carefully

consider before deciding to purchase our securities.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this

prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal

offense.

H.C. Wainwright &

Co.

February 23, 2018

Table of Contents

Prospectus Supplement

Prospectus

ABOUT THIS PROSPECTUS SUPPLEMENT

This

document is in two parts. The first part is the prospectus supplement, including the documents incorporated by reference, which

describes the specific terms of this offering. The second part, the accompanying prospectus dated December 22, 2017, including

the documents incorporated by reference, provides more general information. Before you invest, you should carefully read this

prospectus supplement, the accompanying prospectus, all information incorporated by reference herein and therein, as well as the

additional information described under “Where You Can Find More Information” on page S-14 of this prospectus supplement.

These documents contain information you should consider when making your investment decision. This prospectus supplement may add,

update or change information contained in the accompanying prospectus. To the extent there is a conflict between the information

contained in this prospectus supplement, on the one hand, and the information contained in the accompanying prospectus or any

document incorporated by reference therein filed prior to the date of this prospectus supplement, on the other hand, you should

rely on the information in this prospectus supplement. If any statement in one of these documents is inconsistent with a statement

in another document having a later date — for example, a document filed after the date of this prospectus supplement and

incorporated by reference in this prospectus supplement and the accompanying prospectus — the statement in the document

having the later date modifies or supersedes the earlier statement.

You should rely only on

the information contained or incorporated by reference in this prospectus supplement, the accompanying prospectus and in any free

writing prospectuses we may provide to you in connection with this offering. We have not, and H.C. Wainwright & Co., LLC has

not, authorized any other person to provide you with any information that is different. If anyone provides you with different or

inconsistent information, you should not rely on it. We are offering to sell, and seeking offers to buy, shares of our common stock

only in jurisdictions where offers and sales are permitted. The distribution of this prospectus supplement and the offering of

the common stock in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession

of this prospectus supplement must inform themselves about, and observe any restrictions relating to, the offering of the common

stock and the distribution of this prospectus supplement outside the United States. This prospectus supplement does not constitute,

and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this

prospectus supplement by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

We further note that the

representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated

by reference in the accompanying prospectus were made solely for the benefit of the parties to such agreement, including, in some

cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation,

warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made.

Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state

of our affairs.

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights

selected information about us, this offering and information appearing elsewhere in this prospectus supplement and in the documents

we incorporate by reference. This summary is not complete and does not contain all the information you should consider before investing

in our common stock pursuant to this prospectus supplement and the accompanying prospectus. Before making an investment decision,

to fully understand this offering and its consequences to you, you should carefully read this entire prospectus supplement and

the accompanying prospectus, including “Risk Factors” beginning on page S-5 of this prospectus supplement and

the financial statements and related notes and the other information that we incorporated by reference herein, including our Annual

Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K that we file from time to time.

Unless the context otherwise

requires, all references in this prospectus to “CASI,” “we,” “us,” “our,” “the

Company” or similar words refer to CASI Pharmaceuticals, Inc., together with our consolidated subsidiaries.

Overview

We are a U.S. based, late-stage

biopharmaceutical company focused on the acquisition, development and commercialization of innovative therapeutics addressing cancer

and other unmet medical needs for the global market, with a focus on commercialization in China. We intend to execute our plan

to become a leading fully-integrated pharmaceutical company with a substantial commercial business in China. We are a Nasdaq-listed

company, headquartered in Rockville, Maryland with established China operations that are growing as we continue to further in-license

products for our pipeline.

Our product pipeline features

(1) EVOMELA®, MARQIBO®, ZEVALIN®, all U.S. Food and Drug Administration (“FDA”) approved drugs in-licensed

from Spectrum Pharmaceuticals, Inc. for China regional rights, and currently in various stages in the regulatory process for market

approval in China, (2) an acquired portfolio of 25 FDA-approved abbreviated new drug applications (“ANDAs”), 4 ANDAs

that are pending FDA approval, from which we will prioritize a select subset of product registration and commercialization in China,

(3) our proprietary drug candidate, ENMD-2076, currently in Phase 2 clinical development, and (4) CASI-001 and CASI-002, proprietary

early-stage candidates in immune oncology in preclinical development.

Our China rights to EVOMELA®

(melphalan) for Injection, MARQIBO® (vinCRIStine sulfate LIPOSOME injection) and ZEVALIN® (ibritumomab tiuxetan) were previously

licensed from its our partner Spectrum Pharmaceuticals, Inc. Based on the U.S. FDA’s approval of these three licensed products,

we are pursuing the Import Drug registration path for approval in China.

We believe our pipeline

reflects a risk-balanced approach between products in various stages of development, and between products that we develop ourselves

and those that we develop with our partners for the China regional market. We intend to continue building a significant product

pipeline of innovative drug candidates that we will commercialize in China and collaborate with partners for the rest of the world.

For in-licensed products, the Company uses a market-oriented approach to identify pharmaceutical candidates that we believe have

the potential for gaining widespread market acceptance, either globally or in China, and for which development can be accelerated

under the Company’s drug development strategy. For ENMD-2076, our current development is focused on niche and orphan indications.

Our primary research and

development focus is on oncology therapeutics. Our strategy is to develop innovative drugs that are potential first-in-class or

market-leading compounds for treatment of cancer. The implementation of our plans will include leveraging our resources in both

the United States and China. In order to capitalize on the drug development and capital resources available in China, the Company

is conducting business in China through its wholly-owned China-based subsidiary that will execute the China portion of the Company’s

drug development strategy, including conducting clinical trials in China, pursuing local funding opportunities and strategic collaborations,

and implementing the Company’s plan to build a leading commercial business in China.

Our principal offices are

located at 9620 Medical Center Drive, Suite 300, Rockville, Maryland 20850, and our telephone number is (240) 864-2600. Additional

information concerning us can be found in our periodic filings with the Securities and Exchange Commission (“SEC”),

which are available on our website at http://www.casipharmaceuticals.com and on the SEC’s website at www.sec.gov. The information

on our website is not deemed to be part of this prospectus.

