Filed Pursuant to Rule 424(b)(5)

Registration No. 333-223048

The information in this prospectus is not complete and may be

changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these

securities in any jurisdiction where the offer or sale is not permitted.

PROSPECTUS SUPPLEMENT (Subject to Completion)

(To Prospectus dated February 15, 2018)

2,300,000 Shares

COMMON STOCK

We are offering up to 2,300,000

shares of our shares of common stock.

Our common stock is listed on

the New York Stock Exchange under the symbol “INST.” On February 14, 2018, the last reported sale price of our common stock on the New York Stock Exchange was $42.05 per share.

Investing in our common stock involves risks. See “

Risk Factors

” beginning on page

S-4

of this prospectus supplement and in our Annual Report on Form

10-K

for the year ended December 31, 2017, which has been filed with the Securities and Exchange

Commission and is incorporated by reference in this prospectus supplement and the accompanying prospectus.

PRICE $ A SHARE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Price to

Public

|

|

|

Underwriting

Discounts and

Commissions

(1)

|

|

|

Proceeds to

Instructure

|

|

|

Per Share

|

|

$

|

|

|

|

$

|

|

|

|

$

|

|

|

|

Total

|

|

$

|

|

|

|

$

|

|

|

|

$

|

|

|

|

(1)

|

|

See “Underwriters” for a description of the compensation payable to the underwriters.

|

We

have granted the underwriters

a 30-day option

to purchase up to an additional 345,000 shares of common stock at the public offering price less underwriting discounts and commissions.

The Securities and Exchange Commission and state securities regulators have not approved or disapproved of these securities, or determined if this

prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of

common stock to purchasers on , 2018.

|

|

|

|

|

MORGAN STANLEY

|

|

CREDIT SUISSE

|

, 2018

TABLE OF CONTENTS

You should rely

only on the information contained in or incorporated by reference in this prospectus supplement, the accompanying prospectus and in any free writing prospectus that we have authorized for use in connection with this offering. We have not, and the

underwriters have not, authorized anyone to provide you with information that is different. We and the underwriters are offering to sell shares of common stock and seeking offers to buy shares of common stock only in jurisdictions where offers and

sales are permitted. The information appearing in this prospectus supplement, the accompanying prospectus, the documents incorporated by reference in this prospectus supplement and the accompanying prospectus, and in any free writing prospectus that

we have authorized for use in connection with this offering, is accurate only as of the date of those respective documents, regardless of the time of delivery of those respective documents or sale of our common stock.

For investors outside the United States: we have not, and the underwriters have not, done anything that would permit this offering or

possession or distribution of this prospectus supplement, the accompanying prospectus and in any free writing prospectus that we have authorized for use in connection with this offering in any jurisdiction where action for that purpose is required,

other than in the United States. Persons outside the United States who come into possession of this prospectus supplement, the accompanying prospectus and any free writing prospectus that we have authorized for use in connection with this offering

must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus supplement, the accompanying prospectus and any free writing prospectus that we have

authorized for use in connection with this offering outside the United States.

i

ABOUT THIS PROSPECTUS SUPPLEMENT

This document consists of two parts. The first part is this prospectus supplement, which describes the terms of this offering of common stock

and also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference into this prospectus supplement. The second part is the accompanying prospectus dated February 15, 2018, which

includes the documents incorporated by reference therein and provides more general information. To the extent the information contained in this prospectus supplement differs or varies from the information contained in the accompanying prospectus or

the documents incorporated by reference herein or therein, you should rely on the information in this prospectus supplement. Generally, when we refer to the prospectus, we are referring to this prospectus supplement and the accompanying prospectus

combined. You should read both this prospectus supplement and the accompanying prospectus, together with additional information described under the heading “Where You Can Find More Information.”

ii

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights certain information about us, this offering and selected information contained elsewhere in or incorporated by

reference into this prospectus supplement. This summary provides an overview of selected information and does not contain all of the information you should consider before deciding whether to invest in our common stock. Therefore, you should read

the entire prospectus supplement and the accompanying prospectus carefully (including the documents incorporated by reference herein and therein), especially the “Risk Factors” section beginning on

page S-4

and in the documents incorporated by reference and our consolidated financial statements (which we refer to as our “Financial Statements”) and the related notes incorporated by

reference in this prospectus supplement and the accompanying prospectus, before deciding to invest in our common stock. Unless the context otherwise requires, we use the terms “Instructure,” “Company,” “we,”

“us” and “our” in this prospectus supplement and the accompanying prospectus to refer to Instructure, Inc. and, where appropriate, our consolidated subsidiaries.

Company Overview

In today’s

dynamic, knowledge-driven economy, quality education and constant learning are critical to the success of people and organizations. Academic institutions recognize that for students to reach their maximum potential, they require an interactive and

accessible learning environment. Similarly, companies strive to compete by delivering continuous learning and feedback to better attract, develop, retain and promote the best people. Organizations in both markets—education and

corporate—also require actionable data to measure, track and improve individual and organizational performance.

With applications

for learning, assessment and performance management, Instructure enables organizations worldwide to develop, deliver, manage and track engaging academic and employee development programs. Built on our innovative, cloud-based platform, our

applications combine powerful, elegant and

easy-to-use

functionality with the reliability, security, scalability and support our customers require. They include:

|

|

•

|

|

Canvas

. Learning management system, or LMS, for K–12 and higher education;

|

|

|

•

|

|

Bridge

. Learning and performance management suite for businesses;

|

|

|

•

|

|

Arc

. Next-generation online video learning platform for academic and corporate learning; and

|

|

|

•

|

|

Gauge

. Assessment management system, or AMS, for K–12.

|

For the millions of

students, teachers and employees who use our applications to achieve their educational and professional goals, we provide an engaging and intuitive user experience designed for frequent and open interactions, a streamlined workflow and the creation

and sharing of content, with anytime, anywhere access to information. Our modern, native-cloud architecture enables users to teach, learn and engage across a wide variety of application environments, operating systems, devices and locations. Our

open standards allow for integration with third-party publishers and software providers to deliver additional learning content and applications. We also provide data analytics capabilities, enabling real-time reaction to information and benchmarking

in order to personalize curricula and goal setting; and to increase the efficacy of the learning, assessment and performance management processes.

We deliver our applications through a

Software-as-a-Service,

or SaaS, business model. Customers can rapidly deploy our systems with minimal upfront implementation.

They also benefit from regular software updates with 99.9% uptime. Our SaaS business model substantially reduces the need for our customers to buy and support a broad range of IT infrastructure, and significantly reduces the cost, complexity and

disruptions associated with implementations and upgrades of

on-premise

software.

S-1

Corporate Information

We were incorporated in Delaware in September 2008. Our principal executive offices are located at 6330 South 3000 East, Suite 700, Salt Lake

City, UT 84121 and our telephone number is (800)

203-6755.

Our corporate website address is www.instructure.com. Information contained on or accessible through our website is not a part of this prospectus, and

the inclusion of our website address in this prospectus is an inactive textual reference only.

