TIDMPMG

RNS Number : 3371J

Parkmead Group (The) PLC

29 March 2018

29 March 2018

The Parkmead Group plc

("Parkmead", "the Company" or "the Group")

Interim Results for the six-month period ended 31 December

2017

Parkmead, the UK and Netherlands-focused independent energy

group, is pleased to report its interim results for the six-month

period ended 31 December 2017.

HIGHLIGHTS

Parkmead doubles gross profit and demonstrates financial

strength

-- Gross profit for the period of GBP1.4 million (2016: GBP0.7 million)

-- Parkmead is cash flow positive on an operating basis

-- Strong total asset base of GBP75.8 million at 31 December 2017

-- Strict financial discipline maintained

-- Well capitalised, with cash balances of US$33.0 million

(GBP24.4 million) at 31 December 2017

-- Debt free

-- Increased volumes at the Diever West gas field

-- Low-cost Netherlands gas production provides positive cash flow growth

67% increase in oil and gas reserves

-- 2P reserves of 46.3 million barrels of oil equivalent

("MMBoe") at 1 March 2018, a 67% increase from Parkmead's 1 March

2017 reserves position of 27.8 MMBoe

-- 2C resources increased by 25% to 73.9 MMBoe at 1 March 2018 (59.1 MMBoe at 1 March 2017)

Major progress on valuable development projects; potential

Greater Perth Area tie-back

-- Significantly increased equity in the Perth and Dolphin oil

fields in UK Central North Sea in February 2018, which lie at the

core of Parkmead's Greater Perth Area ("GPA") oil hub project

-- Increased equity in the Perth and Dolphin fields raises

Parkmead's 2P reserves to 46.3 MMBoe

-- Parkmead now in full control of the GPA oil hub project with operatorship and 100% equity

-- Agreement signed with Nexen Petroleum, a subsidiary of China

National Offshore Oil Corporation (CNOOC), to undertake a detailed

engineering study for the potential subsea tie-back of the GPA

project to the Nexen-operated Scott facilities in the Central North

Sea

-- Nexen's Scott facilities lie approximately 10km southeast of Parkmead's GPA project

-- New reservoir study commissioned with AGR Tracs International

in relation to well stimulation, which could lead to increasing oil

flow rates and oil reserves recovery from the two fields by

analysing the effect of fracture stimulation on the reservoir

Doubled gas volumes at Diever West. Gross production reaches 45

MMscfd

-- New dynamic reservoir modelling suggests Diever West has

approximately 108 billion cubic feet ("Bcf") of gas-in-place

volumes, more than double the post drill static volume estimate of

41 Bcf

-- The Group has substantially increased production from its

Diever West gas field by perforating the Akkrum reservoir

formation

-- Average gross production during February 2018 at Diever West

was 45.5 million cubic feet per day ("MMscfd"), approximately 7,833

barrels of oil equivalent per day ("boepd")

-- Low-cost onshore gas portfolio in the Netherlands produces

from four separate gas fields with an average operating cost of

just US$10 per barrel of oil equivalent, generating positive cash

flows

-- Further production enhancement work planned on Parkmead's

Netherlands portfolio, including a new well at the Geesbrug gas

field to maximise production and early development planning at the

Ottoland discovery

-- Production at the Brakel field has recommenced following compression work

Well positioned for further acquisitions

-- Seven acquisitions, at both an asset and corporate level, have been completed to date

-- Parkmead evaluating further acquisition opportunities and

prioritising those that provide growth

-- Current oil and gas environment provides a good opportunity

to continue the Group's growth trajectory

Parkmead's Executive Chairman, Tom Cross, commented:

"I am pleased to report excellent progress in the period to 31

December 2017. The Group has doubled gross profit, through a

combination of Parkmead's increased gas production in the

Netherlands and the proactive cost reduction programme in the

UK.

We are delighted to have significantly increased production at

the Diever West gas field, which builds Parkmead's cash flow. New

reservoir modelling indicates that Diever West could be more than

double the size originally expected.

We are also pleased with the major progress made with the

Greater Perth Area project. By increasing our stake in the Perth

and Dolphin oil fields, Parkmead's oil and gas reserves grow by

some 67%.

The study with Nexen will examine one path to potentially unlock

the substantial value of the GPA project for the benefit of the UK

and Parkmead shareholders, as well as providing further value for

the existing infrastructure partners.

