TIDMPMO

RNS Number : 0531H

Premier Oil PLC

08 March 2018

Premier Oil

Full Year Results for the year ended 31 December 2017

Press Release

Tony Durrant, Chief Executive, commented:

"2017 was a successful year for Premier with the refinancing

completed, our producing portfolio performing well, the Catcher

field brought on-stream and the notable Zama oil discovery in

Mexico. 2018 will see further production growth, allowing us to

deliver on our plans for reducing net debt to restore balance sheet

strength while also progressing projects that deliver the highest

financial returns."

2017 Operational highlights

-- Production of 75 kboepd (2016: 71.4 kboepd)

-- Catcher first oil achieved in December, on schedule and under budget

-- Tolmount funding secured

-- World class discovery offshore Mexico, estimated 600 mmbbls (gross)

-- US$300 million of non-core asset disposals

-- Reserves and resources of 902 mmboe (2016: 835 mmboe)

2017 Financial highlights

-- Comprehensive refinancing completed; cash and undrawn

facilities at year-end of US$541.2 million

-- Cash flows from operations of US$496.0 million up 15% (2016: US$431.4 million)

-- Opex of US$16.4/boe, maintaining low cost base

-- Development and exploration capex of US$275.6 million, down 58%

-- Positive free cash flow of US$71.2 million, net debt reduced to US$2.7 billion

-- EBITDAX increased to US$589.7 million (2016: US$494.1 million)

-- US$253.8 million post-tax loss after previously disclosed impairments and refinancing costs

2018 Outlook

-- Production guidance of 80-85 kboepd

-- Opex and capex guidance of US$17-18/boe and US$300 million, respectively

-- Catcher expected to reach 60 kbopd (gross) in April ahead of plan

-- Tolmount project sanction anticipated

-- Material progress on Sea Lion towards final investment decision

-- Zama: rig contracting in progress for 2H appraisal

-- Significant covenant headroom forecast by year-end

-- Rising free cash flow, driving debt reduction through 2018 and 2019

ENQUIRIES

Premier Oil plc Tel: + 44 (0)20 7730

1111

Tony Durrant

Richard Rose

Camarco Tel: + 44 (0)20 3757

4980

Billy Clegg

Georgia Edmonds

A presentation to analysts will be held at 9.30am today at the

offices of Premier Oil, 23 Lower Belgrave Street, London SW1W 0NR

and will be webcast live on the company's website at

www.premier-oil.com. A copy of this announcement is available for

download from our website at www.premier-oil.com.

CHIEF EXECUTIVE OFFICER'S REVIEW

2017 saw continued volatility in commodity prices contributing

to economic and market uncertainty for the industry. For Premier,

the year contained three very significant highlights with a world

class oil discovery at Zama offshore Mexico, first oil from the

Catcher development, and the completion of our comprehensive debt

refinancing. These events, together with a strong production

performance from the existing business, continuing cost control and

selective disposals of non-core assets, mean that Premier is

already delivering ahead of its strategic plan agreed at the time

of the refinancing. More recently the outlook has improved with oil

prices closing 2017 at a two-year high of US$66.9/bbl.

Regardless of the external environment, Health, Safety,

Environment and Security ('HSES') matters will always be of

paramount importance to us and we will not compromise on the

integrity and safety of our people and our operations. We continue

to set ourselves challenging HSES targets to drive continuous

improvement. Our HSES performance in 2017, as measured against our

Group aggregate HSES targets, improved. In addition, all of our

production and drilling operations retain their OHSAS 18001 and ISO

14001 certifications. More broadly, our corporate responsibility

efforts continue to be guided by the Ten Principles of the UN

Global Compact, to which we remain committed.

In the near-term Premier's focus is on reducing debt by

utilising the Group's cash flow generated from our low cost stable

production base. In 2017, Premier delivered production of 75.0

kboepd, in line with full year guidance and up five per cent on

2016. This increase in production was driven by a record first half

underpinned by high operating efficiency across the portfolio and a

full year contribution from the ex-E.ON assets.

Production Working interest Entitlement

(kboepd)

-------------- ------------------- -----------------------

2017 2016 2017 2016

-------------- --------- -------- ----------- ----------

Indonesia 14.1 14.3 10.3 10.1

-------------- --------- -------- ----------- ----------

Pakistan and

Mauritania 6.5 7.9 6.4 7.9

-------------- --------- -------- ----------- ----------

UK 39.5 33.0 39.5 33.0

-------------- --------- -------- ----------- ----------

Vietnam 14.9 16.2 13.0 15.1

-------------- --------- -------- ----------- ----------

Total 75.0 71.4 69.2 66.1

-------------- --------- -------- ----------- ----------

Our South East Asia assets performed well during 2017. In

Indonesia, demand from Singapore for our gas was strong and our

operated Natuna Sea Block A fields secured an increased market

share within its principal gas sales contract ('GSA1') of 49.6 per

cent against a contractual share of 47.25 per cent. It also

delivered record production under the second gas sales contract

('GSA2'). Across the border in Vietnam, gross production from the

Premier-operated Chim Sáo field passed 50 million barrels, in

excess of the original total sanctioned volumes. The field exceeded

expectations both in terms of operating efficiency and better than

expected reservoir performance, with a successful well intervention

programme helping to mitigate natural decline from the field.

Year-end production levels were also boosted by a further 6.5

kboepd (gross) after completing a low cost, two well infill

drilling programme.

UK production, which represents over half of Group production,

grew 20 per cent from 2016 principally as a result of a full year's

contribution from the ex-E.ON assets, which continue to exceed

expectations at the time of acquisition. The Huntington field saw

particular outperformance, contributing 13.0 kboepd, and it remains

the highest net producer in our UK portfolio prior to the ramp up

of production from the Catcher Area. The continuing strong

reservoir performance, together with an improved lease rate

structure on the FPSO agreed with Teekay, means that we expect

Huntington to continue to produce longer than previously envisaged.

The long-life Elgin-Franklin field continued to benefit from an

ongoing infill drilling programme and our Babbage gas field

delivered a strong performance in 2017 underpinned by well

intervention and optimisation of the existing well stock.

Production from the Solan field was lower than originally expected

due to poorer performance in the East reservoir. This has resulted

in a write down in recoverable reserves leading to a non-cash

impairment charge in the year. Current production from Solan is

performing in line with our revised expectations and we continue to

evaluate options to improve production levels and recovery. Profits

from UK production continue to be sheltered by Premier's brought

forward cumulative tax loss and allowance position.

In December we were delighted to safely deliver first oil from

the Catcher Area, marking a significant milestone for Premier. The

successful execution of this project on schedule, and with total

project costs expected to be some 30 per cent below the original

sanctioned budget, is testament to the hard work, skill and

capability of the project team and our contractors. We are bringing

the development on-stream in a phased manner from the three fields

that make up the Catcher Area, firstly from the Catcher field, then

Varadero and shortly from Burgman, as the final commissioning

activities on the FPSO are completed. Once the field is fully

operational we will be producing at a plateau production rate of 60

kbopd (gross) which we expect to achieve during April. Development

drilling throughout the project has been encouraging with 14 wells

now completed and a further 4 wells to be drilled by September

2018. Catcher is an example of Premier's capability to deliver full

cycle FPSO projects from exploration through to production and the

increased cash flows it generates will play an important role in

our debt reduction plans in 2018 and beyond.

During 2018, we expect Group production to increase to 80-85

kboepd reflecting the phased ramp up from the Catcher Area, offset

by natural decline in certain of our fields and the impact of

disposals.

Strict management of our operating cost base and our committed

capital expenditure have remained a key focus for Premier in 2017.

