Filed

Pursuant to Rule 424(b)(5)

Registration

No. 333-213280

PROSPECTUS

SUPPLEMENT

(to

Prospectus dated August 31, 2016)

810,000

American Depositary Shares Representing 40,500,000 Ordinary Shares

Medigus

Ltd.

We

are offering 810,000 American Depositary Shares, or ADSs, representing 40,500,000 of our ordinary shares, par value NIS 0.10 per

share, at a price of $2.00 per ADS, pursuant to this prospectus supplement and the accompanying prospectus. Each ADS represents

50 ordinary shares. See “Description of American Depositary Shares” and “Description of Ordinary Shares”

in the accompanying prospectus for more information.

In

a concurrent private placement, we are selling to the investors warrants to purchase up to 405,000 ADSs, representing 20,250,000

of our ordinary shares, par value NIS 0.10 per share, at an initial exercise price of $2.25 per ADS, or the Warrants. The Warrants,

the ADSs issuable upon the exercise of the Warrants and the ordinary shares represented by such ADSs are being offered pursuant

to an exemption from registration provided in Section 4(a)(2) under the Securities Act of 1933, as amended, or the Securities

Act, and Rule 506(b) promulgated thereunder, and they are not being offered pursuant to this prospectus supplement and the accompanying

prospectus.

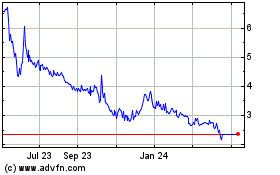

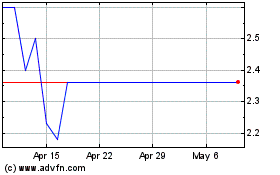

Our ADSs trade on the

Nasdaq Capital Market, or the NASDAQ, under the symbol “MDGS”. On November 22, 2017, the last reported sale

price of our ADSs on NASDAQ was $2.23 per ADS. Our ordinary shares currently trade on the Tel Aviv Stock Exchange Ltd., or

TASE, under the symbol “MDGS.” On November 23, 2017, the last reported sale price of our ordinary shares on the

TASE was NIS 0.152, or $0.043 per share (based on the exchange rate reported by the Bank of Israel on such date).

On October 20, 2017, the aggregate market value of our ordinary shares held by non-affiliates was $7,171,181,

based on 151,285,784 ordinary shares outstanding (equivalent to 3,025,715 ADSs) and a per ADS price of $2.39 based on the closing

sale price of our ADSs on NASDAQ on October 20, 2017. We have sold an aggregate of approximately $763,244 of our securities pursuant

to General Instruction I.B.5 on Form F-3 during the prior 12 calendar month period that ends on and includes the date of this prospectus.

You

should carefully read this prospectus supplement and the accompanying prospectus (including all of the information incorporated

by reference therein) before you invest. Investing in our securities involves a high degree of risk. Before buying any securities,

you should read the discussion of material risks of investing in our securities in the section entitled “Risk Factors”

beginning on page S-10 of this prospectus supplement.

|

|

|

Per ADS

|

|

|

Total

|

|

|

Offering price

|

|

$

|

2.00

|

|

|

$

|

1,620,000

|

|

|

Placement agent fee

(1)

|

|

$

|

0.14

|

|

|

$

|

113,400

|

|

|

Proceeds, before expenses, to us

|

|

$

|

1.86

|

|

|

$

|

1,506,600

|

|

|

(1)

|

In

addition to the placement agent cash fee listed in the table above, we have agreed to reimburse the placement agent for certain

of its expenses with respect to this offering and issue warrants to purchase our ADSs as described under “Plan of Distribution”

on page S-39 of this prospectus supplement.

|

Delivery

of the ADSs is expected to be made on or about November 28, 2017.

None

of the United States Securities and Exchange Commission, the Israeli Securities Authority, any state securities commission or

any other regulatory body, has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus

supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

Prospectus

Supplement dated November 24, 2017

Table

Of Contents

ABOUT

THIS PROSPECTUS SUPPLEMENT

You

should rely only on the information incorporated by reference or provided in this prospectus supplement and the accompanying prospectus,

or to which we have referred you. We have not authorized anyone to provide you with different information. If anyone provides

you with different or inconsistent information, you should not rely on it. This prospectus supplement and the accompanying prospectus

do not constitute an offer to sell, or a solicitation of an offer to purchase, the securities offered by this prospectus supplement

and the accompanying prospectus in any jurisdiction where it is unlawful to make such offer or solicitation. You should not assume

that the information contained in this prospectus supplement or the accompanying prospectus, or any document incorporated by reference

in this prospectus supplement or the accompanying prospectus, is accurate as of any date other than the date on the front cover

of the applicable document. Neither the delivery of this prospectus supplement nor any distribution of securities pursuant to

this prospectus supplement shall, under any circumstances, create any implication that there has been no change in the information

set forth or incorporated by reference into this prospectus supplement or in our affairs since the date of this prospectus supplement.

Our business, financial condition, results of operations and prospects may have changed since that date.

A registration statement

on Form F-3 (File No. 333-213280) utilizing a shelf registration process relating to the securities described in this prospectus

supplement was initially filed with the Securities and Exchange Commission, or the SEC, on August 24, 2016, and was declared effective

on August 31, 2016. Under this shelf registration process, of which this offering is a part, we may, from time to time, sell up

to an aggregate of $20 million of our securities. We have sold an aggregate of $763,244 of our securities under this shelf registration

process during the prior 12 calendar month period that ends on and includes the date of this prospectus supplement. This document

comprises two parts. The first part is this prospectus supplement, which describes the specific terms of this offering and also

adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference herein. The

second part, the accompanying prospectus, gives more general information, some of which may not apply to this offering. Generally,

when we refer to this prospectus supplement, we are referring to both parts of this document combined. If the description of the

offering varies between this prospectus supplement and the accompanying prospectus or the documents incorporated herein by reference

filed prior to the date of this prospectus supplement, you should rely on the information contained in this prospectus supplement.

However, if any statement in one of these documents is inconsistent with a statement in another document having a later date —

for example, a document incorporated by reference in the accompanying prospectus — the statement in the document having the

later date modifies or supersedes the earlier statement.

Before

purchasing any securities, you should carefully read both this prospectus supplement and the accompanying prospectus, together

with the additional information described under the headings, “Where You Can Find More Information” and “Incorporation

of Information by Reference,” on page S-42 of this prospectus supplement.

Unless

the context otherwise requires, all references to “Medigus,” “we,” “us,” “our,”

the “Company” and similar designations refer to Medigus Ltd. The term “NIS” refers to New Israeli Shekels,

the lawful currency of the State of Israel, the terms “dollar”, “US$” or “$” refer to U.S.

dollars, the lawful currency of the United States. Our functional and presentation currency is the U.S. dollar. Foreign currency

transactions in currencies other than the U.S. dollar are translated in this prospectus supplement into U.S. dollars using exchange

rates in effect at the date of the transactions.

We

further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any

document that is incorporated by reference herein were made solely for the benefit of the parties to such agreement, including,

in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation,

warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made.

Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state

of our affairs.

We

are offering to sell, and seeking offers to buy, ADSs representing our ordinary shares only in jurisdictions where offers and

sales are permitted. The distribution of this prospectus supplement and the accompanying prospectus and the offering of the ADSs

in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession of this prospectus

supplement and the accompanying prospectus must inform themselves about, and observe any restrictions relating to, the offering

of the ADSs and the distribution of this prospectus supplement and the accompanying prospectus outside the United States. This

prospectus supplement and the accompanying prospectus do not constitute, and may not be used in connection with, an offer to sell,

or a solicitation of an offer to buy, any securities offered by this prospectus supplement and the accompanying prospectus by

any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus supplement, the accompanying prospectus, and the information incorporated by reference herein and therein may include

forward looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other U.S. Federal securities

laws. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance

or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking

statements. In some cases, you can identify forward-looking statements by terms including “anticipates”, “believes”,

“could”, “estimates”, “expects”, “intends”, “may”, “plans”,

“potential”, “predicts”, “projects”, “should”, “will”, “would”,

and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views

with respect to future events and are based on assumptions and subject to risks and uncertainties. In addition, certain sections

of this prospectus supplement, the accompanying prospectus, and the information incorporated by reference herein contain information

obtained from independent industry and other sources that we have not independently verified. You should not put undue reliance

on any forward-looking statements. Unless we are required to do so under U.S. federal securities laws or other applicable laws,

we do not intend to update or revise any forward-looking statements.

Our

ability to predict our operating results or the effects of various events on our operating results is inherently uncertain. Therefore,

we caution you to consider carefully the matters described under the caption “Risk Factors” on page S-10 of this

prospectus supplement, and certain other matters discussed in this prospectus supplement, the accompanying prospectus, and the

information incorporated by reference herein and therein, and other publicly available sources. Such factors and many other factors

beyond our control could cause our actual results, performance or achievements to be materially different from any future results,

performance or achievements that may be expressed or implied by the forward-looking statements.

Factors

that could cause our actual results to differ materially from those expressed or implied in such forward-looking statements include,

but are not limited to:

|

|

●

|

the

overall global economic environment;

|

|

|

●

|

insufficient

coverage or reimbursement from medical insurers;

|

|

|

●

|

the

impact of competition and new technologies;

|

|

|

●

|

general

market, political, reimbursement and economic conditions in the countries in which we

operate;

|

|

|

●

|

our

ability to continue as a going concern;

|

|

|

●

|

projected

capital expenditures and liquidity;

|

|

|

●

|

changes

in our strategy;

|

|

|

●

|

government

regulations and approvals;

|

|

|

●

|

changes

in customers’ budgeting priorities;

|

|

|

●

|

litigation

and regulatory proceedings;

|

|

|

●

|

those

factors referred to the “Risk Factors” found on page S-10 of this prospectus

supplement; and

|

|

|

●

|

those

factors referred to in “Item 3. Key Information – D. Risk Factors,”

“Item 4. Information on the Company,” and “Item 5. Operating

and Financial Review and Prospects” in our Annual Report on Form 20-F for the year

ended December 31, 2016.

|

We

caution you to carefully consider these risks and not to place undue reliance on our forward-looking statements. Except as required

by law, we assume no responsibility for updating any forward-looking statements.

PROSPECTUS

SUPPLEMENT SUMMARY

This

summary highlights selected information about us, this offering and information contained in greater detail elsewhere in this

prospectus supplement, the accompanying prospectus, and in the documents incorporated by reference. This summary is not complete

and does not contain all of the information that you should consider before investing in our ADSs. You should carefully read and

consider this entire prospectus supplement, the accompanying prospectus and the documents, including financial statements and

related notes, and information incorporated by reference into this prospectus supplement, including the financial statements and

“Risk Factors” starting on page S-10 of this prospectus supplement, before making an investment decision. If you invest

in our securities, you are assuming a high degree of risk.

Overview

Who

We Are

We

are a medical device company dedicated to the development, manufacturing and marketing of surgical endostaplers and direct vision

systems for minimally invasive medical procedures or other commercial use. Our expertise is in the development, production and

marketing of innovative surgical devices with direct visualization capabilities for the treatment of Gastroesophageal Reflux Disease,

or GERD, a common ailment, which is predominantly treated by medical therapy (e.g. proton pump inhibitors) or in chronic cases,

conventional open or laparoscopic surgery. Our FDA-cleared and CE-marked endosurgical system, known as the MUSE

TM

(Medigus

Ultrasonic Surgical Endostapler) system, enables minimally-invasive and incisionless procedures for the treatment of GERD by reconstruction

of the esophageal valve via the mouth and esophagus, eliminating the need for surgery in eligible patients. We believe that this

procedure offers a safe, effective and economical alternative to the current modes of GERD treatment for certain GERD patients,

and has the ability to provide results which are equivalent to those of standard surgical procedures while reducing pain and trauma,

minimizing hospital stays, and delivering economic value to hospitals and payors.

The

key elements of the MUSE

TM

system include a single-use endostapler containing several sophisticated innovative technologies

such as flexible stapling technology, a miniature camera and ultrasound sensor, as well as a control console offering a video

image transmitted from the tip of the endostapler.

In

addition to the MUSE

TM

system for the treatment of GERD, we have developed miniaturized video cameras for use in various

medical procedures as well as specialized industrial applications.

Prevalence

of GERD

GERD,

is a worldwide disorder, with evidence suggesting an increase in GERD disease prevalence since 1995. The sample size weighted

mean for the GERD population in the United States and Europe is 19.8% and 15.2% respectively. In the United States alone, over

49 million adults are affected by the disease, with over 29 million adults suffering daily GERD symptoms. Proton pump inhibitors,

or PPIs, are a class of effective and generally safe medication to treat GERD, but not everyone who experiences heartburn needs

a PPI. Several PPIs have been widely advertised to consumers and heavily promoted by physicians. This has led to an overuse of

the drug. PPIs are the third highest selling class of drugs in the U.S. and Nexium has the second highest retail sales among all

drugs at $4.8 billion in 2008. This figure does not include sales of other brands of PPIs.

After

being swallowed, food descends through the esophagus to the stomach, which contains acids and enzymes intended to digest and break

down food. GERD is caused by the defective operation of the lower esophageal sphincter, or LES, a valve, which controls the flow

of ingested food from the esophagus into the stomach. While eating and between eating periods, a properly operating LES prevents

stomach contents from entering the esophagus. Among GERD sufferers, the valve opens spontaneously or is unable to close properly.

This results in acidic stomach contents rising into the esophagus, causing irritation, acid reflux and heartburn, as well as other

potentially dangerous conditions.

Beyond

painful symptoms, GERD may also increase sufferers’ susceptibility to cancer. Whereas the stomach is lined by the “gastric

mucosal barrier” which allows acidic material to be contained harmlessly, the surface of the esophagus consists of flat,

thin cells called squamous cells, which are not resistant to acid. Repeated episodes of acid reflux can cause inflammation

of the esophagus, a condition called esophagitis. The flat cells lining the esophagus can also undergo genetic changes due to

exposure to acid, causing these cells to resemble those found in the stomach lining, a condition known as Barrett’s Esophagus.

