FISCAL 2018 FIRST QUARTER KEY FINANCIAL

HIGHLIGHTS

- Revenues of $2.06 billion, a 5%

increase compared to $1.97 billion in the prior year

- Net income was $87 million compared

to nil in the prior year

- Total Segment EBITDA was $249

million compared to $130 million in the prior year

- Reported revenue and Segment EBITDA

growth in every segment

- Reported EPS were $0.12 compared to

($0.03) in the prior year – Adjusted EPS were $0.07 compared to

($0.01) in the prior year

- Digital revenues represented 27% of

News and Information Services segment revenues, compared to 24% in

the prior year

News Corporation (“News Corp” or the “Company”) (NASDAQ:NWS)

(NASDAQ:NWSA) (ASX:NWS) (ASX:NWSLV) today reported financial

results for the three months ended September 30, 2017.

Commenting on the results, Chief Executive Robert Thomson

said:

“In the first quarter, revenues and Segment EBITDA increased

across every segment of our business, in particular, in digital

real estate services, which have become core to our character and

are on track for significant growth in coming quarters. Total

reported revenues this quarter increased 5% to $2.1 billion, net

income increased to $87 million and Total Segment EBITDA rose 92%

to $249 million. Excluding one-time items and foreign currency

impacts, our underlying Total Adjusted Segment EBITDA grew 46%.

We have reason for optimism about the future of our premium

media businesses, in light of the profound changes agreed by Google

in the ranking of news content. These changes follow almost a

decade of campaigning by News Corp, which led the world in

understanding the threat to and the opportunities for quality

journalism in the digital age. We are continuing our discussions

with both Google and Facebook about further facilitating

subscriptions and the sharing of permissioned personal data. And we

look forward to serving our advertisers with data that is reliable,

not risible.

In August, we and Telstra announced a non-binding agreement to

combine Foxtel and FOX SPORTS Australia, with News Corp owning 65%

of the new company. Pending definitive documentation and regulatory

approval, we expect to close in the first half of calendar year

2018. The combined company, with majority control by News Corp, is

expected to fundamentally transform our revenue and EBITDA profile,

and increase the relative share of digital subscription

businesses.”

FIRST QUARTER RESULTS

The Company reported fiscal 2018 first quarter total revenues of

$2.06 billion, a 5% increase compared to $1.97 billion in the prior

year period, reflecting continued growth in the Digital Real Estate

Services segment, the acquisitions of Australian Regional Media

(“ARM”) and Wireless Group plc (“Wireless Group”) and a $26 million

positive impact from foreign currency fluctuations. Growth was

partially offset by lower print advertising revenues at the News

and Information Services segment. Adjusted Revenues (which exclude

the foreign currency impact, acquisitions and divestitures as

defined in Note 1) increased 1%.

Net income for the quarter was $87 million as compared to nil in

the prior year. The increase was primarily driven by higher Total

Segment EBITDA, as discussed below, and lower depreciation and

amortization expense, partially offset by higher income tax expense

associated with higher pre-tax income.

The Company reported first quarter Total Segment EBITDA of $249

million, a 92% increase compared to $130 million in the prior year.

The increase was primarily due to strong performances across all

segments as well as a one-time $46 million benefit from the

reversal of certain previously accrued net liabilities related to

certain employment taxes in the U.K. Operational improvement was

driven by the continued growth in the Digital Real Estate Services

segment, as well as lower costs at the News and Information

Services segment and at FOX SPORTS Australia. Adjusted Total

Segment EBITDA (as defined in Note 1) increased 46%.

Income (loss) per share available to News Corporation

stockholders was $0.12 as compared to ($0.03) in the prior

year.

Adjusted EPS (as defined in Note 3) were $0.07 compared to

($0.01) in the prior year.