Our operating costs were US$16.4/boe (2016: US$15.8/boe) in line

with budget, reflecting changes in the production portfolio and

ongoing cost saving initiatives. We continue to see opportunities

for further savings from collaboration initiatives and competitive

re-tendering, and expect to maintain a low cost base for the

medium-term. 2017 capital expenditure was well below our original

guidance as we secured further savings on the Catcher project and

on our drilling campaign in Mexico. As the current phase of the

Catcher development completes in the middle of 2018, Premier's

forward committed capex will fall significantly.

Alongside increasing production and cost control discipline, our

selective disposal programme of non-core assets announced in 2017

has enabled us to start deleveraging our balance sheet. These

disposals included the sale of our Pakistan business that will

complete after the receipt of Pakistani authorities approval, the

ongoing rationalisation of assets acquired with the E.ON portfolio

and the disposal of our non-operated interest in the Wytch Farm

field which completed in December. These disposals, which will

generate consideration of US$300 million, are an important part of

meeting our debt reduction targets.

In the medium-term Premier intends to invest selectively in our

portfolio of future projects to maintain and grow our production in

the 2019-2021 timeframe and deliver value for all stakeholders. In

July we were delighted to announce a material exploration success

in Mexico. The world class oil discovery at the Zama-1 exploration

well vindicated our strategy of focusing on under-explored but

proven hydrocarbon basins and our initial estimates for the full

field are a P90-P10 gross unrisked resource range of 400-800

mmbbls, well ahead of pre-drill expectations. Premier continues to

work with both our joint venture partners and PEMEX in the

neighbouring block to secure a pre-unitisation agreement to

progress the appraisal of this significant discovery. Discussions

are underway to secure an option on a rig to undertake the

appraisal programme which is expected to commence in the second

half of 2018 or early 2019.

Our next development is an incremental gas project in Indonesia,

which was sanctioned by the Board in March 2017. Bison, Iguana,

Gajah Puteri ('BIGP'), which is designed to back fill our existing

Singapore and domestic gas sales contracts, is proceeding well and

is on budget and scheduled to deliver first gas in 2019.

Our Tolmount Main gas development in the Southern North Sea,

which will provide the next significant phase of our growth, is

targeted for project sanction in 2018. This initial phase is

targeting gross resources of 540 Bcf (100 mmboe) and is an

economically robust project for Premier even at low gas prices.

There is also significant resource upside, currently estimated at a

further 400 Bcf (gross) in the Greater Tolmount Area. Front End

Engineering Design ('FEED') work is progressing well, the

environmental assessments for the project are underway and a draft

field development plan has been submitted to the OGA. We are

pleased to have agreed an innovative financing arrangement for the

project, establishing an infrastructure partnership for the field

facilities. The impact of this arrangement is to reduce Premier's

share of the capex required to develop this large gas field to

approximately US$100 million.

Our Sea Lion project in the Falkland Islands is Premier's

largest pre-development project with around 400 mmboe reserves and

resources (net to Premier) to be developed over several phases.

With considerable progress made in 2016 to optimise the project

economics for the first phase of the development, work in 2017

focused on the commercial, regulatory and fiscal work streams and

on securing a financing solution. Discussions are ongoing with

senior debt providers and supply chain contractors to secure

suitable funding and commercial terms. Letters of Intent have now

been signed with contractors for the provision of a range of

services including vendor financing. Premier is working towards a

final investment decision by the end of 2018.

At 31 December 2017 group proven and probable (2P) reserves, on

a working interest basis, were 302 mmboe (2016: 353 mmboe) and

total 2P reserves and 2C resources increased to 902 mmboe (2016:

835 mmboe).

2P reserves

Proven and and 2C

probable contingent

2P reserves resources

(mmboe) (mmboe)

---------------------------- ------------- ------------

1 January 2017 353 835

---------------------------- ------------- ------------

Production (27) (27)

---------------------------- ------------- ------------

Net additions, revisions,

discoveries (12) 120

---------------------------- ------------- ------------

Disposals, relinquishments (12) (26)

---------------------------- ------------- ------------

31 December 2017 302 902

---------------------------- ------------- ------------

The decrease in 2P reserves is driven by the impact of 2017

production, a downward revision to our Solan 2P reserve estimates

and the disposal of our Wytch Farm interests. This is partially

offset by upward revisions to our estimates of 2P reserves at both

Huntington and Babbage. The increase in our 2C resources of 118

mmboe was principally a result of the Zama oil discovery offshore

Mexico, the addition of Tolmount East as a contingent resource and

upward revision to the Sea Lion Phase 2 resources including the

2015 Zebedee discovery.

The completion of the refinancing of our debt facilities in July

marked a major milestone for Premier and has established a solid

foundation for us to fulfil our strategic plans. Debt reduction

remains our top priority, but the refinancing provides the headroom

and flexibility to plan for future investment in selective new

projects. At year-end net debt stood at US$2.7 billion. Positive

free cash flow including disposals was offset by adjustments to

reflect the terms and costs of the refinancing and non-cash foreign

exchange movements. Post year-end Premier invited our convertible

bondholders to accelerate the conversion of their bonds.

Approximately US$200 million was converted resulting in a further

reduction in net debt.

As we enter 2018, our stable production delivered from a

competitive operating cost base and lower capital commitments will

generate increasing free cash flows, which in the short-term will

be directed at reducing our debt. Looking forward, we will

selectively invest in new development projects within a strict

capital discipline framework to provide growth in the medium-term

and deliver future value for all stakeholders.

Tony Durrant

Chief Executive Officer

OPERATIONAL REVIEW

UNITED KINGDOM

The UK delivered 20 per cent higher production in 2017, with a

full year's contribution from the E.ON assets acquired during 2016

and high operating efficiency across the portfolio. First oil from

the Catcher Area, which was delivered on 23 December on schedule

and with total forecast project costs some 30 per cent below the

sanctioned budget, will deliver a further increase to UK production

in 2018. Looking forward, we expect to sanction the Tolmount gas

project during 2018, providing the next phase of growth for the UK

business, which is expected to average around 50 kboepd (net) over

the next five years.

Production

Production from Premier's UK fields averaged 39.5 kboepd (net)

(2016: 33.0 kboepd (net)), up 20 per cent on 2016. Following

delivery of first oil from Catcher at the end of the year, there

will be a further production growth in 2018, despite the impact of

the Wytch Farm disposal in December. Production from the Catcher

Area is currently ramping up and is expected to reach plateau rates

during April.

The Premier-operated Huntington field (100 per cent interest)

was the highest producer in the UK portfolio in 2017 with

production averaging 13.0 kboepd (2016: 10.8 kboepd), 28 per cent

higher than budget. This strong performance was achieved by

improved reservoir management and high FPSO operating efficiency.

The lease agreement with Teekay, the owner of the Voyageur Spirit

FPSO, has been extended beyond April 2018 for a minimum of a year

with a revised lower lease cost structure. The combination of

better than expected reservoir performance and a lower FPSO lease

rate has led Premier to increase its estimate of Huntington's

remaining net 2P reserves by 4 mmboe.

Production from the non-operated Elgin-Franklin field (5.2 per

cent interest) was marginally below budget, averaging 5.4 kboepd

(net). Strong underlying field performance as a result of an

ongoing infill drilling campaign was offset by an extended summer

maintenance shutdown required to replace a large platform riser

shutdown valve, and by downtime of the Forties Pipeline System

('FPS') export pipeline during the fourth quarter of 2017. 2018

production to the end of February has averaged 7.7 kboepd (net),

above expectations, due to contributions from infill drilling and

high operating efficiency. The non-operated Glenelg field (18.75

per cent interest), a satellite field within the Elgin-Franklin

area, produced intermittently during 2017 due to downhole scaling

in the single well. This is likely to require an intervention in

2018/19 to rectify fully.

