P.A.M. Transportation Services, Inc. Announces Results for the Second Quarter Ended June 30, 2010

July 27 2010 - 12:00PM

P.A.M. Transportation Services, Inc. (Nasdaq:PTSI) today reported

net income of $1,261,577 or diluted and basic earnings per share of

$0.13 for the quarter ended June 30, 2010, and net income of

$946,134 or diluted and basic earnings per share of $0.10 for the

six month period then ended. These results compare to a net loss of

$2,356,317 or diluted and basic loss per share of $0.25, and net

loss of $5,702,244 or diluted and basic loss per share of $0.61,

respectively, for the three and six months ended June 30, 2009.

Operating revenues, including revenue from fuel surcharges, were

$85,237,911 for the second quarter of 2010, a 24.5% increase

compared to $68,476,476 for the second quarter of 2009. Operating

revenues, including fuel surcharges, were $167,084,734 for the six

months ended June 30, 2010, a 24.4% increase compared to

$134,294,511 for the six months ended June 30, 2009.

Daniel H. Cushman, President of the Company, commented, "We were

very pleased with our operating results for the quarter, which were

not only favorable for obvious financial reasons, but also to

reinforce to everyone in our organization that our focused efforts

yielded the desired results. Our operating income for the quarter

was $2.3 million versus an operating loss of $3.6 million for the

second quarter of 2009, which is a $5.9 million improvement quarter

over quarter. Year to date operating income improved $9.5 million,

from an operating loss of $7.2 million as of June 30, 2009 to

operating income of $2.3 million as of June 20, 2010. To our

shareholders, this improvement translates to a $0.38 improvement in

quarterly earnings per share from a $0.25 loss to a $0.13 gain, and

a $0.71 improvement in year over year earnings per share from a

$0.61 net loss per share as of June 30, 2009 to $0.10 earnings per

share as of June 30, 2010. To our employees this means the removal

of the five percent pay reduction that was implemented last

year.

"Improvements in several of our key performance indicators

contributed to our improved results. Equipment utilization improved

14.5%, from 392 miles per truck per day in the second quarter 2009

to 449 miles per truck per day for the second quarter 2010. We

were able to reduce the percentage of empty miles by 30.8% from

8.5% for the second quarter of 2009 to 5.9% for the second quarter

of 2010. Our rate per mile was $1.23 for the second quarter 2010

compared to $1.24 for the second quarter 2009, which by itself

appears to be a negative trend. However, this is actually a

positive when the quarter over quarter reduction in our dependence

on brokerage freight from 8.4% for the second quarter 2009 compared

to 1.7% for the second quarter 2010 is considered. The reason this

is important is because the majority of brokerage freight is hauled

for a flat fee which includes fuel surcharge, making the rate per

mile appear more favorable. Non-brokerage freight includes both a

rate component that is included in our rate per mile calculation

and a fuel surcharge which is not included in our rate per mile.

Therefore, the fact that our rate per mile went down $0.01 while

reducing our brokerage freight by 79.8% was a noteworthy factor in

our improved operating results. We believe this trend will continue

into the second half of the year.

"We are seeing a continued trend towards shipping capacity

shortages in the marketplace. There are several ways to approach a

market that has turned favorable to carriers after a long period of

being at a dramatic disadvantage due to overcapacity. We have

chosen an approach of 'rate corrections' as opposed to 'rate

increases'. Our rate corrections are based on supportable facts

that we can sit down with our customers and discuss. This

information has become available through our continued investment

in a yield management team and tools that allow us to determine the

right freight at the right price going to the right place. We have

found both our existing customers and our new customers to be

supportive of this approach in a market place proliferated with

carriers aggressively seeking rate increases based on the maximum

amounts that various markets will tolerate. We see our approach as

a sustainable opportunity to gain market share through growth in

business with existing customers and gaining business with new

customers as others impose aggressive rate increases on the

marketplace. Results of these efforts are highlighted by the fact

that 20% of customers in our top one hundred customer list were

added in the last 12 months.

"We are very pleased by our return to profitability for each

month of the second quarter and thank our customers for their

support and our employees for their hard work and dedication in

positioning PAM Transport for success."

P.A.M. Transportation Services, Inc. is a leading truckload dry

van carrier transporting general commodities throughout the

continental United States, as well as in the Canadian provinces of

Ontario and Quebec. The Company also provides transportation

services in Mexico through its gateways in Laredo and El Paso,

Texas under agreements with Mexican carriers.

The PAM Transportation Services, Inc. logo is available at

http://www.globenewswire.com/newsroom/prs/?pkgid=5148

Certain information included in this document contains or may

contain "forward-looking statements" within the meaning of the

Private Securities Litigation Reform Act of 1995. Such

forward-looking statements may relate to expected future financial

and operating results or events, and are thus prospective. Such

forward-looking statements are subject to risks, uncertainties and

other factors which could cause actual results to differ materially

from future results expressed or implied by such forward-looking

statements. Potential risks and uncertainties include, but are not

limited to, excess capacity in the trucking industry; surplus

inventories; recessionary economic cycles and downturns in

customers' business cycles; increases or rapid fluctuations in fuel

prices, interest rates, fuel taxes, tolls, license and registration

fees; the resale value of the Company's used equipment and the

price of new equipment; increases in compensation for and

difficulty in attracting and retaining qualified drivers and

owner-operators; increases in insurance premiums and deductible

amounts relating to accident, cargo, workers' compensation, health,

and other claims; unanticipated increases in the number or amount

of claims for which the Company is self insured; inability of the

Company to continue to secure acceptable financing arrangements;

seasonal factors such as harsh weather conditions that increase

operating costs; competition from trucking, rail, and intermodal

competitors including reductions in rates resulting from

competitive bidding; the ability to identify acceptable acquisition

candidates, consummate acquisitions, and integrate acquired

operations; a significant reduction in or termination of the

Company's trucking service by a key customer; and other factors,

including risk factors, included from time to time in filings made

by the Company with the Securities and Exchange Commission. The

Company undertakes no obligation to update or clarify

forward-looking statements, whether as a result of new information,

future events or otherwise.