Instructure, Canvas, the Instructure logo,

Canvas logo and Bridge logo are trademarks of Instructure, Inc. We do not intend our use or display of other companies’ trade names or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

S-2

THE OFFERING

|

|

|

|

|

|

|

|

Common stock offered by us

|

|

2,300,000 shares

|

|

|

|

|

Common stock to be outstanding after this offering

|

|

33,160,241 shares

|

|

|

|

|

Option to purchase additional shares

|

|

345,000 shares

|

|

|

|

|

Use of proceeds

|

|

We estimate that the net proceeds from this offering will be approximately $93.4 million (or approximately $107.5 million if the

underwriters exercise in full their option to purchase additional shares), after deducting underwriting discounts and commissions and estimated offering expenses payable by us.

We intend to use the net proceeds to us from this offering primarily for general

corporate purposes, including working capital, sales and marketing activities, research and development activities, general and administrative matters and capital expenditures. We may also use a portion of the net proceeds from this offering for

acquisitions of, or investments in, technologies, solutions or businesses that complement our business, although we have no present commitments or agreements to enter into any such acquisitions or investments. See “Use of Proceeds” for

additional information.

|

|

|

|

|

New York Stock Exchange symbol

|

|

“INST”

|

The number of shares of common stock to be outstanding after this offering is based on 30,860,241 shares of

common stock outstanding as of December 31, 2017, and excludes:

|

|

•

|

|

2,010,500 shares of common stock issuable upon the exercise of outstanding stock options as of December 31, 2017, with a weighted-average exercise price of $9.09 per share;

|

|

|

•

|

|

1,515,470 shares of common stock issuable upon the vesting of restricted stock units outstanding as of December 31, 2017;

|

|

|

•

|

|

16,666 shares of common stock issuable upon the exercise of outstanding warrants as of December 31, 2017, with a weighted-average exercise price of $4.47 per share;

|

|

|

•

|

|

1,926,822 shares of common stock reserved for future issuance under our 2015 Equity Incentive Plan, as well as any automatic increases in the number of shares of common stock reserved for future issuance under this

plan; and

|

|

|

•

|

|

352,631 shares of common stock reserved for future issuance under our 2015 Employee Stock Purchase Plan, as well as any automatic increases in the number of shares of common stock reserved for future issuance under this

plan.

|

Unless otherwise indicated, all information in this prospectus supplement assumes no exercise of the

underwriters’ option to purchase additional shares of common stock.

S-3

RISK FACTORS

Investing in our common stock involves high degrees of significant risk. You should carefully consider the following risks, the risks

described in our Annual Report

on Form 10-K for

the year ended December 31, 2017, as well as other information in this prospectus supplement and the accompanying prospectus, including

information incorporated by reference herein and therein, and any free writing prospectus that we have authorized for use in connection with this offering, before you invest in our common stock. If any of these risks actually materializes, our

operating results, financial condition and liquidity could be materially adversely affected. As a result, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risks Related to this Offering

We have broad

discretion in the use of the net proceeds from this offering and may not use them effectively.

Our management will have broad

discretion in the application of the balance of the net proceeds from this offering and could spend the proceeds in ways that do not improve our business, financial condition or results of operations or enhance the value of our common stock. We

intend to use the proceeds from this offering primarily for general corporate purposes, including working capital, sales and marketing activities, research and development activities, general and administrative matters and capital expenditures. We

may also use a portion of the net proceeds from the sale of common stock under this prospectus for the acquisition of, or investment in, technologies, solutions or businesses that complement our business, although we have no present commitments or

agreements to enter into any such acquisitions or investments.

The failure by our management to apply these funds effectively could

result in financial losses that could harm our business and cause the price of our common stock to decline. Pending their use, we may invest the net proceeds from this offering in a manner that does not produce income or that loses value.

Purchasers in this offering will experience immediate and substantial dilution in the tangible net book value of their investment.

If you purchase our common stock in this offering, you will incur an immediate dilution of $39.75 in net tangible book value per share from the

price you paid, based on an assumed public offering price of $42.05 per share, which is the last reported sale price of our common stock on the New York Stock Exchange on February 14, 2018. The exercise of outstanding options will result in

further dilution. For a further description of the dilution that you will experience immediately after this offering, see the section of this prospectus supplement titled “Dilution.”

S-4

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying prospectus, the documents incorporated by reference into this prospectus supplement and the

accompanying prospectus and any free writing prospectus that we have authorized for use in connection with this offering and therein contain forward-looking statements that are based on our beliefs and assumptions and on information currently

available to our management. Discussions containing these forward-looking statements may be found, among other places, in this prospectus supplement, the accompanying prospectus in any free writing prospectus we may authorize for use in connection

with a this offering, in the sections titled “Business,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” incorporated by reference from our most recent

Annual Report on

Form 10-K

and in our most recent Quarterly Report on

Form 10-Q,

as well as any amendments thereto reflected in subsequent filings with the

Securities and Exchange Commission, or SEC.

Forward-looking statements may include, but are not limited to, statements about:

|

|

•

|

|

our ability to grow and retain our customer base, both domestically and internationally;

|

|

|

•

|

|

our ability to increase revenue from our customer base by selling additional applications and services, including Arc, Gauge and Practice;

|

|

|

•

|

|

our ability to provide effective customer support and induce our customers to renew and upgrade their subscriptions;

|

|

|

•

|

|

our ability to expand our sales organization to address effectively the new industries, geographies and types of organizations we intend to target;

|

|

|

•

|

|

our ability to forecast and maintain an adequate rate of revenue growth and appropriately plan our expenses;

|

|

|

•

|

|

our ability to displace existing products addressing learning management applications, along with continued acceptance of SaaS as an effective method for delivering our applications;

|

|

|

•

|

|

the effects of seasonal and cyclical trends on our results of operations;

|

|

|

•

|

|

the attraction and retention of qualified employees and key personnel;

|

|

|

•

|

|

our ability to protect and enhance our brands and intellectual property;

|

|

|

•

|

|

costs related to defending intellectual property infringement and other claims;

|

|

|

•

|

|

the effects of increased competition and alternatives to our platform and applications and our ability to successfully differentiate our platform and applications;

|

|

|

•

|

|

our expectations concerning our relationships and actions with third parties;

|

|

|

•

|

|

future regulatory, judicial and legislative changes in our industry; and

|

|

|

•

|

|

future arrangements with, or investments in, other entities or associations, products, services or technologies.

|

In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “believe,”

“continue,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “should,” and “will,” or

the negative of terms like these or other comparable terminology, and other words or terms of similar meaning. These statements reflect our current views with respect to future events, are based on assumptions and are subject to risks and

uncertainties. Given these risks and uncertainties, you should not place undue reliance on these forward-looking statements. We discuss in greater detail, and incorporate by reference into this prospectus in their entirety, many of these risks and

uncertainties under the section titled “Risk Factors” contained in the applicable prospectus supplement, in any free writing prospectus we may authorize for use in connection with a specific offering, and in our most recent Annual Report

on Form

10-K,

as well as any

S-5

amendments thereto reflected in subsequent filings with the SEC. Also, these forward-looking statements represent our estimates and assumptions only as of the date of the document containing the

applicable statement. Unless required by law, we undertake no obligation to update or revise any forward-looking statements to reflect new information or future events or developments. Thus, you should not assume that our silence over time means

that actual events are bearing out as expressed or implied in such forward-looking statements. You should read this prospectus, the applicable prospectus supplement, together with the documents we have filed with the SEC that are incorporated by

reference and any free writing prospectus we have authorized for use in connection with a specific offering completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of the

forward-looking statements in the foregoing documents by these cautionary statements.