SEGMENT REVIEW

For the three months ended September

30, 2017 2016 % Change (in millions) Better/

(Worse)

Revenues: News and Information Services $ 1,241 $

1,222 2 % Book Publishing 401 389 3 % Digital Real Estate Services

271 226 20 % Cable Network Programming 145 128 13 % Other -

- **

Total Revenues $ 2,058 $ 1,965

5 %

Segment EBITDA: News and Information

Services(a) $ 73 $ 46 59 % Book Publishing 50 48 4 % Digital Real

Estate Services 95 67 42 % Cable Network Programming 27 14 93 %

Other(b) 4 (45 ) **

Total Segment

EBITDA $ 249 $ 130 92 % ** - Not meaningful (a)

News and Information Services Segment EBITDA for the three

months ended September 30, 2016 included transaction related costs

of $5 million associated with the acquisition of Wireless Group.

(b) Other Segment EBITDA for the three months ended September 30,

2017 includes a $46 million benefit from the reversal of certain

previously accrued net liabilities for the U.K. Newspaper Matters

as a result of an agreement reached with the relevant tax authority

related to certain employment taxes. Other Segment EBITDA for the

three months ended September 30, 2017 and 2016 included $3 million

and $2 million, respectively, of fees and costs, net of

indemnification, related to the U.K. Newspaper Matters.

News and Information Services

Revenues in the quarter increased $19 million, or 2%, compared

to the prior year. Within the segment, News Corp Australia and Dow

Jones revenues grew 4% and 2%, respectively, while revenues at News

UK and News America Marketing declined 6% and 4%, respectively.

Adjusted Revenues were 3% lower compared to the prior year.

Advertising revenues were flat compared to the prior year as the

growth driven by $23 million from the acquisition of Wireless

Group, $21 million from the acquisition of ARM, the positive impact

from foreign currency fluctuations and a modest increase in digital

advertising revenue was offset by the weakness in the print

advertising market and lower free standing insert revenues at News

America Marketing.

Circulation and subscription revenues increased 3%, primarily

due to healthy contribution from Dow Jones, which saw an 11%

increase in its circulation revenues and growth in its professional

information business, and higher subscription pricing and selected

cover price increases at News Corp Australia and News UK, partially

offset by lower print volume.

Segment EBITDA increased $27 million in the quarter, or 59%, as

compared to the prior year. The increase was due to revenue growth

and lower expenses at Dow Jones, lower investment spending at

Checkout 51, the absence of transaction costs associated with the

acquisition of Wireless Group, as well as lower expenses due to

ongoing cost efficiencies. Adjusted Segment EBITDA (as defined in

Note 1) increased 33%.

Digital revenues represented 27% of segment revenues in the

quarter, compared to 24% in the prior year; for the quarter,

digital revenues for Dow Jones and the newspaper mastheads

represented 31% of their revenues. Digital subscribers and users

across key properties within the News and Information Services

segment are summarized below:

- The Wall Street Journal average daily

digital subscribers in the three months ended September 30, 2017

were 1,318,000, compared to 967,000 in the prior year (Source:

Internal data)

- Closing digital subscribers at News

Corp Australia’s mastheads as of September 30, 2017 were 375,400

(including ARM), compared to 283,100 in the prior year (Source:

Internal data; adjusted for divested mastheads)

- The Times and Sunday Times closing

digital subscribers as of September 30, 2017 were 212,000, compared

to 181,000 in the prior year (Source: Internal data)

- The Sun’s digital offering reached

approximately 84 million global monthly unique users in September

2017, compared to 46 million in the prior year, based on ABCe

(Source: Omniture)

Book Publishing

Revenues in the quarter increased $12 million, or 3%, compared

to the prior year, primarily due to the continued popularity of

Hillbilly Elegy by J.D. Vance and The Subtle Art of Not Giving a

F*ck by Mark Manson, as well as the success of frontlist titles

such as Daniel Silva’s House of Spies and Karin Slaughter’s The

Good Daughter. Digital sales increased 6% compared to the prior

year and represented 21% of Consumer revenues for the quarter,

driven by growth in downloadable audio book sales. Segment EBITDA

for the quarter increased $2 million, or 4%, from the prior year

due to the higher revenues discussed above.

Digital Real Estate Services

Revenues in the quarter increased $45 million, or 20%, compared

to the prior year, primarily due to the continued growth at REA

Group and Move. Segment EBITDA in the quarter increased $28

million, or 42%, compared to the prior year, primarily due to the

higher revenues discussed above. Adjusted Revenues and Adjusted

Segment EBITDA increased 19% and 38%, respectively.

