Antitrust landscape changes with suit against AT&T-Time

Warner merger. Will Comcast-Fox talks be affected?

By Keach Hagey and Joe Flint

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (November 25, 2017).

In the past year, every single one of the biggest media

companies in the U.S. has either agreed to a transformational

merger or considered one. Now the industry is trying to figure out

what the Justice Department's lawsuit to block AT&T Inc.'s

acquisition of Time Warner Inc. means for other deals.

Analysts have been especially interested in weighing the

potential impact on Comcast Corp.'s desire to acquire a significant

chunk of 21st Century Fox's assets.

Comcast is continuing its talks with Fox and doesn't think the

proposed deal would face the same regulatory hurdles because the

vast majority of the revenue from the Fox assets in question comes

from overseas, said a person familiar with Comcast's thinking.

Plus, Comcast already owns content from its prior acquisition of

NBCUniversal. Therefore, the media giant sees the acquisition of

some Fox content assets as more of a "horizontal" deal of like

businesses rather than a "vertical" merger akin to AT&T-Time

Warner.

But others question that thinking. A Comcast/Fox deal would

combine a content provider and a distributor -- similar to the

AT&T deal that the Justice Department is arguing is

illegal.

"How could Comcast buy more content if AT&T can't buy Time

Warner?" asked Rich Greenfield, an analyst at BTIG Research.

The Wall Street Journal reported last week that Comcast was one

of several suitors in talks to buy Fox's studio, some U.S. cable

networks such as FX and National Geographic, and its international

businesses.

Of course, it's possible that AT&T will win its case and be

able to buy Time Warner. AT&T CEO Randall Stephenson said

Monday that the company was ready to square off against the

government in court. The healthy performance of most media stocks

on Tuesday -- the first trading day after the government filed its

suit -- suggests investors may be betting the government doesn't

have a strong case.

But while the litigation drags on, M&A in the sector is

likely to take a "four- or five-month pause," Mr. Greenfield

said.

The pause comes as the industry is under intense pressure from

the acceleration of cord-cutting, the growing power of tech

companies such as Netflix, Amazon and Facebook, and a wave of

consolidation among pay-TV distributors that has left the giants of

media searching for a transformational next move.

This fall, those pressures led Walt Disney Co. to reach out to

Fox to discuss buying a substantial piece of its entertainment

assets. Although the talks have cooled, they helped put Fox in

play. Fox has since been approached by a host of suitors including

Comcast, Sony and Verizon, the Journal has reported.

Analysts and investors are now trying to analyze which

combination may be acceptable to antitrust officials. Telsey

Advisory Group analyst Thomas Eagan wrote in a research note that

the DOJ's suit and clear concerns about vertical mergers makes it

difficult for Comcast or Verizon to purchase Fox assets, leaving

Disney -- and possibly Sony -- as "the only real buyer."

For Comcast, there are also other factors to consider. For one,

some antitrust experts have argued that the government didn't do

enough to limit Comcast's power when it took control of

NBCUniversal in 2011. Comcast would also be acquiring Fox's movie

and television studios, making it an even larger producer of

content and reducing the number of major studio, which could be a

concern for regulators.

Comcast is also interested in buying Fox's regional sports

networks, according to the person familiar with Comcast's thinking,

assets that weren't under discussion with Disney.

21st Century Fox and Wall Street Journal parent company News

Corp share common ownership.

The interest in Fox marks just the latest in a series of merger

talks across the media industry over the past year: Discovery

Communications struck a deal this summer to acquire Scripps

Networks International. Last year, Viacom Inc. and CBS Corp.

explored a merger that would have reunited the companies a decade

after their separation.

"Six months ago, the market believed that the industry was

poised to see further, significant and maybe unprecedented

consolidation over the next several years, driven as much by

defensive tactics -- building a moat around the business -- as

offensive," said William Drewry, founding partner at Pursuit

Advisory, a boutique advisory firm specializing in media. "Now that

is under serious question."

Indeed, it is exactly this kind of moat-building that the

Justice Department said it is trying to prevent. In the complaint

filed on Monday, one of the reasons it cited for blocking the deal

was that a merged AT&T-Time Warner would have the power and

incentive to slow the growth of new online video distributors that

are disrupting its business. (Mr. Stephenson has said that the

point of buying Time Warner was to take its content and give it

broader distribution, not more limited distribution.)

Some analysts believe a horizontal merger between two content

providers -- the kind of deal that traditionally receives more

scrutiny from antitrust officials because it eliminates a direct

competitor -- might still be able to pass muster in today's

regulatory environment, precisely because it doesn't pose the same

risks to new online entrants.

Guggenheim Securities analyst Michael Morris argues that Time

Warner could still conceivably merge with Disney, Fox or CBS --

should the AT&T deal fall apart.

Write to Keach Hagey at keach.hagey@wsj.com and Joe Flint at

joe.flint@wsj.com

(END) Dow Jones Newswires

November 25, 2017 02:47 ET (07:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

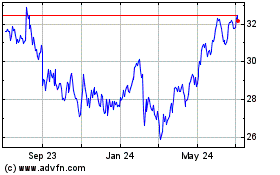

Fox (NASDAQ:FOX)

Historical Stock Chart

From Mar 2024 to Apr 2024

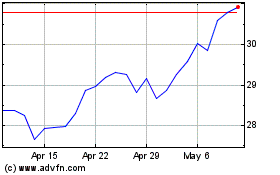

Fox (NASDAQ:FOX)

Historical Stock Chart

From Apr 2023 to Apr 2024