In addition, statements that “we believe”

and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this prospectus, and while we believe such information forms a reasonable basis for such

statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are

inherently uncertain and investors are cautioned not to unduly rely upon these statements.

S-6

USE OF PROCEEDS

We estimate that the net proceeds from the sale of shares of common stock in this offering will be approximately $93.4 million, after

deducting underwriting discounts and commissions and estimated offering expenses payable by us. If the underwriters exercise in full their option to purchase additional shares, we estimate that the net proceeds will be approximately

$107.5 million, after deducting underwriting discounts and commissions and estimated offering expenses payable by us.

As of the date

of this prospectus supplement, we cannot specify with certainty all of the particular uses for the net proceeds to us from this offering. However, we currently intend to use the net proceeds to us from this offering primarily for general corporate

purposes, including working capital, sales and marketing activities, research and development activities, general and administrative matters and capital expenditures. We may also use a portion of the net proceeds from this offering for the

acquisition of, or investment in, technologies, solutions or businesses that complement our business, although we have no present commitments or agreements to enter into any such acquisitions or investments. We will have broad discretion over the

uses of the net proceeds from this offering and investors will be relying on the judgment of our management regarding the application of the net proceeds from this offering. Pending these uses, we plan to invest the net proceeds that we receive in

this offering in short-term and intermediate-term interest-bearing obligations, investment-grade investments, certificates of deposit, or direct or guaranteed obligations of the U.S. government.

S-7

MARKET PRICE OF COMMON STOCK

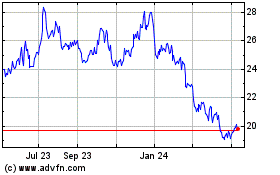

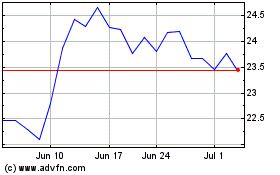

Our common stock is traded on the New York Stock Exchange under the symbol “INST.” The following table sets forth, for the periods

indicated, the high and low sales price for our common stock as reported on the New York Stock Exchange.

|

|

|

|

|

|

|

|

|

|

|

|

|

2018

|

|

|

|

|

High

|

|

|

Low

|

|

|

First quarter (through February 14, 2018)

|

|

$

|

43.80

|

|

|

$

|

32.60

|

|

|

|

|

|

|

|

2017

|

|

|

|

|

High

|

|

|

Low

|

|

|

First quarter

|

|

$

|

25.05

|

|

|

$

|

19.80

|

|

|

Second quarter

|

|

|

29.95

|

|

|

|

22.40

|

|

|

Third quarter

|

|

|

34.05

|

|

|

|

28.60

|

|

|

Fourth quarter

|

|

|

36.40

|

|

|

|

32.05

|

|

|

|

|

|

|

|

2016

|

|

|

|

|

High

|

|

|

Low

|

|

|

First quarter

|

|

$

|

22.38

|

|

|

$

|

13.79

|

|

|

Second quarter

|

|

|

21.88

|

|

|

|

16.73

|

|

|

Third quarter

|

|

|

25.66

|

|

|

|

18.58

|

|

|

Fourth quarter

|

|

|

26.66

|

|

|

|

18.65

|

|

As of February 12, 2018, there were 66 holders of record of our common stock. The actual number of

stockholders is greater than this number of record holders and includes stockholders who are beneficial owners but whose shares are held in street name by brokers and other nominees.

S-8

DIVIDEND POLICY

We have never declared or paid cash dividends on our capital stock. We intend to retain all available funds and future earnings, if any, to

fund the development and expansion of our business and we do not anticipate paying any cash dividends in the foreseeable future. The terms of our credit facility also restrict our ability to pay dividends, and we may also enter into debt instruments

in the future that will restrict our ability to declare or pay cash dividends on our common stock. Any future determination related to dividend policy will be made at the discretion of our board of directors and will be dependent on a number of

factors, including our earnings, capital requirements and overall financial condition.

S-9

DILUTION

Dilution is the amount by which the price paid by the purchasers of the shares of common stock sold in the offering exceeds the net tangible

book value per share of common stock after the offering. Net tangible book value per share is determined by subtracting our total liabilities from the total book value of our tangible assets and dividing the difference by the number of shares of

common stock deemed to be outstanding at that date.

Our historical net tangible book value as of December 31, 2017 was

$(17.2) million, or $(0.56) per share.

After giving effect to the sale of 2,300,000 shares of common stock in this offering at the

assumed public offering price of $42.05 per share, which is the last reported sale price of our common stock on the New York Stock Exchange on February 14, 2018, after deducting underwriting discounts and commissions and estimated offering

expenses payable by us, our as adjusted net tangible book value as of December 31, 2017, would have been $76.2 million, or $2.30 per share. This represents an immediate increase in as adjusted net tangible book value of $2.86 per share to

our existing stockholders and immediate dilution of $39.75 per share to new investors purchasing common stock in this offering.

The

following table illustrates this dilution on a per share basis to new investors:

|

|

|

|

|

|

|

|

|

|

|

Assumed public offering price per share

|

|

|

|

|

|

$

|

42.05

|

|

|

Historical net tangible book value per share as of December 31, 2017

|

|

$

|

(0.56

|

)

|

|

|

|

|

|

Increase in as adjusted net tangible book value per share attributable to new investors in this

offering

|

|

|

2.86

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As adjusted net tangible book value per share after this offering

|

|

|

|

|

|

|

2.30

|

|

|

|

|

|

|

|

|

|

|

|

|

Dilution in net tangible book value per share to new investors in this offering

|

|

|

|

|

|

$

|

39.75

|

|

|

|

|

|

|

|

|

|

|

|

If the underwriters exercises in full their option to purchase an additional 345,000 shares of our common

stock at an assumed public offering price of $42.05 per share, which is the last reported sale price of our common stock on the New York Stock Exchange on February 14, 2018, the as adjusted net tangible book value per share after giving

effect to this offering would be $2.69 per share, representing an immediate increase to existing stockholders of $3.25 per share, and immediate dilution to new investors in this offering of $39.36 per share.

