NewRiver REIT PLC AM Agreement signed with Canterbury City Council (1840B)

September 19 2018 - 2:01AM

UK Regulatory

TIDMNRR

RNS Number : 1840B

NewRiver REIT PLC

19 September 2018

NewRiver REIT plc

("NewRiver" or the "Company")

Asset Management Agreement signed with Canterbury City

Council

NewRiver is pleased to announce that it has signed an Asset

Management Agreement ('AMA') with Canterbury City Council ('the

Council') for the asset management of Whitefriars Shopping

Centre.

This agreement is the first to be signed by NewRiver since it

announced in May 2018 its longer-term strategies to adapt to a

changing retail real estate market, which included using the

Company's market-leading asset management platform to manage

third-party assets. Under the terms of the AMA, NewRiver will

undertake full asset management responsibilities for the shopping

centre in exchange for a management fee calculated as a proportion

of net operational income received and a development fee calculated

on third-party-tendered development costs. The agreement will

initially be for two years, with the option of a roll on for a

further two years subject to the agreement of both parties.

NewRiver will not acquire an equity stake in the asset as part of

the agreement.

Whitefriars Shopping Centre is the dominant regional shopping

centre for East Kent and is located in the heart of Canterbury,

with a catchment of 270,000 people within a 30 minute drive and

annual footfall of 13 million. It has 75 units across 474,000 sq ft

and 530 car parking spaces, and is anchored by Fenwicks, Marks

& Spencer, Next and Primark. The shopping centre has been fully

owned by the Council since February 2018, when it purchased the

remaining 50% of the asset from its 50:50 joint venture with TH

Real Estate for GBP75 million, equating to a net initial yield of

6.5%. The joint venture was formed in 2016, when the Council paid

GBP79 million for its initial 50%, equating to a net initial yield

of 6.0%.

Allan Lockhart, Chief Executive, NewRiver said: "We are

delighted to have signed this Asset Management Agreement with

Canterbury City Council to bring our asset management expertise to

Whitefriars Shopping Centre. NewRiver's selection by the Council in

a competitive tender process demonstrates that our strong

relationships with retailers and track record of successful asset

management makes us the clear choice for third-party retail asset

owners. Against a growing trend of local authorities purchasing

shopping centre assets and taking control of their town centres,

NewRiver is ideally positioned to provide best-in-class asset

management expertise to them, delivering thriving assets for local

communities and sustainable, long-term revenue for our

shareholders."

Colin Carmichael, Chief Executive, Canterbury City Council said:

"Our purchase of Whitefriars Shopping Centre in February 2018 was a

once-in-a-generation opportunity to take control of one our city's

key sites and ensure it works for the benefit of the community. The

Council is very pleased to be partnering with one of the UK's

leading retail asset managers in NewRiver to realise this ambition.

Their passion and expertise give the Council the confidence that

Whitefriars will continue to go from strength to strength."

For further information

+44 (0)20 3328

NewRiver REIT plc 5800

Allan Lockhart (Chief Executive)

Mark Davies (Chief Financial Officer)

Will Hobman (Head of Investor

Relations)

Finsbury +44 (0)20 7251 3801

Gordon Simpson

James Thompson

About NewRiver

NewRiver REIT plc ('NewRiver') is a leading Real Estate

Investment Trust specialising in buying, managing, developing and

recycling convenience-led, community-focused retail and leisure

assets throughout the UK.

Our GBP1.4 billion portfolio covers over 8 million sq ft and

comprises 34 community shopping centres, 21 conveniently located

retail parks and over 600 community pubs. Having hand-picked our

assets since NewRiver was founded in 2009, we have deliberately

focused on the fastest growing and most sustainable sub-sectors of

the UK retail market, with grocery, convenience stores, value

clothing, health & beauty and discounters forming the core of

our retail portfolio. This focus, combined with our affordable

rents and desirable locations, delivers sustainable and growing

returns for our shareholders, while our active approach to asset

management and in-built 1.9 million sq ft development pipeline

provide further opportunities to extract value from our

portfolio.

NewRiver has a Premium Listing on the Main Market of the London

Stock Exchange (ticker: NRR) and is a constituent of the FTSE 250

and EPRA indices. Visit www.nrr.co.uk for further information.

LEI Number: 2138004GX1VAUMH66L31

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

AGRBCGDCLSBBGII

(END) Dow Jones Newswires

September 19, 2018 02:01 ET (06:01 GMT)

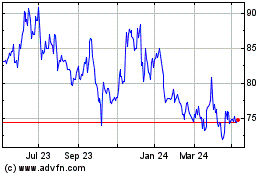

Newriver Reit (LSE:NRR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Newriver Reit (LSE:NRR)

Historical Stock Chart

From Apr 2023 to Apr 2024