THE OFFERING

|

Issuer

|

CASI Pharmaceuticals, Inc.

|

|

|

|

|

Common stock offered by us

|

Shares having an aggregate offering price of not more than $25,000,000.

|

|

|

|

|

Manner of offering

|

“At the market offering”

that may be made from time to time through our sales agent, H.C. Wainwright & Co., LLC. See “Plan of Distribution”

on page S-13.

|

|

|

|

|

Use of proceeds

|

We intend to use the net proceeds

for working capital and general corporate purposes, which include, but are not limited to, advancing our product portfolio, acquiring

the rights to new product candidates, and general and administrative expenses. Please see “Use of Proceeds” on page

S-10.

|

|

|

|

|

Risk factors

|

This investment involves a high degree

of risk. See “Risk Factors” beginning on page S-5 of this prospectus supplement, as well as the other information included

in or incorporated by reference in this prospectus supplement and the accompanying prospectus, for a discussion of risks you should

carefully consider before investing in our securities.

|

|

|

|

|

Nasdaq Capital Market symbol

|

CASI

|

RISK FACTORS

Investing in our securities

involves a high degree of risk and uncertainty. In addition to the other information included or incorporated by reference in this

prospectus supplement and the accompanying prospectus, you should carefully consider the risks described below, before making an

investment decision with respect to the securities. We expect to update these Risk Factors from time to time in the periodic and

current reports that we file with the SEC after the date of this prospectus supplement. These updated Risk Factors will be incorporated

by reference in this prospectus supplement and the accompanying prospectus. Please refer to these subsequent reports for additional

information relating to the risks associated with investing in our common stock. If any of such risks and uncertainties actually

occurs, our business, financial condition, and results of operations could be severely harmed. This could cause the trading price

of our common stock to decline, and you could lose all or part of your investment.

Risks Related to Our Business, Our Financial Results and Our

Need for Financing

We have a history of losses and anticipate

future losses and may never become profitable on a sustained basis.

To date, we have been engaged

primarily in research and development activities. Although in the past we have received limited revenues on royalties from the

sales of pharmaceuticals, license fees and research and development funding from a former collaborator and limited revenues from

certain research grants, we have not derived significant revenues from operations.

We have experienced losses

in each year since inception. Through September 30, 2017, we had an accumulated deficit of approximately $448 million. We will

seek to raise capital to continue our operations and although we have been successfully funded to date through the sales of our

equity securities and through limited royalty payments, there is no assurance that our capital-raising efforts will be able to

attract the funding needed to sustain our operations. If we are unable to obtain additional funding for operations, we may not

be able to continue operations as proposed, requiring us to modify our business plan, curtail various aspects of our operations

or cease operations. In any such event, investors may lose a portion or all of their investment.

We expect that our ongoing

clinical and corporate activities will result in operating losses for the foreseeable future before we commercialize any products,

if ever. In addition, to the extent we rely on others to develop and commercialize our products, our ability to achieve profitability

will depend upon the success of these other parties. To support our research and development of certain product candidates, we

may seek and rely on cooperative agreements from governmental and other organizations as a source of support. If a cooperative

agreement were to be reduced to any substantial extent, it may impair our ability to continue our research and development efforts.

Even if we do achieve profitability, we may be unable to sustain or increase it.

We are uncertain whether additional funding

will be available for our future capital needs and commitments, and if we cannot raise additional funding, or access the credit

markets, we may be unable to complete development of our product candidates.

We will require substantial

funds in addition to our existing working capital to develop our product candidates and otherwise to meet our business objectives.

We have never generated sufficient revenue during any period since our inception to cover our expenses and have spent, and expect

to continue to spend, substantial funds to continue our clinical development programs. Any one of the following factors, among

others, could cause us to require additional funds or otherwise cause our cash requirements in the future to increase materially:

|

|

·

|

progress of our clinical trials or correlative

studies;

|

|

|

·

|

results of clinical trials;

|

|

|

·

|

changes in or terminations of our relationships

with strategic partners;

|

|

|

·

|

changes in the focus, direction, or costs

of our research and development programs;

|

|

|

·

|

competitive and technological advances;

|

|

|

·

|

establishment of marketing and sales capabilities;

|

|

|

·

|

the regulatory approval process; or

|

At September 30, 2017,

we had cash and cash equivalents of approximately $22 million. We may continue to seek additional capital through public or private

financing or collaborative agreements in 2018 and beyond. Our operations require significant amounts of cash. We may be required

to seek additional capital for the future growth and development of our business. We can give no assurance as to the availability

of such additional capital or, if available, whether it would be on terms acceptable to us. In addition, we may continue to seek

capital through the public or private sale of securities, if market conditions are favorable for doing so. If we are successful

in raising additional funds through the issuance of equity securities, stockholders will likely experience substantial dilution.

If we are not successful in obtaining sufficient capital because we are unable to access the capital markets on favorable terms,

it could reduce our research and development efforts and materially adversely affect our future growth, results of operations and

financial results.

Risks Related to our Common Stock and

the Offering

The market price of our

common stock may be highly volatile or may decline regardless of our operating performance. Our common stock price has fluctuated

from year-to-year and quarter-to-quarter and will likely continue to be volatile. During 2017, our closing stock price ranged from

$0.91 to $4.00. We expect that the trading price of our common stock is likely to be highly volatile in response to factors that

are beyond our control. The valuations of many biotechnology companies without consistent product revenues and earnings are extraordinarily

high based on conventional valuation standards, such as price to earnings and price to sales ratios. These trading prices and valuations

may not be sustained. In the future, our operating results in a particular period may not meet the expectations of any securities

analysts whose attention we may attract, or those of our investors, which may result in a decline in the market price of our common

stock. Any negative change in the public’s perception of the prospects of biotechnology companies could depress our stock

price regardless of our results of operations. These factors may materially and adversely affect the market price of our common

stock.

Our largest holders of common stock may

have different interests than our other stockholders.

A small number of our stockholders

hold a significant amount of our outstanding common stock. These stockholders may have interests that are different from the interests

of our other stockholders. We cannot assure that our largest stockholders will not seek to influence our business in a manner that

is contrary to our goals or strategies or the interests of our other stockholders. In addition, the significant concentration of

ownership in our common stock may adversely affect the trading price for our common stock because investors often perceive disadvantages

in owning stock in companies with significant stockholders. Our largest stockholders, if they acted together, could significantly

influence all matters requiring approval by our stockholders, including the election of directors and the approval of mergers or

other business combination transactions. Our largest stockholders together may be able to determine all matters requiring stockholder

approval.

Investors in this offering will experience

immediate and substantial dilution.

The public offering price

of our common stock is substantially higher than the net tangible book value per share of our common stock. Therefore, if you purchase

shares of our common stock in this offering, you will incur immediate and substantial dilution in the pro forma net tangible book

value per share of common stock from the price per share that you pay for the common stock. See “Dilution.”

We may require additional capital in

the future, which may not be available to us on favorable terms; issuances of our equity securities to provide this capital may

dilute your ownership in us.