The team at Parkmead is working intensively to evaluate and

execute further opportunities which could build value and provide

additional upside to the Company. Parkmead is analysing both oil

and gas, and wider energy related opportunities, which could

broaden and enhance the Group's revenue stream.

Parkmead is well positioned for the future. We have excellent

regional expertise, significant cash resources, and a growing,

low-cost gas portfolio. The Group will continue to build upon the

inherent value in its existing interests with a balanced,

acquisition-led growth strategy, securing opportunities that

maximise long-term value for our shareholders."

For enquiries please contact:

The Parkmead Group plc +44 (0) 1224 622200

Tom Cross (Executive Chairman)

Ryan Stroulger (Chief Financial

Officer)

Panmure Gordon (UK) Limited +44 (0) 20 7886 2500

(Financial Adviser, NOMAD

and Corporate Broker to Parkmead)

Adam James

Atholl Tweedie

Instinctif Partners Limited +44 (0) 20 7457 2020

(PR Adviser to Parkmead)

David Simonson

Laura Syrett

George Yeomans

Review of Activities

Parkmead has delivered significant growth across its oil and gas

operations in the UK and the Netherlands, continuing to build a

high quality portfolio across each stage of the asset life

cycle.

In August 2017, the Company completed the acquisition of a 50%

interest in UK North Sea Licence P.2209 from Verus Petroleum (SNS)

Limited, which contains the Farne Extension prospect and a further

four prospective leads. This acquisition doubled Parkmead's equity

in the licence to 100%. Licence P.2209 comprises two adjacent

blocks, Block 42/19 and Block 42/20b. The range of prospects and

leads within this licence, which is operated by Parkmead, have the

potential to contain 175 billion cubic feet of gas initially in

place on a most likely, P50 basis.

In February 2018, Parkmead announced that it had significantly

increased its equity in the Perth and Dolphin oil fields in the UK

Central North Sea from 60.5% to 100%. The Perth and Dolphin fields

lie at the core of Parkmead's Greater Perth Area ("GPA") oil hub

project.

The Company has also signed an agreement with Nexen Petroleum, a

subsidiary of the China National Offshore Oil Corporation (CNOOC),

to conduct a detailed engineering study in relation to the

potential subsea tie-back of the Greater Perth Area project to the

Nexen-operated Scott platform and associated facilities in the UK

Central North Sea. The Scott facilities lie just some 10km

southeast of Parkmead's GPA project.

In addition, Parkmead has commissioned a new reservoir study

with AGR Tracs International in relation to well stimulation, which

could lead to increasing oil flow rates and oil reserves recovery

from the two fields by analysing the effect of fracture stimulation

on the reservoir.

A tie-back of the GPA project to the Scott facilities could

yield a number of mutually beneficial advantages for both the Scott

partnership and Parkmead. Utilisation of this export route has the

potential to transform the GPA project commercially and

economically, by dramatically reducing the capital expenditure

required to bring the GPA project onstream and by lowering the

operating costs thereafter.

The new reservoir study with AGR Tracs in relation to well

stimulation could substantially increase the predicted recovery

factor of the two fields by analysing the effect of fracture

stimulation on the reservoir. The Perth field benefits from having

a very large volume of oil-in-place, which stands at 197 million

barrels of oil ("MMBbls") for core Perth, and 498 MMBbls when

including the northern areas of the field. The Perth reservoir has

a gross oil column of around 2,000 feet, making the reservoir ideal

for fracture stimulation.

Perth and Dolphin are located in the Moray Firth area of the UK

Central North Sea, which contains very large oil fields such as

Piper, Claymore and Tartan. Through a series of licensing round

successes and strategic acquisitions, Parkmead has established a

key position in this area of the North Sea. Perth and Dolphin are

two substantial Upper Jurassic Claymore sandstone accumulations

that have tested 32-38deg API oil at production rates of up to

6,000 boepd per well. At Perth, the Claymore Sandstone forms a

combined structural-stratigraphic trap, onlapping the Tartan Ridge

to the North, with a southward-thickening and dipping sandstone

wedge. The sandstones that comprise the accumulation were deposited

as deep-water turbidites sourced from the Halibut Horst, with a

minor contribution from the Tartan Ridge.

