National Express Group PLC Notification of transactions by PDMRs (9732G)

March 07 2018 - 10:30AM

UK Regulatory

TIDMNEX

RNS Number : 9732G

National Express Group PLC

07 March 2018

National Express Group PLC

7 March 2018

NATIONAL EXPRESS GROUP PLC

("Company")

Notification of transactions by Persons Discharging Managerial

Responsibilities ("PDMRs")

The Company provides notification of the following transactions

relating to the two below named PDMRs and their respective

interests in the ordinary shares of nominal value 5p each in the

capital of the Company ("Shares") (ISIN: GB0006215205).

The transactions arise for each of the PDMRs from: (i) the 96.7%

vesting on 5 March 2018 of a three-year performance conditioned

option award over certain Shares - the original award having been

granted to them on 11 June 2015 under the Company's Long-Term

Incentive Plan 2015 ("LTIP"), and (ii) the exercise of their

respective option over vested Shares and the immediate sale of a

sufficient number of such Shares to cover their personal income tax

and social security contributions liability (as applicable) arising

on exercise, with the remainder being retained.

Name and Number Number of Number Total beneficial Total other

position of Shares vested Shares of Shares interest interest

of PDMR vesting acquired sold at held in Shares held in

under option on exercise 390.3431p following Shares following

on of option per share the transactions(3) the transactions

5 March(1) on on 6 March

6 March

----------------- -------------- --------------- ------------- --------------------- ------------------

Dean Finch,

Group Chief

Executive 344,544 344,544 162,261(2) 334,081 1,238,448

----------------- -------------- --------------- ------------- --------------------- ------------------

Matthew

Ashley,

President

and CEO,

North America 138,186 138,186 62,309(2) 187,662 327,380

----------------- -------------- --------------- ------------- --------------------- ------------------

(1) Awards under the LTIP were granted in the form of nil cost

options. Vested Shares are subject to a two-year holding and

exercise period which run concurrently (the latter for tax purposes

only). Malus and clawback apply to the vested Shares for two years

form the date of vesting. Any unexercised vested Shares qualify for

dividend equivalent payments from the Company during the holding

period. Any residual Shares held post exercise of the option must

be retained for the remainder of the holding period. All Shares

delivered were through the transfer of market purchased Shares from

the Company's Employee Benefit Trust.

(2) The Shares sold equate in value to the individual's personal

income tax and social security contributions (as applicable)

liability which arises immediately on exercise of the option.

(3) Including those held by connected persons.

Under the Company's Executive Deferred Bonus Plan and LTIP.

The stretching performance condition targets which attached to

the original awards were set at the time of grant and related to

the three-year financial period ended 31 December 2017. These

targets, and the Company's measured performance against them, are

shown below (and will appear in full in the Company's 2017 Annual

Report) and were used to determine the 96.7% level of vesting of

Shares under option.

Performance Weighting Threshold Actual performance % vesting

Condition performance Maximum

(30% vesting) performance

(100% vesting)

----------------- ---------- --------------- ----------------- ------------------- ----------

TSR vs.FTSE Median ->Upper

250 1/6 Median Upper Quintile Quintile 85.2%

----------------- ---------- --------------- ----------------- ------------------- ----------

TSR vs.Bespoke Equal to >= Index > Index +10%

Index 1/6 Index +10% pa pa 100.0%

----------------- ---------- --------------- ----------------- ------------------- ----------

EPS 1/3 24.8p 28.6p 30.0p 100.0%

----------------- ---------- --------------- ----------------- ------------------- ----------

ROCE 1/3 9% 12% 11.9% 97.5%

----------------- ---------- --------------- ----------------- ------------------- ----------

Total vesting 96.7%

----------------- ---------- --------------- ----------------- ------------------- ----------

The following disclosures are made in accordance with Article 19

of the EU Market Abuse Regulation 596/2014.

1. Details of PDMR

---- ---------------------------------------------------------------------------------

Full Name Dean Finch

---- ------------------------- ------------------------------------------------------

Position / status Group Chief Executive

---- ------------------------- ------------------------------------------------------

Initial notification Initial notification

/ amendment

---- ------------------------- ------------------------------------------------------

2. Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

---- ---------------------------------------------------------------------------------

Name National Express Group PLC

---- --------------------------- ----------------------------------------------------

LEI 213800A8IQEMY8PA5X34

---- --------------------------- ----------------------------------------------------

3. Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of

transaction; (iii) each date; and (iv) each place where

transactions have been conducted

---- ---------------------------------------------------------------------------------

(i) Description of Ordinary shares of nominal value 5p each

the financial GB0006215205

instrument

Identification

code

---- ------------------------- ------------------------------------------------------

Nature of the Acquisition

transaction The exercise, post-performance conditioned

vesting, of a nil cost option to acquire

344,544 shares under the Company's Long-Term

Incentive Plan 2015.