Barrett’s

Esophagus is a complication of GERD and predisposes patients to esophageal adenocarcinoma, a tumor that has increased in incidence

more than 7-fold over the past several decades. Studies have shown that people exhibiting Barrett’s Esophagus have a higher

risk of developing cancer of the esophagus. Studies have also shown, that compared to patients not exhibiting GERD symptoms, patients

exhibiting weekly symptoms of GERD have a five times higher probability for developing esophageal cancer while patients exhibiting

daily symptoms of GERD have a seven times higher probability for developing esophageal cancer. The most common risk factors for

cancer in Barrett esophagus patients include chronic GERD, hiatal hernia, advanced age, male sex, white race, cigarette smoking

and obesity.

Treatment

of GERD

Treatment

of GERD involves a stepwise approach. The goals are to control symptoms, to heal esophagitis and to prevent recurrent esophagitis.

The treatment is based on lifestyle modification and control of gastric acid through medical treatment (antacids, PPI’s,

H2 blockers or other reflux inhibitors) or antireflux surgery. Mild GERD may be defined as intermittent reflux symptoms that can

be managed with lifestyle changes or over-the-counter medications. Moderate to severe GERD represents more chronic symptoms that

may require stronger drugs, long term medication or surgical intervention.

Drug

treatment - Proton pump inhibitors (PPI)

For

moderate to severe GERD, physicians usually prescribe proton pump inhibiting drugs, or PPI. This class of drugs reduces acid production

by the stomach, and thereby relieves the patients of their symptoms. Drugs of this class are among the most commonly prescribed

medications in the world. There are several brands on the market, best known are Prilosec (omeprazole), Prevacid (lansoprazole)

and Nexium (esomeprazole). Certain PPI drugs are available over the counter in the United States and in other countries, but the

over the counter dosage may be inadequate to control GERD symptoms, except in mild cases.

While

PPI drugs effectively reduce the severity and frequency of GERD symptoms, they have a number of drawbacks:

a)

In approximately 30% of patients, symptom control is incomplete;

b)

The drugs do not treat the disease, they only control its manifestations, therefore must be taken for life at a dosage which requires

prescription. Accumulated costs may be substantial; and

c)

Long term use is associated with a number of serious adverse effects. In particular, they increase the risk of osteoporosis and

fractures of the hip, wrist and spine. The FDA had issued a warning on this effect as well as warnings against other untoward

effects on absorption of other essential minerals, which may lead to chronic kidney disease, irregular heartbeat, diarrhea and

increased flatulence.

Interventional

treatment

The

most common operation for GERD is called a surgical fundoplication, a procedure that prevents reflux by wrapping or attaching

the upper part of the stomach around the lower esophagus and securing it with sutures. Due to the presence of the wrap or attachment,

increasing pressure in the stomach compresses the portion of the esophagus which is wrapped or attached by the stomach, and prevents

acidic gastric content from flowing up into the esophagus. Today, the operation is usually performed laparoscopically: instead

of a single large incision into the chest or abdomen, four or five smaller incisions are made in the abdomen, and the operator

uses a number of specially designed tools to operate under video control.

The

operation does not completely eliminate the use of PPI, and up to approximately 60% still use some in long term follow up. Nevertheless,

the dose is usually lower – in the over the counter range - and the response rate is excellent. Since the majority of patients

referred to surgeons are incomplete responders, or require a high dose of PPI, the patients are generally satisfied with the operation,

and the overall costs of treatment are lower in the long run.

In

spite of the clinical outcome of surgery, relatively few patients undergo surgery. We estimate that large numbers of patients

who are candidates for operative treatment are either not referred by their treating physician or decline it. We believe that

many patients decline to undergo operations to avoid even minute scars or violation of the abdominal cavity.

Given

the current environment in which the vast majority of GERD sufferers in North America and Europe must choose between long-term

pharmaceutical therapy and surgery, leading to what is known in our industry as the “treatment gap”, we believe there

is a demand for a minimally-invasive, incision-less procedure which treats the root cause of the disease. We believe that the

MUSE

TM

system is positioned to fill this need.

Our

system achieves the general physiological result of surgical fundoplication, by inserting the MUSE

TM

endostapler

through the mouth and the esophagus, and stapling the top of the stomach to the side of the esophagus. The endostapler contains

a video camera and stapling system. Staples have long been used in surgical procedures in place of sutures, and we believe that

they are at least as reliable and potentially more durable. Our endostapler uses standard surgical staples.

First

line therapy for GERD includes a combination of lifestyle modifications and medical therapy, or PPIs. Unfortunately, 25% to 42%

of patients with GERD do not respond to an initial 4-8-week treatment of PPI. In those who do respond to therapy, the effectiveness

of PPI treatment decreases over time. Antireflux surgery controls acid reflux and treats an incompetent lower esophageal sphincter,

while also improving patient quality of life in the long term. Thus, PPI therapy and lifestyle modifications are frequently eliminated.

Despite

the effectiveness of surgery, it is invasive, requires hospitalization, and carries the risk of short and long-term complications,

including dysphagia, diarrhea, and gas bloat syndrome Thus, endoscopic therapies that mimic the mechanism through which surgery

works and can reduce surgical morbidity have gained popularity for the treatment of GERD.

The

market for medical devices, including the market for endoscopic therapies, is very broad, with an increasing demand for new less

invasive alternatives to the existing surgical procedures for the treatment of various diseases. This increasing need for minimally

invasive and incision-less treatments, such as endoscopy-based procedures, are also augmented by the increase in the average age

of global population. In 2000, the worldwide population of persons aged more than 65 years was an estimated 420 million. During

2000-2030, the worldwide population aged more than 65 years is projected to increase by approximately 550 million to 973 million.

This increase in age will potentially lead to increased health-care costs and may have dramatic consequences for public health

and the health care financing and delivery systems significant patient benefits and cost savings.

Endoscopy

is a minimally invasive method of performing investigative, diagnostic and therapeutic medical procedures, employing an endoscope,

which allows real-time visual observation of the patient’s internal organs during the procedure. Endoscopic procedures are

most commonly performed through natural orifices, including via the mouth, to avoid incisions. Because of the accessibility of

the digestive tract through the mouth, the endoscopy field is largely focused on disorders of the gastrointestinal tract such

as disorders of the colon, esophagus, stomach and duodenum.

Endoscopes

are commonly composed of a flexible tube with a camera installed at its tip. Endoscopes often include “working channels”

through which catheters or other endoscopic tools or devices may be inserted directly into the patient’s digestive system.

The primary advantage of endoscopy is the elimination of incisions to the patient’s body during a medical procedure. We

believe that this is safer, prevents most post-operative pain and facilitates faster recuperation. Patient perception or preference

is important as well. The perception of endoscopy procedures as being safer, and less painful than, corresponding surgical procedures

may have the effect of minimizing patient fears.