In the quarter, revenues at REA Group increased 22% to $158

million from $129 million in the prior year due to an increase in

Australian residential depth revenue, driven by favorable product

mix and pricing increases, the acquisition of Smartline and the

positive impact from foreign currency fluctuations. The growth was

partially offset by the sale of its European business in fiscal

2017.

Move’s revenues in the quarter increased 15% to $107 million

from $93 million in the prior year, primarily due to the continued

growth in its ConnectionsSM for Buyers product. The growth was

partially offset by the $3 million decline in revenue associated

with the sale of TigerLead®. Based on Move’s internal data, average

monthly unique users of realtor.com®’s web and mobile sites for the

fiscal first quarter grew year-over-year to more than 55 million,

with mobile representing more than half of all unique users.

Cable Network Programming

Revenues in the quarter increased $17 million, or 13%, compared

to the prior year due to the acquisition of Australian News Channel

Pty Ltd (“ANC”), operator of Australia’s SKY NEWS network, higher

affiliate revenues at FOX SPORTS Australia and favorable foreign

currency fluctuations, partially offset by lower advertising

revenues. Segment EBITDA in the quarter increased $13 million, or

93%, compared with the prior year, primarily due to the timing of

programming amortization related to the launch of a dedicated

National Rugby League channel, combined with lower other sports

programming rights costs. Adjusted Revenues and Adjusted Segment

EBITDA, which exclude the impact from favorable foreign currency

fluctuations and the ANC acquisition as described in Note 1,

increased 2% and 107%, respectively.

REVIEW OF EQUITY LOSSES OF AFFILIATES’ RESULTS

Equity losses of affiliates for the first quarter were $10

million compared to $15 million in the prior year.

For the three months ended September 30, 2017

2016 (in millions) Foxtel(a) $ (5 ) $ (11 ) Other

equity affiliates, net(b) (5 ) (4 ) Total equity

losses of affiliates $ (10 ) $ (15 ) (a) The Company

amortized $17 million and $19 million related to excess cost over

the Company’s proportionate share of its investment’s underlying

net assets allocated to finite-lived intangible assets during the

three months ended September 30, 2017 and 2016, respectively. Such

amortization is reflected in Equity losses of affiliates in the

Statements of Operations. (b) Other equity affiliates, net for the

three months ended September 30, 2017 primarily includes losses

from the Company’s interest in Elara Technologies, which owns

PropTiger.

On a U.S. GAAP basis, Foxtel revenues for the first quarter

increased $15 million, or 2%, to $633 million from $618 million in

the prior year period. In local currency, Foxtel revenues decreased

2% due to lower subscription revenues, partially offset by higher

pay-per-view revenue. Foxtel’s total closing subscribers were more

than 2.8 million as of September 30, 2017, which was lower than the

prior year, primarily due to the shutdown of Presto and the winding

down of Telstra’s T-box. Total subscribers improved compared to the

prior quarter due to the launch of Foxtel Now. In the first

quarter, cable and satellite churn was 12.7% compared to 15.5% in

the prior year. Broadcast residential ARPU for the first quarter

was A$86, a 2% decline compared to the prior year.

Foxtel’s net income of $24 million increased from $16 million in

the prior year period, primarily due to the absence of losses

associated with Foxtel management’s decision to cease Presto

operations in January 2017 and lower non-programming expenses,

partially offset by planned increases in sports rights costs.

Equity losses of affiliates for Foxtel of $(5) million and $(11)

million for the three months ended September 30, 2017 and 2016,

respectively, reflect the Company's share of Foxtel's net income,

less the Company's amortization of $17 million and $19 million,

respectively, related to the Company's excess cost over its share

of Foxtel's finite-lived intangible assets.

Foxtel EBITDA declined $21 million to $122 million from $143

million in the prior year. In local currency, Foxtel EBITDA

decreased 18% due to planned increases in sports programming costs

of $24 million, primarily related to the Australian Football League

rights, partially offset by lower sales and marketing and

transmission costs. Foxtel operating income declined to $63 million

from $91 million in the prior year, primarily as a result of the

increased programming spend noted above. Operating income includes

depreciation and amortization of $59 million compared to $52

million in the prior year.

