By Rachel Koning Beals

Dollar index at strongest in a year; consumer price data

ahead

U.S. stocks seem poised to fall Friday, as the global equity

retreat fueled by the mounting currency crisis in Turkey raises the

alarm for possible contagion into other markets,

The U.S. dollar, sought as a haven relative to other currencies,

muscled to its firmest level in nearly a year

(http://www.marketwatch.com/story/dollar-index-jumps-to-around-one-year-high-as-turkeys-lira-gets-rocked-2018-08-10)

against major rivals.

What are early indications showing?

Futures on the Dow Jones Industrial Average fell 93 points or

0.4%, while futures on the S&P 500 shed over 11 points, or

0.4%, and on the Nasdaq-100 gave up 34 points, or 0.5%.

U.S. stocks closed mostly lower Thursday as weak energy and

industrial shares weighed on the market, but the Nasdaq bucked the

trend to rise for an eighth straight session, logging its best

winning streak since October.

On Thursday, the Dow industrials fell 74.52 points, 0.3%, to

25,509.23, while the S&P 500 shed 4.12 points, or 0.1%, to

2,853.58. The Nasdaq Composite Index edged up 3.46 points to

7,891.78.

For the week, the Dow and S&P 500 have narrow weekly gains

under threat, while the Nasdaq is on track for a weekly return

nearing 1%.

What's driving the market?

The steep decline in the Turkish lira comes after the European

Central Bank expressed concern about the country

(http://www.marketwatch.com/story/ecb-worries-that-some-european-banks-may-be-too-exposed-to-turkey-ft-2018-08-10),

whose leader President Recep Tayyip Erdogan was re-elected in a

snap vote in June and whose growing power has raised questions

about the independence of the country's central bank

(http://www.marketwatch.com/story/heres-why-there-may-be-more-pain-in-store-for-turkeys-lira-on-friday-2018-08-02).

The isShares MSCI Turkey ETF(TUR) traded down 6.2% in the U.S.

premarket.

Russia's market volatility added to the global theme. Newly

announced U.S. sanctions--and the potential for a second round of

actions in 90 days--roiled Russia's currency and blue-chip stocks

as the country braced for further economic pain

(http://www.marketwatch.com/story/us-sanctions-take-heavy-toll-on-russian-stocks-and-ruble-2018-08-10)

amid uncertainties over the Trump administration's commitment to

enforcement.

In Moscow, the ruble shed as much as 5% against the dollar on

Thursday and stock averages there plunged as much as 9%.

U.S. stock trading in recent sessions has mostly been a tug of

war between concerns about the continuing trade dispute between the

U.S. and China and positive sentiment over strong corporate

earnings against a healthy economic backdrop. U.S. earnings, on the

whole, are solid, with the number of companies beating earnings

estimates at the highest point since the third quarter of 2009,

according to JPMorgan Chase.

Read: Behold the 'scariest chart' for the stock market

(http://www.marketwatch.com/story/behold-the-scariest-chart-for-the-stock-market-2018-08-08)

What data are in focus?

Consumer price indexes for July are due for release at 8:30 a.m.

Eastern time, while a snapshot of the federal budget hits at 2

p.m.

See more in the U.S. Economic Calendar

(http://www.marketwatch.com/economy-politics/calendars/economic).

What are market participants saying?

"These increased tensions [in Turkey and Russia] have ... added

up to a stronger dollar, something exacerbated this morning as

reports of the ECB being concerned by the exposure of eurozone

banks to Turkish debt (which is largely denominated in U.S.

dollars)," said Richard Perry, strategist at Hantec Markets. "With

major bond yields falling across the board, the euro has now broken

down below a key floor around $1.1500 against the U.S. dollar.

Equities are coming under corrective pressure too amidst the safe

haven flow."

Which stocks are in focus?

Overstock.com Inc.(OSTK) is up 15% premarket and rallied more

than 20% in the extended session Thursday after news about a

private-equity investment overshadowed a larger-than-expected

quarterly loss

(http://www.marketwatch.com/story/overstock-shares-rally-as-private-equity-deal-outweigh-quarterly-loss-2018-08-09)

for the online retailer.

Dropbox Inc.(DBX) is down some 5% premarket after it fell nearly

10% in the extended session. The retreat comes after a

second-quarter earnings report

(http://www.marketwatch.com/story/dropbox-earnings-easily-beat-expectations-2018-08-09),

which also included news that Chief Operating Officer Dennis

Woodside was stepping down and a post-IPO lockup on shares would

expire earlier than previously planned.

Tronc Inc.(TRNC) shares slipped in the extended session Thursday

following a run-up fueled by reports of a possible buyout

(http://www.marketwatch.com/story/tronc-shares-slip-after-quarterly-results-following-buyout-report-rally-2018-08-09)

after the media company reported quarterly results.

How are other markets performing?

European stocks fell

(http://www.marketwatch.com/story/european-stocks-tumble-as-ecb-raises-questions-about-turkey-contagion-2018-08-10),

as did Asian markets

(http://www.marketwatch.com/story/trade-oil-price-worries-blow-asian-markets-lower-2018-08-09).

The Stoxx Europe 600 was down 0.7% to 387.30, after finishing

Thursday's session with a 0.1% gain.

The lira has been consistently hovering around an all-time low

against the U.S. dollar this summer. It fell by about 5.3% against

the greenback, paring more severe losses overnight. One dollar

recently bought 5.8595 Turkish lira, compared with 5.5426

late-Thursday in New York, according to Dow Jones Market Data.

According to FactSet data, the country's lira is down 13.3% this

week, bringing its year-to-date decline to more than 35%.

The ICE U.S. Dollar Index was up 0.4%, off earlier sharper

gains.

(http://www.marketwatch.com/story/dollar-higher-ahead-of-data-new-zealand-currency-at-lowest-since-2016-2018-08-09)

U.S. benchmark West Texas Intermediate futures were up slightly,

(http://www.marketwatch.com/story/oil-pauses-slide-as-iran-production-trade-row-tug-at-market-2018-08-09)while

gold futures fell 0.2%, hit by the surging dollar.

(END) Dow Jones Newswires

August 10, 2018 06:40 ET (10:40 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

Overstock com (NASDAQ:OSTK)

Historical Stock Chart

From Mar 2024 to Apr 2024

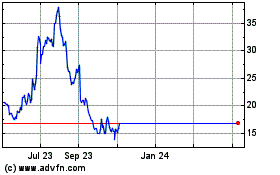

Overstock com (NASDAQ:OSTK)

Historical Stock Chart

From Apr 2023 to Apr 2024