A successful well intervention programme and continued

production optimisation of the existing well stock led to the

Premier-operated Babbage field (47 per cent interest) delivering

3.1 kboepd (net), ahead of budget. In addition, field operating

costs were reduced by more than 20 per cent as a result of the

platform being transitioned to a Not Permanently Attended

Installation ('NPAI') in April. Premier will continue to undertake

production optimisation activities at the field which are expected

to add incremental production for low additional expenditure in

coming years. As a result of the improved production performance

and lower operating costs, Premier now expects a longer than

expected field life beyond 2030 and has revised upwards its

estimates of Babbage's remaining net 2P reserves.

In the Southern North Sea, similar well optimisation efforts,

including re-instatement of inactive wells and interventions in

existing well stock, have seen production restart at the Rita gas

field (74 per cent interest) after being shut in for almost two

years. There have also been successful well re-instatements at the

Johnston gas field (50.1 per cent interest). These low cost

activities typically deliver short-term cash payback in less than

12 months.

Production from the Premier-operated Solan field (100 per cent

interest) averaged 5.9 kboepd, lower than originally expected, as a

result of the first production well ('P1') being shut in for a

period in February following the failure of the existing electric

submersible pump ('ESP'). P1 is currently producing as expected on

free flow and as a result the Company has no immediate requirement

for workover operations. Production rates from the second producer

('P2') remain limited due to poor reservoir performance in the

eastern part of the field. During the year further topside

enhancements were completed with the successful installation and

commissioning of a water injection upgrade and produced water

handling projects. Options to improve production levels and

recovery at Solan continue to be evaluated including a possible

further drilling campaign starting in 2019 or 2020. Premier has

reduced its estimates of Solan's remaining net 2P reserves,

reflecting lower expected recovery from the asset over its economic

life. This reduction does not take account of any potential upside

from the deeper Triassic play on the Solan licence or the impact of

any potential third-party volumes across the Solan infrastructure,

which are currently being assessed.

Production from the Premier-operated Balmoral Area performed as

expected delivering 2.2 kboepd (net) (2016: 2.1 kboepd (net)).

Previous plans for cessation of production at Balmoral by April

2019 have been re-evaluated, driven by the asset's performance and

improving market oil prices. Planning for the decommissioning of

the area is well advanced, including the disposal and sale of the

Balmoral Floating Production Vessel ('FPV'). Some decommissioning

work has started and during the fourth quarter, the Helix Well Op's

Seawell intervention vessel entered four old suspended Balmoral

water injection wells to gather information on well status and to

prepare the wells for later abandonment. Premier is now considering

moving cessation of production out to 2021, subject to partner and

Government approvals. In order to do this, some modest further

investment on wells, subsea and topsides may be required to

maintain performance and asset integrity, whilst a lower but

appropriate level of decommissioning planning works would also

continue.

Production from the non-operated Wytch Farm field (33.8 per cent

interest) averaged 4.4 kboepd (net) (2016: 5.1 kboepd (net),

reflecting natural reservoir decline and a reduced contribution

following disposal of the asset in December.

UK unit operating costs for the year were US$23/boe (2016:

US$24/boe) as a result of favourable asset uptime, continued cost

control measures and a full year's contribution from the E.ON

assets. In 2018, Premier expects a further reduction in the UK

operating costs per barrel with increased production from the

start-up of the Catcher Area and the lower leased FPSO rates at

Huntington, offsetting natural decline at certain fields.

Development

Catcher

First oil was successfully delivered on schedule on the

Premier-operated Catcher project on 23 December. The Catcher Area

(50 per cent interest) comprises three fields - Catcher, Varadero

and Burgman - with production initially started from the Catcher

field. Total forecast capex remains at US$1.6 billion, 30 per cent

lower than the sanctioned estimate.

Following successful final construction and pre-commissioning

activity during the period, the Catcher FPSO departed the Keppel

shipyard in Singapore on 10 August and completed its journey to the

UK via the Suez Canal without incident and ahead of schedule. The

vessel then completed a planned stop at Nigg Port, Scotland for

preparatory work ahead of arrival at the Catcher field location on

18 October. By 20 October it was successfully connected in-field to

the pre-installed buoy and had completed the initial rotation test.

The installation, hook-up and commissioning ('IHUC') work has

proceeded to plan. All production and injection risers were

permanently hung-off, shutdown valving installed and subsea control

umbilicals attached. The remaining offshore construction period of

work was complete by the end of November, when the focus switched

to final commissioning of subsea systems and the interfaces with

the vessel. A trial for oil tanker offloading completed

successfully in the third week of November ahead of first oil in

December.

The initial production wells from the Catcher field were cleaned

up and tested at rates in excess of 20 kbopd (gross) each, in line

with expectations and reflecting initial high productivity. As

planned, production is being ramped up in phases with first oil

from Varadero brought on in early January, to be followed by

Burgman shortly. Production levels have had to be deliberately

constrained during the ramp up phase while commissioning of the

full gas processing modules and the water injection systems on the

FPSO are carried out. Water injection was brought on in

mid-February and the final gas compression commissioning is

underway. Following this, full production from the Catcher Area of

60 kbopd (gross) is expected during April. The first two export

cargos of over 500,000 barrels each were lifted on 23 January and

18 February and both were sold at a premium to Brent.

Drilling activities using the Ensco 100 rig have continued with

operations ahead of schedule and under budget. Fourteen production

and injection wells have now been drilled and completed with

consistently positive reservoir results, with 12 of these wells

being tied-in ahead of first oil. The rig is currently drilling the

CCP6 well on the second Catcher template and will drill a further

Catcher well before moving to the Burgman field. A total of 18

wells will be drilled by September 2018 before a planned drilling

break. As a result of initial production from the field and these

positive well results to date, Premier is encouraged about the

potential overall recovery from the Catcher Area and continues to

target peak plateau production of approximately 60 kbopd (gross),

20 per cent higher than that envisaged at sanction.

Premier and its joint venture partners are already examining

future Catcher Area development opportunities to make full use of

the newly commissioned facilities. Studies are underway for the

future development of the 2016 Laverda discovery in conjunction

with an infill well in the northern area of the Catcher field.

These future activities, amongst others, are planned to provide

incremental production from 2020 onwards.

Pre-development

Good progress has been achieved on the Premier-operated Tolmount

project (50 per cent interest) in the Southern Gas Basin. It is

envisaged that the initial phase, which will target the Tolmount

main structure, will recover 540 Bcf (gross) of gas from four

producing wells at a production capacity of up to 300 mmscfd

(gross).

In February 2017, the development concept, comprising a

standalone normally unmanned installation ('NUI') and a new gas

export pipeline to shore, was selected. A commercial Heads of Terms

was also signed with a terminal operator to process the Tolmount

fluids and to undertake terminal modification works on behalf of

the Tolmount project. Front End Engineering & Design ('FEED')

work is progressing well, with platform and pipeline FEED completed

and tenders received for the project scopes under evaluation. Bids

are also being evaluated from drilling rig providers to cover the

development drilling programme, and the earlier drilling of the

Tolmount East appraisal well in 2019.

Alongside the FEED process, Premier signed a Heads of Terms to

enter into an infrastructure partnership for the Tolmount

development with Dana Petroleum and CATS Management Limited,

whereby they will jointly finance, construct and own the Tolmount

platform and export pipeline as a standalone development, as well

as undertaking the onshore modifications at the onshore gas

receiving terminal. The Tolmount field will be tied-in to the

platform and a tariff will be paid to the infrastructure owners by

the upstream partners for the transportation of gas production

through the infrastructure over the life of the field. As a result,

Premier's share of capex is estimated to be approximately US$100

million. Fully termed agreements are being progressed ahead of

project sanction which is scheduled during 2018.

Exploration

During 2017, well operations on the Ravenspurn North Deep well

(five per cent carried interest), which was testing the deep

Carboniferous play underlying the Ravenspurn North field in the

Southern Gas Basin, were completed. The well was plugged and

abandoned.