CASH FLOW

The following table presents a reconciliation of net cash used

in continuing operating activities to free cash flow available to

News Corporation:

For the three months ended

September 30,

2017 2016 (in millions) Net cash used in continuing

operating activities $ (4 ) $ (268 ) Less: Capital expenditures

(62 ) (49 ) (66 ) (317 ) Less: REA Group free cash

flow (27 ) (28 ) Plus: Cash dividends received from REA Group

33 28 Free cash flow available to News

Corporation $ (60 ) $ (317 )

Net cash used in continuing operating activities improved $264

million for the three months ended September 30, 2017 as compared

to the prior year period, primarily due to the absence of the NAM

Group’s settlement payments of $250 million and higher Total

Segment EBITDA, partially offset by higher working capital.

Free cash flow available to News Corporation in the three months

ended September 30, 2017 was ($60) million compared to ($317)

million in the prior year period. The improvement was primarily due

to the absence of the settlement payments as discussed above,

partially offset by higher capital expenditures.

Free cash flow available to News Corporation is a non-GAAP

financial measure defined as net cash used in continuing operating

activities, less capital expenditures (“free cash flow”), less REA

Group free cash flow, plus cash dividends received from REA Group.

Free cash flow available to News Corporation excludes cash flows

from discontinued operations.

The Company considers free cash flow available to News

Corporation to provide useful information to management and

investors about the amount of cash that is available to be used to

strengthen the Company’s balance sheet and for strategic

opportunities including, among others, investing in the Company’s

business, strategic acquisitions, dividend payouts and repurchasing

stock. A limitation of free cash flow available to News Corporation

is that it does not represent the total increase or decrease in the

cash balance for the period. Management compensates for the

limitation of free cash flow available to News Corporation by also

relying on the net change in cash and cash equivalents as presented

in the Company’s consolidated statements of cash flows prepared in

accordance with GAAP which incorporates all cash movements during

the period.

COMPARISON OF ADJUSTED INFORMATION TO U.S. GAAP

INFORMATION

Adjusted Revenues, Total Segment EBITDA, Adjusted Total Segment

EBITDA, Adjusted Segment EBITDA, adjusted net income available to

News Corporation stockholders, Adjusted EPS and free cash flow

available to News Corporation are non-GAAP financial measures

contained in this earnings release. The Company believes these

measures are important tools for investors and analysts to use in

assessing the Company’s underlying business performance and to

provide for more meaningful comparisons of the Company’s operating

performance between periods. These measures also allow investors

and analysts to view the Company’s business from the same

perspective as Company management. These non-GAAP measures may be

different than similar measures used by other companies and should

be considered in addition to, not as a substitute for, measures of

financial performance calculated in accordance with GAAP.

Reconciliations for the differences between non-GAAP measures used

in this earnings release and comparable financial measures

calculated in accordance with U.S. GAAP are included in Notes 1, 2

and 3 and the reconciliation of net cash used in continuing

operating activities to free cash flow available to News

Corporation is included above.

Conference call

News Corporation’s earnings conference call can be heard live at

5:30pm EST on November 9, 2017. To listen to the call, please visit

http://investors.newscorp.com.

Annual Meeting of Stockholders

News Corporation will provide a live audio webcast of its 2017

Annual Meeting of Stockholders to be held in Los Angeles,

California on November 15, 2017, beginning at 3:00pm PST. The

webcast will be available via

http://newscorp.com/annual-meeting-information. A replay will be

available at the same location for a period of time following the

meeting.

Cautionary Statement Concerning Forward-Looking

Statements

This document contains certain “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995. These statements are based on management’s views and

assumptions regarding future events and business performance as of

the time the statements are made. Actual results may differ

materially from these expectations due to changes in global

economic, business, competitive market and regulatory factors. More

detailed information about these and other factors that could

affect future results is contained in our filings with the

Securities and Exchange Commission. The “forward-looking

statements” included in this document are made only as of the date

of this document and we do not have any obligation to publicly

update any “forward-looking statements” to reflect subsequent

events or circumstances, except as required by law.