The outstanding share information in the table above is based on 30,860,241 shares of common stock outstanding as of December 31, 2017,

and excludes:

|

|

•

|

|

2,010,500 shares of common stock issuable upon the exercise of outstanding stock options as of December 31, 2017, with a weighted-average exercise price of $9.09 per share;

|

|

|

•

|

|

1,515,470 shares of common stock issuable upon the vesting of restricted stock units outstanding as of December 31, 2017;

|

|

|

•

|

|

16,666 shares of common stock issuable upon the exercise of outstanding warrants as of December 31, 2017, with a weighted-average exercise price of $4.47 per share;

|

|

|

•

|

|

1,926,822 shares of common stock reserved for future issuance under our 2015 Equity Incentive Plan, as well as any automatic increases in the number of shares of common stock reserved for future issuance under this

plan; and

|

|

|

•

|

|

352,631 shares of common stock reserved for future issuance under our 2015 Employee Stock Purchase Plan, as well as any automatic increases in the number of shares of common stock reserved for future issuance under this

plan.

|

S-10

MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES

TO NON-U.S. HOLDERS

OF COMMON STOCK

The following summary describes the material U.S.

federal income tax consequences of the acquisition, ownership and disposition of our common stock acquired in this offering

by Non-U.S. Holders

(as defined below). This discussion is not a

complete analysis of all potential U.S. federal income tax consequences relating thereto, and does not deal with foreign, state and local consequences that may be relevant

to Non-U.S. Holders

in

light of their particular circumstances, nor does it address U.S. federal tax consequences (such as gift and estate taxes) other than income taxes. Special rules different from those described below may apply to

certain Non-U.S. Holders

that are subject to special treatment under the Internal Revenue Code of 1986, as amended (or the Code), such as financial institutions, insurance

companies, tax-exempt organizations,

broker-dealers and traders in securities, U.S. expatriates, “controlled foreign corporations,” “passive foreign investment companies,” corporations

that accumulate earnings to avoid U.S. federal income tax, corporations organized outside of the United States, any state thereof or the District of Columbia that are nonetheless treated as United States income taxpayers for United States federal

tax purposes, persons that hold our common stock as part of a “straddle,” “hedge,” “conversion transaction,” “synthetic security” or integrated investment or other risk reduction strategy, persons who acquire

our common stock through the exercise of an option or otherwise as compensation, persons subject to the alternative minimum tax or federal Medicare contribution tax on net investment income, partnerships and other pass-through entities or

arrangements, and investors in such pass-through entities or arrangements.

Such Non-U.S.

Holders are urged to consult their own tax advisors to determine the U.S. federal, state, local and other tax

consequences that may be relevant to them. Furthermore, the discussion below is based upon the provisions of the Code, and Treasury regulations, rulings and judicial decisions thereunder as of the date hereof, and such authorities may be

repealed, revoked or modified, perhaps retroactively, so as to result in U.S. federal income tax consequences different from those discussed below. We have not requested a ruling from the U.S. Internal Revenue Service, or IRS, with respect to

the statements made and the conclusions reached in the following summary, and there can be no assurance that the IRS will agree with such statements and conclusions. This discussion assumes that

the Non-U.S. Holder

holds our common stock as a “capital asset” within the meaning of Section 1221 of the Code (generally, property held for investment).

Persons considering the purchase of our common stock pursuant to this offering should consult their own tax advisors concerning the U.S.

federal income, estate and other tax consequences of acquiring, owning and disposing of our common stock in light of their particular situations as well as any consequences arising under the laws of any other taxing jurisdiction, including any

state, local or foreign tax consequences.

For the purposes of this discussion,

a “Non-U.S. Holder”

is, for U.S. federal income tax purposes, a beneficial owner of common stock that is neither a U.S. Holder, nor a partnership (or other entity treated as a partnership

for U.S. federal income tax purposes regardless of its place of organization or formation). A “U.S. Holder” means a beneficial owner of our common stock that is for U.S. federal income tax purposes any of the following:

|

|

•

|

|

an individual who is a citizen or resident of the United States;

|

|

|

•

|

|

a corporation or other entity treated as a corporation for U.S. federal income tax purposes created or organized in or under the laws of the U.S., any state thereof or the District of Columbia;

|

|

|

•

|

|

an estate the income of which is subject to U.S. federal income taxation regardless of its source; or

|

|

|

•

|

|

a trust if it (1) is subject to the primary supervision of a court within the U.S. and one or more U.S. persons have the authority to control all substantial decisions of the trust or (2) has a valid election

in effect under applicable U.S. Treasury regulations to be treated as a U.S. person.

|

S-11

Distributions

Distributions, if any, made on our common stock to

a Non-U.S. Holder

to the extent made out

of our current or accumulated earnings and profits (as determined under U.S. federal income tax principles) generally will constitute dividends for U.S. tax purposes and will be subject to withholding tax at a 30% rate or such lower rate as may be

specified by an applicable income tax treaty, subject to the discussion below regarding foreign accounts. To obtain a reduced rate of withholding under a treaty,

a Non-U.S. Holder

generally will

be required to provide us with a properly executed

IRS Form W-8BEN (in

the case of individuals) or IRS

Form W-8BEN-E (in

the case of entities), or other appropriate form, including a U.S. taxpayer identification number, or in certain circumstances, a foreign tax

identifying number, and certifying

the Non-U.S. Holder’s

entitlement to benefits under that treaty. This certification must be provided to us or our paying agent prior to the payment of

dividends and must be updated periodically. In the case of

a Non-U.S. Holder

that is an entity, Treasury Regulations and the relevant tax treaty provide rules to determine whether, for purposes of

determining the applicability of a tax treaty, dividends will be treated as paid to the entity or to those holding an interest in that entity. If

a Non-U.S. Holder

holds stock through a

financial institution or other agent acting on the holder’s behalf, the holder will be required to provide appropriate documentation to such agent. The holder’s agent will then be required to provide certification to us or our paying

agent, either directly or through other intermediaries. If you are eligible for a reduced rate of U.S. federal withholding tax under an income tax treaty and you do not timely file the required certification, you may be able to obtain a refund

or credit of any excess amounts withheld by timely filing an appropriate claim for a refund with the IRS.

We generally are not required

to withhold tax on dividends paid to

a Non-U.S. Holder

that are effectively connected with

the Non-U.S. Holder’s

conduct of a trade or business

within the United States (and, if required by an applicable income tax treaty, are attributable to a permanent establishment that such holder maintains in the United States) if a properly executed

IRS Form W-8ECI, stating

that the dividends are so connected, is furnished to us (or, if stock is held through a financial institution or other agent, to such agent). In general, such

effectively connected dividends will be subject to U.S. federal income tax, on a net income basis at the regular graduated rates applicable to U.S. residents. A

corporate Non-U.S. Holder

receiving effectively connected dividends may also be subject to an additional “branch profits tax,” which is imposed, under certain circumstances, at a rate of 30% (or such lower rate as may be specified by an applicable treaty) on the

corporate Non-U.S. Holder’s

effectively connected earnings and profits, subject to certain

adjustments. Non-U.S. Holders

should consult their tax

advisors regarding any applicable income tax treaties that may provide for different rules.