Premier continues to actively manage its UK exploration

portfolio. In September, Premier exited the P2184 Licence which

carried a commitment well obligation on the Ekland prospect and a

further four licences were relinquished by the end of the year.

This includes the P2136 Artemis Licence, where a well commitment

was offset against other activity in the UKCS.

Portfolio management

During the first half of the year Premier exercised its

pre-emption rights to acquire an additional 3.71 per cent of the

Wytch Farm field for approximately US$15 million, taking Premier's

overall interest in the field to 33.8 per cent. Subsequently,

Premier agreed to dispose of its entire 33.8 per cent interest in

the Wytch Farm field to Perenco UK Limited for a cash consideration

of US$200 million, realising an attractive valuation in excess of

that implied from the previous transaction and above Premier's

internal valuation. Premier was also able to release Letters of

Credit, amounting to approximately US$75 million, held in respect

of future field abandonment liabilities. The sale completed in

December, generating a pre-tax profit on disposal of approximately

US$133 million.

Premier continued its programme of non-core asset disposals in

2017 principally from the E.ON portfolio acquired in 2016. It

disposed of its interests in the Austen and Arran fields in the

Central North Sea during the year and in December announced the

disposal of its 30 per cent interest in the Esmond Transportation

System ('ETS') pipeline for up to US$31.6 million. These disposals,

together with the relinquishment of other licences, has meant that

Premier has actively managed its current UK licence position down

from 63 blocks in 2016 to 39 blocks today, and this rationalisation

activity is expected to continue in 2018.

INDONESIA

The Premier-operated Natuna Sea Block A fields delivered a

robust and stable performance in 2017 with production of 12.9

kboepd (net), underpinned by supplying an increased market share of

49.6 per cent within GSA1 and strong Singapore demand for gas

deliveries under GSA2. This, together with continued low operating

costs of US$9.6/boe, once again led to the Indonesian business unit

generating material positive net cash flows for the Group.

Production and development

Production from Indonesia in 2017 on a working interest basis

was in line with budget at 14.1 kboepd (net) (2016: 14.3 kboepd

(net)). The Premier-operated Natuna Sea Block A fields (28.67 per

cent interest) delivered 12.9 kboepd (net) while production from

the non-operated Kakap field (18.75 per cent interest) averaged 1.2

kboepd (net). Operating efficiency remained high at over 99 per

cent.

Gas supply by contract

GSA1 GSA2 GSA5

-------------- ---------- ---------- ----------

BBtud (gross) 2017 2016 2017 2016 2017 2016

-------------- ---- ---- ---- ---- ---- ----

Anoa (Pelikan

field) 143 132 - - - -

-------------- ---- ---- ---- ---- ---- ----

Gajah Baru

(Naga field) - - 91 94 - 11

-------------- ---- ---- ---- ---- ---- ----

Total Block

A 143 132 91 94 - 11

-------------- ---- ---- ---- ---- ---- ----

Kakap 17 17 - - - -

-------------- ---- ---- ---- ---- ---- ----

Total 160 149 91 94 - 11

-------------- ---- ---- ---- ---- ---- ----

Premier sold an average of 234 BBtud (gross) (2016: 237 BBtud)

from its operated Natuna Sea Block A fields during 2017. Singapore

demand for gas sold under GSA1 remained robust, averaging 286 BBtud

(2016: 297 BBtud). Premier's Anoa and Pelikan fields delivered 143

BBtud (gross) (2016: 132 BBtud (gross)), capturing 49.6 per cent

(2016: 44.4 per cent) of GSA1 deliveries, above Natuna Sea Block

A's contractual share of 47.2 per cent. Natuna Sea Block A's

contractual share for 2018 has been increased to 51.7 per cent.

Gajah Baru and Naga delivered production of 91 BBtud (gross)

(2016: 94 BBtud (gross)) under GSA2, representing 100 per cent

nomination delivery by Premier. There were no deliveries under GSA5

(2016: 11 BBtud (gross)) following the expiry of the Domestic Gas

Supply Agreement.

Gas sales from the non-operated Kakap field averaged 17 BBtud

(gross) (2016: 17 BBtud (gross)) while gross liquids production was

2.6 kbopd (2016: 2.7 kbopd). Gross liquids production from the Anoa

field was 1.1 kbopd (2016: 1.4 kbopd), underpinned by successful

well intervention work.

Premier continues to benefit from a low cost base in Indonesia,

delivering further cost reductions in 2017. Based on current

production levels, Natuna Sea Block A remains well placed to

deliver operating costs of around US$9/boe into the

medium-term.

The Anoa development well ('WL-5X'), which made the Lama

discovery under Anoa in 2012, was re-completed in August 2017. The

well was brought on-stream to carry out a long-term production test

which will help to define the potential of these deeper zones

within the Anoa field.

The development of the Bison, Iguana and Gajah Puteri ('BIGP')

gas fields was sanctioned in 2017 which marks the next generation

of Natuna Sea Block A projects to support Premier's long-term gas

contracts into Singapore. The EPCI contract for BIGP, which will be

developed as subsea tiebacks to existing infrastructure, was

executed in October 2017 and development drilling is planned for

early 2019. First gas remains on budget and on schedule for the

second half of 2019.

In January Premier was granted a three-year extension to the

exploration period of the Premier-operated Tuna PSC licence where

the evaluation of potential development scenarios for the 2014 Kuda

Laut and Singa Laut discoveries, now collectively known as the Tuna

field (65 per cent interest), is ongoing. In November a Memorandum

of Understanding between PetroVietnam, SKK Migas (on behalf of the

Indonesian Government) and Premier for future gas sales from the

Tuna field in Indonesia into Vietnam was signed, enhancing future

commercialisation. In 2018, a farm-out process has been launched

with a view to funding Premier's share of an appraisal campaign in

2019.

Exploration and appraisal

As a result of the production performance from the Anoa

development well WL-5X, brought on-stream in August, Premier is

reprocessing 3D seismic over the Anoa field to enhance the seismic

imaging across the Lama Play area. Premier will use this

reprocessed data to identify and mature Lama Play leads and

prospects on its Natuna Sea Block A acreage.

Since the year-end, Premier together with its joint venture

partners has been awarded the Andaman II licence (40 per cent,

operated interest) in the North Sumatra basin offshore Aceh,

Indonesia. The licence has the potential to deliver significant gas

volumes into North Sumatra and adds a potentially material gas play

to Premier's Indonesian portfolio.

Portfolio management

In December, Premier signed a sale and purchase agreement with

Batavia Oil to sell its entire 18.75 per cent non-operated interest

in the Kakap field for a cash consideration of US$3.2 million.

Completion is subject to approval from the Government of

Indonesia.

VIETNAM

The Vietnam business generated strong operating cash flows in

2017 due to a higher than budgeted production performance combined

with continued low operating costs. During the period, gross

cumulative production surpassed 50 million barrels, in excess of

the original volumes estimated at project sanction.

Production

Production from the Premier-operated Block 12W (53.13 per cent

interest), which contains the Chim Sáo and Dua fields, was ahead of

budget, averaging 14.9 kboepd (net) (2016: 16.2 kboped (net))

underpinned by high operating efficiency, excellent reservoir

performance and a successful well intervention programme which

helped to mitigate natural decline from the fields.

A two well infill drilling programme completed in December 2017

proved highly successful, adding incremental net production of 3.3

kboepd and further extending the long-term potential from the

field. The infill drilling programme comprised two low cost wells.

The first well was a side-track of a water injector well no longer

required which was re-completed as a production well while the

second well was drilled from the final unused slot on the Chim Sáo

wellhead platform. Using lessons learnt from previous drilling

campaigns, reservoir performance has been improved and production

increased, with some further zones remaining unperforated. This

will allow us to target bringing further incremental production

on-stream in 2018.