We may need to raise additional

funds through public or private debt or equity financings in order to:

|

|

·

|

take advantage of expansion opportunities;

|

|

|

·

|

acquire complementary businesses or technologies;

|

|

|

·

|

develop new services and products; or

|

|

|

·

|

respond to competitive pressures.

|

Any additional capital

raised through the issuance of our equity securities may dilute your percentage ownership interest in us. Furthermore, any additional

financing we may need may not be available on terms favorable to us or at all. The unavailability of needed financing could adversely

affect our ability to execute our growth strategy.

Sales of substantial amounts of our common

stock or the perception that such sales may occur could cause the market price of our common stock to drop significantly, even

if our business is performing well.

The market price of our

common stock could decline as a result of sales by, or the perceived possibility of sales by, our existing stockholders of shares

of our common stock in the market after this offering. These sales might also make it more difficult for us to sell equity securities

at a time and price that we deem appropriate, or at all. In addition, we have filed resale shelf registration statements to register

shares of our common stock that may be sold by certain of our stockholders, which may increase the likelihood of sales, or the

perception of an increased likelihood of sales, by our existing stockholders of shares of our common stock.

We will have broad discretion in how

we use the proceeds of this offering, and we may not use these proceeds effectively, which could affect our results of operations

and cause our stock price to decline.

We will have considerable

discretion in the application of the net proceeds of this offering. We currently intend to use the net proceeds of this offering

to support our business development activities, advance development of our pipeline, and for other general corporate purposes.

However, our management has broad discretion over how these proceeds are used and could spend the proceeds in ways with which you

may not agree. We may not invest the proceeds of this offering effectively or in a manner that yields a favorable or any return,

and consequently, this could result in financial losses that could have a material and adverse effect on our business, cause the

price of our common stock to decline or delay the development of our product candidates.

Because we do not expect to pay dividends

in the foreseeable future, you must rely on the possibility of stock appreciation for any return on your investment.

We have paid no cash dividends

on any of our capital stock to date, and we currently intend to retain our future earnings, if any, to fund the development and

growth of our business. As a result, we do not expect to pay any cash dividends in the foreseeable future, and payment of cash

dividends, if any, will also depend on our financial condition, results of operations, capital requirements and other factors and

will be at the discretion of our board of directors. Furthermore, we are subject to various laws and regulations that may restrict

our ability to pay dividends and we may in the future become subject to contractual restrictions on, or prohibitions against, the

payment of dividends. Accordingly, the success of your investment in our common stock will likely depend entirely upon any future

appreciation. There is no guarantee that our common stock will appreciate in value after the offering or even maintain the price

at which you purchased your shares, therefore, you may not realize a return on your investment in our common stock and you may

lose your entire investment in our common stock.

Special Note Regarding Forward-Looking Statements

This prospectus supplement

contains and incorporates by reference certain forward-looking statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements also may be included in other statements that we make. All statements that are not

descriptions of historical facts are forward-looking statements. These statements can generally be identified by the use of forward-looking

terminology such as “believes,” “expects,” “intends,” “may,” “will,”

“should,” or “anticipates” or similar terminology. These forward-looking statements include, among others,

statements regarding the timing of our clinical trials, our cash position and future expenses, and our future revenues.

Forward-looking statements

are subject to numerous assumptions, risks and uncertainties, which change over time. Forward-looking statements speak only as

of the date they are made, and we assume no duty to update forward-looking statements. New factors emerge from time to time, and

it is not possible for us to predict which factors will arise. In addition, we cannot assess the impact of each factor on our business

or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained

in any forward-looking statements.

Actual results could differ

materially from those currently anticipated due to a number of factors, including: the risk that we may be unable to continue as

a going concern as a result of our inability to raise sufficient capital for our operational needs; the possibility that we may

be delisted from trading on the Nasdaq Capital Market; the volatility in the market price of our common stock; risks relating to

interests of our largest stockholders that differ from our other stockholders; the risk of substantial dilution of existing stockholders

in future stock issuances; the difficulty of executing our business strategy in China; our inability to enter into strategic partnerships

for the development, commercialization, manufacturing and distribution of our proposed product candidates or future candidates;

risks relating to the need for additional capital and the uncertainty of securing additional funding on favorable terms; risks

associated with our product candidates; risks associated with any early-stage products under development; the risk that results

in preclinical models are not necessarily indicative of clinical results; uncertainties relating to preclinical and clinical trials,

including delays to the commencement of such trials; the lack of success in the clinical development of any of our products; dependence

on third parties; and risks relating to the commercialization, if any, of our proposed products (such as marketing, safety, regulatory,

patent, product liability, supply, competition and other risks). risks relating to interests of our largest stockholders that differ

from our other stockholders. Such factors, among others, could have a material adverse effect upon our business, results of operations

and financial condition. We caution readers not to place undue reliance on any forward-looking statements, which only speak as

of the date made. Additional information about the factors and risks that could affect our business, financial condition and results

of operations, are contained in our filings with the SEC, which are available at

www.sec.gov

.

You are encouraged to review

the Risk Factors included in this prospectus supplement and under the heading “Item 1A. Risk Factors” in our annual

report on Form 10-K for the fiscal year ended December 31, 2016 and our other filings with the SEC.

USE OF PROCEEDS

We will have broad discretion

in the use of the net proceeds from any sale of securities offered under this prospectus supplement. We intend to use the net proceeds

for working capital and general corporate purposes, which include, but are not limited to, advancing our product portfolio, acquiring

the rights to new product candidates, and general and administrative expenses.

We have not determined

the amount of net proceeds to be used specifically for such purposes. Pending the use of any net proceeds, we expect to invest

the net proceeds in interest-bearing, marketable securities.

DILUTION

If you invest in our common

stock, your interest will be diluted immediately to the extent of the difference between the public offering price per share and

the adjusted net tangible book value per share of our common stock after this offering.

The net tangible book value

of our common stock as of September 30, 2017, was approximately $15,600,000, or approximately $0.26 per share. Net tangible book

value per share represents the amount of our total tangible assets, less total liabilities, divided by the total number of shares

of our common stock outstanding. Dilution per share to new investors represents the difference between the amount per share paid

by purchasers for each share of common stock in this offering and the net tangible book value per share of our common stock immediately

following the completion of this offering.

