Medallion Financial Corp. (Nasdaq: TAXI), a specialty finance

company with a leading position servicing the taxicab industry and

other niche markets, announced that earnings, or net increase in

net assets resulting from operations was $5,466,000 or $0.30 per

diluted common share in the 2012 first quarter, up $1,186,000 or

28% from $4,280,000 or $0.24 per diluted common share in the 2011

first quarter. Medallion Bank, the Company’s unconsolidated

wholly-owned portfolio company, had net income of $4,125,000 in the

2012 first quarter, compared to $3,082,000 in the 2011 first

quarter, an increase of $1,043,000 or 34%, primarily reflecting

improved net interest income and reduced loan losses, partially

offset by higher income taxes, compared to the prior year. As the

Company continues to use Medallion Bank as a primary funding source

it refers more loans to Medallion Bank for origination to take

advantage of current short term borrowing rates.

Andrew Murstein, President of Medallion Financial stated, “We

are extremely pleased with the quarter’s results, and our increased

dividend. This marks the 6th consecutive quarter that we have been

able to increase the dividend. It is now at the highest level it

has been in over 10 years. We continue to experience zero losses on

New York City taxi medallion loans that we originated,” said Mr.

Murstein. “The taxi industry remains resilient in this type of

economic environment for several reasons such as corporate and

consumer cutbacks on more expensive limousine and town car

services, high taxi fleet utilization, and continuing high taxi

ridership levels. In addition, the loan to value ratio on our

entire medallion portfolio is approximately 40%.

“In April, The New York City Taxi and Limousine Commission

approved a new taxi auction to sell up to 2,000 new taxi medallions

within the next few years. We know there have been objections to

the plan, including but not limited to understandable concerns from

those who would like to see more wheelchair accessible taxis on the

road in conformity with the Americans with Disability Act. We hope

that a mutually acceptable plan can be worked out by all parties,”

said Mr. Murstein.

Larry D. Hall, Chief Financial Officer of Medallion Financial

stated, “Medallion Financial’s capital and liquidity levels

remained strong, with over $107,000,000 of deposit-raising capacity

at Medallion Bank, in addition to over $89,000,000 of availability

in our other funding sources.”

Mr. Hall continued, “In addition, during 2012 we have continued

to replace higher cost borrowings with lower cost fixed and

floating rate debt, further enhancing our profitability, and we see

additional opportunities to continue this. For example, our

$33,000,000 of Trust Preferred securities, which currently carry a

fixed rate of 7.68%, will re-price to 90 day Libor plus 2.125% in

September, or 2.59% at today’s rates, which should be accretive to

subsequent earnings.”

Medallion Financial’s on-balance sheet taxicab medallion loan

portfolio was $291,000,000 at quarter end, down from $310,000,000 a

year ago, primarily due to the funding of most new medallion loan

originations at Medallion Bank, and the Company’s sale of loan

participations to third party banks. Total managed medallion loans

increased $10,000,000 or 2% to $674,000,000 at quarter end, up from

$664,000,000 a year ago.

Medallion Financial’s on-balance sheet commercial loan portfolio

was $56,000,000 at quarter end, down from $74,000,000 a year ago.

The managed commercial loan portfolio was $120,000,000 at quarter

end, down from $134,000,000 last year. In both cases, the declines

primarily reflected portfolio repayments. Medallion Bank’s consumer

loan portfolio increased 7% to $198,000,000 at quarter end from

$185,000,000 a year ago. Overall, total managed assets increased 1%

to $1,134,348,000 at year end, up from $1,118,255,000 a year ago.

Asset quality remained very strong, with managed loans 90 days or

more past due of only 1.5% at quarter end, down from 1.8% at year

end, and up slightly from 1.3% a year ago.

The Company also announced an increase in the dividend of 24% to

$0.21 per share for the 2012 first quarter, up from $0.17 per share

in the 2011 first quarter. This brings the total dividends paid

over the last four quarters to $0.78, and equates to a yield of

over 7% based on the closing price of the Company’s stock on May 1,

2012. The current dividend will be paid on May 25, 2012, to

shareholders of record on May 15, 2012. Since the Company’s initial

public offering in 1996, the Company has paid in excess of

$171,714,000 or $10.81 per share in dividends.

