Nestlé Sales Growth Weakens to Slowest in Decades -- 2nd Update

February 15 2018 - 5:00AM

Dow Jones News

By Brian Blackstone

ZURICH -- Sluggish U.S. demand limited Nestlé SA's sales growth

to its slowest pace in decades last year, underscoring the

challenge facing the Swiss consumer goods giant as it tries to

reposition itself as a nimble provider of healthy food and

drinks.

Nestlé also said it is considering selling its Gerber Life

Insurance business, continuing a string of changes to its sprawling

portfolio, and said it doesn't plan to raise its stake in cosmetics

giant L'Oréal SA. Nestlé didn't say whether it would consider

reducing its stake.

Nestlé said that organic growth, which strips out the effects of

currency changes, acquisitions and divestments, came in at 2.4% in

2017. That was below last year's pace of 3.2% and the weakest since

at least the mid-1990s when Nestlé started tracking that

indicator.

A worrying sign: sales growth was weak at the end of last year,

a time when the global economy seemed to be perking up. Meanwhile,

U.S. organic revenues fell slightly last year despite low

unemployment and healthy economic growth.

Asked about this disconnect in Nestlé's biggest market, Chief

Executive Mark Schneider said the usual transmission from a strong

U.S. economy to rising consumer spending has been delayed. "When

that updraft sets in, we're really in a good spot," he said.

Brazil was also challenging, Mr. Schneider said, while sales

growth in Europe and Asia "was encouraging."

Nestlé expects overall organic growth between 2% and 4% this

year, and said it was on track to achieve its 2020 operating margin

target.

Its shares were down 2.3% in early European trading.

Total sales were 89.8 billion Swiss francs ($96.9 billion), up

0.4% from 2016 and slightly below analyst forecasts of 90 billion

francs. Its net profit was 7.2 billion francs, down 15.8% from 2016

and well below expectations.

The earnings report may raise pressure on Nestlé from investors

to take more dramatic steps to improve its financial performance.

Activist investor Daniel Loeb's Third Point LLC has been pressing

for bold steps for many months, and while Nestlé has made many

changes, Mr. Loeb has signaled he wants them to go further.

The full-year results were the first for Mr. Schneider, who took

the helm as CEO at the start of last year after running a German

health-care company. Nestlé missed a longstanding target of 5% to

6% organic growth for four-straight years through 2016, and one of

Mr. Schneider's first big moves was to ditch that target one year

ago.

Like other consumer goods companies, Nestlé has struggled with a

mix of weaker growth in the world economy, deflationary pressures

that made it hard to raise prices and aging populations. These have

coincided with changing consumer tastes toward locally grown,

organic food and away from mass-produced prepared meals that have

long been a staple for the maker of Stouffer's frozen dishes and

Lean Cuisine.

Last year was an active one for Mr. Schneider, the first CEO

chosen from outside Nestlé's ranks in nearly a century. Last

summer, facing pressure from Mr. Loeb to improve its financial

performance, Nestlé announced a 20 billion franc share buyback and

said it would orient its capital spending toward high-growth parts

of its business, like pet care and coffee. It also set a formal

profit-margin target.

It also made relatively small-scale U.S. acquisitions in areas

outside its longstanding bread and butter of mass-produced packaged

foods, including plant-based food maker Sweet Earth and a majority

stake in premium coffee chain Blue Bottle.

It expanded its push into consumer health care by acquiring a

Canadian vitamin maker.

Nestlé's highest-profile move has been the sale last month of

its U.S. candy business that includes Butterfinger and Baby Ruth

brands to Italian candy maker Ferrero International SA for $2.8

billion. That division was a drag on U.S. organic sales last year,

Mr. Schneider said.

The life-insurance business that Nestlé is putting up for sale

was part of its acquisition of Gerber from Novartis in 2007, and

the unit generated 2017 sales of 840 million francs. Nestlé said it

was "fully committed" to Gerber's baby-food business.

Although many of these steps mirrored Mr. Loeb's

recommendations, the activist investor has signaled he wants Nestlé

to consider more changes, including selling its skin-health

business and its large stake in cosmetics giant L'Oréal.

Nestlé also said it expects the recently enacted U.S. tax

overhaul to shave about 300 million francs a year from its U.S.

corporate-tax expenses.

--Anthony Shevlin contributed to this article.

Write to Brian Blackstone at brian.blackstone@wsj.com

(END) Dow Jones Newswires

February 15, 2018 04:45 ET (09:45 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

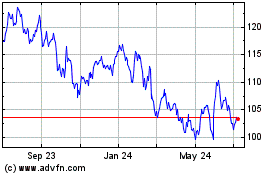

Nestle (PK) (USOTC:NSRGY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nestle (PK) (USOTC:NSRGY)

Historical Stock Chart

From Apr 2023 to Apr 2024