TIDMNRR

RNS Number : 9563U

NewRiver REIT PLC

18 July 2018

NewRiver REIT plc First Quarter Company Update

18 July 2018

Convenience & community focus delivers robust performance

and growing dividend

Allan Lockhart, Chief Executive commented: "This has been an

active period for NewRiver, in which our continued focus on

convenience & community retail and leisure assets,

characterised by frequent spend on everyday essential goods and

services, has enabled us to continue to deliver robust operational

performance despite wider sector headwinds. Our portfolio is

focused on the fastest growing and most sustainable sub-sectors of

the UK retail market, with grocery, convenience stores, value

clothing, health & beauty and discounters forming the core of

our retail portfolio, and a deliberately limited exposure to

department stores of just 0.1% of our total rent roll.

Since the start of this financial year we have invested over

GBP140 million across our core sectors of community shopping

centres, retail parks and community pubs at a blended initial yield

of 13%, demonstrating our disciplined approach to capital

allocation and the diversified nature of our assets. The

integration of Hawthorn Leisure, which we acquired in May 2018, is

progressing well and is on track for completion in early 2019.

Across our portfolio we are progressing a number of

opportunities to unlock further value, having identified the

potential to develop an additional 1,300 residential units across

our retail portfolio and commenced a review of the Hawthorn Leisure

portfolio to identify convenience store development sites. In

addition, we continue to recycle capital profitably, with GBP25

million of disposals completed or under offer, and over GBP30

million in the market. The 3% increase in our first quarter

dividend to 5.4 pence reflects our continued commitment to deliver

growing and sustainable cash returns to shareholders."

Acquisitions completed in core sectors at attractive entry

prices with opportunities for further value creation

-- Hawthorn Leisure acquired in May 2018 for GBP106.8 million,

representing a NIY of 13.6%; acquisition included a portfolio of

298 high quality community pubs and an established pub management

platform which is expected to generate at least GBP3 million of

annualised operating synergies; integration of the business is

progressing well, with a dedicated committee established to involve

all stakeholders in the process; integration completion expected in

Q4 FY19

-- Grays Shopping Centre acquired in June 2018 for GBP20.2

million, representing a NIY of 9.4% on the shopping centre element

and a capital value across the whole site of just GBP40 per sq ft;

well-located with the City of London accessible by train in under

35 minutes; now pursuing opportunities to meet demand for a budget

hotel, budget gym and discount food retailer, and to secure

planning permission to build up to 300 residential units

-- Hollywood Retail & Leisure Park, Barrow-in-Furness,

acquired in July 2018 for GBP15.3 million, representing a NIY of

8.7%; conversion of two existing units to introduce Aldi to the

asset to commence imminently

-- Acquisitions and the strength of our underlying cash flows

supported first quarter ordinary dividend increase of 3% to 5.4

pence (Q1 FY18: 5.25 pence)

Convenience & community focus continues to deliver robust

operating metrics

-- High level of retail occupancy sustained at 96.2% (March

2018: 96.5%); pub occupancy of 99.0% including Hawthorn Leisure

(March 2018: 99.0%); pub portfolio trading performance has

benefitted from World Cup

-- Shopping centre footfall outperformed the UK benchmark by 50

bps, down 2.5% on a like-for-like basis

-- Average retail rent remains affordable and sustainable at

GBP12.35 per sq ft (March 2018: GBP12.36 per sq ft)

-- Over 99% of Q1 rents already collected; retention rate of 94%

based on lease expiries and breaks during Q1

Portfolio contains in-built value creating opportunities

-- 50 leasing events across 160,800 sq ft securing annual rent

of GBP1.4 million; includes the letting of a 12,900 sq ft unit

formerly used for storage at The Broadway Shopping Centre,

Bexleyheath, to low cost gym operator The Gym on a 15 year lease

unlocking GBP162,500 of annualised incremental income; long term

deals on average +2.4% vs March 2018 ERV with an average lease

length of 7.9 years

-- Progress made on strategy to extract value from market

leading asset management platform; selected as asset manager by

local authority shopping centre owner subject to final

agreement

-- During Q1 completed a strategic review of entire portfolio,

identifying the potential to deliver up to 1,300 residential units

adjacent to or above our retail assets over the next 5-10 years, in

addition to the 1,100 units already included within our 1.9 million

sq ft risk-controlled development pipeline; residential opportunity

has potential to deliver up to GBP140 million of development

profit

-- On-site phase of Canvey Island Retail Park development

progressing well, with practical completion scheduled for Q3 FY19;

