NZ Dollar Advances On Rising Risk Appetite

July 05 2018 - 11:59PM

RTTF2

The New Zealand dollar climbed against its major counterparts in

the Asian session on Friday amid rising risk appetite, as investors

brace for the implementation of American and Chinese tariffs.

The U.S. tariffs on 34 billion dollars worth of Chinese imports

went into effect just after midnight Thursday, with China saying it

is "forced to make a necessary counterattack".

U.S. President Donald Trump said the U.S. might seek tariffs on

more than $500 billion of Chinese goods, about the amount of total

goods the U.S. imported from China last year, if China responds

with retaliatory tariffs.

Also in focus is the US jobs data due later in the day. The

economy is expected to have added 195,000 jobs in June, while

jobless is forecast to remain at 3.8 percent.

The kiwi climbed to 9-day highs of 0.6818 against the greenback

and 75.47 against the yen, from its early lows of 0.6782 and 74.97,

respectively. The kiwi is likely to find resistance around 0.69

against the greenback and 77.00 against the yen.

Reversing from an early low of 1.7228 against the euro, the kiwi

hit a weekly high of 1.7157. The next possible resistance for the

kiwi is seen around the 1.70 level.

The kiwi firmed to an 8-day high of 1.0861 against the aussie

and held steady thereafter. The pair closed Thursday's deals at

1.0881.

Survey from the Australian Industry Group showed that the

construction sector in Australia continued to expand in June,

albeit at a much slower pace, with a Performance of Construction

Index score of 50.6.

That's down from 54.0 in May, although it remains above the

boom-or-bust line of 50 that separates expansion from

contraction.

Looking ahead, U.S. and Canadian jobs data and trade reports, as

well as Canada Ivey PMI, all for June are due in the New York

session.

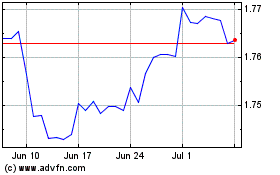

Euro vs NZD (FX:EURNZD)

Forex Chart

From Mar 2024 to Apr 2024

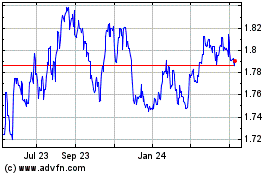

Euro vs NZD (FX:EURNZD)

Forex Chart

From Apr 2023 to Apr 2024