Parkmead made a number of important growth steps during 2017 in

relation to the GPA project. An invitation to tender was announced

to the service provider market, covering the pre-FEED, FEED and

subsequent development phases of the project. Parkmead was pleased

to report that 13 alliance submissions were received, comprising 35

companies, across all project components of drilling, subsea

construction and export route options. After evaluating the

proposals, Parkmead is holding discussions with a number of

leading, internationally-renowned service companies.

The majority of the proposals have focused on innovative

approaches to the potential development, with significant new work

carried out on well planning, timeline to production and financing.

A number of the proposals have also offered finance to the Group

for major parts of the development, further reducing the capital

expenditure required to bring the project onstream.

Detailed technical work undertaken across the wider Parkmead

portfolio has allowed the company to release non-core acreage, such

as licence P.1566, considerably reducing licence costs.

Strong Netherlands asset base

The Group has substantially increased production from the Diever

West gas field over the last few months. The Akkrum formation

section of the field has been perforated, almost quadrupling the

perforated reservoir interval. Gross production during February

2018 at Diever West averaged 45.5 million cubic feet per day

(approximately 7,833 boepd, Parkmead 7.5%).

The Diever West field has performed above expectations since

first production, and new dynamic reservoir modelling suggests the

field has approximately 108 billion cubic feet of gross

gas-in-place volumes, more than double the post-drill static volume

estimate of 41 billion cubic feet.

The Parkmead portfolio includes four separate producing gas

fields with a very low average operating cost of just US$10 per

barrel of oil equivalent. This profitable gas production from the

Netherlands provides important cash flow to the Group. This is

valuable income for Parkmead, particularly given the oil price

environment.

A number of enhanced production opportunities have been

identified within Parkmead's existing Netherlands portfolio, which

the Group intends to capitalise on with the aim of further

increasing its gas production. Production at the Brakel field has

recommenced following compression work to optimise gas flows.

Production on the field is gradually being increased and is

expected to reach a gross rate of 1.85 million cubic feet per day

(approximately 318 boepd, Parkmead 15%).

Detailed work has begun on the Ottoland discovery, located on

the same Andel Va block as the Brakel gas field. Seismic

interpretation and depth migration studies, followed by structural

and static modelling, will refine the volumetrics ahead of a

development plan, potentially including a new horizontal well. In

addition, seismic reprocessing will be carried out on the Andel Vb

licence ahead of updating the prospectivity estimates for this

area. This extensive new work will be conducted throughout

2018.

At Parkmead's producing Geesbrug gas field, the potential for a

new low-cost infill well is being studied in order to maximise

production. New work is also being undertaken on the Papekop

onshore oil and gas discovery. Previous evaluation of the discovery

by the joint venture partnership indicates that Papekop contains

gross unrisked oil-in-place of 40 million barrels and gas-in-place

of 24 billion cubic feet on a most likely, P50 case. New structural

and static modelling will look to refine the volume estimates at

Papekop, after which development scenarios will be analysed and

planned.

Results

During the six-month period to 31 December 2017, the Group

generated revenues of GBP2.7 million (2016: GBP2.7 million).

Parkmead doubled gross profit for the period to GBP1.4 million

(2016: GBP0.7 million profit). This is a significant achievement

and is testament to the success of the Group's onshore gas

portfolio and strict financial discipline. The Group's gas

portfolio in the Netherlands generates positive cash flows and

Parkmead's four separate gas fields have an average operating cost

of just US$10 per barrel of oil equivalent. Detailed technical work

undertaken across the wider Parkmead portfolio has allowed the

company to release non-core acreage, such as licence P. 1566,

considerably reducing licence costs. This has resulted in an

impairment charge of GBP4.5 million.

Administrative expenses were GBP0.3 million (2016: GBP2.4

million). Underlying administrative expenses (not including

non-cash share based payment charges) have been reduced and are

continually being monitored and reviewed to ensure that Parkmead

maintains a strong balance sheet.

Parkmead's total assets at 31 December 2017 were GBP75.8m (2016:

GBP84.0m). Available-for-sale financial assets were GBP4.1m (2016:

GBP4.0m). Cash and cash equivalents at year end were GBP24.4m

(2016: GBP26.7m). Parkmead is very carefully managed and remains

debt free. Loans issued during the period were GBP1.7m (2016:

GBPnil). The Group's net asset value was GBP65.2m (2016: GBP70.1m).