After giving effect to

the sale of shares of our common stock in the aggregate amount of $25,000,000 at an assumed offering price of $3.75 per share,

the last reported sale price of our common stock on February 22, 2018 on the Nasdaq Capital Market, and after deducting estimated

commissions and estimated offering expenses, our as-adjusted net tangible book value as of September 30, 2017 would have been approximately

$39,700,000 or approximately $0.59 per share. This represents an immediate increase in net tangible book value of approximately

$0.33 per share to our existing stockholders and an immediate dilution in as-adjusted net tangible book value of approximately

$3.16 per share to new purchasers of our common stock in this offering, as illustrated by the following table:

|

Assumed offering price per share

|

|

|

|

|

|

$

|

3.75

|

|

|

Net tangible book value per share as of September 30, 2017

|

|

$

|

0.26

|

|

|

|

|

|

|

Increase per share attributable to this offering

|

|

$

|

0.33

|

|

|

|

|

|

|

As-adjusted net tangible book value per share as of September 30, 2017, after giving effect to this offering

|

|

|

|

|

|

$

|

0.59

|

|

|

Dilution per share to new investors participating in this offering

|

|

|

|

|

|

$

|

3.16

|

|

The table above assumes,

for illustrative purposes only, an aggregate of 6,666,666 shares of our common stock are sold at a price of $3.75 per share, for

aggregate gross proceeds of $25,000,000. The shares, if any, sold in this offering will be sold from time to time at various prices.

An increase of $1.00 per share in the price at which the shares are sold from the assumed offering price of $3.75 per share shown

in the table above, assuming all of our common stock in the aggregate amount of $25,000,000 is sold at that price, would increase

our adjusted net tangible book value per share after the offering to $0.61 per share and result in an immediate dilution in as-adjusted

net tangible book value of approximately $4.14 per share to new purchasers of our common stock in this offering, after deducting

commissions and estimated aggregate offering expenses payable by us. A decrease of $1.00 per share in the price at which the shares

are sold from the assumed offering price of $3.75 per share shown in the table above, assuming all of our common stock in the aggregate

amount of $25,000,000 is sold at that price, would increase the adjusted net tangible book value per share after the offering to

$0.57 per share and result in an immediate dilution in as-adjusted net tangible book value of $2.18 per share to new purchasers

of our common stock in this offering, after deducting commissions and estimated aggregate offering expenses payable by us. This

information is supplied for illustrative purposes only.

The table above is based

on 60,196,574 shares of our common stock outstanding as of September 30, 2017, and excludes the following shares:

|

|

·

|

4,686,760 shares of our common stock issuable

upon exercise of warrants outstanding as of September 30, 2017, with a weighted-average exercise price of $1.71 per share;

|

|

|

·

|

12,242,004 shares of our common stock

issuable upon exercise of options outstanding as of September 30, 2017, with a weighted-average exercise price of $1.41 per share;

and

|

|

|

·

|

2,355,358 shares of our common stock reserved

and available as of September 30, 2017 for future issuance under our 2011 Long-Term Incentive Plan.

|

To the extent that after

September 30, 2017 any outstanding options or warrants were or are exercised, new equity awards were or are issued under our equity

incentive plan, or we otherwise issued or issue additional shares of common stock in the future at prices per share below the price

per share for any shares sold in this offering, there will be further dilution to new investors.

PLAN OF DISTRIBUTION

We have entered into a

sales agreement with Wainwright, under which we may issue and sell from time to time shares of our common stock having an aggregate

offering price of not more than $25,000,000 through Wainwright as our sales agent. Sales of the common stock, if any, will be made

by any method permitted by law deemed to be an “at the market offering” as defined in Rule 415 promulgated under the

Securities Act.

Wainwright will offer our

common stock at prevailing market prices subject to the terms and conditions of the sales agreement as agreed upon by us and Wainwright.

We will designate the number of shares which we desire to sell, the time period during which sales are requested to be made, any

limitation on the number of shares that may be sold in one day and any minimum price below which sales may not be made. Subject

to the terms and conditions of the sales agreement, Wainwright will use its commercially reasonable efforts to sell on our behalf

all of the shares of common stock requested to be sold by us. We or Wainwright may suspend the offering of the common stock being

made through Wainwright under the sales agreement upon proper notice to the other party.

Settlement for sales of

common stock will occur on the second business day or such shorter settlement cycle as may be in effect under Exchange Act Rule

15c6-1 from time to time, following the date on which any sales are made, or on some other date that is agreed upon by us and Wainwright

in connection with a particular transaction, in return for payment of the net proceeds to us. There is no arrangement for funds

to be received in an escrow, trust or similar arrangement.

We will pay Wainwright

in cash, upon each sale of our shares of common stock pursuant to the sales agreement, a commission equal to 3.0% of the gross

proceeds from each sale of shares of our common stock. Because there is no minimum offering amount required as a condition to this

offering, the actual total public offering amount, commissions and proceeds to us, if any, are not determinable at this time. Pursuant

to the terms of the sales agreement, we agreed to reimburse Wainwright for the documented fees and costs of its legal counsel reasonably

incurred in connection with entering into the transactions contemplated by the sales agreement in an amount not to exceed $50,000

in the aggregate. Additionally, pursuant to the terms of the sales agreement, we agreed to reimburse Wainwright for the documented

fees and costs of its legal counsel reasonably incurred in connection with Wainwright’s ongoing diligence, drafting and other

filing requirements arising from the transactions contemplated by the sales agreement in an amount not to exceed $2,500 in the

aggregate per calendar quarter. We estimate that the total expenses of the offering payable by us, excluding commissions payable

to Wainwright under the sales agreement, will be approximately $150,000. We will report at least quarterly the number of shares

of common stock sold through Wainwright under the sales agreement, the net proceeds to us and the compensation paid by us to Wainwright

in connection with the sales of common stock.

In connection with the

sales of common stock on our behalf, Wainwright will be deemed to be an “underwriter” within the meaning of the Securities

Act, and the compensation paid to Wainwright will be deemed to be underwriting commissions or discounts. We have agreed in the

sales agreement to provide indemnification and contribution to Wainwright against certain liabilities, including liabilities under

the Securities Act.

The offering of our shares

of common stock pursuant to the sales agreement will terminate upon the earlier of the (i) sale of all of our shares of common

stock provided for in this prospectus supplement, or (ii) termination of the sales agreement as permitted therein.

Wainwright and its affiliates

may in the future provide various investment banking and other financial services for us and our affiliates, for which services

they may in the future receive customary fees. To the extent required by Regulation M, Wainwright will not engage in any market

making activities involving our shares of common stock while the offering is ongoing under this prospectus supplement. This summary

of the material provisions of the sales agreement does not purport to be a complete statement of its terms and conditions. We are

filing a copy of the sales agreement with the SEC on a Current Report on Form 8-K concurrently with the filing of this prospectus

supplement.