Endoscopic

procedures generally involve less recovery time and patient discomfort than conventional open or laparoscopic surgery. These procedures

are also typically performed in the outpatient hospital setting as opposed to an inpatient setting. Typically, outpatient procedures

cost the hospital or the insurer less money since there is no overnight stay in the hospital.

Our

Solution

The MUSE ™ System

Our

primary product, the MUSE

TM

single use system for transoral funduplication, is an innovative device for the incisionless

treatment of GERD. The MUSE

TM

technology is based on our proprietary platform technology, experience and know-how.

While at present substantially all of our revenue is derived from the miniature video camera and related equipment, our strategy

is focused on the development and promotion of the MUSE

TM

System, which we therefore refer to as our ‘primary

product’.

Transoral

means the procedure is performed through the mouth, rather than through incisions in the abdomen. The MUSE

TM

system for transoral fundoplication was previously known as the SRS

TM

Endoscopic Stapling System. We rebranded

to the MUSE

TM

system following the launch of the most recent generation product. The MUSE

TM

system is used

to perform a procedure as an alternative to a surgical fundoplication. The MUSE

TM

offers an endoscopic, incisionless

alternative to surgery. A single surgeon or gastroenterologist can perform the MUSE

TM

procedure in a trans-oral way,

unlike in a laparoscopic fundoplication which requires incisions.

The

system consists of the MUSE

TM

console controller, the MUSE

TM

endostapler and several accessories, including

an overtube, irrigation bottle, tubing supplies and staple cartridges. The MUSE

TM

endostapler incorporates a video

camera, a flexible surgical stapler and an ultrasonic guidance system, that is used to measure the distance between the anvil

and the cartridge of the stapler, to ensure their proper alignment and tissue thickness. The device also contains an alignment

pin, which is used for initial positioning of the anvil against the cartridge, two anvil screws, which are used to reduce the

thickness of the tissue that needs to be stapled and to fix the position of the anvil and the MUSE

TM

endostapler during

stapling. The system allows the operator to staple the fundus of the stomach to the esophagus, in two or more locations, typically

around the circumference, thereby creating a fundoplication, without any incisions.

The

clearance by the FDA, or ‘Indications for Use’, of the MUSE

TM

System is “for endoscopic

placement of surgical staples in the soft tissue of the esophagus and stomach in order to create anterior partial

fundoplication for treatment of symptomatic chronic Gastro-Esophageal Reflux Disease in

patients who require and respond to pharmacological therapy”. As such, the FDA clearance covers the use by an

operator of the MUSE

TM

endostapler as described in the above paragraph. In addition, in the pivotal study

that was presented to the FDA in order to gain clearance,only patients who were currently taking GERD medications(i.e.

pharmacological therapy) were allowed in the study. In addition, all patients had to have a significant decrease in

their symptoms when they were taking medication compared to when they were off the medication. As such, the FDA

clearance included the indication that MUSE

TM

is intended for patients who require and respond to pharmacological

therapy. The MUSE

TM

System indication does not restrict its use with respect to GERD severity from a

regulatory point of view. However, clinicians typically only consider interventional treatment options for moderate to severe

GERD. Therefore, it is reasonable to expect the MUSE

TM

System would be primarily used to treat moderate and

severe GERD in practice. The system has received 510(k) marketing clearance from the FDA in the United States, as well as a

CE mark in Europe and a license from Health Canada. It is also cleared for use in Turkey and in Israel.

Clinical

Studies

The

original FDA submission for the MUSE

TM

System included short-term (6 month) results from a multi-center clinical trial.

The trial was conducted in support of the 510(k) marketing clearance submission for the system and pursuant to an FDA-issued Investigational

Device Exemption (IDE).

Enrollment

was completed in November 2010. A total of 72 patients were enrolled and 69 were treated with the MUSE

TM

system during

the study. A manuscript detailing the results of this study was published in Surgical Endoscopy and is currently available online.

Publication in the hardcopy of the journal was in the January 2015 issue.

The

primary objective of the study was to assess the safety and efficacy of the MUSE

TM

system in the treatment of subjects

with GERD. The primary efficacy endpoint was at least a 50% improvement in the GERD-HRQL (Health Related Quality of Life) scores

in 53% of the subjects. HRQL is the standard assessment of how an individual’s well-being may be affected over time by a disease.

Secondary efficacy assessments included PPI intake, esophageal acid exposure during a 24-hour period and anatomical changes. The

follow-up period was set at six months following each procedure.

The

primary endpoint was met in that 73% of subjects exhibited at least a 50% reduction in HRQL at six months. In addition, 85% of

subjects reduced their PPI intake by at least 50%, with 65% of subjects eliminating PPI use completely at six months.

FDA

marketing clearance for our system was granted in May 2012 following the original FDA submission. Subsequent improvements to the

system included improvements to the camera, illumination and alignment mechanisms, the addition of an electronic stapling motor,

and condensing two control consoles into a single unit. FDA clearance for the modified system was obtained in March 2014. The

modified system has also obtained a CE mark in Europe and a license from Health Canada and was approved in Turkey and Israel.

In

May 2013, we received five years of follow-up results for a precursor IRB (Institutional Review Board) approved pilot study of

the system conducted in 2007 at Deenanath Mangeshkar Hospital and Research Center in the city of Pune, India. The results of this

follow-up study were published in the peer review journal Surgical Endoscopy in March 2015. As noted in the journal article,

the five-year results are similar to the results obtained from subjects who received-laparoscopic procedures for GERD in the same

period. Each year, eleven of the thirteen patients were reached (although not always the same eleven). All thirteen patients had

at least a four year follow-up. Throughout the follow up period, GERD-HRQL scores were normal in all but one patient. All patients

indicated that they would agree to do the procedure again. Out of the initial thirteen patients, seven (54%) had eliminated PPI

and another three (23%) reduced PPI use by 50% or more. It should be emphasized that for this trial patients were selected with

GERD severity at a higher than average level (moderate to severe), a fact which may indicate an even greater outcome of the effect

of the system in an average GERD level patient population.

In

November 2015 a follow-up study conducted in the United States looked at evaluating the long-term clinical outcome of 37 patients

who received GERD treatment with the MUSE

TM

device in the multi-center study mentioned above was concluded. Efficacy

and safety data were analyzed up to four years post-procedure. No new complications have been reported in such long-term analysis.

The proportions of patients who remained off daily PPI were 83.8% (31/37) at six months, and 69.4% (25/36) at 4 years post-procedure.

GERD-HRQL scores off PPI were significantly decreased following six months and four years post-procedure. The authors concluded

that the MUSE

TM

stapling device appeared to be safe and effective in improving symptom scores as well as reducing PPI

use in patients with GERD. These results appeared to be equal to or better than those of the other devices for endoluminal GERD

therapy.