---- ------------------------- ------------------------------------------------------

Price(s) and Price(s) Volume(s)

volume(s) ----------------------- ------------------------

Nil per Ordinary share 344,544 Ordinary shares

----------------------- ------------------------

---- ------------------------- ------------------------------------------------------

Aggregated information

Aggregated volume 344,544 Ordinary shares at Nil per Ordinary

Price share

totalling GBPNil

---- ------------------------- ------------------------------------------------------

Date of the transaction 6 March 2018

---- ------------------------- ------------------------------------------------------

Place of the N/A

transaction

---- ------------------------- ------------------------------------------------------

(ii) Description of Ordinary shares of nominal value 5p each

the financial GB0006215205

instrument

Identification

code

---- ------------------------- ------------------------------------------------------

Nature of the Disposal

transaction The sale of 162,261 shares in the market

to cover income tax and social security

contributions (as applicable) liability

on vesting

---- ------------------------- ------------------------------------------------------

Price(s) and Price(s) Volume(s)

volume(s) ------------------------- ------------------------

GBP3.903431 per Ordinary 162,261 Ordinary shares

share

------------------------- ------------------------

---- ------------------------- ------------------------------------------------------

Aggregated information

Aggregated volume 162,261 Ordinary shares at GBP3.903431

Price per Ordinary share

totalling GBP633,374.62

---- ------------------------- ------------------------------------------------------

Date of the transaction 6 March 2018

---- ------------------------- ------------------------------------------------------

Place of the London Stock Exchange

transaction

---- ------------------------- ------------------------------------------------------

1. Details of PDMR

---- --------------------------------------------------------------------------------

Full Name Matt Ashley

---- ------------------------- -----------------------------------------------------

Position / status President and Chief Executive, North America

---- ------------------------- -----------------------------------------------------

Initial notification Initial notification

/ amendment

---- ------------------------- -----------------------------------------------------

2. Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

---- --------------------------------------------------------------------------------

Name National Express Group PLC

---- --------------------------- ---------------------------------------------------

LEI 213800A8IQEMY8PA5X34

---- --------------------------- ---------------------------------------------------

3. Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of

transaction; (iii) each date; and (iv) each place where

transactions have been conducted

---- --------------------------------------------------------------------------------

(i) Description of Ordinary shares of nominal value 5p each

the financial GB0006215205

instrument

Identification

code

---- ------------------------- -----------------------------------------------------

Nature of the Acquisition

transaction The exercise, post-performance conditioned

vesting, of a nil cost option to acquire

138,186 shares under the Company's Long-Term

Incentive Plan 2015.

---- ------------------------- -----------------------------------------------------

Price(s) and Price(s) Volume(s)

volume(s) ----------------------- ------------------------

Nil per Ordinary share 138,186 Ordinary shares

----------------------- ------------------------

---- ------------------------- -----------------------------------------------------

Aggregated information

Aggregated volume 138,186 Ordinary shares at Nil per Ordinary

Price share totalling GBPNil

---- ------------------------- -----------------------------------------------------

Date of the transaction 6 March 2018

---- ------------------------- -----------------------------------------------------

Place of the N/A

transaction

---- ------------------------- -----------------------------------------------------

(ii) Description of Ordinary shares of nominal value 5p each

the financial GB0006215205

instrument

Identification

code

---- ------------------------- -----------------------------------------------------

Nature of the Disposal

transaction The sale of 62,309 shares in the market

to cover income tax and social security

contributions (as applicable) liability

on vesting

---- ------------------------- -----------------------------------------------------

Price(s) and Price(s) Volume(s)

volume(s) ------------------------- -----------------------

GBP3.903431 per Ordinary 62,309 Ordinary shares

share

------------------------- -----------------------

---- ------------------------- -----------------------------------------------------

Aggregated information

Aggregated volume 62,309 Ordinary shares at GBP3.903431

Price per Ordinary share

totalling GBP243,218.88

---- ------------------------- -----------------------------------------------------

Date of the transaction 6 March 2018

---- ------------------------- -----------------------------------------------------

Place of the London Stock Exchange

transaction

---- ------------------------- -----------------------------------------------------

- END -

National Express contact and telephone number for enquiries:

Michael Arnaouti, Group Company Secretary

++44 (0) 207 805 3807

Notes

Legal Entity Identifier: 213800A8IQEMY8PA5X34

Classification: 2.4 (with reference to DTR6 Annex 1R)

This information is provided by RNS

The company news service from the London Stock Exchange

END

DSHSSDFSWFASEID

(END) Dow Jones Newswires

March 07, 2018 10:30 ET (15:30 GMT)

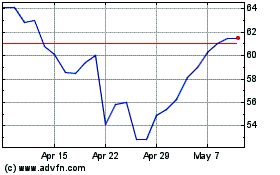

Mobico (LSE:MCG)

Historical Stock Chart

From Mar 2024 to Apr 2024

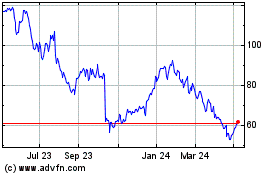

Mobico (LSE:MCG)

Historical Stock Chart

From Apr 2023 to Apr 2024