LEGAL MATTERS

The validity of the shares

of common stock offered hereby has been passed upon for us by Arnold & Porter Kaye Scholer LLP, Washington, D.C. Wainwright

is being represented in connection with this offering by Duane Morris LLP, Newark, New Jersey.

EXPERTS

CohnReznick LLP (“CohnReznick”),

independent registered public accounting firm, has audited our consolidated financial statements included in our Annual Report

on Form 10-K for the year ended December 31, 2016, as set forth in their report which is incorporated by reference in this prospectus

and elsewhere in the registration statement. Our financial statements as of and for the years ended December 31, 2016 and December

31, 2015 are incorporated by reference in reliance on CohnReznick’s report, given upon their authority as experts in accounting

and auditing.

Where

You Can Find More Information

We have filed with the

SEC a registration statement under the Securities Act that registers the distribution of the securities offered under this prospectus.

The registration statement, including the attached exhibits and schedules and the information incorporated by reference, contains

additional relevant information about us and the securities. The rules and regulations of the SEC allow us to omit from this prospectus

certain information included in the registration statement.

In addition, we file annual,

quarterly and special reports, proxy statements and other information with the SEC. You may read and copy this information and

the registration statement at the SEC public reference room located at 100 F Street, N.E., Washington D.C. 20549. Please call the

SEC at 1-800-SEC-0330 for more information about the operation of the public reference room.

In addition, any information

we file with the SEC, including the documents incorporated by reference into this prospectus, is also available on the SEC’s

website at http://www.sec.gov. We also maintain a web site at http://www.casipharmaceuticals.com, which provides additional information

about our company and through which you can also access our SEC filings. The information set forth on our web site is not part

of this prospectus.

Incorporation

of Certain Documents by Reference

The SEC allows us to incorporate

by reference the information that we file with the SEC, which means that we can disclose important information to you by referring

you to those documents. The information incorporated by reference is considered to be part of this prospectus. These documents

may include periodic reports, such as Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K,

as well as Proxy Statements. Any documents that we subsequently file with the SEC will automatically update and replace the information

previously filed with the SEC. Thus, for example, in the case of a conflict or inconsistency between information set forth in this

prospectus and information incorporated by reference into this prospectus, you should rely on the information contained in the

document that was filed later.

This prospectus incorporates

by reference the documents listed below that we previously have filed with the SEC and any additional documents that we may file

with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act excluding portions thereof deemed to be “furnished”

to the SEC pursuant to Item 2.02, Item 7.01 or Item 9.01 of a Current Report on Form 8-K) between the date of this prospectus and

the termination of the offering of the securities. These documents contain important information about us.

|

|

·

|

The Company’s Annual Report on Form

10-K for the year ended December 31, 2016, filed with the SEC on March 31, 2017.

|

|

|

·

|

The Company’s Quarterly Reports

on Form 10-Q for the quarters ended March 31, 2017, June 30, 2017 and September 30, 3017, filed with the SEC on May 15, 2017, August

14, 2017 and November 14, 2017, respectively.

|

|

|

·

|

The Company’s Definitive Proxy Statement

on Schedule 14A for its 2015 Annual Stockholder’s Meeting, filed with the SEC on April 14, 2017.

|

|

|

·

|

The Company’s Current Reports on

Form 8-K, filed on March 31, 2017, May 15, 2017, June 9, 2017, August 14, 2017, September 7, 2017, October 19, 2017, November 14,

2017, December 8, 2017, December 22, 2017, January 26, 2018 and February 9, 2018.

|

|

|

·

|

The description of the Company’s

common stock contained in the Company’s Registration Statement on Form 8-A filed under the Exchange Act on May 14, 1996,

including any amendment or report filed for the purpose of updating such description.

|

You can obtain a copy

of any or all of the documents incorporated by reference in this prospectus (other than an exhibit to a document unless that exhibit

is specifically incorporated by reference into that document) from the SEC on its website at http://www.sec.gov. You also can obtain

these documents from us without charge by visiting our website at http://www.casipharmaceuticals.com or by requesting them in writing,

by email or by telephone at the following address:

CASI Pharmaceuticals, Inc.

9620 Medical Center Drive, Suite 300

Rockville, Maryland 20850

(240) 864-2600

ir@casipharmaceuticals.com

PROSPECTUS

CASI PHARMACEUTICALS, INC.

$100,000,000

Common Stock

Warrants to Purchase Common Stock

Units

We may offer and sell from time to time shares

of common stock or warrants to purchase shares of common stock either individually or in units. We may also offer common stock

upon exercise of warrants. We may sell any combination of the above described securities, either individually or in units, in one

or more offerings in amounts, at prices and on terms determined at the time of the offering. We refer to the shares of common stock,

warrants to purchase shares of common stock and units collectively as the “securities.”

This prospectus provides you with a general description

of the securities that we may offer. This prospectus may not be used to consummate sales of securities unless accompanied by a

prospectus supplement. Each time we sell securities, we will provide a prospectus supplement that will contain specific information

about the terms of that offering. The prospectus supplement may also add information or update information contained in this prospectus.

You should read both this prospectus and any prospectus supplement together with the documents incorporated by reference and described

under the heading “Where You Can Find More Information” before you make your investment decision.

An investment in the securities offered under

this prospectus involves a high degree of risk. You should carefully consider the risk factors described in the applicable prospectus

supplement and certain of our filings with the Securities and Exchange Commission, as described under “Risk Factors”

on page 4.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful

or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is

TABLE OF CONTENTS

About This Prospectus

This prospectus is part of a “shelf”

registration statement we filed with the Securities and Exchange Commission, or the SEC. By using a shelf registration statement,

we may offer to sell any one or more or a combination of the securities described in this prospectus from time to time for an aggregate

offering price of up to $100,000,000.

You should rely only on the information contained

in or specifically incorporated by reference into this prospectus or a prospectus supplement. No dealer, sales person, agent or

other individual has been authorized to give any information or to make any representations not contained in this prospectus. If

given or made, such information or representations must not be relied upon as having been authorized by us.

This prospectus does not constitute an offer

to sell, or a solicitation of an offer to buy, the securities offered hereby in any jurisdiction where, or to any person to whom,

it is unlawful to make such offer or solicitation.

We may sell securities to underwriters who will

sell the securities to the public on terms fixed at the time of sale. In addition, the securities may be sold by us directly or

through dealers or agents designated from time to time. If we, directly or through agents, solicit offers to purchase the securities,

we reserve the sole right to accept and, together with any agents, to reject, in whole or in part, any of those offers.