To the extent distributions on our common

stock, if any, exceed our current and accumulated earnings and profits, they will first reduce

the Non-U.S.

Holder’s adjusted basis in our common stock, but not below zero, and then will be treated

as gain to the extent of any excess, and taxed in the same manner as gain realized from a sale or other disposition of common stock as described in the next section.

Gain on Disposition of Our Common Stock

Subject to the discussion below regarding backup withholding and foreign accounts,

a Non-U.S. Holder

generally will not be subject to U.S. federal income tax with respect to gain realized on a sale or other disposition of our common stock unless (a) the gain is effectively

connected with a trade or business of such holder in the United States (and, if required by an applicable income tax treaty, is attributable to a permanent establishment that such holder maintains in the United States),

(b) the Non-U.S. Holder

is a nonresident alien individual and is present in the United States for 183 or more days in the taxable year of the disposition and certain other conditions are met or

(c) we are or have been a “United States real property holding corporation” within the meaning of Code Section 897(c)(2) at any time within the shorter of the five-year period preceding such disposition or such holder’s

holding period. In general, we would be a U.S. real property holding corporation if interests in U.S. real estate comprise (by fair market value) at least half of our business assets. We believe that we have not been and we are not, and do

not anticipate becoming, a U.S. real property holding corporation. Even if we are treated as a U.S. real property holding corporation, gain realized by

a Non-U.S. Holder

on a disposition

S-12

of our common stock will not be subject to U.S. federal income tax so long as

(1) the Non-U.S. Holder

owned, directly, indirectly and

constructively, no more than five percent of our common stock at all times within the shorter of (i) the five-year period preceding the disposition or (ii) the holder’s holding period and (2) our common stock is regularly traded

on an established securities market. There can be no assurance that our common stock will continue to qualify as regularly traded on an established securities market. If any gain on your disposition is taxable because we are a United States real

property holding corporation and your ownership of our common stock exceeds 5%, you will be taxed on such disposition generally in the manner applicable to U.S. persons.

If you are

a Non-U.S. Holder

described in (a) above, you will be required to pay tax on

the net gain derived from the sale at regular graduated U.S. federal income tax rates, and

corporate Non-U.S. Holders

described in (a) above may be subject to the additional branch profits tax

at a 30% rate or such lower rate as may be specified by an applicable income tax treaty. Gain described in (b) above will be subject to U.S. federal income tax at a flat 30% rate or such lower rate as may be specified by an applicable

income tax treaty, which gain may be offset by certain U.S.-source capital losses (even though you are not considered a resident of the U.S.), provided that

the Non-U.S. Holder

has timely filed U.S.

federal income tax returns with respect to such losses.

Information Reporting Requirements and Backup Withholding

Generally, we must report information to the IRS with respect to any dividends we pay on our common stock (even if the payments are exempt from

withholding), including the amount of any such dividends, the name and address of the recipient, and the amount, if any, of tax withheld. A similar report is sent to the holder to whom any such dividends are paid. Pursuant to tax treaties

or certain other agreements, the IRS may make its reports available to tax authorities in the recipient’s country of residence.

Dividends paid by us (or our paying agents) to

a Non-U.S. Holder

may also be subject to U.S.

backup withholding. U.S. backup withholding generally will not apply to

a Non-U.S. Holder

who provides a properly executed

IRS Form W-8BEN, IRS

Form W-8BEN-E, or

IRS

Form W-ECI, or

otherwise establishes an exemption. Notwithstanding the foregoing, backup withholding may apply if the payor has actual knowledge, or reason to know, that the holder is a U.S. person

who is not an exempt recipient.

U.S. information reporting and backup withholding requirements generally will apply to the proceeds of a

disposition of our common stock effected by or through a U.S. office of any broker, U.S. or foreign, except that information reporting and such requirements may be avoided if the holder provides a properly executed

IRS Form W-8BEN or

IRS

Form W-8BEN-E or

otherwise meets documentary evidence requirements for

establishing non-U.S.

person status or otherwise establishes an exemption. Generally, U.S. information reporting and backup withholding requirements will not apply to a payment of disposition proceeds to

a Non-U.S. Holder

where the transaction is effected outside the U.S. through

a non-U.S. office

of

a non-U.S.

broker. Information reporting and backup withholding requirements may, however, apply to a payment of disposition proceeds if the broker has actual knowledge, or reason to know, that the holder is, in fact, a U.S. person. For information

reporting purposes, certain brokers with substantial U.S. ownership or operations will generally be treated in a manner similar to U.S. brokers.

Backup withholding is not an additional tax. Any amounts withheld under the backup withholding rules may be credited against the tax liability

of persons subject to backup withholding, provided that the required information is timely furnished to the IRS.

Foreign Accounts

Sections 1471 through 1474 of the Code (commonly referred to as FATCA) impose a U.S. federal withholding tax of 30% on certain payments,

including dividends paid on and the gross proceeds of a disposition of our common stock paid to a foreign financial institution (as specifically defined by applicable rules) unless

S-13

such institution enters into an agreement with the U.S. government to withhold on certain payments and to collect and provide to the U.S. tax authorities substantial information regarding U.S.

account holders of such institution (which includes certain equity holders of such institution, as well as certain account holders that are foreign entities with U.S. owners). FATCA also generally imposes a federal withholding tax of 30% on

certain payments, including dividends paid on and the gross proceeds of a disposition of our common stock to

a non-financial foreign

entity unless such entity provides the withholding agent with

either a certification that it does not have any substantial direct or indirect U.S. owners or provides information regarding substantial direct and indirect U.S. owners of the entity. An intergovernmental agreement between the United States

and an applicable foreign country may modify those requirements. The withholding tax described above will not apply if the foreign financial institution

or non-financial foreign

entity otherwise

qualifies for an exemption from the rules. Holders are encouraged to consult with their own tax advisors regarding the possible implications of FATCA on their investment in our common stock.

The withholding provisions described above currently apply to payments of dividends, and will apply to payments of gross proceeds from a sale

or other disposition of common stock on or after January 1, 2019.

EACH PROSPECTIVE INVESTOR SHOULD CONSULT ITS OWN TAX ADVISOR REGARDING THE TAX

CONSEQUENCES OF PURCHASING, HOLDING AND DISPOSING OF OUR COMMON STOCK, INCLUDING THE CONSEQUENCES OF ANY RECENT CHANGE IN APPLICABLE LAW.