Overlying the two main reservoirs in the Chim Sáo field are

several smaller but significant hydrocarbon bearing sandstones

which are intersected by the production wells. In 2017, as the rate

of hydrocarbon flow from the main reservoirs reduced, the shallower

reservoirs of selected wells were perforated to access new zones.

In addition, producing zones in several wells were worked over to

accelerate hydrocarbon production. This intervention programme on

existing wells reduced the rate of natural production decline and

contributed 1.0 kboepd (net) to Premier's 2017 production at a cost

of only US$4/barrel.

Chim Sáo's operating efficiency remained at over 90 per cent in

2017. This was the result of safe and reliable operations and

maintenance services, minimal unplanned events, and planned

shutdown and slowdown campaigns being completed on schedule.

During 2017 Chim Sáo operating costs remained low at US$9.8/boe

(2016: US$8.7/boe). Low costs were maintained by replacing the

supply vessel contract at depressed market rates, improved vessel

management, and the impact of the lower Chim Sáo FPSO lease rate

agreed at the end of 2016. These savings, along with Chim Sáo crude

continuing to sell at premiums to the Brent oil price, contributed

to a positive net operating cash flow from the Vietnam business

unit in 2017 despite the cost of the infill programme.

PAKISTAN

Premier's Pakistan business continued to generate positive and

stable net cash flows for the Group. During 2017, the average

realised gas price was US$3.0/mscf while operating costs remained

low at US$4.2/boe (US$0.6/mscf).

Production and Development

Net production in Pakistan averaged 6.2 kboepd (39.1 mmscfd)

(2016: 7.5 kboepd (47.4 mmscfd)) from Premier's six non-operated

producing gas fields. The fall in production reflects natural

decline in the main gas fields which was partially offset by

successful well intervention campaigns at the Bhit and Badhra

fields.

Mmscfd (net) Production Equity interest

%

--------------- ----------------

2017 2016

--------------- ------ ----- ----------------

Bhit 7.0 8.4 6.0

--------------- ------ ----- ----------------

Badhra 4.6 5.7 6.0

--------------- ------ ----- ----------------

Qadirpur 14.9 16.1 4.75

--------------- ------ ----- ----------------

Kadanwari 4.1 5.5 15.79

--------------- ------ ----- ----------------

Zamzama 7.9 11.3 9.38

--------------- ------ ----- ----------------

Zarghun South 0.6 0.4 3.75

--------------- ------ ----- ----------------

Total 39.1 47.4

--------------- ------ ----- ----------------

Portfolio management

In April, Premier announced the sale of its Pakistan business to

Al-Haj Group for US$65.6 million. To date, Al-Haj has paid deposits

of US$25.0 million. Completion of the sale is awaiting final

approvals from the Pakistani authorities and in the meantime

Premier continues to collect the cash flows generated from the

Pakistan assets.

MAURITANIA

Production and development

Production from the Chinguetti field (8.12 per cent interest)

averaged 257 bopd (2016: 368 bopd) net to Premier during 2017. The

fall in production was driven by natural decline from the existing

wells. As a result of these low production volumes and resulting

marginal cash flows, the joint venture partners ceased production

from the field on 30 December 2017 and the FPSO is being prepared

for sail away. A drill ship has now been mobilised to the

Chinguetti field to start a six-month campaign for temporary

suspension of wells starting with the water injection wells. The

permanent abandonment of the wells is scheduled for 2019. The field

abandonment and decommissioning plan is awaiting approval by the

Government of Mauritania. In addition, plans are being prepared for

the abandonment of the suspended exploration and appraisal wells on

the previously relinquished Banda and Tiof discoveries.

THE FALKLAND ISLANDS

The focus in 2017 for the Premier-operated Sea Lion Phase 1

project has been on progressing commercial and regulatory work

streams and on securing commitments from key contractors for the

project.

Pre - development

The Sea Lion project and the wider North Falklands Basin, has

the potential to be significant for Premier and the strategy is to

develop the discovered resources in several phases. Sea Lion Phase

1 (60 per cent interest), which is targeting gross reserves of over

220 mmbbls in PL032, will utilise a conventional FPSO based scheme,

very similar to Premier's successful Catcher development.

Engineering design work which was largely completed in 2016,

focused on optimising the facilities design and installation

methodology required reducing the estimated gross capex to first

oil to US$1.5 billion.

During 2017, Premier focused on securing agreement with key

supply chain contractors for the project. Good progress was made in

this respect with Letters of Intent signed with a number of

contractors for the provision of a range of services and vendor

financing. Further discussions with senior debt providers including

commercial banks and export credit finance agencies will progress

in 2018.

Alongside this, Premier continued to engage with the Falkland

Islands Government ('FIG') on environmental, fiscal and other

regulatory matters with a view to obtaining the consents and

agreements necessary to be in a position to reach a final

investment by the end of 2018. As part of this process the latest

drafts of the Field Development Plan and Environmental Impact

Statement ('EIS') for Sea Lion Phase 1 were submitted to FIG and

the formal public consultation of the EIS commenced in January

2018.

It is estimated that a subsequent Phase 2 development will

recover over 300 mmbbls (gross) from the remaining volumes in PL032

and the satellite accumulations in the north of the adjacent PL004.

During 2017 further technical analysis carried out on Phase 2,

including the 2015 Zebedee discovery in PL004, has resulted in an

increase in net 2C resources at the year-end.

EXPLORATION

In recent years, Premier's strategy has been to focus its

exploration portfolio on under-explored but proven hydrocarbon

basins rather than traditional but now mature areas, with priority

given to lower cost operating environments. This strategy resulted

in a major success with the world class oil discovery at the Zama-1

well offshore Mexico during 2017, capitalising on Premier's first

mover advantage as the country opened up to foreign investment.

MEXICO

During 2017 Premier, together with its joint venture partners

Talos Energy (Operator) and Sierra Oil & Gas, drilled the Zama

prospect in Block 7 in the Sureste Basin, offshore Mexico which

resulted in a significant oil discovery. The Zama-1 well

encountered a continuous oil bearing interval of over 335 metres

(1,100 feet) with up to 200 metres of net oil bearing reservoir in

upper Miocene sandstones with no water contact. Initial tests of

hydrocarbon samples recovered to the surface showed light oil with

API gravities between 28 and 30 degrees. Premier's initial gross

oil-in-place estimates are 1.2-1.8 billion barrels, with an

estimated recoverable P90-P10 gross resource range of 400-800

mmbbls. These estimates include those volumes that extend into the

neighbouring block which is operated by PEMEX. The joint venture is

now working with PEMEX to secure a pre-unitisation agreement in

order to progress the appraisal programme which is expected to

commence on Premier's block in the second half of 2018 or in early

2019. Our joint venture is close to securing an option on a rig to

complete the appraisal programme on Block 7 and PEMEX has indicated

that they intend to appraise the Zama discovery on their licence

with a well scheduled to spud in the second quarter of 2018. In

addition to appraisal well planning, pre-FEED scoping studies have

been received from seven vendors aiding appraisal planning and

identifying additional data to be acquired in the up and coming

drilling programme. Premier holds a 25 per cent paying interest in

Block 7.

Premier also currently holds a carried 10 per cent interest in

Block 2, with an option to increase to 25 per cent or to exit. The

joint venture is evaluating which prospect will be the first to be

drilled, targeting a well in 2019. Premier continues to evaluate

opportunities for growth in Mexico, from future licensing

rounds.

BRAZIL

Premier received 4,000 km(2) of final processed broadband

seismic data across all three of its Ceará Basin blocks in April

2017. The data has now been interpreted, the best prospects

selected and the wells are being planned in advance of a potential

drilling campaign in 2019 or 2020. Significant progress has been

made on obtaining environmental and drilling permits as Premier

continues to leverage its position as the largest acreage holder in

the Ceará Basin, along with its growing experience in Brazil, to

coordinate operational synergies. In October the ANP, the Brazilian

Government regulator, published an option to all Round 11 awards

that entitles Premier to request extension of its licences by a

further two years to at least July 2021.