Any prospectus supplement will contain the names

of the underwriters, dealers or agents, if any, together with the terms of offering, the compensation of those underwriters and

the net proceeds to us. Any underwriters, dealers or agents participating in the offering may be deemed “underwriters”

within the meaning of the Securities Act of 1933, as amended, or the Securities Act.

We have not taken any action to permit a public

offering of the shares of common stock outside the United States or to permit the possession or distribution of this prospectus

outside the United States. Persons outside the United States who come into possession of this prospectus must inform themselves

about and observe any restrictions relating to the offering of the shares of common stock and the distribution of this prospectus

outside of the United States.

The information contained in this prospectus

is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of securities.

Neither the delivery of this prospectus nor any sale made hereunder shall, under any circumstances, create an implication that

there has not been any change in the facts set forth in this prospectus or in our affairs since the date of this prospectus.

Special Note Regarding Forward-Looking

Statements

This prospectus contains and incorporates certain

forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act

of 1934, as amended, or the Exchange Act. Forward-looking statements also may be included in other statements that we make. All

statements that are not descriptions of historical facts are forward-looking statements. These statements can generally be identified

by the use of forward-looking terminology such as “believes,” “expects,” “intends,” “may,”

“will,” “should,” or “anticipates” or similar terminology. These forward-looking statements

include, among others, statements regarding the timing of our clinical trials, our cash position and future expenses, and our future

revenues.

Our forward-looking statements are based on

information available to us today, and we will not update these statements.

Actual results could differ materially from those currently anticipated

due to a number of factors, including: the risk that we may be unable to continue as a going concern as a result of our inability

to raise sufficient capital for our operational needs; the possibility that we may be delisted from trading on the Nasdaq Capital

Market; the volatility in the market price of our common stock; risks relating to interests of our largest stockholders that differ

from our other stockholders; the risk of substantial dilution of existing stockholders in future stock issuances; the difficulty

of executing our business strategy in China; our inability to predict when or if our product candidates will be approved for marketing

by the China Food and Drug Administration authorities; our inability to enter into strategic partnerships for the development,

commercialization, manufacturing and distribution of our proposed product candidates or future candidates; risks relating to the

need for additional capital and the uncertainty of securing additional funding on favorable terms; risks associated with our product

candidates; risks associated with any early-stage products under development; the risk that results in preclinical and early clinical

models are not necessarily indicative of later clinical results; uncertainties relating to preclinical and clinical trials, including

delays to the commencement of such trials; the lack of success in the clinical development of any of our products; dependence on

third parties; and risks relating to the commercialization, if any, of our proposed products (such as marketing, safety, regulatory,

patent, product liability, supply, competition and other risks). Such factors, among others, could have a material adverse effect

upon our business, results of operations and financial condition. We caution readers not to place undue reliance on any forward-looking

statements, which only speak as of the date made. Additional information about the factors and risks that could affect our business,

financial condition and results of operations, are contained in our filings with the U.S. Securities and Exchange Commission, or

the SEC, which are available at www.sec.gov.

About CASI Pharmaceuticals, Inc.

We are a U.S. based, late-stage biopharmaceutical

company focused on the acquisition, development and commercialization of innovative therapeutics addressing cancer and other unmet

medical needs for the global market, with a focus on commercialization in China. We intend to execute our plan to become a leading

fully-integrated pharmaceutical company with a substantial commercial business in China. We are headquartered in Rockville, Maryland

with established China operations that are growing as we continue to further in-license products for our pipeline.

Our product pipeline features (1) EVOMELA®,

MARQIBO® and ZEVALIN®, all U.S. Food and Drug Administration (FDA) approved drugs in-licensed from Spectrum Pharmaceuticals,

Inc. for China regional rights, and currently in various stages in the regulatory and clinical process for market approval in China,

(2) CASI-001 and CASI-002, proprietary preclinical candidates in immune-oncology, and (3) our proprietary drug candidate, ENMD-2076,

ongoing in one Phase 2 clinical study.

Our China rights to EVOMELA® (melphalan)

for Injection, MARQIBO® (vinCRIStine sulfate LIPOSOME injection) and ZEVALIN® (ibritumomab tiuxetan) were previously licensed

from its our partner Spectrum Pharmaceuticals, Inc. Based on the U.S. FDA’s approval of these three licensed products, we

are pursuing the Import Drug registration path for approval in China.

We believe our pipeline reflects a risk-balanced

approach between products in various stages of development, and between products that we develop ourselves and those that we develop

with our partners for the China regional market. We intend to continue building a significant product pipeline of innovative drug

candidates that we will commercialize in China and collaborate with partners for the rest of the world. For in-licensed products,

the Company uses a market-oriented approach to identify pharmaceutical candidates that we believe have the potential for gaining

widespread market acceptance, either globally or in China, and for which development can be accelerated under the Company’s

drug development strategy. For ENMD-2076, our current development is focused on niche and orphan indications.

Our primary research and development focus is

on oncology therapeutics. Our strategy is to develop innovative drugs that are potential first-in-class or market-leading compounds

for treatment of cancer. The implementation of our plans will include leveraging our resources in both the United States and China.

In order to capitalize on the drug development and capital resources available in China, the Company is conducting business in

China through its wholly-owned China-based subsidiary that will execute the China portion of the Company’s drug development

strategy, including conducting clinical trials in China, pursuing local funding opportunities and strategic collaborations, and

implementing the Company’s plan to build a leading commercial business in China.

Our principal offices are located at 9620 Medical

Center Drive, Suite 300, Rockville, Maryland 20850, and our telephone number is (240) 864-2600. Additional information concerning

us can be found in our periodic filings with the SEC, which are available on our website at http://www.casipharmaceuticals.com

and on the SEC’s website at www.sec.gov. The information on our website is not deemed to be part of this prospectus.

Risk Factors

An investment in our securities involves a high

degree of risk. Before you decide whether to purchase any of our securities, in addition to the other information in this prospectus

and the accompanying prospectus supplement, you should carefully consider the risk factors set forth under the heading “Risk

Factors” in our most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q, which are incorporated

by reference into this prospectus, as the same may be updated from time to time by our future filings under the Securities Exchange

Act of 1934. For more information, see the section entitled “Incorporation of Certain Documents by Reference.” The

risks and uncertainties we have described are not the only ones facing our company. Additional risks and uncertainties not presently

known to us or that we currently consider immaterial may also affect our business operations. To the extent that a particular offering

implicates additional significant risks, we will include a discussion of those risks in the applicable prospectus supplement.