In

February 2017, we received an approval to start a multi-center MUSE

TM

clinical study in China after the China Food

and Drug Administration, or CFDA, reviewed the complete submission package. In addition, each study location received approval

from their ethics committee and agreements were put in place.. Under Principal Investigator, Yunsheng Yang, Director of Gastroenterology

Department Clinical center at 301 Hospital and Chairman of Chinese Society of Gastroenterology, The General Hospital of People’s

Liberation Army in Beijing, the clinical study will include approximately 62 patients, will take place at five centers across

China: The General Hospital of People’s Liberation Army, Renji Hospital of Shanghai, Shanghai General Hospital, Peking University

Third Hospital and Navy General Hospital.

Procedures

started in March 2017 and are expected to carry on through 2018. We expect the results to be reported back to the CFDA in 2019

as part of the final CFDA submission for clearance to sell MUSE

TM

in China.

Miniature

Video Cameras

By

definition all endoscopes must include vision apparatus to facilitate the operator’s view of the internal organs of the

patient. In the past, fiber optics were utilized for this purpose, and have been gradually replaced with electronic video systems

offering higher resolution and higher-quality images. We have developed several models of miniaturized digital video cameras and

video processing equipment, for use in medical endoscopy products as well as industrial uses. Our cameras range between 3.45mm

to 0.99 mm in diameter, and are based on single-use Complementary Metal Oxide Semiconductor, or CMOS, image sensors. In some cases,

our cameras are relatively inexpensive, allowing them to be used in single-use devices.

Our

miniature cameras are intended for use in medical applications in which it has not yet been feasible to use miniature video cameras,

and may be integrated into devices developed by the company, or by third parties who source the camera from us. We expect that

the growing demand for single-use medical devices will increase demand for the CMOS cameras in particular, in fields such as gastroenterology,

orthopedics, gynecology, ears nose throat, urology, cardio-vascular, and other fields in which diagnostic and surgical procedures

may be performed endoscopically. Small-diameter video cameras permit not only smaller camera-based endoscopes which are able to

penetrate previously inaccessible organs or visualize them in improved image quality, but also allows for the addition of working

channels and other features in the valuable space freed by the reduction in camera size.

Our

most advanced camera is a prototype CMOS-based camera measuring only 0.99 mm in diameter transmitting 45,000 pixels in HDMI format,

which we believe to be the smallest video camera ever produced. This camera is based on “through-silicon-via” technology

whereby the electronics pass vertically through the sensor, permitting smaller diameter devices. This prototype camera will not

be commercially available in the foreseeable future.

Other Products

We

have utilized the MUSE

TM

system technological platform for the development of prototypes for other endoscopy and direct

vision products, including a device aiding colonoscopy, a device used in dental surgery and others. To date, we have not yet applied

for regulatory approvals for these devices, nor have we entered into agreements for the commercialization of these devices.

Our

Strategy

Our

primary goal is to generate recurring revenues by driving sales of our MUSE™ system and establishing it as the

standard-of-care procedure and device for the treatment of moderate to severe GERD. We believe that we can achieve this goal by

continuing to accumulate clinical data and promote reimbursement for the procedure in the principal markets of North America,

Europe and Asia. Our strategy includes the following key elements:

Driving

MUSE ™ sales

. We intend to continue to focus on commercializing the MUSE

TM

system in key geographies

and markets. Our distribution network continues to expand for further commercialization beyond Italy and Germany. During 2017,

we entered into additional European distribution agreements in Spain and Switzerland. In Germany and the U.S. we will continue

marketing the MUSE™ through a direct effort at key institutions. In addition, we have successfully completed the

technical testing for CFDA approval in China and have already begun the necessary clinical trial in March 2017.

Collaborating

and co-developing with established companies

. We seek to initiate co-development or licensing collaborations with leading

companies which have existing marketing channels or significant marketing power in critical geographies and sales channels.

Out-licensing

products

. We may consider plans to issue a license for various endoscopic systems which are based on owned and patent-protected

technology which has been developed by us. We continue to work to engage in agreements with companies which produce and market

medical devices, to include the production of systems for the foregoing companies which will be integrated by them in the endoscopic

systems which they produce or that we will develop or produce for them.

Developing

additional products

. Additionally, we intend to develop other products which will be based on the integrated and platform

technology which we have developed to date, including our miniaturized visualization imaging products, combined with our flexible

stapling platform, similar to the MUSE

TM

system. Additional products could include a fully integrated, endoscopic platform

designed for endoscopic surgical tissue dissection or for endoscopic sleeve gastrectomy.

Corporate

Information

Our

registered office and principal place of business are located at Omer Industrial Park, No. 7A, P.O. Box 3030, Omer 8496500, Israel

and our telephone number in Israel is + 972 72 260 2200. Our website address is http://www.medigus.com. The information

contained on our website or available through our website does not constitute part of this prospectus supplement. Our registered

agent in the United States is Medigus USA LLC. The address of Medigus USA LLC is 140 Town & Country Dr., Suite C, Danville,

CA 94526, USA.

THE

OFFERING

|

Securities

offered by us in the offering

|

|

810,000

ADSs representing 40,500,000 ordinary shares.

|

|

|

|

|

|

Total

ordinary shares outstanding immediately after this offering

|

|

191,785,784

ordinary shares.

|

|

|

|

|

|

The

ADSs

|

|

Each

ADS represents 50 ordinary shares. The ADSs will be evidenced by American Depositary

Receipts, or ADRs, executed and delivered by The Bank of New York Mellon, as Depositary.

The

Depositary, as depositary, will be the holder of the ordinary shares underlying your ADSs and you will have rights as

provided in the Deposit Agreement, among us, The Bank of New York Mellon, as Depositary, and all owners and holders from

time to time of ADSs issued thereunder, or the Deposit Agreement, a form of which has been filed as Exhibit 1 to the Registration

Statement on Form F-6 filed by The Bank of New York Mellon with the Securities and Exchange Commission on May 7, 2015.

Subject

to compliance with the relevant requirements set out in the prospectus, you may turn in your ADSs to the Depositary in

exchange for ordinary shares underlying your ADSs.

The

Depositary will charge you fees for such exchanges pursuant to the Deposit Agreement.

You

should carefully read the “Description of our American Depositary Shares” section of the accompanying prospectus

and the Deposit Agreement to better understand the terms of the ADSs.

|

|

|

|

|

|

Offering

Price

|

|

The

offering price is $2.00 per ADS.

|

|

|

|

|

|

Concurrent

private placement

|

|

In

a concurrent private placement, we are selling to the investors who purchased ADSs in this offering warrants to purchase up

to 405,000 ADSs, representing 20,250,000 of our ordinary shares, par value NIS 0.10 per share, at an initial exercise price

of $2.25 per ADS, or the Warrants. The Warrants will be exercisable upon the six-month anniversary of their issuance and will

expire five and a half years following the date of issuance. The Warrants, ADSs issuable upon the exercise of the Warrants

and the ordinary shares represented by such ADSs are being offered pursuant to an exemption from registration provided in

Section 4(a)(2) under the Securities Act of 1933, as amended, or the Securities Act, and Rule 506(b) promulgated thereunder,

and they are not being offered pursuant to this prospectus supplement and the accompanying prospectus. See “Private

Placement of Warrants” on page S-39 of this prospectus supplement for a more complete description of the concurrent

private placement.