on completion, activates an annualised rent roll of GBP1 million

and a projected yield on cost of 9%

-- Continued progress with convenience store ('c-store')

development programme for The Co-operative: on-site with three

further c-stores, which on completion would bring our total number

delivered to 23; The Co-operative is currently reviewing sites

across the Hawthorn Leisure portfolio for c-store development

potential

Strong balance sheet underpins growth plans

-- Following acquisition activity, LTV of 35% (based on March

2018 valuations), increased from 28% in March 2018; LTV within

stated guidance of <40%; community pubs now account for 19% of

GBP1.4 billion portfolio following Hawthorn Leisure acquisition

-- Completed GBP2.2 million of profitable capital recycling on

terms 11% ahead of March 2018 valuation with a further GBP22.8

million of disposals under offer and GBP32.2 million in the

market

For further information

NewRiver REIT plc +44 (0)20 3328 5800

Allan Lockhart (Chief Executive)

Mark Davies (Chief Financial Officer)

Will Hobman (Head of Investor

Relations)

+44 (0)20 7251

Finsbury 3801

Gordon Simpson

James Thompson

About NewRiver

NewRiver REIT plc ('NewRiver') is a leading Real Estate

Investment Trust specialising in buying, managing, developing and

recycling convenience-led, community-focused retail and leisure

assets throughout the UK.

Our GBP1.4 billion portfolio covers over 8 million sq ft and

comprises 34 community shopping centres, 21 conveniently located

retail parks and over 600 community pubs. Having hand-picked our

assets since NewRiver was founded in 2009, we have deliberately

focused on the fastest growing and most sustainable sub-sectors of

the UK retail market, with grocery, convenience stores, value

clothing, health & beauty and discounters forming the core of

our retail portfolio. This focus, combined with our affordable

rents and desirable locations, delivers sustainable and growing

returns for our shareholders, while our active approach to asset

management and in-built 1.9 million sq ft development pipeline

provide further opportunities to extract value from our

portfolio.

NewRiver has a Premium Listing on the Main Market of the London

Stock Exchange (ticker: NRR) and is a constituent of the FTSE 250

and EPRA indices. Visit www.nrr.co.uk for further information.

LEI Number: 2138004GX1VAUMH66L31

Forward-looking statements

The information in this announcement may include forward-looking

statements, which are based on current projections about future

events. These forward-looking statements reflect the directors'

beliefs and expectations and are subject to risks, uncertainties

and assumptions about NewRiver REIT plc (the 'Company'), including,

amongst other things, the development of its business, trends in

its operating industry, returns on investment and future capital

expenditure and acquisitions, that could cause actual results and

performance to differ materially from any expected future results

or performance expressed or implied by the forward-looking

statements.

None of the future projections, expectations, estimates or

prospects in this announcement should be taken as forecasts or

promises nor should they be taken as implying any indication,

assurance or guarantee that the assumptions on which such future

projections, expectations, estimates or prospects have been

prepared are correct or exhaustive or, in the case of the

assumptions, fully stated in the document. As a result, you are

cautioned not to place reliance on such forward-looking statements

as a prediction of actual results or otherwise. The information and

opinions contained in this announcement are provided as at the date

of this document and are subject to change without notice. No one

undertakes to update publicly or revise any such forward looking

statements. No statement in this document is or is intended to be a

profit forecast or profit estimate or to imply that the earnings of

the Company for the current or future financial years will

necessarily match or exceed the historical or published earnings of

the Company.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTSFIESWFASEIW

(END) Dow Jones Newswires

July 18, 2018 02:00 ET (06:00 GMT)

Newriver Reit (LSE:NRR)

Historical Stock Chart

From Mar 2024 to Apr 2024

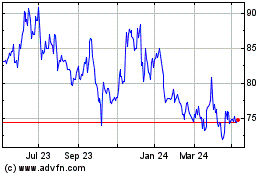

Newriver Reit (LSE:NRR)

Historical Stock Chart

From Apr 2023 to Apr 2024