Use of Proceeds

Except as may be otherwise set forth in the prospectus

supplement accompanying this prospectus, we will use the net proceeds we receive from sales of the securities offered hereby for

general corporate purposes, including support for our continuing research and development, commercialization activities, business

development activities, and, if opportunities arise, acquisitions of businesses, products, technologies or licenses that are complementary

to our business, although we have no current definitive plans, commitments or agreements with respect to any acquisitions as of

the date of this prospectus.

Plan of Distribution

We may sell the securities offered through

this prospectus in any one or more of the following ways:

|

|

·

|

directly to investors or purchasers;

|

|

|

·

|

to investors through agents;

|

|

|

·

|

to or through brokers or dealers;

|

|

|

·

|

to the public through underwriting syndicates led by one or more managing underwriters;

|

|

|

·

|

to one or more underwriters acting alone for resale to investors or to the public;

|

|

|

·

|

through a block trade in which the broker or dealer engaged to handle the block trade will attempt to sell the securities as

agent, but may position and resell a portion of the block as principal to facilitate the transaction; and

|

|

|

·

|

through a combination of any such methods of sale.

|

Securities may also be issued upon exercise

of warrants. We reserve the right to sell securities directly to investors on our own behalf in those jurisdictions where we are

authorized to do so.

The securities may be distributed at a fixed

price or prices, which may be changed; market prices prevailing at the time of sale; prices related to the prevailing market prices;

or negotiated prices.

The prospectus supplement will, where applicable:

|

|

·

|

describe the terms of the offering;

|

|

|

·

|

identify any underwriters, dealers or agents;

|

|

|

·

|

identify any managing underwriter or underwriters;

|

|

|

·

|

provide purchase price of the securities;

|

|

|

·

|

provide the net proceeds from the sale of the securities;

|

|

|

·

|

describe any delayed delivery arrangements;

|

|

|

·

|

describe any underwriting discounts, commissions and other items constituting underwriters’ compensation;

|

|

|

·

|

describe any initial public offering price;

|

|

|

·

|

describe any discounts or concessions allowed or reallowed or paid to dealers; and

|

|

|

·

|

describe any commissions paid to agents.

|

Sale Through Underwriters or Dealers

If underwriters are used in the sale, the underwriters

will acquire the securities for their own account, including through underwriting, purchase, security lending or repurchase agreements

with us. The underwriters may resell the securities from time to time in one or more transactions, including negotiated transactions.

Underwriters may sell the securities in order to facilitate transactions in any of our other securities (described in this prospectus

or otherwise), including other public or private transactions and short sales. Underwriters may offer securities to the public

either through underwriting syndicates represented by one or more managing underwriters or directly by one or more firms acting

as underwriters. Unless otherwise indicated in the prospectus supplement, the obligations of the underwriters to purchase the securities

will be subject to certain conditions, and the underwriters will be obligated to purchase all the offered securities if they purchase

any of them. The underwriters may change from time to time any initial public offering price and any discounts or concessions allowed

or reallowed or paid to dealers.

If dealers are used in the sale of securities

offered through this prospectus, we will sell the securities to them as principals. They may then resell those securities to the

public at varying prices determined by the dealers at the time of resale. The prospectus supplement will include the names of the

dealers and the terms of the transaction.

Direct Sales and Sales Through Agents

We may sell the securities offered through

this prospectus. In this case, no underwriters or agents would be involved. Such securities may also be sold through agents designated

from time to time. The prospectus supplement will name any agent involved in the offer or sale of the offered securities and will

describe any commissions payable to the agent. Unless otherwise indicated in the prospectus supplement, any agent will agree to

use its reasonable best efforts to solicit purchases for the period of its appointment.

We may sell the securities directly to institutional

investors or others who may be deemed to be underwriters within the meaning of the Securities Act with respect to any sale of those

securities. The terms of any such sales will be described in the prospectus supplement.

Delayed Delivery Contracts

If the prospectus supplement indicates, we

may authorize agents, underwriters or dealers to solicit offers from certain types of institutions to purchase securities at the

public offering price under delayed delivery contracts. These contracts would provide for payment and delivery on a specified date

in the future. Delayed delivery contracts will be subject only to those conditions set forth in each applicable prospectus supplement,

and each prospectus supplement will set forth any commissions we pay for solicitation of these contracts.

“At the Market” Offerings

We may from time to time engage a firm to act

as our agent for one or more offerings of our securities. We sometimes refer to this agent as our “offering agent.”

If we reach agreement with an offering agent with respect to a specific offering, including the number of securities and any minimum

price below which sales may not be made, then the offering agent will try to sell such securities on the agreed terms. The offering

agent could make sales in privately negotiated transactions or any other method permitted by law, including sales deemed to be

an “at the market” offering as defined in Rule 415 promulgated under the Securities Act, including sales made

directly on the The Nasdaq Capital Market, or sales made to or through a market maker other than on an exchange. The offering agent

will be deemed to be an “underwriter” within the meaning of the Securities Act with respect to any sales effected through

an “at the market” offering.

Market Making, Stabilization and Other Transactions

Unless the applicable prospectus supplement

states otherwise, each series of offered securities will be a new issue and will have no established trading market. We may elect

to list any series of offered securities on an exchange. Any underwriters that we use in the sale of offered securities may make

a market in such securities, but may discontinue such market making at any time without notice. Therefore, we cannot assure you

that the securities will have a liquid trading market.

To the extent permitted by and in accordance

with Regulation M under the Exchange Act in connection with an offering an underwriter may engage in over-allotments, stabilizing

transactions, short covering transactions and penalty bids. Over-allotments involve sales in excess of the offering size, which

creates a short position. Stabilizing transactions permit bids to purchase the underlying security so long as the stabilizing bids

do not exceed a specified maximum. Short covering transactions involve purchases of the securities in the open market after the

distribution is completed to cover short positions. Penalty bids permit the underwriters to reclaim a selling concession from a

dealer when the securities originally sold by the dealer are purchased in a covering transaction to cover short positions. Those

activities may cause the price of the securities to be higher than it would be otherwise. If commenced, the underwriters may discontinue

any of the activities at any time.

To the extent permitted by and in accordance

with Regulation M under the Exchange Act, any underwriters who are qualified market makers on the Nasdaq Capital Market may

engage in passive market making transactions in the securities on the Nasdaq Capital Market during the business day prior to the

pricing of an offering, before the commencement of offers or sales of the securities. Passive market makers must comply with applicable

volume and price limitations and must be identified as passive market makers. In general, a passive market maker must display its

bid at a price not in excess of the highest independent bid for such security; if all independent bids are lowered below the passive

market maker’s bid, however, the passive market maker’s bid must then be lowered when certain purchase limits are exceeded.