Medallion Financial Corp. is a specialty finance company with a

leading position in the origination and servicing of loans

financing the purchase of taxicab medallions and related assets.

The Company also originates and services loans in other commercial

industries, and its wholly-owned portfolio company, Medallion Bank,

also originates and services consumer loans. The Company and its

subsidiaries have lent approximately $5 billion to its taxicab

industry and other small businesses.

Please note that this press release contains forward-looking

statements that involve risks and uncertainties relating to

business performance, cash flow, costs, sales, net investment

income, earnings, and growth. Medallion’s actual results may differ

significantly from the results discussed in such forward-looking

statements. Factors that might cause such a difference include, but

are not limited to, those factors discussed under the heading “Risk

Factors,” in Medallion’s 2011 Annual Report on Form 10-K.

MEDALLION FINANCIAL CORP.

CONSOLIDATED STATEMENTS OF

OPERATIONS

Three Months Ended March 31, (Dollars

in thousands, except per share data)

2012 2011

Total investment income $ 7,863

$ 9,597

Total interest expense

3,247 3,502

Net interest

income 4,616 6,095

Total noninterest income 335

409 Salaries and benefits

2,050

2,207 Professional fees

313 331 Occupancy expense

211

227 Other operating expenses

766

898

Total operating expenses 3,340

3,663

Net investment income

before income taxes 1,611 2,841 Income tax (provision)

benefit

- -

Net

investment income after income taxes 1,611

2,841

Net realized gains (losses) on

investments (58 ) 9

Net change in unrealized appreciation (depreciation) on

investments

2,013 (216 ) Net change in unrealized

appreciation on Medallion Bank and other controlled subsidiaries

1,900 1,646

Net

unrealized appreciation on investments 3,913

1,430

Net realized/unrealized gains

on investments 3,855 1,439

Net increase in net assets resulting from

operations $ 5,466 $ 4,280

Net investment income after income taxes per common

share Basic

$ 0.09 $ 0.16 Diluted

0.09 0.16

Net increase in net

assets resulting from operations per common share Basic

$ 0.31 $ 0.25 Diluted

0.30

0.24

Dividends declared per

share $ 0.21 $ 0.17

Weighted average common shares outstanding Basic

17,657,222 17,400,233 Diluted

17,936,958 17,548,036

MEDALLION FINANCIAL CORP.

CONSOLIDATED BALANCE SHEETS

(Dollars in thousands, except per share data)

March 31, 2012 December 31, 2011

Assets

Medallion loans, at fair value

$ 291,025 $

307,167 Commercial loans, at fair value

56,111 54,159

Investment in Medallion Bank and other controlled subsidiaries, at

fair value

88,207 85,932 Equity investments, at fair value

5,524 4,577 Investment securities, at fair value

- -

Net investments 440,867

451,835 Cash and cash equivalents

24,566 29,352

Accrued interest receivable

1,089 1,120 Fixed assets, net

527 466 Goodwill, net

5,069 5,069 Other assets, net

50,529 49,189

Total

assets $ 522,647 $ 537,031

Liabilities Accounts payable and accrued expenses

$

4,104 $ 6,040 Accrued interest payable

764 1,708

Funds borrowed

343,520 357,779

Total

liabilities 348,388 365,527

Commitments and contingencies

- -

Total shareholders' equity (net assets)

174,259 171,504

Total liabilities and

shareholders' equity $ 522,647 $

537,031 Number of common shares outstanding

17,942,510 17,719,570 Net asset value per share

$ 9.71 $ 9.68 Total managed loans

$ 991,391 $ 984,576 Total managed assets

1,134,348 1,141,806

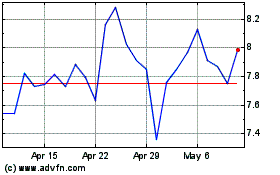

Medallion Financial (NASDAQ:MFIN)

Historical Stock Chart

From Mar 2024 to Apr 2024

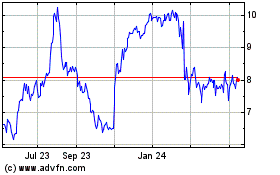

Medallion Financial (NASDAQ:MFIN)

Historical Stock Chart

From Apr 2023 to Apr 2024