Sales growth slows on slack demand as food maker turns to

healthier fare

By Brian Blackstone and Saabira Chaudhuri

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 16, 2018).

Sluggish U.S. demand held Nestlé SA to its slowest sales growth

in decades last year, underscoring the challenge facing the Swiss

company as it tries to recast itself as a nimble provider of

healthy food and drinks.

The results for 2017, which missed analyst estimates despite a

raft of measures to jump-start growth, ratchet up the pressure on

Chief Executive Mark Schneider. The former health-care executive

has faced calls from activist investor Daniel Loeb to raise

shareholder returns since soon after he took the reins at Nestlé at

the start of last year.

In the U.S., Nestlé's largest market, the Nescafe and Purina

owner has struggled to woo shoppers or raise prices despite an

improving economy.

Since Mr. Loeb took a $3.5 billion stake in the world's biggest

packaged-foods maker, Mr. Schneider has moved to sell Nestlé's U.S.

confectionery business, set a formal margin target and begin

remaking about 10% of its portfolio. The company has made a string

of acquisitions of high-growth businesses, including Blue Bottle

coffee, vitamins maker Atrium Innovations and meal-delivery service

Freshly. It also launched a big share-buyback program.

Despite such efforts, results for 2017 were disappointing.

Organic growth, which strips out the effects of currency changes,

acquisitions and divestments, measured 2.4%. That was below last

year's pace of 3.2% and the weakest since at least the mid-1990s

when Nestlé started tracking that indicator. Analysts had expected

2.6% growth.

Sales were weak at the end of 2017 when the global economy

seemed to be perking up, sparking fears about Nestlé's prospects

for the new year.

Nestlé shares fell 2.1% on Thursday in Switzerland.

"Mark Schneider's efforts to shift the group's focus toward a

better balance between margin expansion and top-line growth are

welcome, yet significant structural headwinds persist," said

Liberum analyst Robert Waldschmidt.

Nestlé's total sales were 89.8 billion Swiss francs ($96.9

billion), up 0.4% from 2016 and roughly in line with analyst

estimates. Net profit was 7.2 billion francs, down nearly 16% and

well below expectations.

The lackluster results could heighten pressure on Nestlé to take

more dramatic steps to improve its financial performance. Mr. Loeb,

who runs the hedge fund Third Point LLC, has called for Nestlé to

sell its 23.29% stake in L'Oréal SA, saying the money could be used

to buy back shares.

On Thursday, Nestlé said it remains committed to L'Oréal

although it won't increase its stake. It is considering selling its

Gerber Life Insurance business, which it inherited as part of its

acquisition of Gerber from Novartis in 2007, The unit had sales of

840 million francs last year.

In an interview, Mr. Schneider said he thinks the various steps

Nestlé is taking to increase sales -- including making careful

acquisitions and restructuring its skin-health business -- will pay

off over time. He said consumer sentiment in the U.S. appears to be

improving and that inflation is picking up, both factors that could

help Nestlé this year.

"I'm very convinced the path we're on is the right one. This is

where today's consumer is going and we are catering to that," said

Mr. Schneider. "We will explain that to our investors including

Third Point."

Like rivals Nestlé has struggled with rising competition from

local upstarts and a rapid shift in consumer tastes toward locally

grown, organic food and away from mass-produced prepared meals that

have long been a staple for the maker of Stouffer's frozen dishes

and Lean Cuisine.

Mr. Schneider aims to move Nestlé's portfolio away from the more

mainstream food and drinks that are facing fierce competition from

private label brands and toward healthy, specialized products for

which people are willing to pay a premium. Nestlé will continue to

make acquisitions but will mainly focus on tweaking existing brands

to make them healthier and more upscale.

"We will not solve the situation simply by drinking the ocean

dry, by buying small to mid-sized companies and enjoying their

growth," Mr. Schneider said. "We would end up with an ungovernable

group of companies and that would be like herding cats."

Nestlé, like some of its consumer-goods peers, has struggled to

charge more for its products, with prices for 2017 edging up just

0.8%. Procter & Gamble Co., Kimberly Clark Corp. and

Colgate-Palmolive have reported weak sales as traditional retailers

like Walmart Inc. push for steep discounts as they compete with

Amazon.com Inc., even as input costs rise. P&G, the maker of

Tide detergent and Pampers diapers, last month said that average

prices on its products fell on a quarterly basis for the first time

since 2011.

Among food companies, Nestlé's pricing was on the low end. "Our

pricing is clearly on the weaker side when compared to other

leading competitors," said Mr. Schneider. "We have some catching up

to do."

Write to Brian Blackstone at brian.blackstone@wsj.com and

Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

February 16, 2018 02:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

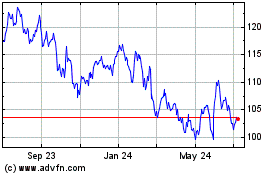

Nestle (PK) (USOTC:NSRGY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nestle (PK) (USOTC:NSRGY)

Historical Stock Chart

From Apr 2023 to Apr 2024