Parkmead is therefore well positioned for growth. This positive

position is a direct result of experienced portfolio management and

a strong focus on capital discipline.

Investments

The Group's largest investment is in Faroe Petroleum plc (LSE

AIM: FPM.L). As at 31 December 2017, this investment was carried at

a value of GBP4.1 million.

Outlook

Parkmead has delivered considerable growth in both its asset

base and financial position in the period to 31 December 2017. This

was achieved through increasing the Group's equity in core assets

of the portfolio, doubling Parkmead's gross profit and increasing

gas production from the low-cost onshore Netherlands portfolio.

The Group is in an excellent position, both operationally and

financially, and is well placed for growth. The Board has

positioned Parkmead to take advantage of the changing energy

environment and views this as a good opportunity to continue the

Group's positive trajectory. Our acquisition-led growth strategy

has resulted in seven deals being completed by Parkmead since

repositioning the business as an independent energy company in

2011, and we intend to build on this track record. As we look

forward into 2018, we will continue to keep shareholders informed

of the steps being taken across our exploration, appraisal,

development and production activities. The Board of Directors is

pleased with the Group's progress, and believes that the Parkmead

team is well positioned to drive the business forward and to build

upon the achievements made to date.

Tom Cross

Executive Chairman

29 March 2018

This announcement contains inside information for the purposes

of Article 7 of Regulation 596/2014. Upon the publication of this

announcement, the information contained herein is now considered to

be in the public domain.

Notes:

1. Dr Colin Percival, Parkmead's Technical Director, who holds a

First Class Honours Degree in Geology and a Ph.D in Sedimentology

and has over 35 years of experience in the oil and gas industry,

has reviewed and approved the technical information contained in

this announcement. Reserves and contingent resource estimates are

stated as at 1 March 2018. Parkmead's evaluation of reserves and

resources was prepared in accordance with the 2007 Petroleum

Resources Management System prepared by the Oil and Gas Reserves

Committee of the Society of Petroleum Engineers and reviewed and

jointly sponsored by the World Petroleum Council, the American

Association of Petroleum Geologists and the Society of Petroleum

Evaluation Engineers.

Glossary of key terms

boped Barrels of oil equivalent per day

Bcf Billions of cubic feet of gas

Gas in place The total quantity of gas that is estimated to exist originally in naturally

occurring reservoirs

Oil in place The total quantity of oil that is estimated to exist originally in naturally

occurring reservoirs

Contingent Resources Those quantities of petroleum estimated, as of a given date, to be potentially

recoverable

from known accumulations by application of development projects but which are not

currently

considered to be commercially recoverable due to one or more contingencies.

Contingent Resources

are a class of discovered recoverable resources

Recoverable resources Those quantities of hydrocarbons that are estimated to be producible from discovered

or undiscovered

accumulations

Proved and Probable or "2P" Those additional Reserves which analysis of geoscience and engineering data indicate

are less

likely to be recovered than Proved Reserves but more certain to be recovered than

Possible

Reserves. It is equally likely that actual remaining quantities recovered will be

greater

than or less than the sum of the estimated Proved plus Probable Reserves (2P). In

this context,

when probabilistic methods are used, there should be at least a 50 per cent.

probability that

the actual quantities recovered will equal or exceed the 2P estimate

Reserves Reserves are those quantities of petroleum anticipated to be commercially recoverable

by application

of development projects to known accumulations from a given date forward under

defined conditions.

Reserves must further satisfy four criteria: they must be discovered, recoverable,

commercial,

and remaining (as of the evaluation date) based on the development project(s)

applied. Reserves

are further categorized in accordance with the level of certainty associated with the

estimates

and may be sub-classified based on project maturity and/or characterized by

development and

production status

P50 Reflects a volume estimate that, assuming the accumulation is developed, there is a

50% probability

that the quantities actually recovered will equal or exceed the estimate. This is

therefore

a median or best case estimate

2C Denotes the best estimate scenario, or P50, of Contingent Resources

FEED Front End Engineering Design

Group statement of profit

or loss

for the six months ended 31 December 2017

Twelve

Six months Six months months

to 31 to 31 to 30

December December June

2017 2016 2017

Notes (unaudited) (unaudited)