FINANCIAL REVIEW

Overview

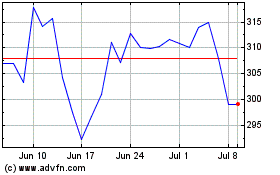

2017 saw continuing oil price volatility. Brent crude opened the

year at US$56.6/bbl before falling to US$44.8/bbl in June and then

strengthening considerably in the second half of the year to close

at US$66.9/bbl at 31 December 2017. The average for 2017 was

US$54.2/bbl against US$43.7/bbl for 2016. Subsequent to the

year-end, prices improved during January reaching a high of

US$71.3/bbl, before falling to US$64.2/bbl on 7 March 2018, below

the year end observed price.

Against this economic backdrop we have achieved our best ever

full year of production, averaging 75.0 kboepd (2016: 71.4 kboepd),

resulting in total revenue from all operations of US$1,102 million

compared with US$983.4 million in 2016 and Free Cash Flow after

disposals of US$71 million (2016: US$580 million cash outflow). In

addition, we successfully completed the refinancing of all of our

debt facilities in July 2017 and reached first oil on the Catcher

field in the UK North Sea in December 2017.

Business performance

EBITDAX for the year from continuing operations was US$589.7

million compared to US$494.1 million for 2016. The increase in

EBITDAX is mainly due to higher production and sales volumes

realised during the year.

Business Performance (continuing operations) 2017 2016

$ million $ million

--------------------------------------------- ----------- -----------

Operating profit / (loss) 33.8 (170.1)

--------------------------------------------- ----------- -----------

Add: Amortisation and depreciation 415.6 326.4

--------------------------------------------- ----------- -----------

Add: Impairment charge on oil and gas

properties 252.2 561.9

--------------------------------------------- ----------- -----------

Add: Exploration expense and pre-licence

costs 17.1 58.5

--------------------------------------------- ----------- -----------

Less: Gain on disposal of assets (129.0) -

--------------------------------------------- ----------- -----------

Reduction in decommissioning estimates - (75.7)

--------------------------------------------- ----------- -----------

Acquisition of subsidiaries:

- Excess of fair value over consideration - (228.5)

- Costs related to the acquisition - 21.6

EBITDAX(1) 589.7 494.1

--------------------------------------------- ----------- -----------

1. Prior year has been restated for results from the Pakistan

business unit, which has been reclassified as a discontinued

operation in the year.

Income statement

Production and commodity prices

Group production on a working interest basis averaged 75.0

kboepd compared to 71.4 kboepd in 2016. This was driven by high

operating efficiency, better than predicted reservoir performance

on certain fields and a full period contribution from the E.ON UK

portfolio acquired in April 2016. Average entitlement production

for the period was 69.2 kboepd (2016: 66.1 kboepd).

Premier realised an average oil price for the year of

US$52.9/bbl (2016: US$44.1/bbl). Including the effect of oil swaps

which settled during 2017, the realised oil price was US$52.1/bbl

(2016: US$52.2/bbl).

In the UK, average natural gas prices achieved were 47.2

pence/therm (2016: 47.6 pence/therm), which included 95.8 million

therms which were sold under fixed price master sales agreements.

Gas prices in Singapore, linked to high sulphur fuel oil ('HSFO')

pricing and in turn, therefore, linked to crude oil pricing,

averaged US$8.4/mscf (2016: US$7.8/mscf).

Total revenue from all operations (including Pakistan) increased

to US$1,102 million (2016: US$983.4 million). From continuing

operations (excluding Pakistan), sales revenue increased to

US$1,043.1 million from US$937.0 million for the prior year.

Cost of operations

Cost of operations comprises operating costs, changes in lifting

positions, inventory movements and royalties. Cost of operations

for the Group from continuing operations was US$455.4 million for

2017, compared to US$412.7 million for 2016.

Operating Costs 2017 2016

$ million $ million

------------------------------------ ----------- -----------

Continuing operations 438.4 402.7

------------------------------------ ----------- -----------

Discontinuing operations (Pakistan) 9.6 10.1

------------------------------------ ----------- -----------

Operating costs 448.0 412.8

------------------------------------ ----------- -----------

Operating costs per barrel 16.4 15.8

------------------------------------ ----------- -----------

Amortisation and depreciation of oil

and gas properties 2017 2016

$ million $ million

----------------------------------------- ----------- -----------

Continuing operations 409.0 318.3

----------------------------------------- ----------- -----------

Discontinuing operations (Pakistan) 7.2 13.9

----------------------------------------- ----------- -----------

Total 416.2 332.2

----------------------------------------- ----------- -----------

Depreciation, depletion and amortisation

('DD&A') per barrel 15.2 12.7

----------------------------------------- ----------- -----------

The increase in absolute operating costs reflects a full year

contribution from the former E.ON assets and the Solan field.

Ongoing cost reduction initiatives, successful contract

renegotiations and strict management of discretionary spend

continue to deliver low and stable operating costs. On a per barrel

basis, operating costs increased by 4 per cent due to portfolio mix

effects in the production base.

The DD&A charge has increased to US$15.2 per barrel

reflecting the accelerated DD&A charge attributable to Solan in

the UK.

Impairment of oil and gas properties

A non-cash net impairment charge of US$252.2 million (pre-tax)

(US$170.9 million post-tax) has been recognised in the income

statement. This relates principally to the Solan field in the UK

North Sea as a result of a reduction in the 2P reserves expected to

be recovered from the asset over its economic life, partially

offset by the recognition of a reversal of impairment for the

Huntington asset in the UK. The reversal of impairment is

principally caused by a 12 month extension in the life of the asset

and a reduction in the lease rate payable for the FPSO. After

recognition of the net impairment charge there is US$2,381.0

million capitalised in relation to PP&E assets and US$240.8

million for goodwill.

Exploration expenditure and pre-licence costs

Exploration expense and pre-licence expenditure costs amounted

to US$17.1 million (2016: US$58.5 million). After recognition of

these expenditures, the exploration and evaluation assets remaining

on the balance sheet at 31 December 2017 amount to US$1,061.9

million, principally for the Sea Lion and Tolmount assets, as well

as our share of drilling costs for the Zama prospect in Mexico.

General and administrative expenses

Net G&A costs of US$16.8 million (2016: US$24.1 million)

reduced year-on-year. 2016 included E.ON's unallocated G&A

costs which fell significantly post integration of the E.ON

operations into the Group's UK business unit. Underlying gross

G&A has fallen in 2017 and is broadly in line with 2015

levels.

Finance gains and charges

Finance costs, other finance expenses and losses of US$329.0

million, have increased compared to the prior year (US$258.8

million), principally due to a step up in the interest margin on

our financing facilities following the completion of the

refinancing.

Taxation

The Group's total tax credit for 2017 is US$96.1 million (2016:

US$522.6 million restated for the exclusion of the Pakistan

business unit) which comprises a current tax charge for the period

of US$74.8 million and a non-cash deferred tax credit for the

period of US$170.9 million.

The total tax charge represents an effective tax rate of 26.2

per cent (2016: 126.3 per cent). The low effective tax rate for the

year is primarily impacted by two UK specific deferred tax items.

The first is the impact of ring fence expenditure supplement claims

in the UK during the year (US$69.1 million credit) and the second

is the element of the UK impairment charge for the year that does

not attract a deferred tax offset (US$19.6 million charge). After

adjusting for the net impact of the above items of US$49.5 million,

the underlying Group tax charge for the period is a credit of

US$145.6 million and an effective tax rate of 40 per cent.

