- Group sales revenue up 13.8%; order

intake up 14.5%; earnings margin1) 28.1%

- Dynamic development across all

product categories and geographies

- Management specifies 2018 sales

guidance at upper range of bandwidth

Regulatory News:

With double-digit increases in sales revenue and earnings,

Sartorius Stedim Biotech (SSB) (Paris:DIM), a leading partner

of the biopharma industry, continues on the growth track.

“Momentum developed very strongly in the course of this year,

even if we adjust for relative moderate comparables particularly in

the third quarter of 2017. We grew dynamically across all product

categories and geographies and increased our profitability

significantly. Conditions in the biopharma market continue to be

healthy and demand for our products remains high. Backed by a

strong order intake, we see us well on track to deliver on our

ambitious 2018 targets,” said Dr. Joachim Kreuzburg, Chairman of

the Board and CEO.

Business development of the Group

In the first nine months of 2018, Sartorius Stedim Biotech

increased its sales revenue in constant currencies by 13.8% to

896.1 million euros (reported +11.4%). Growth was driven both by

strong demand for equipment and single-use products. Almost all of

the increase in sales revenue was achieved organically, whereas the

acquisition of the software company Umetrics contributed around 0.5

percentage points of non-organic growth. Order intake also rose

significantly by 14.5% in constant currencies to 955.6 million

euros (reported +12.0%).

In view of the regions, the Americas led growth, reporting a

gain of 20.3% to 315.8 million euros relative to a moderate

previous-year base (reported +15.9%). Compared to high growth in

the year-earlier period, sales revenue in Asia|Pacific also showed

positive development, increasing by 11.9% to 203.8 million euros.

The EMEA2) region recorded a solid gain of 9.8% to 376.5 million

euros (reported +9.4%). (All regional growth in constant

currencies.)

In the first nine months of 2018, Sartorius Stedim Biotech

increased its underlying EBITDA1) overproportionately relative to

sales, by 17.2% to 251.4 million euros. Driven by economies of

scale and positive product mix effects, the Group's respective

margin improved significantly year over year from 26.7% to 28.1%.

Relevant net profit3) for the Group grew even more strongly by

22.9% from 130.8 million euros to 160.7 million euros thus earnings

per share were 1.74 euros (9M 2017: 1.42 euros).

The Group's key financial indicators remained at very robust

levels. At the end of the reporting period, the ratio of net debt

to underlying EBITDA stood at 0.4, and company's equity ratio was

61.6% (Dec. 31, 2017: 0.4 and 62.6%, resp.). The CAPEX ratio in the

first nine months of 2018 was 13.9%, in-line with expectations (9M

2017: 11.3%). Investment activities focused on the expansion of the

plant for manufacturing single-use bags and filters in Puerto Rico,

IT and digitalization projects, and on the consolidation and

expansion of sites and production capacity levels in G�ttingen,

Germany.

2018 guidance confirmed and specified

In view of positive business development in the first nine

months of 2018, management specified its full-year guidance as

follows: Sales revenue growth is now projected to be in the upper

range of the previously targeted bandwidth of 11% to 14% while the

underlying EBITDA margin continues to be expected at around 28.0%,

up from the prior-year figure of 27.3.

All forecasts are based on constant currencies. As a result of

changes in the currency exchange rates, reported figures in actual

currencies may differ from constant currency guidance.

1) Sartorius uses underlying EBITDA (earnings before interest,

taxes, depreciation and amortization and adjusted for extraordinary

items) as the key profitability indicator

2) EMEA = Europe | Middle East | Africa

3) After non-controlling interest, adjusted for extraordinary

items and non-cash amortization, as well as based on the normalized

financial result and corresponding tax effects

This press release contains statements about the future

development of the Sartorius Stedim Biotech Group. We cannot

guarantee that the content of these statements will actually apply

because these statements are based upon assumptions and estimates

that harbor certain risks and uncertainties.

Conference call

Joachim Kreuzburg, Chairman of the Board and CEO of the

Sartorius Stedim Biotech Group, will discuss the company’s results

with analysts and investors on Tuesday, October 23, 2018, at 3:00

p.m. Central European Time (CEST), in a teleconference. You may

register for the teleconference at:

http://services.choruscall.de/DiamondPassRegistration/register?confirmationNumber=6785779&linkSecurityString=2c6a4a5c7

Alternatively, you can dial into the teleconference, without

registering, at:

+49 (0) 69 566 03 6000

To view the presentation, log onto:

https://www.sartorius.com/en/company/investor-relations/sartorius-stedim-biotech-sa-investor-relations

Current image files

https://www.sartorius.com/en/company/newsroom/downloads-publications

Upcoming financial dates

January 29, 2019 Publication of preliminary figures for 2018

A profile of Sartorius Stedim Biotech

Sartorius Stedim Biotech is a leading international partner of

the biopharmaceutical industry. As a total solutions provider, the

company helps its customers to manufacture biotech medications

safely, rapidly and economically. Headquartered in Aubagne, France,

Sartorius Stedim Biotech is quoted on the Eurolist of Euronext

Paris. With its own manufacturing and R&D sites in Europe,

North America and Asia and an international network of sales

companies, Sartorius Stedim Biotech has a global reach. The Group

has been annually growing by double digits on average and has been

regularly expanding its portfolio by acquisitions of complementary

technologies. In 2017, Sartorius Stedim Biotech employed approx.

5,100 people and earned sales revenue of €1,081.0 million.

Key Performance Indicators for the Nine-Month Period of

2018

€ in millions unless

otherwise specified

9 months2018

9 months1)2017

∆ in %Reported

∆ in %cc2)

Sales revenue 896.1 804.7 +11.4 +13.8

EMEA3) 376.5 344.2 +9.4 +9.8 Americas3)

315.8 272.6 +15.9 +20.3 Asia |

Pacific3) 203.8 187.9 +8.4 +11.9 Order

intake 955.6 853.0 +12.0 +14.5 EBITDA4)

251.4 214.5 +17.2 EBITDA

margin4) in % 28.1 26.7 +1.4pp

Net profit5) 160.7 130.8 +22.9

Earnings per share5) in € 1.74 1.42 +22.9

1) Data slightly adjusted due to finalization of purchase price

allocation of the acquisition of Umetrics (now Sartorius Stedim

Data Analytics AB)

2) In constant currencies

3) According to customers’ location

4) Underlying EBITDA = earnings before interest, taxes,

depreciation and amortization, and adjusted for extraordinary

items

5) Underlying net profit = net profit after non-controlling

interest; adjusted for extraordinary items and non-cash

amortization, as well as based on a normalized financial result and

tax rate

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181022005744/en/

Sartorius Stedim BiotechPetra KirchhoffHead of Corporate

Communications+49

(0)551.308.1686petra.kirchhoff@sartorius.comwww.sartorius-stedim.com

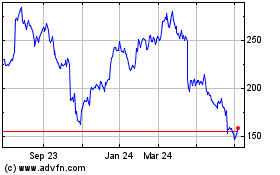

Sartorius Stedim Biotech (EU:DIM)

Historical Stock Chart

From Mar 2024 to Apr 2024

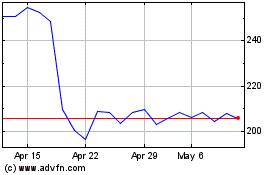

Sartorius Stedim Biotech (EU:DIM)

Historical Stock Chart

From Apr 2023 to Apr 2024