Derivative Transactions and Hedging

We, the underwriters or other agents may engage

in derivative transactions involving the securities. These derivatives may consist of short sale transactions and other hedging

activities. The underwriters or agents may acquire a long or short position in the securities, hold or resell securities acquired

and purchase options or futures on the securities and other derivative instruments with returns linked to or related to changes

in the price of the securities. In order to facilitate these derivative transactions, we may enter into security lending or repurchase

agreements with the underwriters or agents. The underwriters or agents may effect the derivative transactions through sales of

the securities to the public, including short sales, or by lending the securities in order to facilitate short sale transactions

by others. The underwriters or agents may also use the securities purchased or borrowed from us or others (or, in the case of derivatives,

securities received from us in settlement of those derivatives) to directly or indirectly settle sales of the securities or close

out any related open borrowings of the securities.

General Information; Offering Limitations

Agents, underwriters, and dealers may be entitled,

under agreements entered into with us, to indemnification by us against certain liabilities, including liabilities under the Securities

Act. Our agents, underwriters, and dealers, or their affiliates, may be customers of, engage in transactions with or perform services

for us, in the ordinary course of business. No securities may be sold under this prospectus without delivery, in paper format,

in electronic format on the Internet, or both, of the applicable prospectus supplement describing the method and terms of the offering.

Dilution

We will set forth in a prospectus supplement

the following information regarding any material dilution of the equity interests of investors purchasing securities in an offering

under this prospectus:

|

|

·

|

the net tangible book value per share of our equity securities before and after the offering;

|

|

|

·

|

the amount of the increase in such net tangible book value per share attributable to the cash payments made by purchasers in

the offering; and

|

|

|

·

|

the amount of the immediate dilution from the public offering price which will be absorbed by such purchasers.

|

The Securities We May Offer

The descriptions of the securities contained

in this prospectus, together with the applicable prospectus supplement, summarize the material terms and provisions of the various

types of securities that we may offer. We will describe in the applicable prospectus supplement relating to any securities the

particular terms of the securities offered by that prospectus supplement. If we so indicate in a prospectus supplement, the terms

of the securities may revise, amend, modify or supersede the terms we have summarized below. We will also include in the prospectus

supplement information, where applicable, about material United States federal income tax considerations relating to the securities,

and the securities exchange or market, if any, on which the securities will be listed or quoted.

We may sell from time to time, in one or more

offerings, one or more of the following securities:

|

|

·

|

warrants to purchase common stock; and

|

|

|

·

|

units, comprised of shares of common stock and/or warrants to purchase shares of common stock.

|

These securities may be offered and sold from

time to time for an aggregate offering price not to exceed $100,000,000.

Description of Common Stock

The following summary of the terms of our common

stock is subject to and qualified in its entirety by reference to our certificate of incorporation and by-laws, each as amended

to date, copies of which are on file with the SEC as exhibits to previous SEC filings. Please see “Where You Can Find More

Information” below for directions on obtaining these documents.

As of September 30, 2017, we had 170,000,000

shares of common stock authorized, of which 60,196,574 shares were outstanding. All of our outstanding common shares are fully

paid and non-assessable. Any additional common shares that we issue will be fully paid and non-assessable.

General

Holders of our common stock are entitled to

one vote per share on matters on which our stockholders vote. There are no cumulative voting rights. Holders of our common stock

are entitled to receive proportionally any dividends declared by our board of directors, out of funds that we may legally use to

pay dividends. In the event of our liquidation or dissolution, holders of our common stock are entitled to share ratably in all

assets remaining after payment of all debts and other liabilities.

Since our initial public offering in 1996,

we have not paid cash dividends on our common stock. We currently anticipate that any earnings will be retained for the continued

development of our business and we do not anticipate paying any cash dividends on our common stock in the foreseeable future.

Transfer Agent and Registrar

The transfer agent and registrar for our common

stock is American Stock Transfer & Trust Company.

Nasdaq Capital Market

Our common stock is listed for quotation on

the Nasdaq Capital Market under the symbol “CASI.”

Description of Warrants

We may issue warrants to purchase shares of common

stock. The warrants may be issued independently or together with any other securities and may be attached to or separate from the

other securities. Further terms of the warrants will be set forth in the applicable prospectus supplement.

The applicable prospectus supplement will describe

the terms of the warrants in respect of which this prospectus is being delivered, including, where applicable, the following:

|

|

·

|

the title of the warrants;

|

|

|

·

|

the aggregate number of the warrants;

|

|

|

·

|

the price or prices at which the warrants will be issued and the currency in which the price for the warrants may be paid;

|

|

|

·

|

the designation, terms and number of shares of common stock purchasable upon exercise of such warrants;

|

|

|

·

|

the designation and terms of the shares of common stock with which such warrants are issued and the number of such warrants

issued with such shares;

|

|

|

·

|

the date on and after which such warrants and the related common stock will be separately transferable, including any limitations

on ownership and transfer of such warrants;

|

|

|

·

|

provisions for changes to or adjustments in the exercise price of the warrants;

|

|

|

·

|

the price at which each share of common stock purchasable upon exercise of such warrants may be purchased;

|

|

|

·

|

the date on which the right to exercise such warrants shall commence and the date on which such right shall expire;

|

|

|

·

|

the minimum or maximum amount of such warrants which may be exercised at any one time;

|

|

|

·

|

information with respect to book-entry procedures, if any;

|

|

|

·

|

a discussion of certain material U.S. federal income tax consequences; and

|

|

|

·

|

any other terms of such warrants, including terms, procedures and limitations relating to the exchange and exercise of such

warrants.

|

Description of Units

The following description, together with the

additional information we may include in any applicable prospectus supplements, summarizes the material terms and provisions of

the units that we may offer under this prospectus and any related unit agreements and unit certificates. While the terms summarized

below will apply generally to any units that we may offer, we will describe the particular terms of any series of units in more

detail in the applicable prospectus supplement. If we indicate in the prospectus supplement, the terms of any units offered under

that prospectus supplement may differ from the terms described below.

We will file as exhibits to the registration

statement of which this prospectus is a part, or will incorporate by reference from reports that we file with the SEC, any form

of unit agreement that describes the terms of the series of units we are offering, and any supplemental agreements, before the

issuance of the related series of units. The following summaries of material terms and provisions of the units are subject to,

and qualified in their entirety by reference to, all the provisions of such unit agreements and any supplemental agreements applicable

to a particular series of units. We urge you to read the applicable prospectus supplements related to the particular series of

units that we may offer under this prospectus and the complete unit agreement and any supplemental agreements that contain the

terms of the units.

We may issue units comprised of shares of our