MetLife Discloses Failure to Pay Thousands of Workers' Pensions

December 15 2017 - 7:09PM

Dow Jones News

By Leslie Scism

MetLife Inc. said Friday it had failed to pay monthly pension

benefits to possibly tens of thousands of workers in accounts that

it has on its books as part of its large retirement business.

The New York insurer said it is seeking to find the retirees who

are owed money, and who generally have average benefits of less

than $150 a month. It said it believes the group represents less

than 5% of about 600,000 people who receive certain benefits from

the firm.

The discovery of the overdue money and the process of locating

the missing people to pay them would require strengthening

reserves, MetLife said in a filing. The company also said the

amount "may be material to our results of operations."

The workers impacted by Friday's disclosure were likely owed a

defined amount of monthly income when MetLife took on

responsibility for their pensions from their employers, under a

booming business known as "pension risk transfer." MetLife didn't

say in what years it had acquired these particular pension plans,

how many different plans the people were involved, and how many

years of missing income was owed.

Some Wall Street analysts assumed that the payments could be 10

or more years overdue. At $150 a month for 30,000 people -- 5% of

the 600,000 -- over 10 years, that could be up to $540 million.

Analyst Thomas Gallagher of Evercore ISI estimated that the

fourth-quarter charge against earning would be in the $200 million

to $400 million pretax range.

Another analyst, Jay Gelb of Barclays, estimated "up to $1

billion pre-tax," which would assume many more years of owed

money.

The company's disclosure of the lost workers recalls a scandal

that played out across a large part of the life-insurance industry

in recent years when state insurance regulators identified that

there were billions of dollars of overdue life-insurance policies

on insurers' books. In 2012, MetLife agreed to pay $40 million to

settle a multistate probe of its handling of death benefits, in a

deal that was expected to pay more than $400 million to heirs of

life-insurance policyholders.

In Friday's filing, MetLife said that it is "improving the

process used to locate a small subset of our total group annuitant

population of approximately 600,000 that have moved jobs, relocated

or otherwise can no longer be reached via the information provided

for them." It said it is using "a wider set of search techniques"

made available through advances in data technology.

The company said it would provide more disclosure when it

reports fourth-quarter results.

The business of pension-risk transfer, in which employers with

old-fashioned pension plans cut deals with insurers to take

responsibility for retirees' monthly benefits, has surged in recent

years.

The movement has transformed the management of pensions for

employers, which can slash their exposure to the volatility of the

stock and bond markets, as well as for the insurance industry,

which gains a source of growth at a time when some traditional

businesses are slipping.

Prudential Financial Inc. has emerged as the leader in U.S.

pension-risk transfer, though MetLife and a host of others are also

in the business.

Despite the spread of 401(k) plans, about 22,000 traditional

plans sponsored by single, private-sector employers remain in the

U.S., covering 30 million people.

Write to Leslie Scism at leslie.scism@wsj.com

(END) Dow Jones Newswires

December 15, 2017 18:54 ET (23:54 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

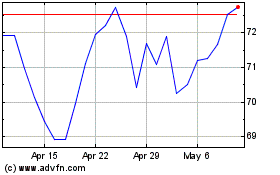

MetLife (NYSE:MET)

Historical Stock Chart

From Mar 2024 to Apr 2024

MetLife (NYSE:MET)

Historical Stock Chart

From Apr 2023 to Apr 2024