S-14

UNDERWRITERS

Under the terms and subject to the conditions in an underwriting agreement dated the date of this prospectus supplement, the underwriters

listed below, for whom Morgan Stanley & Co. LLC and Credit Suisse Securities (USA) LLC are acting as representatives, have severally agreed to purchase, and we have agreed to sell to them, severally, the number of shares indicated below:

|

|

|

|

|

|

|

Name

|

|

Number of

Shares

|

|

|

Morgan Stanley & Co. LLC

|

|

|

|

|

|

Credit Suisse Securities (USA) LLC

|

|

|

|

|

|

|

|

|

|

|

|

Total:

|

|

|

2,300,000

|

|

|

|

|

|

|

|

The underwriters and the representatives are collectively referred to as the “underwriters” and the

“representatives,” respectively. The underwriters are offering the shares of common stock subject to their acceptance of the shares from us and subject to prior sale. The underwriting agreement provides that the obligations of the

underwriters to pay for and accept delivery of the shares of common stock offered by this prospectus supplement are subject to the approval of certain legal matters by their counsel and to certain other conditions. The underwriters are obligated to

take and pay for all of the shares of common stock offered by this prospectus supplement if any such shares are taken. However, the underwriters are not required to take or pay for the shares covered by the underwriters’ option to purchase

additional shares described below.

The underwriters initially propose to offer part of the shares of common stock directly to the public

at the offering price listed on the cover page of this prospectus supplement and part to certain dealers at a price that represents a concession not in excess of $ per share under the public offering price. After the initial

offering of the shares of common stock, the offering price and other selling terms may from time to time be varied by the representatives.

We have granted to the underwriters an option, exercisable for 30 days from the date of this prospectus supplement, to purchase up to 345,000

additional shares of common stock at the public offering price listed on the cover page of this prospectus supplement less underwriting discounts and commissions. To the extent the option is exercised, each underwriter will become obligated, subject

to certain conditions, to purchase about the same percentage of the additional shares of common stock as the number listed next to the underwriter’s name in the preceding table bears to the total number of shares of common stock listed next to

the names of all underwriters in the preceding table.

The following table shows the per share and total public offering price,

underwriting discounts and commissions, and proceeds before expenses to us. These amounts are shown assuming both no exercise and full exercise of the underwriters’ option to purchase up to an additional 345,000 shares of common stock.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

|

|

Per

Share

|

|

|

No

Exercise

|

|

|

Full

Exercise

|

|

|

Public offering price

|

|

$

|

|

|

|

$

|

|

|

|

$

|

|

|

|

Underwriting discounts and commissions to be paid by us

|

|

$

|

|

|

|

$

|

|

|

|

$

|

|

|

|

Proceeds, before expenses, to us

|

|

$

|

|

|

|

$

|

|

|

|

$

|

|

|

The estimated offering expenses payable by us, exclusive of the underwriting discounts and commissions, are

approximately $400,000. We have agreed to reimburse the underwriters for expense relating to clearance of this offering with the Financial Industry Regulatory Authority up to $20,000.

Our common stock has been approved for listing on the New York Stock Exchange under the trading symbol “INST.”

S-15

We and all our directors and officers have agreed that, without the prior written consent of

Morgan Stanley & Co. LLC and Credit Suisse Securities (USA) LLC, on behalf of the underwriters, we and they will not, during the period ending 90 days after the date of this prospectus supplement (the “restricted period”):

|

|

•

|

|

offer, pledge, sell, contract to sell, sell any option or contract to purchase, purchase any option or contract to sell, grant any option, right or warrant to purchase, lend or otherwise transfer or dispose of, directly

or indirectly, any shares of common stock or any securities convertible into or exercisable or exchangeable for shares of common stock;

|

|

|

•

|

|

file any registration statement with the Securities and Exchange Commission relating to the offering of any shares of common stock or any securities convertible into or exercisable or exchangeable for common stock; or

|

|

|

•

|

|

enter into any swap or other arrangement that transfers to another, in whole or in part, any of the economic consequences of ownership of the common stock.

|

whether any such transaction described above is to be settled by delivery of common stock or such other securities, in cash or otherwise. In

addition, we and each such person agrees that, without the prior written consent of Morgan Stanley & Co. LLC and Credit Suisse Securities (USA) LLC, on behalf of the underwriters, we or such other person will not, during the restricted

period, make any demand for, or exercise any right with respect to, the registration of any shares of common stock or any security convertible into or exercisable or exchangeable for common stock.

The restrictions described in the immediately preceding paragraph to do not apply to:

|

|

(1)

|

|

transactions relating to shares of our common stock or other securities acquired in this offering or in open market transactions after the completion of this offering;

|

|

|

(2)

|

|

transfers of shares of our common stock or any security convertible into our common stock as a bona fide gift or charitable contribution;

|

|

|

(3)

|

|

transfers of shares of our common stock or any security convertible into our common stock to an immediate family member or a trust for the direct or indirect benefit of the party subject to the lockup agreement or such

immediate family member of the party subject to the

lock-up

agreement (for purposes of the

lock-up

agreement, “immediate family” shall mean any relationship by

blood, marriage or adoption, not more remote than first cousin); or

|

|

|

(4)

|

|

transfers of shares of our common stock or any security convertible into our common stock by will or intestacy;

|

|

|

(5)

|

|

transfers of shares of our common stock or any security convertible into our common stock pursuant to a domestic relations order, divorce decree or court order;

|

|

|

(6)

|

|

transfers or distributions of shares of our common stock or any securities convertible into or exercisable or exchangeable for our common stock by a stockholder that is a trust to a trustor or beneficiary of the trust

or to the estate of a beneficiary of such trust;

|

|

|

(7)

|

|

transfers to us in connection with the repurchase of our common stock in connection with the termination of the employment with us of the party subject to the

lock-up

agreement

pursuant to contractual agreements with us;

|

|

|

(8)

|

|

the disposition of shares of our common stock to us, or the withholding of shares of our common stock by us, in a transaction exempt from Section 16(b) of the Exchange Act solely in connection with the payment of

taxes due with respect to the vesting of restricted stock granted under a stock incentive plan, stock purchase plan or pursuant to a contractual employment arrangement described in this prospectus, insofar as such restricted stock is outstanding as

of the date of this prospectus;

|

|

|

(9)

|

|

the exercise of a stock option granted under a stock incentive plan or stock purchase plan described in this

prospectus by the party subject to the

lock-up

agreement, and the receipt by the party subject to the

|

S-16

|

|

lock-up

agreement of shares of our common stock from us upon such exercise, insofar as such option is outstanding as of the date of this prospectus,

provided that the underlying shares shall continue to be subject to the restrictions on transfer set forth in the

lock-up

agreement and, provided, further that, if required, any public report or filing under