About News Corporation

News Corporation (NASDAQ:NWS) (NASDAQ:NWSA) (ASX:NWS)

(ASX:NWSLV) is a global, diversified media and information

services company focused on creating and distributing authoritative

and engaging content to consumers throughout the world. The

company comprises businesses across a range of media, including:

news and information services, book publishing, digital real estate

services, cable network programming in Australia, and pay-TV

distribution in Australia. Headquartered in New York, the

activities of News Corporation are conducted primarily in the

United States, Australia, and the United Kingdom. More information

is available at: www.newscorp.com.

NEWS CORPORATION

CONSOLIDATED STATEMENTS OF

OPERATIONS

(Unaudited; in millions, except per

share amounts)

For the three months ended September

30, 2017 2016 Revenues: Advertising $ 670 $ 670

Circulation and subscription 651 621 Consumer 386 374 Real estate

203 172 Other 148 128 Total

Revenues 2,058 1,965 Operating expenses (1,149 ) (1,157 )

Selling, general and administrative (660 ) (678 ) Depreciation and

amortization (97 ) (120 ) Restructuring charges (15 ) (20 ) Equity

losses of affiliates (10 ) (15 ) Interest, net 6 7 Other, net

8 17 Income (loss) before income tax

(expense) benefit 141 (1 ) Income tax (expense) benefit (54

) 1 Net income 87 - Less: Net income attributable to

noncontrolling interests (19 ) (15 ) Net income

(loss) available to News Corporation stockholders $ 68 $ (15

) Weighted average shares outstanding: Basic 582 581 Diluted

583 581 Net income (loss) available to News Corporation

stockholders per share - basic and diluted $ 0.12 $ (0.03 )

NEWS CORPORATION

CONSOLIDATED BALANCE SHEETS

(in millions)

As of September 30, 2017 As of

June 30, 2017

ASSETS (unaudited) (audited) Current assets:

Cash and cash equivalents $ 1,877 $ 2,016 Receivables, net 1,365

1,276 Other current assets 526 523

Total current assets 3,768 3,815

Non-current assets: Investments 2,044 2,027 Property, plant and

equipment, net 1,636 1,624 Intangible assets, net 2,301 2,281

Goodwill 3,922 3,838 Deferred income tax assets 553 525 Other

non-current assets 438 442 Total assets

$ 14,662 $ 14,552

LIABILITIES AND

EQUITY Current liabilities: Accounts payable $ 235 $ 222

Accrued expenses 1,146 1,204 Deferred revenue 448 426 Other current

liabilities 588 600 Total current

liabilities 2,417 2,452

Non-current liabilities: Borrowings 281 276 Retirement benefit

obligations 313 319 Deferred income tax liabilities 73 61 Other

non-current liabilities 362 351 Commitments and

contingencies Redeemable preferred stock 20 20

Equity: Class A common stock 4 4 Class B common stock 2 2

Additional paid-in capital 12,340 12,395 Accumulated deficit (581 )

(648 ) Accumulated other comprehensive loss (852 )

(964 ) Total News Corporation stockholders' equity 10,913 10,789

Noncontrolling interests 283 284 Total

equity 11,196 11,073 Total liabilities

and equity $ 14,662 $ 14,552

NEWS CORPORATION

CONSOLIDATED STATEMENTS OF CASH

FLOWS

(Unaudited; in millions)

For the three months ended September

30, 2017 2016

Operating activities: Net income $ 87 $

- Less: Income from discontinued operations, net of tax -

- Income from continuing operations 87 -

Adjustments to reconcile income from continuing operations

to cash used in operating activities: Depreciation and amortization

97 120 Equity losses of affiliates 10 15 Other, net (8 ) (17 )

Deferred income taxes and taxes payable 6 (35 ) Changes in

operating assets and liabilities, net of acquisitions: Receivables

and other assets (73 ) (64 ) Inventories, net (16 ) (16 ) Accounts

payable and other liabilities (107 ) (21 ) NAM Group settlement

- (250 ) Net cash used in operating activities from

continuing operations (4 ) (268 ) Net cash used in operating

activities from discontinued operations - (3 )

Net cash used in operating activities (4 ) (271 )