|

|

|

|

|

|

Use

of proceeds

|

|

We

currently intend to use the net proceeds from the sale of our ADSs for general corporate purposes, including research and

development related purposes and for potential acquisitions. See “Use of Proceeds” for additional information.

|

|

Listing

|

|

Our

ADSs are listed on NASDAQ under the symbol “MDGS” and our ordinary shares currently trade on the TASE in Israel

under the symbol “MDGS”.

|

|

|

|

|

|

Risk

factors

|

|

Before

deciding to invest in our ADSs, you should carefully consider the risks related to our business, the offering and our securities,

and our location in Israel. See “Risk Factors” on page S-10 of this prospectus supplement and those factors

referred to in “Item 3. Key Information – D. Risk Factors” in our Annual Report on Form 20-F for the year

ended December 31, 2016.

|

|

|

|

|

|

Dividend

Policy

|

|

We

have never declared or paid any cash dividends to our shareholders, and we currently do not expect to declare or pay any cash

dividends in the foreseeable future. See “Dividend Policy” on page S-39 of this prospectus supplement.

|

|

|

|

|

|

Depositary

|

|

The

Bank of New York Mellon.

|

The number of ordinary

shares to be outstanding immediately after the offering as shown above is based on 151,285,784 ordinary shares outstanding as of

November 24, 2017. This number does not include, as of such date (i) 12,667,625 ordinary shares issuable upon the exercise of outstanding

options to purchase 12,667,625 ordinary shares at a weighted average exercise price of NIS 0.58 per share or $0.17 per share (based

on the exchange rate reported by the Bank of Israel on such date), equivalent to 253,353 ADSs at a weighted average exercise price

of $8.26 per ADS, (ii) 120,659,480 ordinary shares issuable upon the exercise of outstanding warrants to purchase 120,659,480 ordinary

shares at a weighted average exercise price of NIS0.41 per share or $0.12 per share (based on the exchange rate reported by the

Bank of Israel on such date), equivalent to 2,413,190 ADSs at a weighted average exercise price of $5.78 per ADS, (iii) 20,250,000

ordinary shares issuable upon the exercise of warrants to purchase 405,000 ADSs to be issued in our concurrent private placement,

at an exercise price of $2.25 per ADS, and (iv) 2,835,000 ordinary shares issuable upon the exercise of warrants to purchase 56,700

ADSs at an exercise price of $2.50 per ADS, to be issued to the placement agent in connection with the offering.

Unless

otherwise stated, outstanding share information throughout this prospectus supplement excludes such outstanding securities.

SUMMARY

FINANCIAL DATA

We

derived the summary financial statement data for the years ended December 31, 2014, 2015 and 2016 set forth below from our

audited financial statements and related notes incorporated by reference in this prospectus supplement and the accompanying prospectus.

We derived the summary financial statement data for the nine months ended September 30, 2016 and 2017 from our unaudited condensed

interim financial statements and related notes incorporated by reference in this prospectus supplement and the accompanying prospectus.

Our results for interim periods are not necessarily indicative of the results that may be expected for the entire year. You should

read the information presented below together with our financial statements, the notes to those statements and the other financial

information incorporated by reference in this prospectus supplement and the accompanying prospectus.

|

|

|

Year Ended December 31,

|

|

|

Nine Months Ended

September 30,

|

|

|

|

|

2014

|

|

|

2015

|

|

|

2016

|

|

|

2016

|

|

|

2017

|

|

|

|

|

|

|

|

(unaudited)

|

|

|

|

|

(U.S. Dollars, in thousands, except per share data)

|

|

|

Consolidated Statements of Loss and Other Comprehensive Loss

|

|

|

|

|

Revenues

|

|

$

|

744

|

|

|

$

|

624

|

|

|

$

|

549

|

|

|

$

|

496

|

|

|

$

|

313

|

|

|

Cost of revenues

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Products and services

|

|

|

351

|

|

|

|

277

|

|

|

|

176

|

|

|

|

154

|

|

|

|

145

|

|

|

Inventory impairment

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

297

|

|

|

Gross profit

|

|

|

393

|

|

|

|

347

|

|

|

|

373

|

|

|

|

342

|

|

|

|

(129

|

)

|

|

Operating Expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development expenses

|

|

|

4,025

|

|

|

|

4,384

|

|

|

|

3,655

|

|

|

|

3,021

|

|

|

|

1,744

|

|

|

Selling and marketing expenses

|

|

|

2,341

|

|

|

|

2,680

|

|

|

|

2,125

|

|

|

|

1,845

|

|

|

|

541

|

|

|

Administrative and general expenses

|

|

|

2,280

|

|

|

|

2,842

|

|

|

|

3,684

|

|

|

|

3,016

|

|

|

|

2,429

|

|

|

Other income, net

|

|

|

269

|

|

|

|

3

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

Total operating expenses

|

|

|

8,377

|

|

|

|

9,903

|

|

|

|

9,464

|

|

|

|

7,882

|

|

|

|

4,714

|

|

|

Operating loss

|

|

|

(7,984

|

)

|

|

|

(9,556

|

)

|

|

|

(9,091

|

)

|

|

|

(7,540

|

)

|

|

|

(4,843

|

)

|

|

Profit (loss) from changes in fair value of warrants issued to investors

|

|

|

980

|

|

|

|

106

|

|

|

|

25

|

|

|

|

17

|

|

|

|

2,242

|

|

|

Financing income (expenses), net

|

|

|

650

|

|

|

|

(14

|

)

|

|

|

87

|

|

|

|

118

|

|

|

|

51

|

|

|

Loss before taxes on income

|

|

|

(6,354

|

)

|

|

|

(9,464

|

)

|

|

|

(8,979

|

)

|

|

|

(7,405

|

)

|

|

|

(2,550

|

)

|

|

Taxes on income

|

|

|

(4

|

)

|

|

|

(68

|

)

|

|

|

(28

|

)

|

|

|

(24

|

)

|

|

|

(17

|

)

|

|

Loss for the period

|

|

$

|

(6,358

|

)

|

|

$

|

(9,532

|

)

|

|

$

|

(9,007

|

)

|

|

$

|

(7,429

|

)

|

|

$

|

(2,567

|

)

|

|

Other comprehensive income (loss) for the period, net of tax

|

|

|

(1,573

|

)

|

|

|

(211

|

)

|

|

|

-

|

|

|

|

|

|

|

|

-

|

|

|

Total comprehensive loss for the period

|

|

$

|

(7,931

|

)

|

|

$

|

(9,743

|

)

|

|

$

|

(9,007

|

)

|

|

$

|

(7,429

|

)

|

|

$

|

(2,567

|

)

|

|

Basic loss per share

|

|

$

|

(0.33

|

)

|

|

$

|

(0.34

|

)

|

|

$

|

(0.26

|

)

|

|

$

|

(0.22

|

)

|

|

$

|

(0.02

|

)

|

|

Diluted loss per share

|

|

$

|

(0.33

|

)

|

|

$

|

(0.34

|

)

|

|

$

|

(0.26

|

)

|

|

$

|

(0.22

|

)

|

|

$

|

(0.03

|

)

|

|

Weighted average shares – denominator for basic net loss per share

|

|

|

19,500

|

|

|

|

28,415

|

|

|

|

34,397

|

|

|

|

33,369

|

|

|

|

111,865

|

|

|

Denominator for diluted loss per share

|

|

|

19,500

|

|

|

|

28,415

|

|

|

|

34,397

|

|

|

|

33,369

|

|

|

|

117,220

|

|

RISK

FACTORS

You

should carefully consider the risks described below and in our annual report on Form 20-F for the year ended December 31,