GBP'000 GBP'000 GBP'000

Revenue 2,707 2,707 4,137

Cost of sales (1,339) (2,035) (2,959)

Gross profit 1,368 672 1,178

Exploration and evaluation

expenses 2 (4,815) (2,412) (2,669)

Administrative expenses 3 (301) (2,408) (2,344)

----------------------------------------------------- -------- ------------ ------------ --------

Operating loss (3,748) (4,148) (3,835)

Finance income 19 28 281

Finance costs (352) (391) (749)

Loss before taxation (4,081) (4,511) (4,303)

Taxation (437) - (607)

----------------------------------------------------- -------- ------------ ------------ --------

Loss for the period attributable

to the equity

holders of the Parent (4,518) (4,511) (4,910)

--------------------------------------------------------------- ------------ ------------ --------

Loss per share (pence)

Basic 5 (4.57) (4.56) (4.96)

Diluted (4.57) (4.56) (4.96)

Group statement of profit or loss and other comprehensive

income

for the six months ended 31 December 2017

Twelve

Six months Six months months

to 31 to 31 to 30

December December June

2017 2016 2017

(unaudited) (unaudited)

GBP'000 GBP'000 GBP'000

Loss for the period (4,518) (4,511) (4,910)

----------------------------------------------------- -------- ------------ ------------ ----------

Other comprehensive income

Items that may be reclassified

subsequently to profit

or loss

Fair value gain on available-for-sale

financial assets 855 1,380 583

----------------------------------------------------- -------- ------------ ------------ ----------

855 1,380 583

Income tax relating to

components of other comprehensive

income - - -

Other comprehensive income

for the period, net of

tax 855 1,380 583

Total comprehensive loss

for the period attributable

to the equity holders

of the Parent (3,663) (3,131) (4,327)

----------------------------------------------------- -------- ------------ ------------ ----------

Group statement of financial position

as at 31 December 2017

At 31 At 31 At 30

December December June

2017 2016 2017

(unaudited) (unaudited)

GBP'000 GBP'000 GBP'000

Non-current assets

Property, plant and equipment:

development & production 12,850 16,454 15,993

Property, plant and equipment:

other 39 81 55

Goodwill 2,174 2,174 2,174

Exploration and evaluation

assets 29,360 32,307 33,382

Available-for-sale financial

assets 4,082 4,024 3,227

Interest bearing loans 1,711 - -

Deferred tax assets 3 3 3

Total non-current assets 50,219 55,043 54,834

--------------------------------- ------------ ------------ ---------

Current assets

Trade and other receivables 1,168 2,043 927

Current tax asset - 158 -

Cash and cash equivalents 24,415 26,727 26,396

Total current assets 25,583 28,928 27,323

--------------------------------- ------------ ------------ ---------

Total assets 75,802 83,971 82,157

--------------------------------- ------------ ------------ ---------

Current liabilities

Trade and other payables (2,608) (3,893) (2,364)

Current tax liabilities (440) - (457)

Total current liabilities (3,048) (3,893) (2,821)

--------------------------------- ------------ ------------ ---------

Non-current liabilities

Other liabilities (82) (64) (70)

Deferred tax liabilities (1,284) (1,284) (1,284)

Decommissioning provisions (6,171) (8,605) (9,102)

--------------------------------- ------------ ------------ ---------

Total non-current liabilities (7,537) (9,953) (10,456)

--------------------------------- ------------ ------------ ---------

Total liabilities (10,585) (13,846) (13,277)

--------------------------------- ------------ ------------ ---------

Net assets 65,217 70,125 68,880

--------------------------------- ------------ ------------ ---------

Equity attributable to equity

holders

Called up share capital 19,533 19,533 19,533

Share premium 87,805 87,805 87,805

Merger reserve - 27,187 -

Revaluation reserve (1,943) (2,001) (2,798)

Retained deficit (40,178) (62,399) (35,660)

--------------------------------- ------------ ------------ ---------

Total equity 65,217 70,125 68,880

--------------------------------- ------------ ------------ ---------

Group statement of changes in equity

for the six months ended 31 December 2017

Share Share Merger Revaluation Retained Total

capital premium reserve reserve earnings

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 July

2016 19,533 87,805 27,187 (3,381) (57,980) 73,164

Loss for

the period - - - - (4,511) (4,511)