| P.A.M. Transportation Services,

Inc. and Subsidiaries |

|

|

|

|

| Key Financial and Operating Statistics |

|

|

|

|

| (unaudited) |

|

|

|

|

| |

Quarter ended June 30, |

Six Months Ended June 30, |

| |

2010 |

2009 |

2010 |

2009 |

| |

|

|

|

|

| Revenue, before fuel surcharge |

$71,939,526 |

$62,367,050 |

$142,298,461 |

$122,636,632 |

| Fuel surcharge |

13,298,385 |

6,109,426 |

24,786,273 |

11,657,879 |

| |

85,237,911 |

68,476,476 |

167,084,734 |

134,294,511 |

| Operating expenses and costs: |

|

|

|

|

| Salaries, wages and benefits |

26,974,312 |

24,011,960 |

53,970,159 |

48,085,009 |

| Fuel expense |

24,692,341 |

16,560,352 |

48,991,723 |

31,483,186 |

| Operating supplies and expenses |

7,126,732 |

6,823,616 |

14,090,177 |

13,225,772 |

| Rent and purchased transportation |

11,285,405 |

9,544,575 |

22,322,386 |

18,620,406 |

| Depreciation |

6,505,440 |

8,569,755 |

13,041,467 |

17,380,058 |

| Operating taxes and licenses |

1,272,680 |

1,402,107 |

2,321,046 |

2,695,966 |

| Insurance and claims |

3,194,700 |

3,130,613 |

6,433,267 |

6,172,820 |

| Communications and utilities |

664,353 |

637,662 |

1,369,689 |

1,335,800 |

| Other |

1,229,576 |

1,291,954 |

2,283,851 |

2,449,538 |

| (Gain) loss on disposition of

equipment |

(27,704) |

67,501 |

(29,383) |

24,252 |

| Total operating expenses and costs |

82,917,835 |

72,040,095 |

164,794,382 |

141,472,807 |

| |

|

|

|

|

| Operating income (loss) |

2,320,076 |

(3,563,619) |

2,290,352 |

(7,178,296) |

| |

|

|

|

|

| Interest expense |

(606,441) |

(629,268) |

(1,106,921) |

(1,292,923) |

| Non-operating income (expense) |

378,890 |

199,880 |

387,959 |

(666,993) |

| |

|

|

|

|

| Income (loss) before income taxes |

2,092,525 |

(3,993,007) |

1,571,390 |

(9,138,212) |

| Income tax expense (benefit) |

830,948 |

(1,636,690) |

625,256 |

(3,435,968) |

| |

|

|

|

|

| Net income (loss) |

$1,261,577 |

$(2,356,317) |

$946,134 |

$(5,702,244) |

| |

|

|

|

|

| Diluted earnings (loss) per share |

$0.13 |

$(0.25) |

$0.10 |

$(0.61) |

| |

|

|

|

|

| Average shares outstanding – Diluted |

9,420,600 |

9,412,292 |

9,419,134 |

9,412,356 |

| |

|

|

|

|

| |

Quarter ended June 30, |

Six Months Ended June 30, |

| Truckload Operations |

2010 |

2009 |

2010 |

2009 |

| |

|

|

|

|

| Total miles |

49,472,218 |

42,912,482 |

98,177,299 |

83,490,826 |

| Operating ratio* |

96.38% |

107.12% |

98.42% |

107.35% |

| Empty miles factor |

5.89% |

8.51% |

6.16% |

8.32% |

| Revenue per total mile, before fuel

surcharge |

$1.23 |

$1.24 |

$1.23 |

$1.26 |

| Total loads |

73,817 |

68,621 |

146,201 |

133,567 |

| Revenue per truck per work day |

$552 |

$486 |

$550 |

$474 |

| Revenue per truck per week |

$2,760 |

$2,430 |

$2,735 |

$2,370 |

| Average company trucks |

1,723 |

1,679 |

1,712 |

1,711 |

| Average owner operator trucks |

27 |

33 |

30 |

33 |

| |

|

|

|

|

| Logistics Operations |

|

|

|

|

| Total revenue |

$11,127,754 |

$9,112,546 |

$21,505,876 |

$17,732,534 |

| Operating ratio |

98.90% |

97.48% |

98.22% |

96.91% |

| |

|

|

|

|

| * Operating ratio has been

calculated based upon total operating expenses, net of fuel

surcharge, as a percentage of revenue, before fuel surcharge. We

used revenue, before fuel surcharge, and operating expenses, net of

fuel surcharge, because we believe that eliminating this sometimes

volatile source of revenue affords a more consistent basis for

comparing our results of operations from period to period. |

CONTACT: P.A.M. Transportation Services, Inc.

Larry J. Goddard

(479) 361-9111

P.O. BOX 188

Tontitown, AR 72770

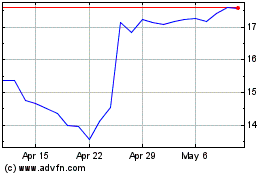

P A M Transport Services (NASDAQ:PTSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

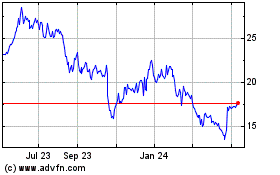

P A M Transport Services (NASDAQ:PTSI)

Historical Stock Chart

From Apr 2023 to Apr 2024