2016, as well as the other information included or incorporated by reference in this prospectus supplement and the accompanying

prospectus, including our financial statements and the related notes, before you decide to buy our securities. The risks and uncertainties

described below and incorporated by reference in this prospectus supplement are not the only risks facing us. We may face additional

risks and uncertainties not currently known to us or that we currently deem to be immaterial. Any of the risks described below

or incorporated by reference in this prospectus supplement, and any such additional risks, could materially adversely affect our

business, financial condition or results of operations. In such case, you may lose all or part of your original investment.

Risks

Related to Our Business

Our

auditors have expressed substantial doubt about our ability to continue as a going concern, which may hinder our ability to obtain

further financing.

Our

audited financial statements for the year ended December 31, 2016, were prepared under the assumption that we would continue

our operations as a going concern. Our independent registered public accounting firm has included a “going concern”

explanatory paragraph in its report on our financial statements for the year ended December 31, 2016, indicating that we

have suffered recurring losses from operations and have a net capital deficiency that raises substantial doubt about our ability

to continue as a going concern. Uncertainty concerning our ability to continue as a going concern may hinder our ability to obtain

future financing. Continued operations and our ability to continue as a going concern are dependent on our ability to obtain additional

funding in the near future and thereafter, and there are no assurances that such funding will be available to us at all or will

be available in sufficient amounts or on reasonable terms. Our financial statements do not include any adjustments that may result

from the outcome of this uncertainty. Without additional funds from private and/or public offerings of debt or equity securities,

sales of assets, sales or out-licenses of intellectual property or technologies, or other transactions, we will exhaust our resources

and will be unable to continue operations. If we cannot continue as a viable entity, our shareholders would likely lose most or

all of their investment in us.

Even

if this offering is successful, we will need additional funding. If we are unable to raise capital, we will be forced to reduce

or eliminate our operations.

As

of September 30, 2017, we held approximately $5.8 million in cash and cash equivalents and short term deposits. Based on our projected

cash flows and our cash balances as of the date of this prospectus supplement, our management is of the opinion that without further

fund raising we will not have sufficient resources to enable us to continue advancing our activities and as a result, there is

substantial doubt about our ability to continue as a going concern. At our current burn rate, and without taking into account

the proceeds from this offering, our current cash balance will be sufficient until approximately August 2018, taking into account

shut down costs. With estimated proceeds from this offering totaling approximately $1.4 million, based upon the public offering

price of $2.00 per ADS, after deducting the placement agent fee and estimated offering expenses payable by us, at our expected

burn rate following this offering, the proceeds from this offering will be sufficient until approximately December 2018.

Even

if this offering is successful, if we are unable to obtain additional sufficient financing, we will be forced to reduce the scope

of, or eliminate our operations. We will also have to reduce marketing, customer service or other resources devoted to our products.

Any of these factors will materially harm our business and results of operations.

Our

management’s plans include the continued commercialization of our products, taking cost reduction steps and securing

sufficient financing through the sale of additional equity securities, debt or capital inflows from strategic partnerships.

There are no assurances however, that we will be successful in obtaining the level of financing needed for our operations.

Even

if we are able to continue to finance our business, the sale of additional equity or debt securities could result in dilution

to our current shareholders and could require us to grant a security interest in our assets. If we raise additional funds through

the issuance of debt securities, these securities may have rights senior to those of our ordinary shares and could contain covenants

that could restrict our operations. In addition, we may require additional capital beyond our currently forecasted amounts to

achieve profitability. Any such required additional capital may not be available on reasonable terms, or at all.

During

the past several months we have been implementing a cost reduction program which may be unsuccessful in its execution, and, even

if successful, may lead to undesirable outcomes.

During

the past several months we have been implementing a cost reduction program that has affected the structure and operation of our

business. Such plan reflects assumptions and analyses based on our experience and perception of historical trends, current market

conditions and expected future developments as well as other factors that we consider appropriate under the circumstances. Whether

our cost reduction program will prove successful depends on a number of factors, including but not limited to (i) our ability

to substantially raise additional funding and to obtain adequate liquidity; (ii) our ability to maintain suppliers’, hospitals’,

medical facilities’ and practitioners’ confidence; (iii) our ability to efficiently reduce our operational expenditures,

while retaining key employees; and (iv) the overall success of our business. In addition, as long as these cost reduction measurements

last, and for a substantial time afterwards, our employees may face considerable distraction and uncertainty and we may experience

increased levels of employee attrition. A loss of key personnel could have a material adverse effect on our ability to meet operational

and financial expectations. The pursuit of additional funding and the application of the cost reduction program has occupied and

will continue to occupy a substantial portion of the time and attention of our management and will impact how our business is

conducted.

We

have a history of operating losses and expect to incur additional losses in the future.

We

have sustained losses in recent years, including an operating net loss of $9.1 million and $4.8 million for the year ended December

31, 2016 and the nine months ended September 30, 2017, respectively. We anticipate that we are likely to continue to incur significant

net losses for at least the next several years as we continue the development of the MUSE™ system and potentially other

products, expand our sales and marketing capabilities in the endoscopy-based products market, continue our commercialization of

our MUSE™ system, expand its adoption and clinical implementation, and continue to develop the corporate infrastructure

required to sell and market our products. Our losses have had, and will continue to have, an adverse effect on our shareholders’

equity and working capital. Any failure to achieve and maintain profitability would continue to have an adverse effect on our

shareholders’ equity and working capital and could result in a decline in our share price or cause us to cease operations.

The

future success of our business depends on our ability to continue to develop and obtain regulatory clearances or approvals for

innovative and commercially successful products in our field, which we may be unable to do in a timely manner, or at all. Our

success and ability to generate revenue or be profitable also depends on our ability to establish our sales and marketing force,

generate product sales and control costs, all of which we may be unable to do.

The

commercial success of the MUSE

TM

system or any future product, if approved, depends upon the degree of market acceptance

by physicians, patients, third-party payors, and others in the medical community.

The

commercial success of the MUSE

TM

system and any future product, if approved, depends in part on the medical community,

patients, and third-party payors accepting our products as medically useful, cost-effective, and safe. Any product that we bring

to the market may or may not gain market acceptance by physicians, patients, third-party payors, and others in the medical community.