Fair value

gain on available-for-sale

financial

assets - - - 1,380 - 1,380

Total comprehensive

income /

(loss) for

the period - - - 1,380 (4,511) (3,131)

Share-based

payments - - - - 92 92

----------------------------- --------- --------- --------- ------------ ---------- --------

At 31 December

2016 19,533 87,805 27,187 (2,001) (62,399) 70,125

----------------------------- --------- --------- --------- ------------ ---------- --------

Loss for

the period - - - - (399) (399)

Fair value

loss on available-for-sale

financial

assets - - - (797) - (797)

----------------------------- --------- --------- --------- ------------ ---------- --------

Total comprehensive

loss for

the period - - - (797) (399) (1,196)

Transfer

merger reserve - - (27,187) - 27,187 -

Share-based

payments - - - - (49) (49)

----------------------------- --------- --------- --------- ------------ ---------- --------

At 30 June

2017 19,533 87,805 - (2,798) (35,660) 68,880

----------------------------- --------- --------- --------- ------------ ---------- --------

Loss for

the period - - - - (4,518) (4,518)

Fair value

gain on available-for-sale

financial

assets - - - 855 - 855

Total comprehensive

income /

(loss) for

the period - - - 855 (4,518) (3,663)

Share-based

payments - - - - - -

----------------------------- --------- --------- --------- ------------ ---------- --------

At 31 December

2017 19,533 87,805 - (1,943) (40,178) 65,217

----------------------------- --------- --------- --------- ------------ ---------- --------

Group statement of cashflows

for the six months ended 31 December

2017

Twelve

Six months Six months months

to 31 to 31 to 30

December December June

2017 2016 2017

(unaudited) (unaudited)

Notes GBP'000 GBP'000 GBP'000

Cashflows from operating

activities

Cashflows from operations 6 1,077 (700) (464)

Taxation (paid)/received (457) 46 56

----------------------------------- ------ ------------ ------------ --------

Net cash generated from

/ (used in) operating activities 620 (654) (408)

----------------------------------- ------ ------------ ------------ --------

Cash flow from investing

activities

Interest received 19 16 271

Acquisition of exploration

and evaluation assets (895) (484) (1,164)

Acquisition of property,

plant and equipment: development

& production (74) (530) (725)

Acquisition of property,

plant and equipment: other (4) (38) (47)

Proceeds from available-for-sale

financial assets - 10 10

Loans issued (1,711) - -

Net cash (used in) investing

activities (2,665) (1,026) (1,655)

----------------------------------- ------ ------------ ------------ --------

Cash flow from financing

activities

Interest paid (1) - (8)

Net cash (used in) financing

activities (1) - (8)

----------------------------------- ------ ------------ ------------ --------

Net decrease in cash and

cash equivalents (2,046) (1,680) (2,071)

----------------------------------- ------ ------------ ------------ --------

Cash and cash equivalents

at beginning of period 26,396 28,288 28,288

Effect of foreign exchange

rate differences 65 119 179

----------------------------------- ------ ------------ ------------ --------

Cash and cash equivalents

at end of period 24,415 26,727 26,396

----------------------------------- ------ ------------ ------------ --------

Notes to the Interim financial statements

1 Accounting policies

Basis of preparation

The interim financial information in this report has been

prepared using accounting policies consistent with International

Financial Reporting Standards (IFRS) as adopted by the European

Union and IFRS Interpretations Committee (IFRIC) interpretations.

IFRS is subject to amendment and interpretation by the

International Accounting Standards Board (IASB) and IFRIC and there

is an ongoing process of review and endorsement by the European

Commission. The financial information has been prepared on the

basis of IFRS that the Directors expect to be adopted by the

European Union and applicable as at 30 June 2018.

The Group has chosen not to adopt IAS 34 - Interim Financial

Statements, in preparing these financial statements.

The accounting policies applied in this report are the same as

those applied in the consolidated financial statements for the year

ended 30 June 2017.

Non-statutory accounts

The financial information set out in this interim report does

not constitute the Group's statutory accounts.

The financial information for the year ended 30 June 2017 has

been extracted from the audited statutory accounts. The statutory

accounts for the year ended 30 June 2017 have been delivered to the

Registrar of Companies. The auditors reported on those accounts;

their report was unqualified, did not contain a statement under

either Section 498 (2) or Section 498 (3) of the Companies Act 2006

and did not include references to any matters to which the auditor

drew attention by way of emphasis.

