Pound Strengthens As U.K. Wage Growth Accelerates To Near 10-year High

October 16 2018 - 2:17AM

RTTF2

The pound spiked up against its key counterparts in the European

session on Tuesday, after a data showed that the U.K. jobless rate

remained at a four-decade low in August and wage growth improved to

the fastest rate in almost a decade.

Data from the Office for National Statistics showed that the

U.K. jobless remained at 4 percent in three months to August. This

was the lowest rate since February 1975.

The number of unemployed decreased by 47,000 from three months

to May to 1.36 million.

Data showed that average earnings excluding bonuses grew 3.1

percent annually and earnings including bonuses rose 2.7 percent.

The annual growth rate was the highest since October to December

2008 period.

Investors were also watching Brexit developments ahead of a

crunch EU summit.

European shares were mixed as investors watched geopolitical

developments in the Middle East and looked ahead to the release of

minutes of the U.S. Federal Reserve's latest policy meeting, due

Wednesday for directional cues.

The currency traded mixed against its major counterparts in the

Asian session. While it held steady against the greenback and the

euro, it rose against the yen and the franc.

The pound appreciated to a 4-day high of 1.3209 against the

greenback, from a low of 1.3138 seen at 5:00 pm ET. The next

possible resistance for the pound is seen around the 1.34

region.

Having dropped to 146.89 against the yen at 5:15 pm ET, the

pound reversed direction and climbed to a 4-day high of 148.16. If

the pound rises further, it may find resistance around the 150.00

region.

The pound added 0.7 percent to a 4-day high of 1.3054 against

the Swiss franc, after falling to 1.2969 at 5:00 pm ET. The pound

is seen finding resistance around the 1.32 area.

The pound was 0.4 percent higher against the euro, touching a

4-day high of 0.8774. This follows a decline to 0.8810 at 10:15 pm

ET. On the upside, 0.86 is likely seen as the next resistance for

the pound.

Figures from Destatis showed that Germany's import prices rose

at a steady pace in August.

Import prices advanced 4.8 percent year-on-year in August, the

same pace of increase as seen in July. Economists had forecast the

rate to accelerate to 5.2 percent.

Looking ahead, U.S. industrial production for September and NAHB

housing market index for October are scheduled for release in the

New York session.

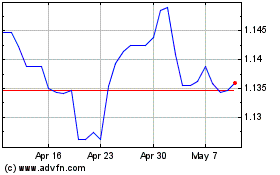

Sterling vs CHF (FX:GBPCHF)

Forex Chart

From Mar 2024 to Apr 2024

Sterling vs CHF (FX:GBPCHF)

Forex Chart

From Apr 2023 to Apr 2024