Investing activities: Capital expenditures (62 ) (49

) Changes in restricted cash for Wireless Group acquisition - ) 315

Acquisitions, net of cash acquired (54 ) (283 ) Investments in

equity affiliates and other (12 ) - Proceeds from property, plant

and equipment and other asset dispositions - 24 Other, net 7

(18 ) Net cash used in investing activities from continuing

operations (121 ) (11 ) Net cash used in investing activities from

discontinued operations - - Net cash

used in investing activities (121 ) (11 )

Financing activities: Repayment of borrowings acquired in

the Wireless Group acquisition - (23 ) Dividends paid (21 ) (18 )

Other, net (10 ) (18 ) Net cash used in financing activities

from continuing operations (31 ) (59 ) Net cash used in financing

activities from discontinued operations - -

Net cash used in financing activities (31 )

(59 ) Net decrease in cash and cash equivalents (156 ) (341

) Cash and cash equivalents, beginning of period 2,016 1,832

Exchange movement on opening cash balance 17 8

Cash and cash equivalents, end of period $ 1,877 $

1,499

NOTE 1 – ADJUSTED REVENUES, ADJUSTED TOTAL SEGMENT EBITDA AND

ADJUSTED SEGMENT EBITDA

The Company uses revenues, Total Segment EBITDA and Segment

EBITDA excluding the impact of acquisitions, divestitures, costs

associated with the U.K. Newspaper Matters and foreign currency

fluctuations (“Adjusted Revenues, Adjusted Total Segment EBITDA and

Adjusted Segment EBITDA,” respectively) to evaluate the performance

of the Company’s core business operations exclusive of certain

items that impact the comparability of results from period to

period such as the unpredictability and volatility of currency

fluctuations. The Company calculates the impact of foreign currency

fluctuations for businesses reporting in currencies other than the

U.S. dollar by multiplying the results for each quarter in the

current period by the difference between the average exchange rate

for that quarter and the average exchange rate in effect during the

corresponding quarter of the prior year and totaling the impact for

all quarters in the current period.

The calculation of Adjusted Revenues, Adjusted Total Segment

EBITDA and Adjusted Segment EBITDA may not be comparable to

similarly titled measures reported by other companies, since

companies and investors may differ as to what type of events

warrant adjustment. Adjusted Revenues, Adjusted Total Segment

EBITDA and Adjusted Segment EBITDA are not measures of performance

under generally accepted accounting principles and should not be

construed as substitutes for amounts determined under GAAP as

measures of performance. However, management uses these measures in

comparing the Company’s historical performance and believes that

they provide meaningful and comparable information to investors to

assist in their analysis of our performance relative to prior

periods and our competitors.

The following table reconciles reported revenues and reported

Total Segment EBITDA to Adjusted Revenues and Adjusted Total

Segment EBITDA for the three months ended September 30, 2017 and

2016.

Revenues Total Segment EBITDA For the

three months ended For the three months ended September 30,

September 30, 2017 2016 Difference 2017 2016

Difference (in millions) (in millions)

As

reported $ 2,058 $ 1,965 $ 93 $ 249 $ 130 $ 119 Impact

of acquisitions (76 ) - (76 ) (2 ) 5 (7 ) Impact of

divestitures - (25 ) 25 - - - Impact of foreign currency

fluctuations (26 ) - (26 ) (4 ) - (4 ) Net impact of U.K.

Newspaper Matters - - - (43 ) 2 (45 )

As

adjusted $ 1,956 $ 1,940 $ 16 $ 200

$ 137 $ 63

Adjusted Revenues and Adjusted Segment EBITDA by segment for the

three months ended September 30, 2017 and 2016 are as follows:

For the three months ended September

30, 2017 2016 % Change (in millions)

Better/(Worse)

Adjusted Revenues: News and Information Services $

1,172 $ 1,209 (3

)%

Book Publishing 399 389 3

%

Digital Real Estate Services 255 214 19

%

Cable Network Programming 130 128 2

%

Other - -

**

Total Adjusted Revenues $ 1,956 $ 1,940

1

%

Adjusted Segment EBITDA: News and Information

Services $ 69 $ 52 33

%

Book Publishing 50 48 4

%

Digital Real Estate Services 91 66 38

%

Cable Network Programming 29 14 107

%

Other (39 ) (43 ) 9

%

Total Adjusted Segment EBITDA $ 200 $ 137 46

%

** - Not meaningful

The following tables reconcile reported revenues and Segment

EBITDA by segment to Adjusted Revenues and Adjusted Segment EBITDA

by segment for the three months ended September 30, 2017 and

2016.