In addition, since the MUSE

TM

system is a therapeutic device being used for a quality of life, benign disease, market

penetration may be more difficult. To date, we have experienced slower than expected market penetration. If the MUSE

TM

system or any future product, if approved, does not achieve an adequate level of acceptance, we may not generate significant product

revenue and may not become profitable. The degree of market acceptance of these products, if approved for commercial sale, will

depend on a number of factors, including:

|

|

●

|

the

cost, safety, efficacy, and convenience of the MUSE

TM

system and any future product in relation to alternative

treatments and products;

|

|

|

●

|

the

ability of third parties to enter into relationships with us without violating their existing agreements;

|

|

|

●

|

the

effectiveness of our sales and marketing efforts;

|

|

|

●

|

the

prevalence and severity of any side effects resulting from the procedure;

|

|

|

●

|

the

willingness of the target patient population to try new procedures and of physicians to perform new procedures;

|

|

|

●

|

the

strength of marketing and distribution support for, and timing of market introduction of, competing products;

|

|

|

●

|

publicity

concerning our products or competing products and treatments; and

|

|

|

●

|

sufficient

third-party insurance coverage or reimbursement.

|

Even

if the MUSE

TM

system and any future product, if approved, displays a favorable safety and efficacy profile in clinical

trials, market acceptance of the product will not be known until after it is launched. Our efforts to educate the medical community

and third-party payors on the benefits of the products may require significant resources and may never be successful. Such efforts

to educate the marketplace may require more resources than are required by conventional technologies.

Insufficient

coverage or reimbursement from medical insurers to users of our products could harm our ability to market and commercialize our

current and future products.

Our

ability to successfully commercialize our products, mainly the MUSE

TM

system, depends significantly on the availability

of coverage and reimbursement for endoscopic procedures from third-party insurers, including governmental programs, as well as

private insurance and private health plans. Reimbursement is a significant factor considered by hospitals, medical facilities

and practitioners in determining whether to acquire and utilize new capital equipment or to implement new procedures such as our

technology.

In

January 2016, the American Medical Association’s (AMA) Current Procedural Terminology, or CPT, published a new Category

I CPT Code for transoral esophagogastric fundoplasty procedures, which describes procedures conducted with the MUSE

TM

system. In the U.S., the CPT Editorial Panel assigns specific billing codes for physician services and outpatient hospital procedures,

which are used by providers, who are our customers, to bill for procedures. Once a CPT code is established, the Centers

for Medicare and Medicaid Services, or CMS, in turn establishes payment levels and coverage rules under Medicare, and private

payors establish rates and coverage rules. Notwithstanding the issuance of a CPT to report the MUSE procedure and the establishment

of payment rates for the code, we cannot guarantee that the MUSE

TM

system is or will be covered and, if covered, that

reimbursement will be sufficient, and furthermore, we cannot guarantee that the MUSE

TM

system or any future product

will be approved for coverage or reimbursement by Medicare, Medicaid or any third-party payor. Reimbursement decisions in

the European Union and in other jurisdictions outside of the United States vary by country and region and there can be no assurance

that we will be successful in obtaining adequate reimbursement.

We

depend on the success of a limited portfolio of products for our revenue, which could impair our ability to achieve profitability.

Though

we have plans for the development of additional natural orifice surgical products based on our technology including miniature

cameras, flexible stapling and ultrasound, and although we currently derive most of our revenue from the sale of miniature cameras

and related imaging equipment, we plan to derive most of our future revenue from product sales of our imaging equipment and our

flagship MUSE

™

system and its future applications, as well as recurring sales of associated products

required to use the MUSE ™ system. Our future growth and success is dependent on the successful commercialization

of the MUSE

™ system. If we are unable to achieve increased commercial acceptance of the MUSE

™

system, obtain regulatory clearances or approvals for future products, or experience a decrease in the utilization of our product

line or procedure volume, our revenue would be adversely affected.

We

may encounter manufacturing issues during the assembly process of our flagship product

.

Due

to the characteristics of the technologies on which the main parts of the MUSE

™

system are manufactured,

which include plastic and metal injection, sheet metals, laser welding and rubber vulcanization, using production tools such as

molds, templates and jigs, in the event that parts are found which are inaccurate and/or which have been rendered defective and/or

which have failed preliminary tests, we will be forced to repair the manufacturing tools and re-manufacture and/or re-order the

parts, a process which will delay the production timetable. Furthermore, in the event that certain parts are not suitable, due

to a situation whereby the manufacturing tools have not produced the part in the appropriate manner, it may be necessary to redesign

and re-manufacture the manufacturing tool and to manufacture the parts rapidly and at additional cost.

Furthermore,

if we are unable to satisfy commercial demand for our MUSE

™

system due to our inability to assemble,

test and deliver the system in compliance with applicable regulations, our business and financial results, including our ability

to generate revenue, would be impaired, market acceptance of our products could be materially adversely affected and customers

may instead purchase or use competing products.

We

may encounter failure in the operation of our products, which may adversely harm patients operated by using our products.

Users

of our products may encounter failures in mechanical components, which could result in difficulties in operation, or opening or

releasing the products, leading to the need for surgical procedures to correct the mechanical failure, in which case, a patients’

medical condition may worsen.

Additionally,

in the event that users of our products do not follow the instructions for use or the available product training or instructions

(which appear on the screen during the performance of the procedure) the foregoing may cause injury and in certain cases, could

even cause death. A result of this kind could reduce the rate of progress of, or even prevent, the marketing for the MUSE

TM

product and our other products.

Furthermore,

users of our products may encounter failure in electronic components of our products used in the system software, which could

lead to incorrect interpretation by the users or to failure in the operation of the endoscope, and to injury to the patient’s

critical internal organs.

We

have only limited clinical data to support the value of the MUSE ™ system, as well as our other products, which may

make patients, physicians and hospitals reluctant to accept or purchase our products.

Physicians,

hospitals and patients will only accept or purchase our products if they believe them to be safe and effective, with advantages

over competing products or procedures. To date, we have collected only limited clinical data with which to assess our products’

(mainly the MUSE

TM

system) clinical and economic value. The collection of clinical and economic data and the process

of generating peer review publications in support of our product and procedure is an ongoing focus for us.

If

future publications of clinical studies indicate that medical procedures using the MUSE

TM

system are less safe or less

effective than competing products or procedures, patients may choose not to undergo our procedure, and physicians or hospitals

may choose not to purchase or use our system. Furthermore, unsatisfactory patient outcomes or patient injury could cause negative

publicity for our products, particularly in the early phases of product introduction.

Current

economic conditions could delay or prevent our customers from obtaining budgetary approval to purchase a MUSE

TM

system

or other products, which would adversely affect our business, financial condition and results of operations.

As

a result of the concerns relating to the current economic situation or related to ongoing healthcare reimbursement changes, customers

and distributors may be delayed in obtaining, or may not be able to obtain, budgetary approval or financing for their purchases

or leases of medical equipment including our products. These delays may in some instances lead to our customers or distributors

postponing the shipment and use of previously ordered systems and products, cancelling their orders, or cancelling their agreements

with us. An increase in delays and order cancellations of this nature could adversely affect our products sales and revenues and,

therefore, harm our business and results of operations.

In

addition, negative worldwide economic conditions and market instability may make it increasingly difficult for us, our customers,