Pillar Income Asset Management Expands Staff Due to Continuous Growth

June 25 2018 - 9:30AM

Business Wire

Pillar Income Asset Management, Transcontinental Realty Investor

Inc.’s management company, announced today that due to stellar

asset growth and several new strategic initiatives, the company has

expanded its staff. The expansion includes the addition of new

positions as well as dividing certain functions to enhance overall

effectiveness.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20180625005189/en/

Pillar’s Capital Markets/HUD function has been redefined. George

Jalil has joined Pillar as Vice President of Capital Markets and

has a diverse background in finance and commercial real estate. Mr.

Jalil specializes in the acquisition and capital structuring of

multifamily transactions. Prior to joining Pillar, he held

leadership roles at Staghorn Capital, NAPA Ventures, Asset

Revitalization Solutions, and various commercial real estate

brokerages throughout Florida and Texas.

Kim Geisheimer fills out the expanded Capital Markets role as

our new Assistant Vice President of Capital Markets. Ms. Geisheimer

has over 25 years of experience in commercial real estate finance

and multifamily development. Prior to joining Pillar, she was

involved with multifamily servicing, asset management and

originations for Barings Multifamily Capital, Red Capital, J.P.

Morgan Chase and Key Bank Real Estate Capital.

Steve Cone is Pillar’s new Vice President of Sales and

Acquisitions. Mr. Cone previously managed land acquisitions and

development at Wilco Partners. He will work closely with the

Capital Markets group and Pillar’s Brokers division to successfully

manage our land portfolio.

In addition to an internal promotion, Pillar has also added

several new positions to the Public Accounting department. Cynthia

Avelar was promoted to Senior Accountant after only four months in

recognition of her unparalleled commitment to the growth and

improvement of the department. The department’s newest additions

are Al Rodriguez – SEC Reporting Manager, Mike Ragsdale – Public

Accounting Manager, and Jud Stagner – Assistant Manager of

Financial Planning and Analysis.

Pillar’s construction affiliate, Regis Property Management, LLC,

also recently welcomed Ryan Dykes as an additional Project Manager

to the team.

“With our organization’s existing and newly engaged Joint

Venture projects and our continuously burgeoning multifamily asset

base, we are committed to the continued growth and education of our

staff,” commented Daniel Moos, President and CEO. “It is likely we

will add even more positions to keep pace as we continue to expand

our strategic footprint.”

Pillar Income Asset Management, Inc. is a Dallas-based real

estate management company, which develops and manages in excess of

$2.5 billion of real estate for public and private real estate

entities. Affiliated companies under management or advisement by

Pillar include American Realty Investors, Inc. (NYSE: ARL);

Transcontinental Realty Investors, Inc. (NYSE: TCI); Income

Opportunity Realty Investors, Inc. (NYSE AMERICAN: IOR), Abode

Properties, and Regis Property Management, LLC.

Transcontinental Realty Investors maintains a strong emphasis on

creating greater shareholder value through acquisition, financing,

operation, developing, and sale of real estate across every

geographic region in the United States. A New York Stock Exchange

company, Transcontinental is traded under the symbol "TCI".

Transcontinental produces revenue through the professional

management of apartments, office buildings, warehouses, and retail

centers that are "undervalued" or "underperforming" at the time of

acquisition. Value is added under Transcontinental ownership, and

the properties are repositioned into higher classifications through

physical improvements and improved management. Transcontinental

also develops new properties, such as luxury apartment homes

principally on land it owns or acquires.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180625005189/en/

Pillar Income Asset ManagementChris Childress,

469-522-4275press@pillarincome.com

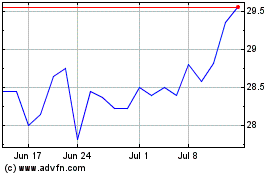

Transcontinental Realty ... (NYSE:TCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

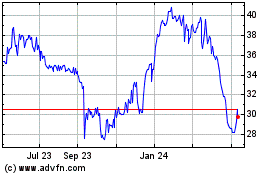

Transcontinental Realty ... (NYSE:TCI)

Historical Stock Chart

From Apr 2023 to Apr 2024