The financial information for the 6 months ended 31 December

2017 and 31 December 2016 is unaudited.

2 Impairment of exploration and evaluation assets

Exploration and evaluation expenses includes impairment charges

of GBP4,508,000 recorded in respect of exploration licences

relinquished in the period. (Six months to 31 December 2016:

GBP2,409,000, Twelve months to 30 June 2017: GBP2,424,000).

3 Administrative expenses

Administrative expenses include a credit in respect of a

non-cash revaluation of share appreciation rights (SARs) totalling

GBP345,000 (Six months to 31 December 2016: GBP1,551,000 debit,

Twelve months to 30 June 2017: GBP611,000 debit). The SARs may be

settled by cash or shares and are therefore revalued with the

movement in share price. The valuation was impacted by the decrease

in The Parkmead Group plc share price between 30 June 2017 and 31

December 2017.

4 Interest bearing loans

During the period, The Parkmead Group plc entered into a credit

facility with Energy Management Associates Limited, whereby

Parkmead agreed to lend up to GBP2,900,000 to Energy Management

Associates Limited. GBP1,700,000 of this credit facility was issued

during the period.

Through this facility, The Parkmead Group plc has been granted

an exclusive option to join Energy Management Associates Limited in

new ventures being evaluated by the company, including interalia

potential opportunities relating to renewable energies.

5 Loss per share

Loss per share attributable to equity holders of the Company

arise as follows:

Twelve

Six months Six months months

to 31 to 31 to 30

December December June

2017 2016 2017

(unaudited) (unaudited)

Loss per 1.5p ordinary share

(pence)

Basic (4.57) (4.56) (4.96)

Diluted (4.57) (4.56) (4.96)

-------------------------------- ------------ ------------ --------

Notes to the Interim financial statements

The calculations were based on the following information:

Twelve

Six months Six months months

to 31 to 31 to 30

December December June

2017 2016 2017

(unaudited) (unaudited)

GBP'000 GBP'000 GBP'000

Loss attributable to ordinary

shareholders (4,518) (4,511) (4,910)

Weighted average number

of shares in issue

Basic weighted average

number of shares 98,929,160 98,929,160 98,929,160

------------------------------- ------------ ------------ -----------

Dilutive potential ordinary

shares

Share options - - -

------------------------------- ------------ ------------ -----------

Profit/(loss) per share is calculated by dividing the profit or

loss for the period by the weighted average number of ordinary

shares outstanding during the period.

Diluted loss per share

Loss per share requires presentation of diluted loss per share

when a company could be called upon to issue shares that would

decrease net profit or increase net loss per share. When the Group

makes a loss the outstanding share options are therefore

anti-dilutive and so are not included in dilutive potential

ordinary shares.

6 Notes to the statement of cashflows

Reconciliation of operating loss to net cash flow from

operations

Twelve

Six months Six months months

to 31 to 31 to 30

December December June

2017 2016 2017

(unaudited) (unaudited)

GBP'000 GBP'000 GBP'000

Operating loss (3,748) (4,148) (3,835)

Depreciation 364 388 667

Amortisation and exploration

write-off 4,508 2,409 2,424

Provision for share based

payments (333) 1,679 43

Currency translation adjustments (65) (119) (179)

(Increase)/decrease in

receivables (241) (568) 548

Increase/(decrease) in

payables 592 (194) (132)

Increase/(decrease) in

other provisions - (147) -

---------------------------------- ------------ ------------ --------

Net cash flow from operations 1,077 (700) (464)

---------------------------------- ------------ ------------ --------

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR EKLBLVXFZBBX

(END) Dow Jones Newswires

March 29, 2018 02:01 ET (06:01 GMT)

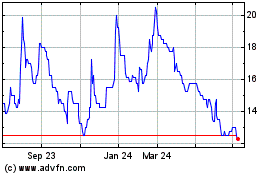

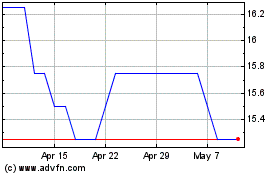

Parkmead (LSE:PMG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Parkmead (LSE:PMG)

Historical Stock Chart

From Apr 2023 to Apr 2024