Global sales topping $3.8 billion in 2017 for Keytruda spur

efforts to develop more uses

By Peter Loftus

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (April 16, 2018).

RAHWAY, N.J. -- Merck & Co. is making one of the biggest

bets on a single drug in the pharmaceutical industry, a move that

is risky but that could, if successful, pay off for the company and

a broad array of cancer patients.

Merck's Keytruda, a new type of cancer drug that harnesses

patients' immune systems to fight tumors, is already marketed to

treat lung, skin, bladder and other cancers. Global sales soared to

more than $3.8 billion in 2017 -- about 9% of Merck's total revenue

-- fueled by a monthly U.S. price tag of $13,500 and studies

showing it prolongs patient survival in some cancers.

Doctors view the development of Keytruda and other

immunotherapies as a big advance that has already helped some

patients live longer. Merck sees more potential uses and sales. The

company and outside researchers are running more than 700 clinical

trials for Keytruda in more than 30 cancer types, according to the

National Institutes of Health -- an effort commanding more than

half of Merck's budget for all clinical drug studies, according to

R&D chief Roger Perlmutter.

Merck says it has scrapped work in other diseases to put

resources into Keytruda, marking a big cultural change for the

company, according to people who have worked there.

"I said to everyone, 'Whatever other projects you're working on,

you can stop now, because we're going to be doing this, and we're

going to put a lot of muscle behind this,'" Dr. Perlmutter said. He

said he based the decision on early clinical data showing that

Keytruda shrank some tumors effectively, and on the knowledge that

rival Bristol-Myers Squibb Co. had already released positive study

results of its rival drug, Opdivo.

Dr. Perlmutter moved scientists and money into Keytruda and shed

projects he considered less promising, he said, such as an

experimental drug for psoriasis that Merck licensed in 2014 to Sun

Pharmaceutical Industries Inc.

"Before Keytruda, Merck's R&D strategy was to bring as many

drugs to market as they could," said Bernard Munos, a

pharmaceutical R&D consultant who previously worked at Eli

Lilly & Co.

Some analysts and investors worry Merck is becoming too reliant

on Keytruda, a factor they say is behind the 8.7% slide in the

company's stock price over the past year, versus a 1.3% decline in

the S&P Pharmaceuticals Select Industry index.

Credit Suisse analysts predict Keytruda annual global sales will

surpass $10 billion in 2022, making up 22% of Merck's total

revenue. Sales of some of Merck's other best-selling drugs,

including Remicade and Vytorin, have declined amid generic

competition, and more drugs are likely to face such competition in

coming years.

"Unfortunately for Merck, the rest of the business is not that

strong," said Credit Suisse analyst Vamil Divan.

Dr. Perlmutter acknowledges the risk of investing so much in

Keytruda but says Merck continues to conduct R&D in other

areas. The company has more than 40 other drugs in clinical

testing, including potential treatments for infectious diseases and

diabetes.

"This is a very easy business to make mistakes in, and you can

always make investments that don't yield major contributions to

human health," he said in an interview at a Merck site in Rahway,

N.J., where oncology R&D is based. "I do feel that we have a

responsibility with Keytruda to ensure that we fully demonstrate

what this drug can do."

Few brand-name drugs have been subjected to as many studies as

Keytruda. More than 600 trials are listed for Keytruda's closest

competitor, Bristol-Myers's Opdivo, and more than 500 for AbbVie

Inc.'s Humira anti-inflammatory drug, according to

ClinicalTrials.gov, a database run by the National Institutes of

Health.

Dr. Perlmutter, who previously ran R&D at Amgen Inc.,

identified Keytruda as a priority soon after Merck Chief Executive

Kenneth Frazier hired him to lead R&D in 2013.

To help oversee the Keytruda trials, Merck boosted its in-house

U.S. oncology leadership to about 100 specialists, from about 20 in

2013, said Roy Baynes, head of global clinical development. About

27,000 patients are enrolled in the Merck-sponsored Keytruda

studies, with targeted enrollment of 62,000, a spokeswoman

said.

One closely watched study could help signal whether Merck's

strategy is sound. The company is expected to report Monday

detailed results of a trial of Keytruda combined with chemotherapy

to treat advanced lung cancer. Merck said in January the

combination improved patient survival but it didn't disclose

details.

Merck also has provided the drug for free to outside researchers

running their own trials. One study by researchers at Johns Hopkins

University in Baltimore showed Keytruda was effective in patients

with a variety of cancer types whose tumors share a rare genetic

defect.

Keytruda trial results haven't been uniformly positive. The drug

failed to prolong survival in some studies, including one in

gastric-cancer patients that Merck disclosed in December. And last

year the FDA ordered Merck to stop two Keytruda trials after more

blood-cancer patients receiving the drug died than those on other

treatments.

"I question our strategy all the time," Dr. Perlmutter said. But

on balance, he said, "we have really good data."

Write to Peter Loftus at peter.loftus@wsj.com

(END) Dow Jones Newswires

April 16, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

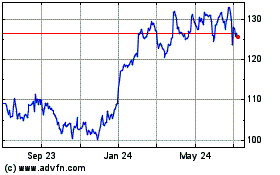

Merck (NYSE:MRK)

Historical Stock Chart

From Mar 2024 to Apr 2024

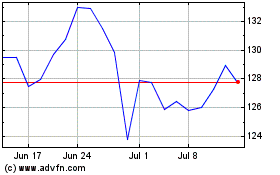

Merck (NYSE:MRK)

Historical Stock Chart

From Apr 2023 to Apr 2024