For the three months ended September 30, 2017

Impact of Net Impact of Foreign U.K.

Impact of Currency Newspaper As Reported Acquisitions Fluctuations

Matters As Adjusted (in millions)

Revenues: News and

Information Services $ 1,241 $ (55 ) $ (14 ) $ - $ 1,172 Book

Publishing 401 - (2 ) - 399 Digital Real Estate Services 271 (10 )

(6 ) - 255 Cable Network Programming 145 (11 ) (4 ) - 130 Other

- - - - -

Total Revenues $ 2,058 $ (76 ) $ (26 ) $ - $

1,956

Segment EBITDA: News and Information

Services $ 73 $ (3 ) $ (1 ) $ - $ 69 Book Publishing 50 - - - 50

Digital Real Estate Services 95 (1 ) (3 ) - 91 Cable Network

Programming 27 2 - - 29 Other 4 - -

(43 ) (39 )

Total Segment EBITDA $ 249

$ (2 ) $ (4 ) $ (43 ) $ 200 For

the three months ended September 30, 2016 Net

Impact of U.K. Impact of Impact of Newspaper As Reported

Acquisitions Divestitures Matters As Adjusted (in millions)

Revenues: News and Information Services $ 1,222 $ - $ (13 )

$ - $ 1,209 Book Publishing 389 - - - 389 Digital Real Estate

Services 226 - (12 ) - 214 Cable Network Programming 128 - - - 128

Other - - - - -

Total Revenues $ 1,965 $ - $ (25 ) $ - $ 1,940

Segment EBITDA: News and Information Services

$ 46 $ 5 $ 1 $ - $ 52 Book Publishing 48 - - - 48 Digital Real

Estate Services 67 - (1 ) - 66 Cable Network Programming 14 - - -

14 Other (45 ) - - 2 (43

)

Total Segment EBITDA $ 130 $ 5 $ - $ 2 $ 137

NOTE 2 – TOTAL SEGMENT EBITDA

Segment EBITDA is defined as revenues less operating expenses

and selling, general and administrative expenses. Segment EBITDA

does not include: Depreciation and amortization, impairment and

restructuring charges, equity losses of affiliates, interest, net,

other, net, income tax (expense) benefit and net income

attributable to noncontrolling interests. Management believes that

Segment EBITDA is an appropriate measure for evaluating the

operating performance of the Company’s business segments because it

is the primary measure used by the Company’s chief operating

decision maker to evaluate the performance of and allocate

resources within the Company’s businesses. Segment EBITDA provides

management, investors and equity analysts with a measure to analyze

the operating performance of each of the Company’s business

segments and its enterprise value against historical data and

competitors’ data, although historical results may not be

indicative of future results (as operating performance is highly

contingent on many factors, including customer tastes and

preferences).

Total Segment EBITDA is a non-GAAP measure and should be

considered in addition to, not as a substitute for, net income

(loss), cash flow and other measures of financial performance

reported in accordance with GAAP. In addition, this measure does

not reflect cash available to fund requirements and excludes items,

such as depreciation and amortization and impairment and

restructuring charges, which are significant components in

assessing the Company’s financial performance. The Company believes

that the presentation of Total Segment EBITDA provides useful

information regarding the Company’s operations and other factors

that affect the Company’s reported results. Specifically, the

Company believes that by excluding certain one-time or non-cash

items such as impairment and restructuring charges and depreciation

and amortization, as well as potential distortions between periods

caused by factors such as financing and capital structures and

changes in tax positions or regimes, the Company provides users of

its consolidated financial statements with insight into both its

core operations as well as the factors that affect reported results

between periods but which the Company believes are not

representative of its core business. As a result, users of the

Company’s consolidated financial statements are better able to

evaluate changes in the core operating results of the Company

across different periods. The following table reconciles Total

Segment EBITDA to net income (loss).