Section 16 of the Exchange Act shall clearly indicate in the footnotes thereto that the filing relates to the exercise of a stock option, that no shares were sold by the reporting person and that the shares received upon exercise of the stock

option are subject to a

lock-up

agreement with the underwriters of this offering;

|

|

|

(10)

|

|

a merger, consolidation or other similar transaction involving a change of control that has been approved by our board of directors, provided that, in the event that such change of control transaction is not completed,

this clause (10) shall not be applicable and the shares of the party subject to the

lock-up

agreement shall remain subject to the restrictions contained in the

lock-up

agreement;

|

|

|

(11)

|

|

the establishment of a trading plan pursuant to Rule

10b5-1

under the Exchange Act for the transfer of shares of our common stock provided that (a) such plan does not provide

for the transfer of our common stock during the restricted period and (b) to the extent a public announcement or filing under the Exchange Act, if any, is required of or voluntarily made by or on behalf of the party subject to the

lock-up

agreement or us regarding the establishment of such plan, such announcement or filing shall include a statement to the effect that no transfer of our common stock may be made under such plan during the

restricted period;

|

|

|

(12)

|

|

the transfer pursuant to a trading plan pursuant to Rule 10b5-1 under the Exchange Act that is existing as of the date hereof, provided that to the extent a public announcement or filing under the Exchange Act is

required of us or on of our officers or directors regarding the sale, such announcement or filing shall include a statement to the effect that the sale occurred pursuant to such trading plan pursuant to Rule 10b5-1;

|

|

|

(13)

|

|

the sale or issuance of or entry into an agreement to sell or issues shares of common stock in connection with our acquisition of one of one or more businesses, products or technologies (whether by means of merger,

stock purchase, asset purchase or otherwise) or in connection with joint ventures, commercial relationships or other strategic transactions;

|

|

|

(14)

|

|

the issuance by us of shares of common stock upon the exercise of an option or warrant or the conversion of a security outstanding on the date hereof and disclosed in the prospectus for this offering, or the issuance by

us of shares of, or options to purchase shares of, common stock or restricted stock units to employees, officers, directors, advisors or consultants pursuant to employee benefit plans in effect on the date hereof and described in the prospectus for

this offering;

|

|

|

(15)

|

|

the disposition of up to 39,000 shares of common stock in the aggregate by our non-employee directors;

|

provided, that, in the case of clauses (2), (3), (4), (5) or (6) above each transferee, donee or distributee shall sign and deliver a

lock-up

agreement; and, provided, further that in the case of clauses (1), (2), (3), (4), (5), (6), (7) or (8) above no filing under Section 16(a) of the Exchange Act, reporting a reduction in beneficial

ownership of shares of our common stock, shall be required or shall be voluntarily made during the restricted period; and provided, further, that, the aggregate number of shares of common stock that we may sell or issue or agree to sell or issue

pursuant to clause (13) above will not exceed 5% of the total number of shares of common stock issued and outstanding immediately following the completion of this offering. A “change of control” means the transfer (whether by tender offer,

merger, consolidation or other similar transaction), in one transaction or a series of related transactions, to a person or group of affiliated persons (other than an underwriter pursuant to this offering), of our voting securities if, after such

transfer, such person or group of affiliated persons would hold at least 90% of our (or the surviving entity’s) outstanding voting securities and for the avoidance of doubt, this offering is not a change of control.

Morgan Stanley & Co. LLC and Credit Suisse Securities (USA) LLC may release the common stock and other securities subject to the

lock-up

agreements described above in whole or in part at any time.

S-17

In order to facilitate the offering of the common stock, the underwriters may engage in

transactions that stabilize, maintain or otherwise affect the price of the common stock. Specifically, the underwriter may sell more shares than they are obligated to purchase under the underwriting agreement, creating a short position. A short sale

is covered if the short position is no greater than the number of shares available for purchase by the underwriters under the option. The underwriters can close out a covered short sale by exercising the option or purchasing shares in the open

market. In determining the source of shares to close out a covered short sale, the underwriters will consider, among other things, the open market price of shares compared to the price available under the option. The underwriters may also sell

shares in excess of the option, creating a naked short position. The underwriters must close out any naked short position by purchasing shares in the open market. A naked short position is more likely to be created if the underwriters are concerned

that there may be downward pressure on the price of the common stock in the open market after pricing that could adversely affect investors who purchase in this offering. As an additional means of facilitating this offering, the underwriters may bid

for, and purchase, shares of common stock in the open market to stabilize the price of the common stock. These activities may raise or maintain the market price of the common stock above independent market levels or prevent or retard a decline in

the market price of the common stock. The underwriters are not required to engage in these activities and may end any of these activities at any time.

We and the underwriters have agreed to indemnify each other against certain liabilities, including liabilities under the Securities Act.

A prospectus supplement in electronic format may be made available on websites maintained by one or more underwriters or selling group

members, if any, participating in the offering. The representatives may agree to allocate a number of shares of common stock to underwriters for sale to their online brokerage account holders. Internet distributions will be allocated by the

representatives to underwriters that may make Internet distributions on the same basis as other allocations.

The underwriters and their

affiliates are full service financial institutions engaged in various activities, which may include securities trading, commercial and investment banking, financial advisory, investment management, investment research, principal investment, hedging,

financing and brokerage activities. Certain of the underwriters and their respective affiliates have, from time to time, performed, and may in the future perform, various financial advisory and investment banking services for us, for which they

received or will receive customary fees and expenses.

In addition, in the ordinary course of their various business activities, the

underwriters and their affiliates may make or hold a broad array of investments and actively trade debt and equity securities (or related derivative securities) and financial instruments (including bank loans) for their own account and for the

accounts of their customers and may at any time hold long and short positions in such securities and instruments. Such investment and securities activities may involve our securities and instruments. The underwriters and their affiliates may also

make investment recommendations or publish or express independent research views in respect of such securities or instruments and may at any time hold, or recommend to clients that they acquire, long or short positions in such securities and

instruments.

Selling Restrictions

Canada

The shares

of our common stock may be sold only to purchasers purchasing, or deemed to be purchasing, as principal that are accredited investors, as defined in National Instrument

45-106

Prospectus Exemptions or

subsection 73.3(1) of the Securities Act (Ontario), and are permitted clients, as defined in National Instrument

31-103

Registration Requirements, Exemptions and Ongoing Registrant Obligations. Any resale of

the shares of our common stock must be made in accordance with an exemption from, or in a transaction not subject to, the prospectus requirements of applicable securities laws.

S-18

Securities legislation in certain provinces or territories of Canada may provide a purchaser with

remedies for rescission or damages if this prospectus (including any amendment thereto) contains a misrepresentation, provided that the remedies for rescission or damages are exercised by the purchaser within the time limit prescribed by the

securities legislation of the purchaser’s province or territory. The purchaser should refer to any applicable provisions of the securities legislation of the purchaser’s province or territory for particulars of these rights or consult with

a legal advisor.

Pursuant to section 3A.3 (or, in the case of securities issued or guaranteed by the government of a

non-Canadian

jurisdiction, section 3A.4) of National Instrument

33-105

Underwriting Conflicts (NI

33-105),

the underwriters are not

required to comply with the disclosure requirements of NI

33-105

regarding underwriter conflicts of interest in connection with this offering.