The Group has a net deferred tax asset of US$1,297.5 million at

31 December 2017 (2016: US$1,111.4 million). The increase in

deferred tax asset primarily arises due to new UK tax losses and

allowances generated in the year. The Group continues to recognise

its deferred tax assets in respect of UK tax losses and allowances

in full.

Loss after tax

Loss after tax is US$253.8 million (2016: profit of US$122.6

million) resulting in a basic loss per share of 49.4 cents from

continuing and discontinued operations (2016: earning of 24.0

cents). The loss after tax in the year is driven by the non-cash

impairment charges recognised and the one-time fees expensed in

relation to the Group's refinancing, partially offset by the gain

on disposal of the Wytch Farm interests.

Cash flows

Cash flow from operating activities was US$496.0 million (2016:

US$431.4 million) after accounting for tax payments of US$69.6

million (2016: US$60.9 million). The increase in operating cash

flows was largely driven by higher production and sales

volumes.

Capital expenditure in 2017 totalled US$275.6 million (2016:

US$662.6 million).

Capital expenditure 2017 2016

$ million $ million

---------------------------- ----------- -----------

Fields/development projects 236.8 533.1

---------------------------- ----------- -----------

Exploration and evaluation 37.6 126.6

---------------------------- ----------- -----------

Other 1.2 2.9

---------------------------- ----------- -----------

Total 275.6 662.6

---------------------------- ----------- -----------

The principal development project was the Catcher field in the

UK and the majority of exploration spend was related to the

drilling programme on the Zama prospect in Mexico. In addition,

cash expenditure for decommissioning activity in the period was

US$25.7 million. Further to this, US$16.7 million of cash was

placed into long-term abandonment escrow accounts for future

decommissioning activities.

In 2018 development and exploration spend is expected to be

around US$300 million, of which US$170 million relates to the

Catcher development (including a one off contractual first oil

payment made to the FPSO provider BW Offshore) and US$45 million to

exploration. Capex will be weighted to the first half of 2018 as

spending on the Catcher project completes with the drilling

programme on the asset due to finish by the end of the third

quarter. Abandonment spend is expected to be approximately US$80

million in 2018, before taking into account the benefits of cost

recovery and tax relief.

Discontinued operations, disposals and assets held for sale

During the year, Premier signed a share purchase agreement with

Al-Haj Energy Limited ('Al-Haj') for the sale of Premier Oil

Pakistan Holdings BV, which comprises Premier's Pakistan business

unit, for a cash consideration of US$65.6 million. During the year,

Al-Haj paid a cash deposit to Premier of US$25.0 million.

The disposal of the Pakistan business unit is expected to

complete in 2018 and, as this is within 12 months of the balance

sheet date, the business unit has been classified as a disposal

group held for sale and presented separately in the balance sheet.

Results for the disposal group in both the current and prior

periods have been presented as a discontinued operation. Profit

after tax for the business unit for the year is US$16.4 million

(2016: US$22.7 million). Assets and liabilities held for sale in

relation to the Pakistan disposal group are US$52.2 million and

US$25.4 million, respectively.

In September 2017, Premier entered into a sale and purchase

agreement to sell its entire interests in Licences PL089 and P534,

which contain the Wytch Farm field ('Wytch Farm'), to Verus

Petroleum SNS Limited ('Verus') for a cash consideration of US$200

million, subject to certain customary financial adjustments. The

disposal included the additional 3.71 per cent equity interest

Premier acquired in September 2017 for US$9.8 million.

The disposal was subject to the pre-emption rights of existing

joint venture partners and Premier subsequently received

notification from Perenco UK Limited ('Perenco') of its intention

to exercise those rights. Therefore, in November 2017, Premier

entered into a sale and purchase agreement with Perenco on

materially the same terms as those agreed with Verus.

The disposal to Perenco completed in December 2017, with Premier

receiving final cash consideration, after working capital

adjustments, of US$177.1 million. This resulted in a gain on

disposal of US$133.0 million and enabled Premier to release letters

of credit totalling approximately US$75 million which had been

issued in relation to future decommissioning liabilities that were

transferred as part of the disposal.

In December 2017, Premier entered into separate sale and

purchase agreements ('SPAs') to dispose of its entire equity

interest in the ETS pipeline in the UK for total consideration of

US$31.6 million (including a potential future payment of US$3.5

million linked to the future development of the Pegasus field) and

its entire non-operated interest in the Kakap field in Indonesia

for US$3.2 million. The assets and liabilities for both of these

interests have been classified as assets held for sale in the

balance sheet at 31 December 2017.

Refinancing

In July 2017, Premier completed a comprehensive refinancing of

its debt facilities with the lenders under the Company's Revolving

Credit Facility ('RCF'), Term Loan, Schuldschein ('SSL') and US

Private Placement ('USPP') notes (together the 'Private Lenders'),

the retail bonds and the convertible bonds. Completion of the

refinancing provides a solid foundation for Premier to deliver its

strategic plans by preserving the Group's debt facilities,

resetting financial covenant headroom and extending maturities to

2021 and beyond.

During the year it was determined that the refinancing

represented a substantial modification of the terms of the USPPs,

the SSL and the convertible bonds. Accordingly, extinguishment

accounting has been applied for the USPPs, SSL and convertible

bonds, resulting in the de-recognition of the carrying amount of

the financial liability and the recognition of a new financial

liability for each of these revised facilities at their fair value.

The de-recognition includes costs in relation to the refinancing of

US$83.7 million.

Furthermore, it was determined that the refinancing did not

represent a substantial modification of the terms of the RCF, the

Term Loan or the retail bonds. Therefore refinancing costs in

relation to the RCF, the Term Loan and the retail bonds of US$121.6

million have been deducted from the carrying amount of these

financial liabilities in the balance sheet. These costs, along with

previous unamortised arrangement fees, will be amortised over the

revised term of these facilities.

The total refinancing costs include the recognition of the USPP

make-whole adjustment, amendment and adviser fees, including the

recognition of the equity and synthetic warrants at fair value. In

connection with the refinancing, Premier issued 71.0 million equity

warrants and 21.4 million synthetic warrants to its Private Lenders

and retail bondholders and 18.1 million equity warrants to its

convertible bondholders in July 2017. At issue the equity warrants

had an exercise price of 42.75 pence and are exercisable from their

issuance until 31 May 2022. The fair value liability for the equity

and synthetic warrants recognised on the date of issue was US$47.7

million. Prior to the end of the year, 13.9 million equity warrants

had been exercised by warrant holders. The closing fair value at 31

December 2017 was US$59.8 million.

Balance sheet position

Net debt

Net debt at 31 December 2017 amounted to US$2,724.2 million (31

December 2016: US$2,765.2 million), with cash resources of US$365.4

million (31 December 2016: US$255.9 million). With the refinancing

completed, the maturity of all of Premier's facilities has been

extended to May 2021, except for the convertible bonds which are

May 2022. Therefore, all of Premier's facilities have been

classified as long-term debt on the year-end balance sheet.

At 31 December 2017, Premier retained significant cash of

US$297.2 million, once cash of US$68.2 million held on behalf of

our joint venture partners is excluded, and undrawn facilities of

US$244.0 million, giving Liquidity of US$541.2 million (31 December

2016: US$592.9 million).

In January 2018, Premier invited convertible bondholders to

exercise their exchange rights in respect of any and all of their

bonds. 87.5 per cent or US$205.8 million of the US$235.2 million

bonds outstanding were accepted for early exchange with an

incentive amount of US$50 per US$1,000 in principal of bonds. The

exchange resulted in the issue of 231,882,091 Ordinary Shares,

which included 7,578,343 incentive shares.

Provisions

The Group's decommissioning provision increased to US$1,432.1

million at 31 December 2017, up from US$1,325.3 million at the end

of 2016. The increase is driven by the addition of provisions

relating to the new Catcher field.

