Pound Declines As U.K. Visible Trade Gap Widens

March 09 2018 - 1:03AM

RTTF2

The pound dropped against its most major opponents in the

European session on Friday, after a data showed that the UK visible

trade deficit increased in January as the pace of growth in imports

exceeded exports growth.

Data from the Office for National Statistics showed that the

visible trade gap widened to GBP 12.32 billion in January from GBP

11.77 billion in the previous month. The shortfall was seen at GBP

11.9 billion.

Exports rose 3.1 percent month-on-month, while imports climbed

3.5 percent in January.

Meanwhile, separate data showed that U.K. industrial production

rebounded in January on oil and gas extraction.

Industrial output grew 1.3 percent month-on-month in January,

offsetting December's 1.3 percent decrease. Output was forecast to

grow 1.5 percent.

In a separate communique, the ONS said construction output

contracted 3.4 percent on month in January after rising in the

previous two months.

Further, data showed that construction output logged its biggest

annual decline since March 2013. Output was down 3.9 percent in

January.

European stocks were trading mixed, as investors digested U.S.

President Donald Trump's announcement to impose tariffs on steel

and aluminum imports and looked ahead to the all-important U.S.

jobs report due later in the day for directional cues.

The pound traded mixed against its major rivals in the Asian

session. While the pound rose against the yen and the franc, it

held steady against the greenback and the euro.

The pound weakened to 0.8923 against the euro, from a 4-day high

of 0.8901 hit at 3:15 am ET. The next possible support for the

pound is seen around the 0.91 level.

Figures from Destatis showed that Germany's industrial

production dropped unexpectedly in January.

Industrial output fell 0.1 percent month-on-month in January,

confounding expectations for an increase of 0.7 percent.

Nonetheless, the pace of decline was slower than the revised 0.5

percent fall logged in December.

Reversing from an early high of 1.3831 against the greenback,

the pound retreated to 1.3802. On the downside, 1.35 is seen as the

next likely support level for the pound.

Following more than a 4-week high of 1.3166 hit at 3:15 am ET,

the pound reversed direction and edged down to 1.3111 versus the

franc. The pound is seen finding support around the 1.30

region.

On the flip side, the pound held steady against the yen, after

rising as high as 147.62 at 3:05 am ET. At yesterday's close, the

pair was worth 146.62.

The Bank of Japan kept its monetary stimulus unchanged, as

widely expected.

Governor Haruhiko Kuroda and his board members decided by an 8-1

majority vote to hold its target of raising the amount of

outstanding JGB holdings at an annual pace of about JPY 80

trillion.

Looking ahead, U.S. and Canadian jobs data for February and U.S.

final wholesale inventories for January are set for release in the

New York session.

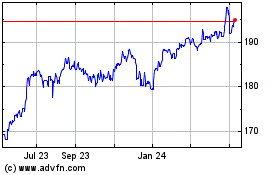

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Mar 2024 to Apr 2024

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Apr 2023 to Apr 2024