For the three months ended September 30, 2017

2016 Change % Change (in

millions) Better/(Worse)

Revenues $ 2,058 $ 1,965 $

93 5

%

Operating expenses (1,149 ) (1,157 ) 8 1

%

Selling, general and administrative (660 ) (678 )

18 3

%

Total Segment EBITDA 249 130 119 92

%

Depreciation and amortization (97 ) (120 ) 23 19

%

Restructuring charges (15 ) (20 ) 5 25

%

Equity losses of affiliates (10 ) (15 ) 5 33

%

Interest, net 6 7 (1 ) (14

)%

Other, net 8 17 (9 ) (53

)%

Income (loss) before income tax (expense) benefit 141 (1 ) 142 **

Income tax (expense) benefit (54 ) 1

(55 ) **

Net income $ 87 $ - $ 87 **

** - Not meaningful

NOTE 3 – ADJUSTED NET INCOME (LOSS) AVAILABLE TO NEWS

CORPORATION STOCKHOLDERS AND ADJUSTED EPS

The Company uses net income (loss) available to News Corporation

stockholders and diluted earnings per share (“EPS”) excluding

expenses related to U.K. Newspaper Matters, impairment and

restructuring charges and “Other, net”, net of tax, recognized by

the Company or its equity investees (“adjusted net income (loss)

available to News Corporation stockholders and adjusted EPS,”

respectively), to evaluate the performance of the Company’s

operations exclusive of certain items that impact the comparability

of results from period to period. The calculation of adjusted net

income (loss) available to News Corporation stockholders and

adjusted EPS may not be comparable to similarly titled measures

reported by other companies, since companies and investors may

differ as to what type of events warrant adjustment. Adjusted net

income (loss) available to News Corporation stockholders and

adjusted EPS are not measures of performance under generally

accepted accounting principles and should not be construed as

substitutes for consolidated net income (loss) available to News

Corporation stockholders and net income (loss) per share as

determined under GAAP as a measure of performance.

However, management uses these measures in comparing the

Company’s historical performance and believes that they provide

meaningful and comparable information to investors to assist in

their analysis of our performance relative to prior periods and our

competitors.

The following table reconciles reported net income (loss)

available to News Corporation stockholders and reported diluted EPS

to adjusted net income (loss) available to News Corporation

stockholders and adjusted EPS for the three months ended September

30, 2017 and 2016.

For the three months ended For the three

months ended September 30, 2017 September 30, 2016

Net income

Net income (loss)

available to

EPS

available to

EPS

stockholders

stockholders

(in millions, except per share data)

Net

income $ 87 $ $ - $ Less: Net income attributable to

noncontrolling interests (19 ) (15 )

Income (loss)

available to News Corporation stockholders $ 68 $ 0.12 $ (15 )

$ (0.03 ) U.K. Newspaper Matters (a) (43 )

(0.07 ) 2 - Restructuring charges 15 0.02 20 0.04

Other, net (8 ) (0.01 ) (17 ) (0.03 ) Equity losses of

affiliates (b) - - 11 0.02 Tax impact on items above 9 0.01

(7 ) (0.01 )

As adjusted $ 41 $ 0.07

$ (6 ) $ (0.01 ) (a) The Company recorded a $46

million benefit from the reversal of certain previously accrued net

liabilities for the U.K. Newspaper Matters as a result of an

agreement reached with the relevant tax authority related to

certain employment taxes. (b) Foxtel’s net income in the three

months ended September 30, 2016 included a $21 million loss

resulting from Foxtel management’s decision to cease Presto

operations in January 2017. Equity losses of affiliates were

negatively affected by $11 million, which represents the Company’s

share of that loss.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171109006631/en/

News CorporationMichael Florin, 212-416-3363Investor

Relationsmflorin@newscorp.comorJim Kennedy, 212-416-4064Corporate

Communicationsjkennedy@newscorp.com

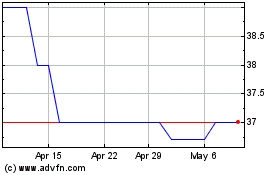

News (ASX:NWSLV)

Historical Stock Chart

From Mar 2024 to Apr 2024

News (ASX:NWSLV)

Historical Stock Chart

From Apr 2023 to Apr 2024