European Economic Area

In relation to each Member State of the European Economic Area which has implemented the Prospectus Directive (each, a “Relevant Member

State”) an offer to the public of any shares of our common stock may not be made in that Relevant Member State, except that an offer to the public in that Relevant Member State of any shares of our common stock may be made at any time under the

following exemptions under the Prospectus Directive, if they have been implemented in that Relevant Member State:

|

|

•

|

|

to any legal entity which is a qualified investor as defined in the Prospectus Directive;

|

|

|

•

|

|

to fewer than 100 or, if the Relevant Member State has implemented the relevant provision of the 2010 PD Amending Directive, 150, natural or legal persons (other than qualified investors as defined in the Prospectus

Directive), as permitted under the Prospectus Directive, subject to obtaining the prior consent of the representatives for any such offer; or

|

|

|

•

|

|

in any other circumstances falling within Article 3(2) of the Prospectus Directive, provided that no such offer of shares of our common stock shall result in a requirement for the publication by us or any underwriter of

a prospectus pursuant to Article 3 of the Prospectus Directive.

|

For the purposes of this provision, the expression an “offer to the

public” in relation to any shares of our common stock in any Relevant Member State means the communication in any form and by any means of sufficient information on the terms of the offer and any shares of our common stock to be offered so as

to enable an investor to decide to purchase any shares of our common stock, as the same may be varied in that Member State by any measure implementing the Prospectus Directive in that Member State, the expression “Prospectus Directive”

means Directive 2003/71/EC (and amendments thereto, including the 2010 PD Amending Directive, to the extent implemented in the Relevant Member State), and includes any relevant implementing measure in the Relevant Member State, and the

expression “2010 PD Amending Directive”

means

Directive 2010/73/EU.

United Kingdom

Each underwriter has represented and agreed that:

|

|

•

|

|

it has only communicated or caused to be communicated and will only communicate or cause to be communicated an invitation or inducement to engage in investment activity (within the meaning of Section 21 of the

Financial Services and Markets Act 2000 (“FSMA”) received by it in connection with the issue or sale of the shares of our common stock in circumstances in which Section 21(1) of the FSMA does not apply to us; and

|

|

|

•

|

|

it has complied and will comply with all applicable provisions of the FSMA with respect to anything done by it in relation to the shares of our common stock in, from or otherwise involving the United Kingdom.

|

S-19

LEGAL MATTERS

The validity of the shares of common stock being offered by this prospectus will be passed upon for us by Cooley LLP, Palo Alto, California.

Wilson Sonsini Goodrich & Rosati, Professional Corporation, Seattle, Washington, is counsel for the underwriters in connection with this offering.

EXPERTS

The consolidated financial statements of Instructure, Inc. appearing in Instructure, Inc.’s Annual Report (Form 10-K) for the year ended

December 31, 2017, and the effectiveness of Instructure, Inc.’s internal control over financial reporting as of December 31, 2017 have been audited by Ernst & Young LLP, independent registered public accounting firm, as set forth in their

reports thereon, included therein, and incorporated herein by reference. Such consolidated financial statements are incorporated herein by reference in reliance upon such reports given on the authority of such firm as experts in accounting and

auditing.

WHERE YOU CAN FIND ADDITIONAL INFORMATION

We file annual, quarterly and other reports, proxy statements and other information with the SEC. Our SEC filings are available to the public

over the Internet at the SEC’s website at http://www.sec.gov. You may also read and copy any document we file at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. You may obtain information on the operation of

the public reference rooms by calling the SEC at

1-800-SEC-0330.

The SEC also maintains an Internet website that contains

reports, proxy statements, and other information about issuers, like us, that file electronically with the SEC. The address of that website is www.sec.gov.

Our Annual Report on Form

10-K,

Quarterly Reports on Form

10-Q

and Current Reports on Form

8-K,

including any amendments to those reports, and other information that we file with or furnish to the SEC pursuant to Section 13(a) or 15(d) of the Exchange Act can also be

accessed free of charge on the Investor section of our website, which is located at investor.instructure.com. These filings will be available as soon as reasonably practicable after we electronically file such material with, or furnish it to, the

SEC. The information contained in, or that can be accessed through, our website is not incorporated by reference into this prospectus supplement.

S-20

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate by reference” information from other documents that we file with it, which means that we can

disclose important information to you by referring you to those documents. The information incorporated by reference is considered to be part of this prospectus. Information in this prospectus supersedes information incorporated by reference that we

filed with the SEC prior to the date of this prospectus, while information that we file later with the SEC will automatically update and supersede the information in this prospectus. We incorporate by reference into this prospectus and the

registration statement of which this prospectus is a part the information or documents listed below that we have filed with the SEC (Commission File

No. 001-37629):

|

|

•

|

|

our Annual Report

on Form 10-K for

the year ended December 31, 2017, which was filed on February 15, 2018;

|

|

|

•

|

|

our Current Report on

Form 8-K, which

was filed on January 24, 2018; and

|

|

|

•

|

|

the description of our common stock in our registration statement on

Form 8-A filed

with the SEC on November 10, 2015, including all amendments and reports filed

for the purpose of updating such description.

|

We also incorporate by reference any future filings (other than current

reports furnished under Item 2.02 or Item 7.01

of Form 8-K and

exhibits filed on such form that are related to such items unless such

Form 8-K expressly

provides to the contrary) made with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act until we file a post-effective amendment that indicates the

termination of the offering of the securities made by this prospectus and will become a part of this prospectus from the date that such documents are filed with the SEC. Information in such future filings updates and supplements the information

provided in this prospectus. Any statements in any such future filings will automatically be deemed to modify and supersede any information in any document we previously filed with the SEC that is incorporated or deemed to be incorporated herein by

reference to the extent that statements in the later filed document modify or replace such earlier statements.

We will furnish without

charge to each person, including any beneficial owner, to whom a prospectus is delivered, upon written or oral request, a copy of any or all of the documents incorporated by reference, including exhibits to these documents. Any such request may be

made by writing or telephoning us at the following address or phone number:

Instructure, Inc.

Attn: Investor Relations

6330

South 3000 East, Suite 700,

Salt Lake City, UT 84121

(800) 203-6755

S-21

PROSPECTUS

$115,000,000

Common Stock

We may, from time to time,

offer and sell up to $115,000,000 of shares of our common stock in amounts, at prices and on terms described in one or more supplements to this prospectus. We may also authorize one or more free writing prospectuses to be provided to you in

connection with these offerings.

This prospectus describes some of the general terms that may apply to an offering of our common stock. The specific

terms and any other information relating to a specific offering will be set forth in a post-effective amendment to the registration statement of which this prospectus is a part, in a supplement to this prospectus or in a free writing prospectus, or

may be set forth in one or more documents incorporated by reference in this prospectus. You should read this prospectus, the information incorporated by reference into this prospectus and any applicable prospectus supplement or free writing

prospectus carefully before you invest.

Shares of our common stock may be sold by us to or through underwriters or dealers, directly to purchasers or

through agents designated from time to time. For additional information on the methods of sale, you should refer to the section titled “Plan of Distribution” in this prospectus and in the applicable prospectus supplement. If any