Non-IFRS measures

The Group uses certain measures of performance that are not

specifically defined under IFRS or other generally accepted

accounting principles. These non-IFRS measures used within this

Financial Review are EBITDAX, Operating cost per barrel, Free Cash

Flow, DD&A per barrel, Net Debt and Liquidity and are defined

in the glossary.

Financial risk management

Commodity prices

At 31 December 2017, the Group had 3.6 mmbbls of open oil swaps

at an average price of US$55.9/bbl. The fair value of these oil

swaps at 31 December 2017 was a liability of US$31.7 million (2016:

liability of US$18.3 million), which is expected to be released to

the income statement during 2018 as the related barrels are lifted.

Furthermore, during the year, the Group paid total premiums of

US$6.3 million to enter into oil option agreements for 2.9 mmbls at

an average price of US$53.5/bbl. Out of these options, 1.1 mmbls

expired in 2017 and 1.8 mmbls will mature during 2018 and are an

asset on the Group's balance sheet with a fair value at 31 December

2017 of US$0.2 million (2016: asset of US$3.5 million). Included

within physically delivered oil sales contracts are a further 1.8

mmbls of oil that will be sold for an average fixed price of

US$54.6/bbl during 2018 as these barrels are delivered.

During 2017, forward oil swaps of 1.5 mmbbls expired resulting

in a net charge of US$11.4 million (2016: US$104.9 million credit)

which has been included in sales revenue for the year.

Foreign exchange

Premier's functional and reporting currency is US dollars.

Exchange rate exposures relate only to local currency receipts, and

expenditures within individual business units. Local currency needs

are acquired on a short-term basis. At the year-end, the Group

recorded a mark-to-market gain of US$28.2 million on its

outstanding foreign exchange contracts (2016: loss of US$58.6

million). The Group currently has GBP150.0 million retail bonds,

EUR63.0 million long-term senior loan notes and a GBP100.0 million

term loan in issuance which have been hedged under cross currency

swaps in US dollars at average fixed rates of US$1.64:GBP and

US$1.37:EUR.

Interest rates

The Group has various financing instruments including senior

loan notes, convertible bonds, UK retail bonds, term loans and

revolving credit facilities. As at year-end, 51 per cent of total

borrowings are fixed or has been fixed using the interest rate swap

markets. On average, the cost of drawn funds for the year was 7.3

per cent. Mark-to-market credits on interest rate swaps amounted to

US$4.6 million (2016: credit of US$1.0 million).

Insurance

The Group undertakes a significant insurance programme to reduce

the potential impact of physical risks associated with its

exploration, development and production activities. Business

interruption cover is purchased for a proportion of the cash flow

from producing fields for a maximum period of 18 months. During

2017, US$7.2 million of cash proceeds were received (net to

Premier) in relation to settled insurance claims.

Going concern

The Group monitors its funding position and its liquidity risk

throughout the year to ensure it has access to sufficient funds to

meet forecast cash requirements. Cash forecasts are regularly

produced based on, inter alia, the Group's latest life of field

production and expenditure forecasts, management's best estimate of

future commodity prices (based on recent forward curves, adjusted

for the Group's hedging programme) and the Group's borrowing

facilities. Sensitivities are run to reflect different scenarios

including, but not limited to, changes in oil and gas production

rates, possible reductions in commodity prices and delays or cost

overruns on major development projects. This is done to identify

risks to liquidity and covenant compliance and enable management to

formulate appropriate and timely mitigation strategies.

As part of the refinancing completed in 2017, the Group amended

its financial covenants. These progressively tighten over the next

12 months with the Net Debt/EBITDA and EBITDA/Interest covenants

returning to 3.0x for the twelve months ended 31 March 2019. At

year-end, the Group continued to have significant liquidity and

headroom on the financial covenants within its borrowing

facilities. The Group's forecasts show that, at currently observed

oil and gas prices and prevailing production, the Group will have

sufficient financial headroom for the 12 months from the date of

approval of the 2017 Annual Report and Financial Statements. In

downside scenarios, where oil and gas prices were to fall and

remain significantly below those currently being realised or

production levels were to be significantly below current

performance then in the absence of any mitigating actions, a breach

of one or more of the financial covenants might arise outside of

the 12 month going concern assessment period. Potential mitigating

actions could include further non-core asset disposals, additional

hedging activity or deferral of expenditure.

Accordingly, after making enquiries and considering the risks

described above, the Directors have a reasonable expectation that

the Company has adequate resources to continue in operational

existence for the foreseeable future. Accordingly, the Directors

continue to adopt the going concern basis of accounting in

preparing these Consolidated Financial Statements.

Business risks

Premier's business may be impacted by various risks leading to

failure to achieve strategic targets for growth, loss of financial

standing, cash flow and earnings, and reputation. Not all of these

risks are wholly within the Company's control and the Company may

be affected by risks which are not yet manifest or reasonably

foreseeable.

Effective risk management is critical to achieving our strategic

objectives and protecting our personnel, assets, the communities

where we operate and with whom we interact and our reputation.

Premier therefore has a comprehensive approach to risk

management.

A critical part of the risk management process is to assess the

impact and likelihood of risks occurring so that appropriate

mitigation plans can be developed and implemented. Risk severity

matrices are developed across Premier's business to facilitate

assessment of risk. The specific risks identified by project and

asset teams, business units and corporate functions are

consolidated and amalgamated to provide an oversight of key risk

factors at each level, from operations through business unit

management to the Executive Committee and the Board.

For all the known risks facing the business, Premier attempts to

minimise the likelihood and mitigate the impact. According to the

nature of the risk, Premier may elect to take or tolerate risk,

treat risk with controls and mitigating actions, transfer risk to

third parties, or terminate risk by ceasing particular activities

or operations. Premier has a zero tolerance to financial fraud or

ethics non-compliance, and ensures that HSES risks are managed to

levels that are as low as reasonably practicable, whilst managing

exploration and development risks on a portfolio basis.

The Group has identified its principal risks for the next 12

months as being:

-- Further oil price weakness and volatility.

-- Underperformance of existing assets.

-- Failure of new Catcher asset to fully deliver to expectations.

-- Execution of planned corporate actions.

-- Ability to fund existing and planned growth projects.

-- Breach of new banking covenants if oil prices fall or assets underperform.

-- Ability to maintain core competencies.

-- Timing and uncertainty of decommissioning liabilities.

-- Political and security instability in countries of current and planned activity.

-- Rising costs if oil prices recover could limit access to services.

Further information detailing the way in which these risks are

mitigated is provided on the Company's website

www.premier-oil.com.

Richard Rose

Finance Director

Consolidated Income Statement

For the year ended 31 December 2017

2017 2016

$ million $ million

--------------------------------------- ------------ ------------

Restated

(1)

Continuing operations

Sales revenues 1,043.1 937.0

Other operating income/costs 18.8 (6.1)

Costs of operation (455.4) (412.7)

Depreciation, depletion, amortisation

and impairment (667.8) (888.3)

Reduction in decommissioning

estimates - 75.7

Exploration expense and pre-licence

costs (17.1) (58.5)

Excess of fair value over costs

of acquisition - 228.5

Costs related to the acquisition

of subsidiaries - (21.6)

Profit on disposal of non-current 129.0 -

assets

General and administration

costs (16.8) (24.1)

--------------------------------------- ------------ ------------

Operating profit/(loss) 33.8 (170.1)

Interest revenue, finance and

other gains 12.6 15.0

Finance costs, other finance

expenses and losses (329.0) (258.8)

Loss on substantial modification (83.7) -

Loss before tax from continuing

operations (366.3) (413.9)

Tax 96.1 522.6

--------------------------------------- ------------ ------------

(Loss)/profit for the year

from continuing operations (270.2) 108.7

--------------------------------------- ------------ ------------