Pivotal Software Files for IPO

March 23 2018 - 4:59PM

Dow Jones News

By Aisha Al-Muslim

Cloud software-services company Pivotal Software Inc., a spinoff

of EMC Corp. and VMware Inc., plans to go public.

Pivotal filed preliminary documents for an initial public

offering, Securities and Exchange Commission records show. The

company's filing Friday with the SEC lists an amount of $100

million but that is a placeholder figure likely to change.

Pivotal didn't disclose where its shares would list or under

what ticker symbol it would trade under. It also didn't list an

initial public offering price, the filing shows.

The company had revenue of $509.4 million in fiscal 2018, which

ended Feb. 2, compared with $280.9 million in fiscal 2016 and

$416.3 million in fiscal 2017. Fiscal 2018 was the first year in

which subscription revenue exceeded its services revenue, but the

company expects that subscription revenue will become a larger

percentage of its total revenue over time, it said in the

filing.

The company posted a $163.5 million net loss in fiscal 2018,

narrower than the $282.7 million it recorded in fiscal 2016 and

$232.9 million in fiscal 2017.

Pivotal plans to use the IPO proceeds to increase its financial

flexibility and for working capital, investments and other general

purposes. It also wants to create a public market for its stock and

facilitate its future access to the public equity markets. It may

also use a portion of the proceeds for investments in or

acquisitions of businesses, technologies or other assets.

Dell Technologies Inc. is currently Pivotal's majority

stockholder. As of Feb. 2, Pivotal had more than 2,518 full-time

employees.

In January, The Wall Street Journal reported that Dell is

considering a range of strategic alternatives that could transform

the maker of PCs and data-storage devices, according to people

familiar with the matter. The closely held technology giant is

expected to explore options including an IPO and a purchase of the

rest of VMware, a publicly traded cloud-infrastructure company, the

people said.

In 2016, Dell bought data-storage company EMC for $67 billion in

the largest technology takeover ever. When Dell bought EMC, EMC

owned 80% of VMware, based in Palo Alto, Calif. which produces

software related to databases, storage and the Internet of

Things.

Write to Aisha Al-Muslim at aisha.al-muslim@wsj.com

(END) Dow Jones Newswires

March 23, 2018 16:44 ET (20:44 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

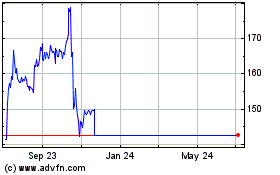

Vmware (NYSE:VMW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Vmware (NYSE:VMW)

Historical Stock Chart

From Apr 2023 to Apr 2024